Ted Ohashi: How To Make Money On MJ Stocks In The Next 3...Months... He doesn't think Canopy will be affected by tax loss selling, which is kind of a bummer as i still have some cash burning holes in my pockets...

How To Make Money On Cannabis Stocks In The Next Three Months

As we approach the end of 2017 and the start of 2018 many seasonal forces will come into play creating profitable opportunities in the cannabis sector.

Anthony Cataldo explained these in his Seeking Alpha article Upcoming Seasonal Anomalies: A Marijuana Stock Focus. I have piggybacked on his ideas and added some Canadian data on year-end cycles.

I cover monthly performance of Canadian stocks, tax loss selling, the Santa Claus rally and the RRSP effect with some analysis based on proprietary data on the Canadian cannabis group.

I expect December to be a positive month with some impact of tax loss selling leading to particular strength after Christmas creating momentum for a strong start to 2018 - the year of legalization.

I would not hold back from investing in the cannabis group for long and certainly don't think you should hold back after Christmas. The seasonal factors may help but don't miss the outstanding long-term growth potential in cannabis.

As we approach the end of the calendar year, stock market investors can expect to see some recurring patterns. I discuss tax loss selling, the Santa Claus rally and the Registered Retirement Savings Plan (RRSP) effect and their potential impact on cannabis investments. Also, I am coming from a Canadian point of view. I recommend everyone also read Anthony Cataldo's Seeking Alpha article Upcoming Seasonal Anomalies: A Marijuana Stock Focus

Starting with tax loss selling, please note I am not giving income tax advice. I am discussing the potential impact of tax rules on the stock market. I will also give you an update on tax loss selling timing which is different this year due to a change in Canadian exchange settlement rules. Please only make personal income tax decisions on the advice of your professional tax expert.

According to Canadian income tax regulations, net taxable capital gains that are crystallized (realized) in a calendar year form part of taxable income in that year. However, if you have realized capital losses in the same calendar year, losses offset gains and reduce or eliminate the amount of taxes payable. This means investors are motivated to realize capital losses to offset capital gains as year end approaches.

The 2017 calendar year qualifies as one in which tax loss selling will most likely be a factor.

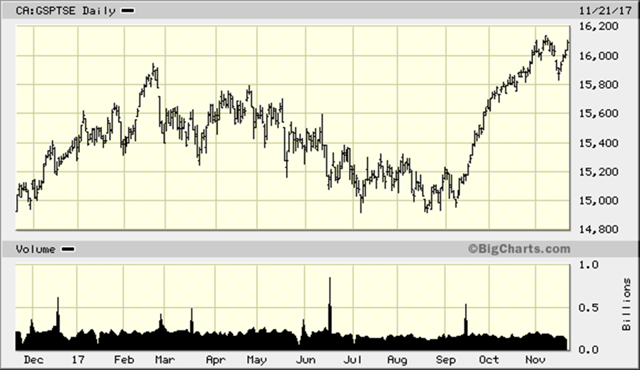

This is the Toronto Stock Exchange Index (S&P/TSEX Composite) so far in 2017. It shows prices are at or near record highs. Although the index has had wide swings this year, investors probably took profits on balance.

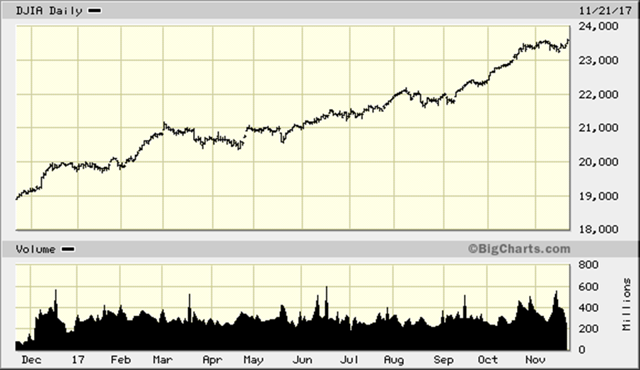

The next chart shows the Dow Jones Industrial Average for 2017. In this case, the trend is predominantly upward and it is even more likely that capital gains were realized during the year.

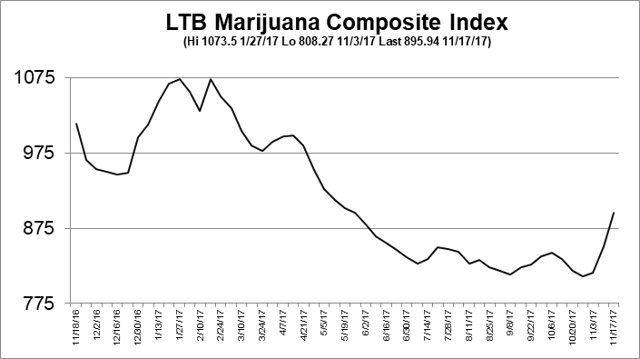

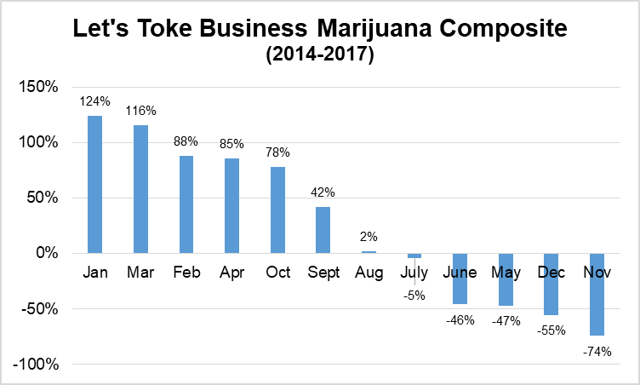

Finally, the following is the chart of the Let's Toke Business Marijuana Composite Index.

The picture here is different. The cannabis stocks have been weak for most of the year except at the start of the year and the last few weeks following the Canopy Growth/Constellation Branks transaction. Also, of the 100+ cannabis stock prices I watch daily, almost half are trading well below the midpoint in their 2017 high/low range. All of this makes it more likely that investors have many opportunities to make tax loss sales in the cannabis group of their portfolios.

To have a capital loss count toward offsetting a taxable capital gain in 2017, the sale must settle within the calendar year. For Canadians, tax loss selling will be different this year because of the switch to two-day settlement (T+2) from three-day settlement (T+3) effective September 5, 2017. This puts Canada in line with U.S. settlement rules. This year Canadians can sell a security on a Canadian exchange as late as December 27, 2017. If we were still operating under 2016 rules, the deadline would have been December 22.

I state again for the record I am not holding myself out as an income tax expert. However, I will add a warning to investors that there is a "superficial loss" rule that applies to Canadian taxpayers. To have a sale crystallize a capital loss for tax purposes, you cannot repurchase the same security until 30 days have passed. You also can't buy it back in your spouse's account. You can't buy it back in a different account of you or your spouse such as a Tax Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP) or a corporation controlled by either of you.

For holders of Canadian cannabis stocks, it means you might see some selling in the group that increases as December 27th approaches. However, this will be on a stock-by-stock basis. For example, as things stand at the time of writing you probably won't see much selling come into Canopy Growth. It would be hard to be in a loss position on this stock. But as I said, almost half of the 100+ stocks I monitor are trading well below the midpoint of their 2017 high and low. So the potential for tax loss selling in the cannabis group is there. If you see that happening to one of your holdings and you are still confident about the business outlook, take advantage of the weakness and buy.

Next, let's talk about the Santa Claus rally also known as the year end rally. The narrowest definition of this phenomenon is a rise in stock prices that occurs between Christmas and New Year's often extended to the first couple of days of the new year. In other words, it is a profit opportunity given to investors by St. Nicholas at Christmas. There are many reasons given to explain this seasonal event including:

- It is a bounce that takes place after the end of tax loss selling.

- Investors spend the cash raised in the process of tax loss selling.

- It is buying in anticipation of rising stock prices in January.

- It is buying on the momentum created in December, one of the best months of the year.

- It is a rally fueled by optimism for the economy in the new year.

- It reflects people investing their Christmas or annual bonuses paid at this time of year.

- It results from regular year/quarter/month end investment by individuals and institutions.

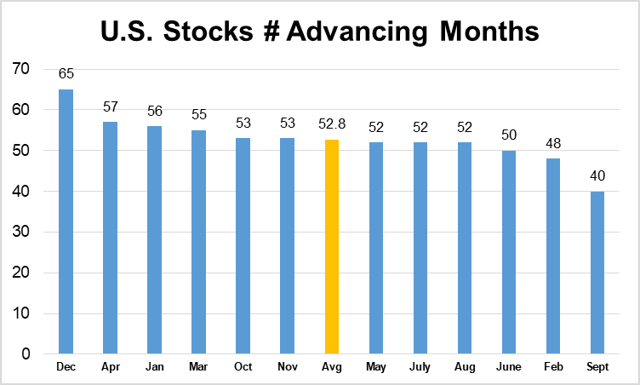

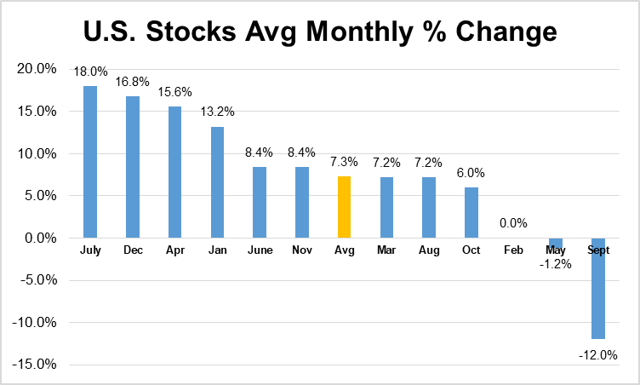

The first chart illustrates in the U.S. December is the month in which gains are recorded most often. It is also interesting to note that three of the next four months of the year record the most frequent positive returns. Overall, four of the five most likely months for gains in the U.S. occur from December to April inclusive.

The next chart contains one major surprise. It shows the monthly annualized rate of return from the U.S. market by month. Although July has been a somewhat substandard month in terms of frequency of positive change, it turns out to be the best month in terms of average return. This can only happen if July produces consistently above average market returns. Still, the next three highest return months fall in the December to April period. Finally, September has been a terrible month with an average annualized return of approximately -12%. It is also the only month that the market goes down more often than it goes up.

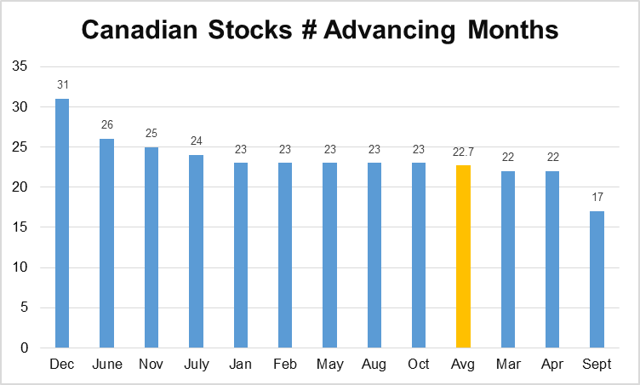

Next, let's turn our attention to Canada. In the chart below, the first point that is evident is although the U.S. and Canadian economies and monetary policies are similar they are not the same. This is reflected in the stock market patterns that are also similar but not the same.

For example, in Canada, December is also the month in which gains are recorded most often and five of the most frequently advancing months fall between November and May, inclusive. As in the U.S., September is also the month in which stock prices advance least often in Canada.

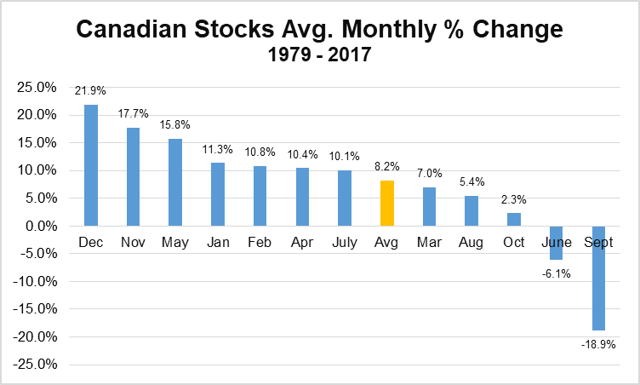

The next chart shows the average monthly stock market returns for Canadian stocks listed on the Toronto Stock Exchange. The Canadian market data shows evidence of a year end rally phenomenon that appears to start sooner and continue longer into the next calendar year. The best month on average has been December followed by November. Five of the best months for stock market return fall in the six months from November to May inclusive. The worst month is September in both cases and Canadian stocks seem to be somewhat more volatile.

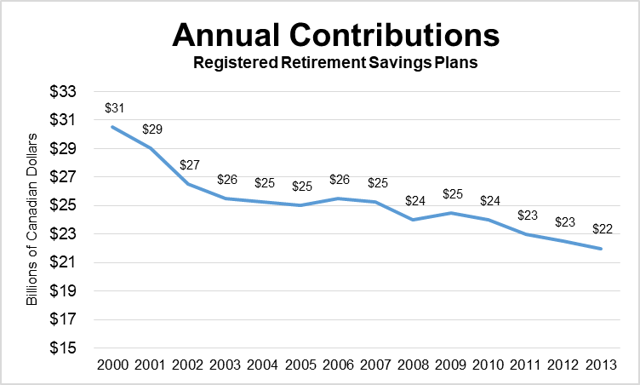

Now let's look at the Registered Retirement Savings Plan effect. In Canada, RRSPs supplement pensions by allowing taxpayers to make annual contributions and deduct the amount contributed from taxable income. The amounts in an RRSP accumulate tax-free until funds are withdrawn. With RRSPs, you have 60 days after the calendar year end to make a contribution that applies to the previous taxation year. This year, for example, you can contribute up to March 1, 2018, and deduct the contribution for the 2017 tax year.

There are two things evident from the chart above and one that is not as clear. First, the amount put into RRSPs has been declining. One explanation is with an aging population, more Canadians are reaching the point of withdrawing funds for retirement income. Also with a more difficult economy generally, some people have been forced to withdraw past savings to pay for current necessities. Another reason might be the introduction of the Tax-Free Savings Account in 2009. TFSA contributions have more than offset the decline in RRSPs but there is no seasonal effect. Despite the lower RRSP totals, there is still over $20 billion a year in contributions. A substantial proportion of these savings finds its way into the stock market.

What isn't as obvious is a significant amount of the total is contributed in January and February for the preceding taxation year. It's human nature to leave things until faced with a deadline. Canadians are accustomed to being in the bank in late February and seeing lines of people making their last-minute contributions. Brokers and investment advisors also are used to scrambling around at that time of year to make sure clients have made their RRSP contributions. The flow of these funds has an impact on the investment markets at this time of year.

Finally, here is a look at the Let's Toke Business Marijuana Composite Index. Our qualification is the lack of data available. The chart is based on statistics from October 2014 to October 2017. This means only four years of data for October and just three for the rest.

One thing that is clearly evident and correct. The cannabis stocks are more volatile. In the previous chart, the best months in Canada were July and December with average annualized gains of 18.0% and 16.8%. With the cannabis stocks, the best average annualized gains were in January and March with annualized advances of 124% and 118%, respectively. The other thing worth noting is December has been the second worst month while the first four months of the year are the best.

Conclusions: Here are my best estimates for the way these seasonal issues will interact to impact cannabis stocks:

- We are entering December on a positive trend in the cannabis stocks. Given the usual seasonal strength in stocks in general, I believe positive momentum will overcome a brief history of weakness in December and carry the rally well into the month.

- Given the strength in markets generally during the year, I think people probably have realized taxable capital gains in 2017. Given many cannabis stocks are down in price in 2017, I think we will see some tax loss selling in this group between mid-December and Christmas.

- Remember, however, stocks need to be in a loss position for tax loss selling to be of any benefit in offsetting taxable capital gains. So tax loss selling will be selective. I don't expect much impact on the stocks I have been recommending all year because they are at or near all-time highs. So don't expect Aprhria (OTCQB:APHQF), Aurora (OTCQX:ACBFF), Canopy Growth (OTCPK:TWMJF), Emerald Health (OTCQX:EMHTF), Lexaria (OTCQB:LXRP), Namaste (OTCQB:NXTTF), Organigram (OTCQB:OGRMF) or Radient (OTC:RDDTF) to be hit significantly by tax loss selling as there isn't much room to realize losses with these stocks. If there is a general market correction, all stocks will probably decline but stocks such as these will be impacted less.

- I still receive questions from readers asking if it is too late to buy Emerald Health, Lexaria, Namaste, and so on. My answer usually involves a reminder that regular readers know I am reluctant to advise chasing stocks up or dumping stocks down. However, I am also a believer in the outstanding long-term outlook for the cannabis industry and the stocks mentioned above in particular. So I would not want to go past Christmas without cannabis exposure in portfolios. As a compromise, I suggest buying a half position in the stock(s) of your choice immediately and following up if there is a tax loss selloff that provides an opportunity to buy more at lower prices.

- After tax loss selling ends on December 27, 2017, I anticipate the cannabis stocks will put together a strong rally at month end, quarter end and year end buying gives stocks positive momentum going into January and February when markets will be fueled by the inflow of Registered Retirement Savings Plan funds. Again based on limited data, these have also been the best months for cannabis stocks. So I believe it is a bad idea to delay investing in cannabis stocks beyond Christmas.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.