seeking alfa new article just came outhttps://seekingalpha.com/article/4105878-major-regulatory-developments-increase-canopy-growths-appeal?auth_param=5c32:1crdtbt:22d9f4a382316fd41a3e403c916f4f82&utoken=6a5c04bdadf248436ef6cd65378c5641

Major Regulatory Developments Increase Canopy Growth's Appeal

Summary

As investors eagerly await the legalization of recreational marijuana across Canada in July, 2018 regulatory developments must be carefully tracked.

The recently released marijuana regulatory regime in Ontario, Canada's largest province, will likely be highly beneficial for large licensed producers such as Canopy Growth.

Other Canadian provinces are making progress on proactively crafting regulations for marijuana sales ahead of legalization.

Additionally, the federal government will imminently advance the legalization of recreational marijuana through legislation and the publication of regulations.

Finally, Canopy Growth continues to maintain its edge over competitors by increasing its already massive marijuana production capacity.

As Canopy Growth (OTCPK:TWMJF) shareholders eagerly await the legalization of recreational marijuana in Canada, provincial and federal bureaucrats have feverishly worked to craft regulations. Canopy Growth shareholders should be optimistic based on the news that Canada's largest province will implement a regulatory regime that is unfriendly to the black market and to small, craft producers of marijuana. This regulatory system will likely be positive for large, established producers such as Canopy Growth.

Progress in other Canadian jurisdictions is another positive indication that provincial governments are committed to the timely implementation of marijuana legalization. Finally, Canopy Growth has continued to maintain its superiority over competitors by increasing its marijuana production capacity. Combined, these factors reinforce the investment thesis from my article titled "Canopy Growth Poised To Dominate The Canadian Marijuana Market," which was released on Aug. 2nd, 2017. The investment thesis, made clear from the title, is that Canopy Growth is on a path to market dominance.

Regulatory Progress

As stated at the outset, marijuana investors are understandably eager for the legalization of recreational marijuana across Canada. Rather than becoming irrationally exuberant, however, it is necessary to assess the emerging regulatory framework for the sale and production of marijuana. In the table below, I will set out my thoughts on the ideal regulatory framework for a large licensed producer such as Canopy Growth.

| Characteristics of the Ideal Regulatory Regime for Large Licensed Producers | Rationale |

| The online sale of marijuana products from licensed producers should be permitted. | Allowing online sales from licensed producers will help customers with mobility issues or who live in rural areas access marijuana from a reputable source. |

| The regulatory regime should crack down on the black market. | A thriving black market will place competitive pressure on licensed producers. |

| The regulatory regime should place reasonable restrictions on the growing of marijuana from home. | If citizens are allowed to grow marijuana from home unimpeded, they will have less reason to buy marijuana products from licensed producers. |

| Small growers and producers should be prevented from proliferating. | Licensed producers would be negatively affected by the proliferation of small, "craft growers." |

| Provincial and federal taxes on marijuana products must be kept low. | High taxes on marijuana products will reduce demand for marijuana products and may provide a boon to the black market. |

It is important to remember that I am not discussing what the best regulatory regime would look like from a public policy or free-market perspective. I am merely directing investors to the types of regulations, which will benefit companies such as Canopy Growth.

Ontario's Recently Announced Regulatory Regime

Ontario, Canada's largest province, announced the creation of a regulatory regime to govern the production and sale of marijuana in the province. The key elements of the regulatory framework and their potential effects on Canopy Growth will be explored in this article.

Source: The Canadian Press

Source: The Canadian Press

1. The proposed minimum age to use, purchase and possess recreational cannabis in Ontario will be 19. The use of recreational cannabis will be prohibited in public places and workplaces. This aspect of the regulatory framework is to be expected and likely will have no material impact on Canopy Growth.

2. The LCBO will oversee the legal retail of cannabis in Ontario through new stand-alone cannabis stores and an online order service. Approximately 150 standalone stores will be opened by 2020, including 80 by July 1, 2019, servicing all regions of the province.

This is an immensely positive aspect of the regulatory framework for Canopy Growth. Small, "craft marijuana" companies will be forced out of the market by the government. The government will need to purchase its marijuana products from large suppliers like Canopy Growth. As reported in the National Observer, industry experts posited that...

... Ontario's plan to sell and distribute recreational pot exclusively through a network of government-operated stores could lock in the dominance of the country's large-scale licensed marijuana producers and weed craft growers out of the market. (emphasis added)

3. Illicit cannabis dispensaries are not and will not be legal retailers. The province will pursue a coordinated and proactive enforcement strategy, working with municipalities, local police services, the OPP and the federal government to help shut down these illegal operations.

This aspect of the regulatory regime is also great news for Canopy Growth shareholders. Tackling the marijuana black market is essential in order to quash a pernicious form of competition. With one of its source of competition extirpated, Canopy Growth will be able to assert dominance over the marijuana market.

For the reasons listed above, Ontario's new marijuana regulatory regime confirms that investment thesis that I articulated this summer: Canopy Growth has the opportunity to not only thrive, but actually dominate the Canadian marijuana market.

Upcoming Federal Regulatory Progress

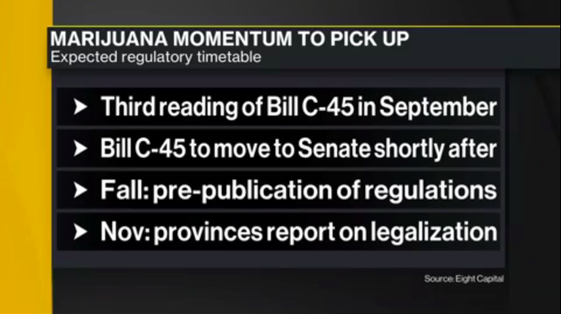

Progress is not only occurring at the provincial level. The federal government is also rapidly increasing the pace of regulatory progress. In the next several months, Parliament is expected to move along the marijuana legalization Bill-C-45. The Senate will then read the Bill before it is approved. This fall will also see the pre-publication of federal marijuana regulations. Canopy Growth investors should keep careful track of these developments and watch them with cautious optimism.

Production Capacity Expansion

Canopy Growth has continued to build production capacity in order to meet demand for marijuana which is forecast to outstrip supply. On Sept. 8th, Tweed Farms Inc., a wholly-owned subsidiary of Canopy Growth, announced an expansion which will give the company...

... 1,000,000 sq. ft. of greenhouse space under glass, plus post-harvest facilities including a recently renovated 10,000 sq. ft. of updated space for new drying rooms and an upgraded laboratory.

Conclusion

The proposed Ontario regulatory framework is a positive indication for Canopy Growth. The regulations will likely have the effect of supporting large licensed producers such as Canopy Growth, while suppressing competition from the black market and small growers. Additionally, the federal government is making substantial progress towards legalization. Finally, Canopy Growth continues to take positive steps to cement its position at the top of the pack of publicly traded marijuana companies. It will take significant effort for Canopy Growth to dominate the Canadian marijuana market. Recent developments demonstrate that the foundation for dominance continues to be laid.

Disclosure: I am/we are long HMMJ.