Canopy Growth Poised To Dominate - Seeking Alpha Canopy Growth Poised To Dominate The Canadian Marijuana Market

Canopy Growth is poised to become the dominant player in Canada's budding recreational marijuana market.

Canopy Growth's diversified business strategy, financial position, and the vast market for recreational marijuana in Canada all contribute to the company's potential to dominate the market.

Impending legalization of recreational marijuana will provide a major catalyst for the company's share price.

The proposed regulatory framework will favour large, licensed producers such as Canopy Growth.

Canopy Growth represents an asymmetric risk/reward opportunity because it is still likely to benefit significantly from legalization even if it does not achieve market dominance.

Introduction

Canopy Growth (OTCPK:TWMJF) is poised to emerge as the dominant player in the Canadian marijuana market once federal legalization takes effect on July 1st, 2018. The market for marijuana products in Canada is vast and is projected to increase significantly in the near future. Investors wishing to profit from the legalization of marijuana should consider taking a long position in Canopy Growth as it continues to lay the groundwork for market dominance. Canopy Growth presents a compelling opportunity for investors who wish to capitalize on a promising company in a dynamic industry which will be spurred by a major upcoming catalyst.

*Please note that all figures in this article are in CAD unless otherwise noted.

Executive Summary

In this article, I demonstrate that the Canadian marijuana market is vast and presents an enormous opportunity for investors. The impending federal legalization of recreational marijuana presents a major catalyst for Canadian companies which are exposed to the marijuana market. One of Canopy Growth's major strengths is its diversified business strategy which places the company in a strong position to become the dominant player in the Canadian marijuana market.

Canopy Growth's current financial position places the company in a comfortable position moving forward. The company has significantly increased revenue and maintains a comfortable amount of cash even after having made major acquisitions. Canopy Growth represents a quintessential asymmetric investment because the company is still likely to be highly successful even if does not achieve market dominance. Therefore, the potential downside is minimal.

Canopy Growth's path to market dominance will be threatened by competition from other marijuana companies as well as from other sources such as the black market. Canopy Growth, however, has a significant edge on all sources of competition. Similarly, various risks to Canopy Growth's business strategy exist but do not represent existential threats to the company.

Article Structure

- Investing In Publicly Traded Marijuana Companies

- My Marijuana Investing Experience

- Gauging Potential for Marijuana Market Dominance

- Canadian Marijuana Market

- Legalization of Recreational Marijuana

- Canopy Growth's Path to Market Dominance

- Canopy Growth's Financial Position

- Competition From Marijuana Companies

- Competition From Other Sources

- Risks

- Conclusion

Investing in Publicly Traded Marijuana Companies

I will begin this article by describing the general parameters of investing in publicly traded marijuana companies. My experience investing in marijuana companies will then be outlined. I hope to demonstrate that investors should proceed with cautious optimism. Indeed, it is exceedingly rare for a new multi-billion dollar industry to emerge as a result of government intervention.

The publicly traded marijuana industry is a relatively new phenomenon. On April 4th, 2014 Tweed Marijuana Inc. (which later became Canopy Growth) became Canada's first publicly traded marijuana company. The share price fluctuated erratically during the first few days of trading as public interest was reflected by significant trading volume. Since 2014, the number of publicly traded companies which specialize in marijuana products has ballooned to over 200.

Because of the new nature of the marijuana industry and the proliferation of marijuana companies, I recommend that investors conduct substantial and thorough due diligence before taking a position. I also suggest that investors avoid letting their personal judgements about marijuana and issues of morality influence their judgement. A multi-billion dollar industry is set to emerge. Immense profits will be made. The main choice is whether to sit on the sidelines or to take part in the growth of this new industry.

My Marijuana Investing Experience

It is fair to say that there are currently no true investment 'experts' in the publicly traded marijuana industry. The industry is simply too new and share prices have been driven largely by investor enthusiasm rather than fundamental valuations of marijuana companies. Nonetheless, investors should be hesitant to take advice from individuals who have neither an understanding of the marijuana industry nor experience in marijuana investing.

I took part in what I have dubbed the ‘green rush’ which began after Justin Trudeau was elected as Canada's Prime Minister on October 19th, 2015. During the election campaign, Trudeau's Liberal party had pledged to legalize recreational marijuana in Canada. As the plans to legalize marijuana solidified, investors began to fawn over the various companies aiming to tap into the recreational marijuana market.

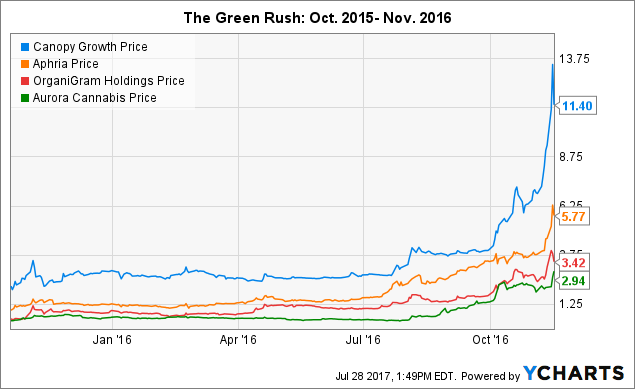

The following graph demonstrates the massive growth in the share prices of four major Canadian marijuana companies. It can be seen that in the year following Prime Minister Trudeau's election, the share prices of Canada's various marijuana companies surged in the summer of 2016.

I invested in the four companies listed in the chart above a few days after Prime Minister Trudeau took office. I was captivated by what I viewed as a tremendously rare opportunity: the ability to take advantage of the creation of an entirely new sector of the economy. To me, this opportunity is akin to the end of American alcohol prohibition. I continue to harbour great optimism that the marijuana industry in Canada will create enormous opportunities for investors.

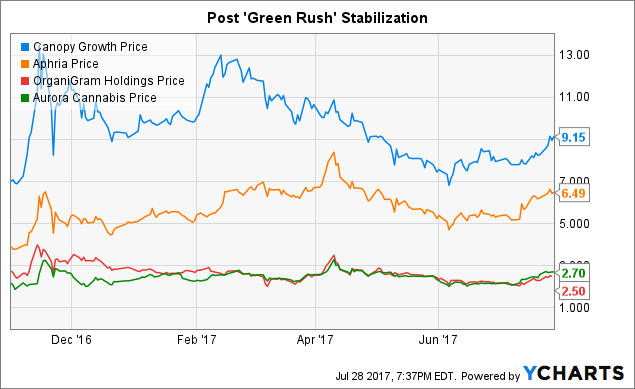

After the 'green rush' the share prices of the major Canadian marijuana companies decline and stagnated. I sold my shares in the four marijuana companies listed below in the winter of 2017 in order to pursue other ventures. The following chart illustrates the decline and stagnation which followed the 'green rush'.

Beyond my experience investing in marijuana companies, I have conducted significant research on the Canadian marijuana industry. This has included research on marijuana law, government policy, potential regulatory frameworks, and the market for marijuana products in Canada. I currently have a long position in HMMJ, an ETF which has exposure to a multitude of marijuana-related companies in North America such as Aurora Cannabis, Aphria, Canopy Growth, GW Pharmaceuticals, and several others. I also plan to initiate a small, but gradually increasing position in Canopy Growth.

Many investors may feel somewhat frustrated that they missed out on the 'green rush'. I don't, however, view that period as the final opportunity for investors to profit from the Canadian marijuana industry. Rather, I view the 'green rush' as the frenetic period of trading driven by euphoria generated by the Liberal pledge to legalize recreational marijuana. The best is yet to come for the Canadian marijuana industry as the legalization of recreational marijuana takes hold. Sales of marijuana products should grow exponentially in the years ahead. The share prices of marijuana companies in Canada should also grow as revenues increase, operating expenses stabilize, and profits are realized.

Gauging Potential for Marijuana Market Dominance

From the outset of this article, I informed readers that Canopy Growth has the potential not only to thrive but to become the dominant player in Canada's budding marijuana industry. This section will demonstrate how I measure the potential for an individual marijuana company to establish market dominance. It must be remembered, however, that the analysis of marijuana companies is an emerging art form rather than an established science.

There may be marijuana companies which provide great investment opportunities even though they specialize in a single element of the marijuana market. These companies, however, are not the focus of this article. Without further ado, the following factors are what I look for in order to determine whether a particular marijuana company has the potential to become a dominant player in the Canadian marijuana market:

- The company must have exposure to both medicinal and recreational marijuana markets. Patients who use marijuana for medical purposes have different needsthan recreational customers. These two groups of customers represent different segments of the marijuana market. A company with exposure to only one segment limits its potential to become a dominant player.

- The company must have the ability to produce significant yields of marijuana for medicinal and recreational purposes. The company should also have the ability to rapidly increase production yields in order to respond to surges in demand. Massive demand is expected to outstrip supply once Canada legalizes recreational marijuana. Inability to produce sufficient amounts of marijuana to meet this demand will crimp business growth.

- The company must have the required licenses in Canada to produce marijuana for recreational and medicinal purposes.

- The company should have a strong supply chain which allows it to efficiently produce, package, and deliver marijuana products to its customers. This will reduce reliance on other companies and will ultimately help reduce costs for large marijuana companies.

- I believe that recreational and medicinal marijuana will continue to be legalized around the world at an increasing pace. Accordingly, connections to international markets and partnerships with marijuana companies in international markets is a valuable asset.

- The company should have recreational and medicinal brands which customers can recognize and grow accustomed to.

- In order to become dominant in the marijuana market as a whole, the company must have the ability to produce and market dried marijuana for smoking or vaporizing, edible marijuana products, tinctures, oils, and cosmetic products such as ointments and lotions.

- Consistent product safety and scientific testing of marijuana products for consistency is critical.

- Finally, it is essential that the company has the ability to develop new strains of marijuana with different chemical structures for unique medical and recreational audiences.

Based on my thorough review of Canadian marijuana companies, I have found that Canopy Growth Corporation is the only one which meets all of these criteria. After describing the market for marijuana in Canada and the impending legalization of recreational marijuana, I will discuss how Canopy Growth meets the criteria listed above.

Canadian Marijuana Market

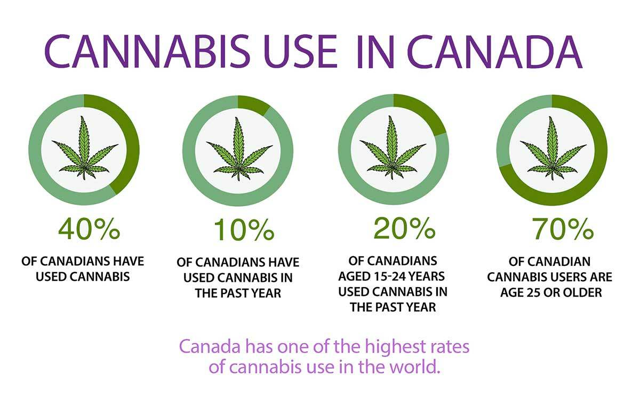

The market for marijuana products in Canada is vast and is set to grow at a rapid pace in the near future. A major reason for Canada's large marijuana market is the propensity of its citizens to use marijuana. As the graphic below demonstrates, a significant portion of Canadians have used marijuana in their lifetime. Further, a sizable portion of Canadians have recently used marijuana.

Source: Global News

It is more than reasonable to speculate that the number of consumers will increase significantly with legalization as people become less afraid of incarceration. As a corollary, I believe that legalization of marijuana will gradually increase the social acceptability of using marijuana products. Finally, it seems natural that Canadians would be more willing to purchase marijuana from legitimate storefronts or through online delivery services than from drug dealers in shady circumstances. My arguments in this regard are supported by a recent poll of 5000 Canadians in which 17% of respondents stated that they would try marijuana if it were legalized.

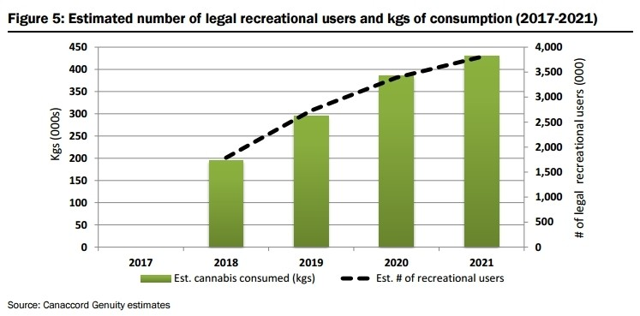

The high rate of marijuana consumption in Canada is projected to increase substantially in the coming years. As illustrated in the following graph, both the number of recreational users and the total amount of marijuana consumed are set to double in the next four years. This bodes well for companies which aim to tap into the marijuana market post-legalization.

Source: Huffington Post

I must make several brief comments about the graph above:

- The graph underestimates total demand because it ignores the market for medicinal marijuana.

- The findings also fail to project the demand for marijuana oils, edibles, and cosmetic products.

Nonetheless, the graph makes clear that Canadians are projected to consume an enormous and increasing amount of marijuana on an annual basis. Canadian demand for marijuana is thought to be so insatiable that demand will outstrip supplyin the period immediately following legalization. The high rate of marijuana usage in Canada coupled with the large customer base creates a substantial market.

Source: Huffington Post

As illustrated above, sales of marijuana could initially amount to approximately $5 billion to almost $9 billion a year. This massive amount could increase rapidly as the customer base grows and social acceptance of marijuana usage increases. Furthermore, Canadian consumers might develop a taste for edible marijuana products, marijuana oils, and cosmetic products. This would further increase the amount of revenue derived from marijuana. To put these numbers into perspective, it is worth noting that sales of beer amounted to $8.7 billion in Canada in 2014.

Legalization of Recreational Marijuana

Canada's federal government announced the introduction of legislation to legalize and regulate recreational marijuana to the Parliament on April 13th, 2017. According to the most recent government information on legalization:

"Should the Cannabis Act become law in July 2018, adults who are 18 years or older would be able to legally:

- possess up to 30 grams of legal dried cannabis or equivalent in non-dried form

- share up to 30 grams of legal cannabis with other adults

- purchase dried or fresh cannabis and cannabis oil from a provincially-licensed retailer

- In those provinces that have not yet or choose not to put in place a regulated retail framework, individuals would be able to purchase cannabis online from a federally-licensed producer.

- grow up to 4 cannabis plants, up to a maximum height of 100cm, per residence for personal use from licensed seed or seedlings

- make cannabis products, such as food and drinks, at home provided that organic solvents are not used

Other products, such as edibles, would be made available for purchase once appropriate rules for their production and sale are developed".

Source: Lift News

I expect the Cannabis Act to become law in July 2018 for several reasons. Firstly, the Act is sponsored by the Minister of Justice rather than a backbench Member of Parliament. Secondly, the Act has made significant progress in the House of Commons, already having passed second reading and referred to the standing committee on health. Finally, Prime Minister Trudeau has firmly supported the July 2018 deadline.

Significantly for Canopy Growth, the government stated that it would strictly regulate the production and sale of marijuana. The legalization plan benefits companies like Canopy Growth because it maintains a system of licensed producers. The fact that Canopy Growth already has the required licenses to operate as a marijuana producer places it in a good position to immediately benefit from legalization. The structure of legalization also limits competition by limiting the amount of companies which can produce and sell marijuana products.

Canopy Growth's Path to Market Dominance

In this section, I will return to each of the criteria for market dominance which I referred to at the beginning of this article. I will then describe how Canopy Growth meets each of these criteria.

Recreational & Medicinal Marijuana

1. The first criteria is that the company must have exposure to both medicinal and recreational marijuana markets. Canopy Growth has significant exposure to the medicinal marijuana market and is actively preparing to address the recreational market. These two aspects of the company will be discussed in turn.

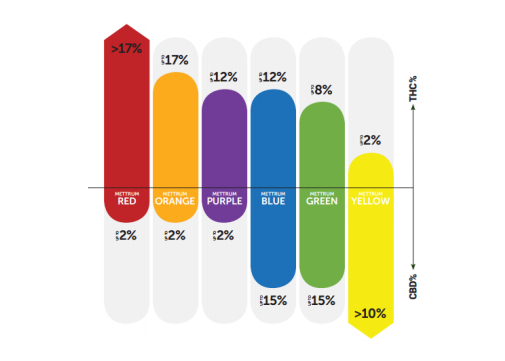

It must be made clear from the outset of the discussion that medicinal and recreational marijuana are different concepts and serve different markets. Essentially, medicinal marijuana is characterized by lower THC (a psychoactive compound which produces a high) and higher CBD (a compound with therapeutic properties). Canopy Growth has long served medicinal marijuana patients and has taken strategic steps to ensure that it can continue to do so in the era of legal recreational marijuana.

In December 2016, Canopy Growth announced a tentative agreement to acquire Mettrum Health Corp, a Toronto-based medicinal marijuana company. This agreement, which was finalized on January 31st, 2017, made Mettrum Health Corp a wholly owned subsidiary of Canopy Growth. This deal greatly expanded Canopy Growth's production capacity and increased the number of registered patients. Canopy Growth recently described several benefits associated with the acquisition of Mettrum as including the company's:

robust online physician portal, significant investment in medical research and multiple production facilities.

Canopy Growth also acquired the innovative 'Mettrum Spectrum' which allows patients to select medicinal marijuana strains with high THC, high CBD, or a balance between these two chemicals. The graphic below illustrates the Mettrum Spectrum.

Source: Canopy Growth

Source: Canopy Growth

Canopy Growth's medicinal marijuana strategy seems to be paying off, with substantial increases in patient registration. The number of medical patients registered with Canopy Growth has increased significantly since 2016.

The massive number of medical marijuana patients who have registered with Canopy Growth will provide a steady stream of income to the company. The explosive growth in the number of registered patients from 2016 to 2017 demonstrates that Canopy Growth is succeeding in marketing itself as a marijuana company which can supply medicinal products to patients across the country.

Source: Tweed Main Street

Canopy Growth has also devoted resources to developing medicinal products which do not require combustion and inhalation. The 'Black Label' capsules pictured above demonstrate a recognizable Canopy Growth product which can be marketed to medicinal marijuana patients.

Canopy Growth has also been actively preparing to provide marijuana products to recreational users. These preparations have included significantly ramping up production capacity as well as creating an online marketplace for recreational marijuana sales to take place. It is difficult to track the success of Canopy Growth's progress in reaching the recreational market because legalization has not yet taken place. Nonetheless, the company's success in targeting the medicinal marijuana market should provide investors with optimism for the future success of recreational sales. In sum, Canopy Growth meets the first criteria for market dominance which is exposure to both medicinal and recreational markets.

Production Capacity

2. The second criteria for market dominance is that the company must have the ability to produce significant yields of marijuana for medicinal and recreational purposes.

Canopy Growth has been rapidly expanding its production capacity in order to meet the demands of both medicinal and recreational markets. I have compiled the following information from the company's most recent report in order to summarize the production capacity and potential for future expansion. Based on the following information, I am satisfied that Canopy Growth has sufficient production capacity and potential to meet new demand. I will be watching carefully to determine whether the company can continue to expand production capacity.

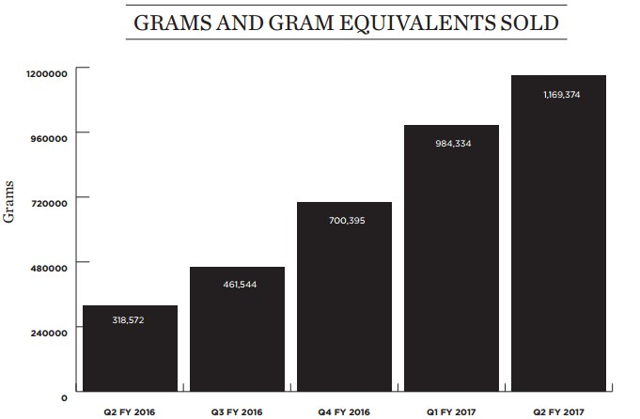

The success of Canopy Growth's production capacity expansion is seen in the increasing number of grams sold every quarter.

Source: Newswire

Licensing Requirements

3. The third criteria for market dominance is that company must have the required licenses in Canada to produce marijuana for recreational and medicinal purposes.

Canopy Growth already has eight medical marijuana production and sale licenses which allow the company,

to produce and sell annually, 21,100 kilograms of dried cannabis and 9,800 kilograms of cannabis oil.

I will be watching carefully as legalization progresses in order to determine whether Canopy Growth is acquiring the necessary recreational licenses. For now, I am satisfied that Canopy Growth has the required medicinal marijuana licenses.

Supply Chain

4. The fourth criteria for market dominance is that the company should have a strong supply chain which allows it to efficiently produce, package, and deliver marijuana products to its customers. Several of Canopy Growth's licenses provide the company with the ability to produce, process, transport, and deliver marijuana products.

I am especially optimistic that Canopy Growth's online marketplace will provide the company with the ability to facilitate its own integrated supply chain. The company describes its online marketplace as follows:

To improve the online experience for today’s medical cannabis customers Canopy Growth recently launched a one-stop shop for multiple cannabis brands. In today’s medical market and in the future recreational market, Tweed Main Street will offer established brands, like Tweed, to age-appropriate customers across the country. Tweed Main Street is an online marketplace that will be available to new entrants, big and small, as more and more producers become licensed for cannabis production.

International Connections

5. Connections to international markets and partnerships with marijuana companies in international markets is an asset but not a requirement for achieving domestic market dominance.

Canopy Growth has stated that one of its goals is to expand into international markets as their governments gradually decriminalize and legalize marijuana. In this regard, the company stated that,

Canopy Growth has to date announced its entry into emerging markets in Germany, Brazil, and Australia, and is evaluating other international opportunities where the regulatory framework permits.

Significant progress has been made in the German marijuana market. Canopy Growth acquired the German medicinal marijuana company MedCann which allows it to distribute medicinal marijuana in Germany. I am optimistic that this represents a precursor to greater expansion in Germany's medicinal market and, once legalized, the country's recreational market.

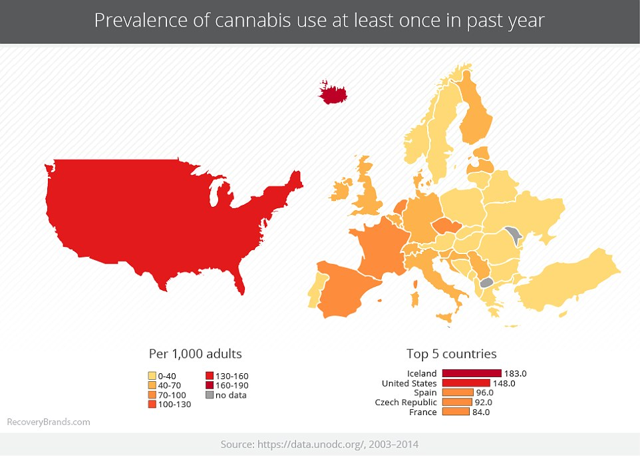

Source: Daily Mail

The graphic above demonstrates that a sizable portion of Europeans have used marijuana recently. These countries, while consuming marijuana at a lower rate than in the United States, represent potential markets for Canopy Growth as the company continues to expand.

Canopy Growth has also made significant progress in Brazil by forming a partnership between its subsidiary Bedrocan and Brazilian company Entourage Phytolab SA in order to develop and market medicinal marijuana products in Brazil. The progress made in this nation of 200 million gives me significant confidence that Canopy Growth can tap into large international markets for medicinal marijuana and, eventually, recreational marijuana. Finally, Canopy Growth has made progress in the Australian marijuana market by signing a strategic partnership with AusCann Group Holdings, a company which develops medicinal marijuana in Australia.

Brand Recognition

6. The sixth criteria for market dominance is that the company should have recreational and medicinal brands which customers can recognize and grow accustomed to.

There can be little doubt that Canopy Growth is developing brands which customers recognize and support. One of the company's principal subsidiaries, Tweed, was recently named an Emerging Cult Brand of the Year at The Gathering, an event which recognizes brands which are successful at developing cult-like followings among customers.

The most positive aspect of Canopy Growth's branding strategy is that it has an array of brands which cater to individual subsections of the marijuana market. The company's core brands are listed below.

Source: Canopy Growth

The brands list is notable because it contains established medicinal marijuana brands such as Bedrocan and Mettrum as well as brands which are attractive to recreational consumers such as Leafs by Snoop. A collaboration with well-known American rapper and actor Snoop Dogg which allows Canopy Growth through its subsidiary Tweed to exclusively market Leafs by Snoop products in Canada.

Product Variety

7. The seventh criteria for market dominance is the ability to produce and market a variety of products such as dried marijuana for smoking or vaporizing, edible marijuana products, capsules, and oils.

As described earlier in this article, Canopy Growth has the ability to produce significant amounts of dried marijuana for smoking or vaporizing. Canopy Growth has also developed a marijuana capsule which can be taken by medicinal marijuana users. The company also has made substantial progress in developing marijuana edibles and oils.

Canopy Growth recently signed a licensing agreement with Isodiol International in order to take advantage of the market for marijuana-infused beverages and marijuana edibles. Canopy Growth has made substantial progress in the marijuana oils sector by acquiring Bedrocan as a subsidiary which has already developed marijuana oils and has licensing to sell these oils to medicinal marijuana patients. Pictures below are some of the marijuana oils produced and sold by Canopy Growth's subsidiary Bedrocan.

Source: New Cannabis Ventures

Product Safety and Consistency

8. The eighth criteria for establishing market dominance is the ability to deliver consistent product safety and scientific testing of marijuana products.

A major scandal erupted at Mettrum in December 2016 when a banned pesticide was discovered in some of the company's products. A month later, Canopy Growth acquired Mettrum. If safety issues appear at Canopy Growth or any of the company's subsidiaries, consumers may begin to steer clear of its products. In addition to a government pledge to increase safety monitoring, Canopy Growth announced that it would implement new safety monitoring procedures. Additionally, Canopy Growth announced that it would support making safety data public in order to win back the public's trust.

I am satisfied that Canopy Growth is actively attempting to secure public trust by implementing rigorous safety testing. I will be watching carefully to see whether any more safety scandals emerge in the next several months.

Ability to Develop New Marijuana Strains

9. The ninth and final criteria for establishing market dominance is the ability to develop new strains of marijuana with different chemical structures for unique medical and recreational audiences.

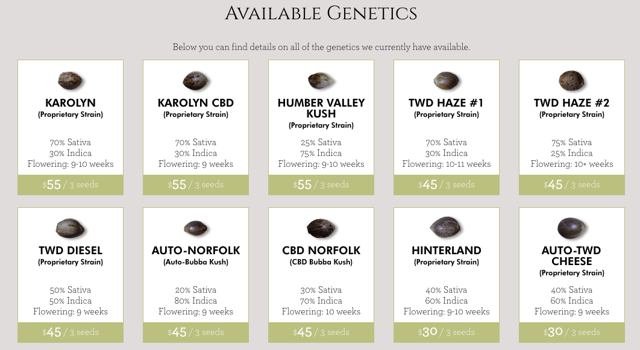

On October 1st, 2015 Canopy Growth and a cannabis breedings and genetics company called DNA Genetics announced an exclusive partnership which will enable Canopy Growth to develop proprietary strains of marijuana to be marketed to different audiences. This is a significant sign of progress and an indication that Canopy Growth understands the importance of creating new marijuana strains.

Canopy Growth's Financial Position

Investors should carefully consider Canopy Growth's financial position before investing in the company. It is important to remember that Canopy Growth is devoting significant investments to prepare for recreational legalization, to develop strategic partnerships with other companies, and to expand into international markets. Accordingly, a profit-driven approach which prioritizes increasing revenue and cutting expenses is not currently appropriate.

The most recent financial information is contained in the financial results for the fourth quarter and fiscal year 2017, the period ended March 31, 2017.

Canopy Growth had approximately $102 million in cash and cash equivalents as of March 31st, 2017 and total liabilities as of March 31st, 2017 were approximately $63 million.

Asymmetric Risk/Reward Opportunity

Canopy Growth is a quintessential example of an asymmetric risk/reward opportunity. This type of opportunity means that investors stand to gain enormously in the best case scenario and not lose much in the worst case scenario. Mohnish Pabrai summarized this type of opportunity this way: "Heads I Win, Tails I Don't Lose Much".

Applying this logic to the situation of Canopy Growth means that investors stand to immensely gain if Canopy Growth becomes the dominant player in Canada's marijuana market. Even if Canopy Growth does not become the dominant player in the market, however, it is still likely to be successful. That is to say, Canopy Growth should still derive a substantial amount of revenue from the legalization of recreational marijuana. This would be reflected in a modest gain to the company's share price even if it does not become the dominant market force.

Competition From Marijuana Companies

Canopy Growth's main business competition will come from the smaller Canadian marijuana companies which will compete for the same market. Aphria, Aurora Cannabis, and Organigram are three main competitors. These marijuana producers each have their own advantages and disadvantages. While it is inevitable that these companies will capture a share of the market, it does not seem likely that they will derail Canopy Growth's path to market dominance.

Aphria

Aphria is a large and consistently profitable marijuana company. Aphria received a license amendment last month from the government which increased their maximum annual production to 8,000 kgs. This is significantly smaller than the production capacity of Canopy Growth's subsidiaries which "are licensed to produce and sell annually, 21,100 kilograms of dried cannabis and 9,800 kilograms of cannabis oil".

Aurora Cannabis

Aurora Cannabis could pose a threat to Canopy Growth due to its large future production capacity. One of the main selling points of this company is its "flagship new 800,000 square foot production facility" which remains under construction and is not projected to produce marijuana until late 2017. The production capacity that Aurora Cannabis may eventually attain could pose a threat to Canopy Growth's dominance of the market. It is worth noting, however, that Aurora only has around 13,000 registered patients compared to Canopy Growth's 55,000. Canopy Growth, therefore, has a large head-start in securing a customer base.

Organigram

Organigram is the largest marijuana producer east of Quebec which could threaten Canopy Growth's market dominance in Eastern Canada and the Maritimes. However, Organigram can only produce and sell 1200kg of dried cannabis and 500kg of oil every year. This is a paltry amount compared to Canopy Growth licensed production.

Competition From Other Sources

Canopy Growth will face competition from the black market for marijuana and from homegrown marijuana. Simply put, if drug dealers and individuals produce and sell substantial amounts of marijuana Canopy Growth's sales will be limited.

The Black Market

An important consideration is the marijuana black market. Essentially, if drug dealers are able to produce and sell marijuana at lower prices than Canopy Growth, the company's revenues will be harmed. This concern is likely not a significant threat to Canopy Growth because the government has pledged to levy harsh penalties on those who sell marijuana outside of the regulatory framework. According to the government,

The Cannabis Act proposes offences targeting those acting outside the legal framework, such as those involved in organized crime. Penalties would be set in proportion to the seriousness of the offence. Sanctions would range from warnings and tickets for minor offences to criminal prosecution and imprisonment for more serious offences.

The penalties are surprisingly harsh with the possibility of 14 years in jail for illegal distribution or sale of marijuana. These penalties should significantly deter drug dealers from competing with Canopy Growth.

Homegrown Marijuana

Under the proposed regulations, adults will be able to "grow up to 4 cannabis plants, up to a maximum height of 100cm". If adults began producing marijuana en masse, Canopy Growth's revenue could be threatened. I am not concerned that this will occur for several reasons.

Firstly, the restrictions state that adults can only grow 4 plants each. Furthermore, provinces can lower the amount of plants which can be grown and may do so in order to derive more taxes from marijuana sales. Finally, it is worth remembering that consumers are able to produce their own alcoholic beverages at home. Only a small portion of the population actually does so. Home-made alcohol does not represent an existential threat to the alcohol industry. For the above reasons, I doubt that homegrown marijuana will represent a significant source of competition.

It is also essential to note that Canopy Growth could profit from homegrown marijuana through the HomeGrow Collection, which offers customers curated seeds in order to grow their own marijuana. This will allow Canopy Growth to benefit from the decision of some individuals to grow their own marijuana.

Source: Tweed Main Street

Source: Tweed Main Street

The picture provided above demonstrates the easy to use order page on Canopy Growth's website which allows customers to select seeds to grow in their own home.

Risks

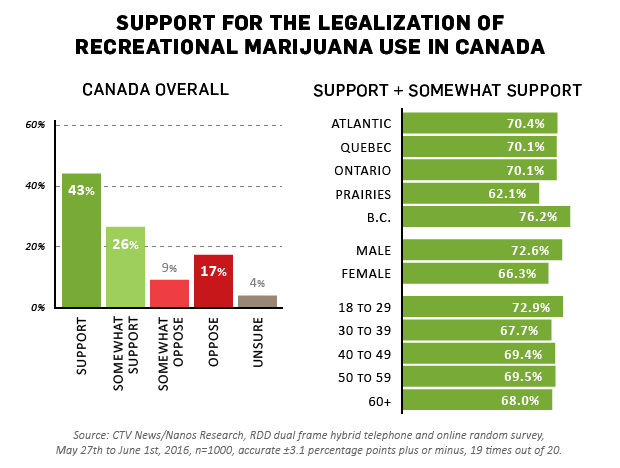

It is also important to know that the nascent marijuana industry in Canada will initially exist at the mercy of the federal government. The government could purposefully or carelessly strangle the industry through the imposition of onerous regulations. Furthermore, the election of a socially conservative federal government could spell trouble for the marijuana industry. It is worth noting that the conservative party is business-friendly and would likely recoil at the idea of quashing a growing industry and the associated taxable revenue. Furthermore, public opinion, as illustrated in the graphic below, is overwhelmingly in favour of the legalization of marijuana.

Source: CTV News

Based on the above reasons, I don't expect the federal government to quash the recreational marijuana industry. In fact, I expect the government to encourage the growth of this new industry in order to spur the economy, provide jobs, and increase taxable revenue. It is important, however, for investors to carefully monitor how the federal government organizes the regulatory framework. Overly high taxes, for example, could cause customers to go the black market to buy their marijuana.

Conclusion

Legalization of recreational marijuana is a massive catalyst which will transform the marijuana industry in Canada. Canopy Growth is in a solid position to take advantage of the impending legalization of recreational marijuana in Canada. The market for marijuana products in Canada is vast and is projected to grow significantly in the years to come. A substantial number of marijuana companies should do well in the near future. Investors should consider Canopy Growth in particular because of its potential to dominate the Canadian marijuana market. The company's diversified business strategy, its strategic partnerships, brand recognition, and financial position lay the groundwork for Canopy Growth to succeed as the dominant player in the industry.

Disclosure: I am/we are long HMMJ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have no position in TWMJF. I am long HMMJ which contains Canopy Growth Corp's Canadian listing WEED. I also plan to initiate a position in Canopy Growth and may do so over the next 72 hours.