RE:RE:RE:DD33Hey Shneps.

First of all to get an idea on what a strip ratio fo 10:1 looks like. (peak is at 19:1 at the bottom).

Here is an image:

That image above would include both Kim-C (TFFE) and CH-20 (no TFFE)...both of which are considered waste in the strip ratio calculation.

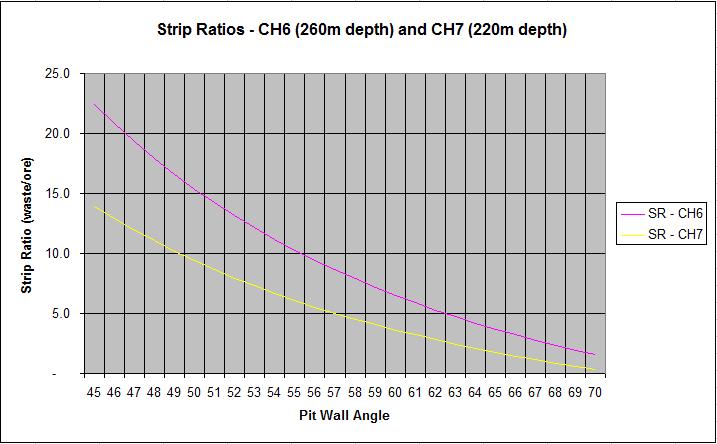

I also mapped out strip ratios based on estimated Depths of CH-6 and CH-7 before the PEA came out.

You can see the impact of going to a 60 degree pit wall. CH-6 could approach 5:1 strip ratio or just get deeper pending the underground/open pit boundary.

Blog - Strip Ratios The 60 degree angle in DD33 was probably more of a target to get pierce points at certain depths more then any connection to pit angle.

Here is an image that contains RQD (

Rock Quality Designation)

You will see most of the information is contained within the pipe itself. Chances are the country rock surrounding the pipe will have similar properties with other country rock in the vicinity..they just need to poke a couple of holes (1,000 metres) to get enough information to determine the quality of the rock and to determine that they are confident enough that it will applicable to most, if not all country rock surrounding the pipe.

You also see the RQD within the kimberlite is variable. Kimberlite material is not the most compotent stuff in the world. Probably wouldn't want to build a pyramid with it.

Economics? NPV?

Pretty simple.

The cost of blasting and hauling and stockpiling (or milling) a tonne of material at Chidliak (based on PEA) is betwen $4 and $4.50.

In the first few years..it is all CH-6 ore. So, assuming a 10:1 strip ratio for the first 5 years at CH-6.

10 tonnes of waste to 1 tonne of ore.

700ktpa mill rate. In 1 year, you mill 700K tonnes of ore and 7,000K or 7 million tonnes of waste. If you reduce the strip ratio from 10:1 to 5:1, then you get 3.5 million tonnes of waste moved.

The cost of moving that waste is $4.25 per tonne...so the total cost savings per year by reducing the strip ratio is $4.25 x 3.5 million tonnes = $14 million per year.

times that savings by 5 years = $70 million. Discount that and you get maybe $40 million.

After tax at 30% reduction = CAD$28 million.

Spending $2 or $3 million on geotech drilling this summer will save you about CAD$30 million in NPV....but if you want to build a mine...it is a needed cost.....a sunk cost...so is really irrelevant how much of a return you get on that specific analysis.

The bigger benefit though...if you can't go UG...is to go deeper into CH-6 to bring in a lot more revenue. That will far outweight the savings of CAD$30 million by keeping the pit the same as the PEA.

LONG...PGD

EKIM