Stay long folks....I have mentioned that CPG will be $15 by Winter or Early Spring (Between FY17Q4 - FY18Q2)...Be patient.

Note: This article was first published to HFI Research subscribers on Oct. 1. We have since published "Paradigm Shift, Part 2" focused on why shale producers are "forced" to move to a return focused business model. If you're interested, come and join us today!

In our 2017 midyear special recap, we wrote a piece called, "Oil Markets Plagued by Lack of Investor Confidence." In this report, we said:

Half-truths are taken as the whole truth in this day and age. Whether it's 'fake news' or false headlines, the market pervasiveness to obsess over U.S. crude storage data over anything else undermined the bull's efforts since the start of 2017.

We then followed with a discussion on U.S. shale. Here's what we said:

What about U.S. shale?

Weekly estimates from EIA points to 9.35 million b/d in the U.S., but the monthly data that just came out from the EIA 914 report on Friday pointed to a drop in U.S. crude production month over month, led by a drop in the Gulf of Mexico. Taking GoM out of the mix, Texas only saw production growth of 35k b/d, or nearly 30k b/d less than what analysts are forecasting. Were we right that the servicing bottleneck will continue to plague shale producers?

It's still too early to celebrate on this, but we think the EIA has been drastically overestimating weekly production data, and U.S. shale is actually growing much slower than everyone expects. Remember that consensus is already pegging an average growth rate of 1.2 million b/d for 2018, so if this comes in below expectations, the market balance in 2018 won't look anywhere close to where the bearish narrative pits the market balance.

With the benefit of hindsight, we can now celebrate our arduous prediction at the time. While we were just a quarter away from realizing this "mythical" truth, the slow realization that U.S. shale is growing much slower than the consensus expected is the biggest "half-truth" bust in this oil cycle.

But the most important prediction of all from our midyear recap was this:

In our view, we needed the bears to return in the first half of 2017 because it sets us up for an even more optimistic second half. As the market tested the pain point for shale producers, we now know that $45 WTI is the point at which U..S shale producers won't be willing to ramp production into. We also know that investors are starting to ignore the business model of "grow at any cost" and reward producers that focus on free cash flow generation, a pivotal turning point in understanding just how much U.S. shale can grow.

With the focus being on prudent capital spending, we estimate that if all shale producers spent within cash flow, even assuming $60 WTI, 2018 production growth would be limited to 400k b/d. If we assume $70 WTI, U.S. shale growth in 2018 would be 650k b/d. Spending within cash flow, if true, might just be what tips us into massive undersupply in the years ahead. Combine that with the cliff drop we're waiting for in non-OPEC supplies, and we have a recipe for the new oil bull market.

In hindsight, this forecast is proving, in our view, to be the most prescient forecast we've made all year. Yes, our discovery that the Eagle Ford was the root cause for the overstated U.S. shale production ranks up there. But understanding the "paradigm shift" is much more important, and if U.S. shale does move from a business model of "grow at any cost" to one where "return" becomes the focus, there will be zero discussion around "lower for longer."

Paradigm Shift Will Bail Out The Bears

Over the last few weeks, we gained an unbelievable edge in understanding the oil markets. For the first time in this oil cycle, we obtained the edge of understanding U.S. shale. Looking back, this was easy to obtain, but the number of hours we needed to think of a way to express our findings was tedious indeed. So, while our efforts seem obvious to us, it's still not obvious to the market yet - and it might never be.

On Friday, the EIA's latest monthly data for U.S. oil production in July showed exactly what's happening. The data came in 178k b/d below the weekly estimate. The sell side came out with mea culpa reports, blaming lackluster U.S. shale growth on the potential shift from "growth at any cost" to "return focused."

We all know that it wasn't the paradigm shift that resulted in these disappointing production results, but the bears and consensus will use whatever is at hand to cover up their mistake of being overly aggressive on U.S. shale. We think the story over the next quarter will be one where journalists and the investment community start discussing the change in executive pay packages at these shale E&Ps from "grow production" to "grow production profitably."

As these discussions heat up, the "lower for longer" crowd will start revising U.S. shale estimates lower. They will claim that this is an important shift and, as a result, they expect U.S. shale production to be slower than expected. While this is not the type of revelation we were looking for, at the end of the day, we couldn't care less. The crowd was wrong, and our edge was right regardless of whether this paradigm shift happens or not.

A Multi-Year Bull Trend And Why It's Beginning

It's precisely this understanding of "perception of reality," however, that makes us think the paradigm shift is here. Perception of reality is a tricky thing. The market operates under imperfect information, and while some half-truths never make it onto investment personnel desks, we think there's going to be one coming very soon - an oil supply shortage.

Our observation of the energy market over the last three years has led us to some interesting conclusions. First, we don't believe that the oil price range we traded in over the last three years represents any type of "fundamental analysis." This is an interesting observation, because if the range that we traded in was artificially depressed, that means the market is holding on to false confidence using this range band.

Second, we believe that the undersupply situation will happen much sooner than many people expect. In Q4 2017, we are already estimating a 2 million b/d deficit. This comes from a combination of our bearishness on non-OPEC supply and a more realistic look at global demand.

The EIA, in its latest weekly report, even noted that Brent reaching $65/bbl is no longer a delusional forecast. If winter proves to be at least normal, a heating oil demand spike will prompt most refineries to materially delay maintenance, resulting in much higher crude draws. And like all perfectly timed cycle turning points, heating oil inventory just so happens to be at the lows of the year right now.

Third, everyone's confidence has been hinged on the idea that U.S. shale would give us enough supplies, when in reality (as our work has shown) it's not going to happen. There is near perfect consensus out in the market place today that U.S. shale will be the harbinger of supplies. Productivity gains and lower break-even have prompted people to call U.S. shale as the new "swing producer."

Whatever nickname they want to give to U.S. shale, the moment these producers start spending within cash flow, no oil price scenario will see the world adequately supplied by 2020. Here's an even scarier thought: Even if U.S. shale decides to go full throttle "grow at any cost" again, it won't get the 1.4 million b/d growth the consensus is forecasting.

So, what happens if U.S. shale producers move from the business model of growing to making money? The answer is quite simple. In a report we wrote in August titled "Shale Is Great But It's Not As Great As People Think It Is," we looked at the economics of owning a "shale producer" from the perspective of a business owner. Here was our conclusion:

For U.S. shale producers, the process of outspending cash flow and borrowing to grow production stems from the inherent bet that the operators believe oil prices will move higher in the future. The NPV value of this basic analysis showed the same net present value in the cash flow generated, because the cost of replacing the declining production will eat into profits.

Taking a further step back here, what we are trying to say is that the economics of the shale business are where if commodity prices remain relatively stable, a producer should not be focused on growing production, instead keeping production flat and returning capital back to shareholders.

Basically, the economics of a commodity producer are no different than those of a technology company. It all comes down to the return on invested capital and the space in which you can deploy this capital into. In the hands of a commodity producer, an upward trending oil price scenario is extremely bullish for return on invested capital. Why? As we noted in the above-mentioned article:

The shale oil and gas business is a predictable business in many senses. Producers can predict the number of wells they will drill that year, estimate the cost to drill, and budget the capital spending plans surrounding it. It's one of the most predictable 'business operating models' in the business world. The biggest caveat? You don't know what you will sell the oil and gas for...

The only uncertain variable in the shale business model is the uncertainty in the commodity price. But if the price is upward trending, then the free cash flow yielded from the operations will surprise to the upside.

We then followed up our commentary on this subject with a report titled "The true power of thinking long-term and what it does to your investment portfolio." We said:

[C]ommodity producers earn a very high return on invested capital, and have large capacities to invest if commodity prices are high enough.

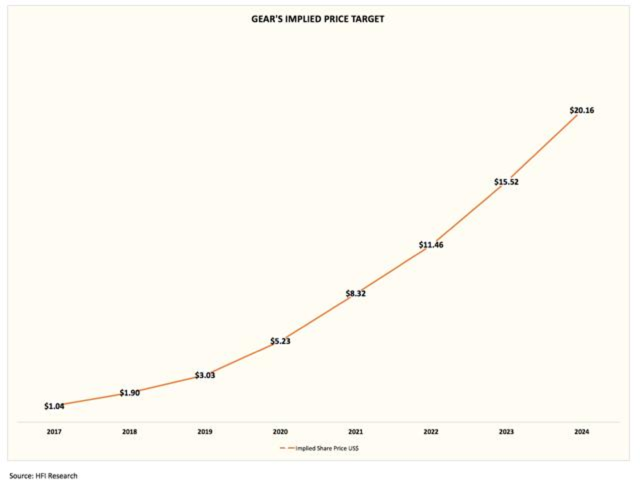

We then illustrated this with Gear Energy (OTCPK:GENGF).

Note: The above is for illustrative purposes only, and not meant to be used as our price target or forecast.

The real power of compounding is letting this trend be your friend, as Pain Capital discussed in a recent daily article. As you can see above, we are reminding everyone what happens if oil prices trend higher from 2017 to 2024. In the hands of a capable producer, your money doesn't just double - it explodes to the upside.

This is precisely what we see in energy stocks. We believe we are in the makings of a multiyear bull trend. After a decade of neglect as demonstrated by the chart below, it's time for the laggard to start shining.

The supply gap in the global oil markets will take hold of the market's perception of reality. We have no doubt that scenario will take place. The only question is: When will the market wake up? Will we see this begin in Q4, as it coincides with U.S. shale production data disappointing to the downside and executives changing compensation packages? Or will it coincide with global oil storage falling to the five-year average by Q1 2018?

What is certain, though, is that there are practically no scenarios right now to take us off this path of an impending oil shortage. The world is not ready for the end of cheap oil, and the only ones positioned to profit will be the investors who own energy stocks. Surprisingly, the interest in energy stocks has never been lower since 2004. Go figures, right?

Disclosure: I am/we are long TSX:GXE.TO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.