{{SKP is mentioned........looking forward for Pluto results....GAME CHANGER......GLTA}}

.

Introduction: Looking over our shoulder and then ahead

The bear market in Gold which arguably started in 2011, had left the junior mining sector hanging on a thread. Interest in junior exploration companies especially, dried up, as did their liquidity. Prospective land packages and gold in the ground were valued at next to nothing. Savvy long term investors warned us that some of these assets had become extreme value propositions and that gold majors were going to face the existential need of restocking their dwindling reserves.

Admittedly, when all seems dark in the 'Gold market', betting on cash burning junior explorers seems to be an act of stupidity, but that is exactly how pessimism knocks prices down and valuations become irrational. The first leg up for precious metals that we witnessed in 2016, definitely rewarded brave and well-informed investors, who dared to invest in these undervalued assets at a time when even the gold majors seemed to be waiting on the sidelines with their cash.

Are we too late? It is funny that, as investors, we seem to get easily caught in the concept of 'being late' as if all opportunities died yesterday.

I will lay down the case that all opportunities did not 'die' yesterday. On the contrary, I'll let the gold majors lead the way and specifically check out what they are up to in the Yukon and try to remind you to stay 'alert' for the'drill result news train' over the coming months!

2017 is a big year for the Yukon precious metals sector

Several majors seem to be battling it out this year in the Yukon. Since 2010, when Kinross (KGC) bought 'Underworld Resources', major precious metals producers had been relatively quiet in the area. With a depressed gold price in recent years, they seemed to focus on getting their existing operations and balance sheets, back on track first.

One could say that Goldcorp (GG) fired the opening salvo in the Yukon when it acquired 'Kaminak Gold Corp' and with it the 'Coffee project' in May of 2016, for a whopping 520 million Canadian Dollars (NYSEARCA:CAD).

Since then, there has been a severe uptick in activity by major gold producers in the area, and you should take notice if you haven't already as we are about to find out how much potential the 'Yukon rocks' are withholding.

Some notable projects in the Yukon!

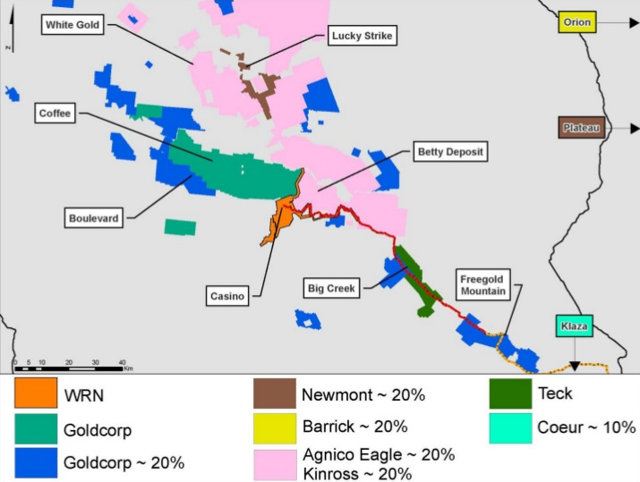

(Source: WRN Corporate presentation)

(Source: WRN Corporate presentation)

Notable moves by large precious metals producers in the first half of 2017:

- Coeur Mining (CDE) takes a 9,9% stake in Rockhaven Resources (OTC:RKHNF) and its 'Klaza' project in the Yukon.

- Barrick Gold Corp (ABX) and Atac Resources Ltd. (OTCPK:ATADF) enter into a partnership to explore the Orion Project. The transaction is valued at 63 million CAD and Barrick can earn up to 70% of the Orion project if it spends at least 55 million CAD.

- Newmont Mining Corporation (NEM) enters into an earn-in arrangement with Goldstrike Resources Ltd. (APRAF) worth 53 million CAD for 75% of the Goldstrike Plateau project in the Yukon territory.

Who else is staking out the Yukon territory?

- Eric Sprott has been spotted with a stake of 12% in the StrikePoint Gold (STKXF) portfolio and an approximate 9% stake in Golden Predator Mining Corp. (OTCQX:NTGSF)

(Source: Strikepoint Gold corporate presentation)

(Source: Strikepoint Gold corporate presentation)

- Agnico Eagle Mining (NYSE:AEM) and Kinross each hold 20% of White Gold Corp (GFRGF). You'll find the 'famous' Shawn Ryan there as Chief Technical Advisor. This is the man who's soil work led to the 'White Gold' and 'Coffee' discovery.

- Western Copper and Gold (WRN) is also positioned in the area with the 'Casino' project and sitting on a massive 4.5 billion lbs of Copper and 9 million ounces of gold in reserves. To build it, however, it will require 2.45 billion USD and that kind of money is still not so readily available in the sector.

- Victoria Gold (OTCPK:VITFF), is in a better position near term as its 'Eagle Gold' project is well underway to be fully financed (Capex: 300 million USD) and is rapidly advancing towards a production decision. Victoria Gold is expected to produce 200,000 ounces of gold per year by 2019, at an AISC of 639 USD per ounce.

- Strategic Metals Ltd. (OTCPK:SMDZF) is a small cap 'project-generator' with a large portfolio of claims and strategic investments in the Yukon. I personally own shares in the company and it is currently one of my preferred ways to diversify in the Yukon.

The 'exploration boost' is underway and 'everyone' is drilling again.

As a direct result of these recent 'dealings' by major precious metals producers in the Yukon, juniors have been able to boost their exploration programs significantly as money is finding its way back to their corporate bank accounts. Find hereunder some examples of money being put at work in 2017;

- Atac and Barrick will be spending approximately 15 million CAD in 2017 on exploration at the 'Rackla Gold property'.

- Gold strike used the following words in its news release on July 5th:

The company has now commenced the largest drill campaign to date on the Plateau Property - Goldstrike’s flagship project - which hosts a newly discovered district-scale gold system that extends for 50 km in Canada’s Yukon

- White Gold's exploration budget for 2017 is up more than 4-fold to 7.3 million CAS from 1.6 million CAD in 2016. They expect to drill 20.000 meters over 200 holes in 2017 and according to their investor's presentation, have already budgeted a minimum of 11 million CAD in exploration expenditures for 2018-2019.

- Golden Predator is executing on a 9.5 million CAD exploration program in 2017, which includes 40.000 meters of drilling.

While the extra money is fantastic for junior explorers, one other fact that boosts my optimism for their chances of success is that these majors do not just provide capital. In most cases, they are very much involved with their human capital as well. It bodes well for the rate of success if you have world-class geologists with 'proprietary knowledge and techniques' working on their projects.

I believe that the dominoes are in place and that positive drill results will lead to more exploration expenditures and more activity in a region that is considered to be one of the safest and favorable mining jurisdictions in the world.

Final thoughts and disclosure

While only time will tell us if the majors got it right with their recent investments in the Yukon territory, it definitely is a testament to their belief that the region has enormous potential. For sure, large and successful mining districts only get full recognition after the fact. It fits the notion of ' I'll believe it when I see it'. I think the Yukon's future could surpass its already famous and glorious past.

The sudden renewed presence of all of these majors and their respective moves, make me think it's not too late to position ahead of the herd in this new 'Yukon Goldrush'. Actually, If you think about it, this might be the exact right time to get in and start positioning, as one has to recognize an elemental truth in the mining business. As long as there is no serious capital invested into exploration, there will be no discovery, and without it, we cannot add value.

In my opinion, the current exploration efforts of the various actors in the region will slowly, but surely, unlock more value in the Yukon. Therefore, I think it's a smart investment strategy to follow the moves of these majors closely, and see which projects really get rewarded with new and follow-up investments towards their respective exploration programs and discoveries.

In the end, we know exploration is a capital intensive and lengthy process and one single drill hole never made it into a mine, so you still should have some time to choose your winners. Follow the majors and follow the drill holes.

In addition, I would also argue that there is probably no need to convince anyone in the gold sector that we are currently not really in a 'gold mania' phase and, in my mind, this helps us to protects ourselves from paying too much for exploration companies and further suggests that 'now' is still a good time to invest.

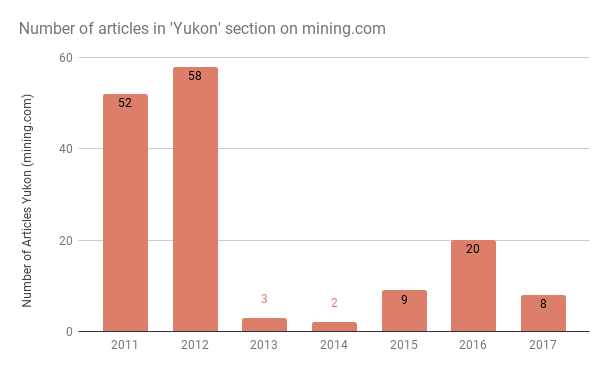

In that regard, I thought you might find it interesting or at least amusing to see how 'interest' in gold and the Yukon territory is measured in 'amount of published articles' on mining.com since 2011.

While I do not pretend that the data compiled to be 'investment grade' as, among other factors, editorial content is not really relevant when making your investment decisions. It does, however, seem to support the 'emotional' journey gold investors have been on. Where would you place extreme optimism (overvaluation), extreme pessimism (undervaluation), and early hope?

(source: data compiled from mining.com)

I suppose that what I'm suggesting is that we are in many ways still early in the potential birth of a new bull cycle in gold and 'interest' in the Yukon is only just starting to pick up. Therefore if you can afford a long term perspective, following the money is probably the safest way to expose your portfolio to 'safe jurisdiction' junior exploration companies in the Yukon.

In closing, I do not intend to pick tomorrow's winners in this article, nor have I mentioned each and every promising company in the area, but I am suggesting you be 'on high alert' for news about exploration companies and their progress, successes or failures in the Yukon. In the end, the majors are not looking for small mines out there. Finding the 'diamond in the rough' might be worth your while.

When investing in small-cap stocks, you should always consider the higher risks involved and the higher volatility of the stock price and the potential total loss of your investment. Your portfolio and investment decisions should be based on your own investment profile and risk appetite. Remember that this article is subject to various factors beyond this author's control (management and execution risks, governmental interference, silver and gold price, environmental issues, etc.); furthermore, this article is not to be interpreted as investment advice - rather, as an idea to further investigate and do your own due diligence.

Disclosure: I am/we are long SMDZF, KGC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.