Africa Oil Corporation (OTCMKTS: OTCPK:AOIFF) is an almost $0.5 billion oil company and one with significant resources. Africa is a rapidly growing economy that will soon become a major player in the oil environment. As we will see throughout this article, the company's leading assets along with the company's financials make it a top tier investment to take advantage of African Oil.

Africa Oil Corporation - Africa Oil

Africa Oil Corporation Leading Assets

Africa Oil Corporation has had a massive drop in its stock of almost 85% since the start of the oil crash. However, the company has a portfolio of leading assets that will produce a significant amount of oil.

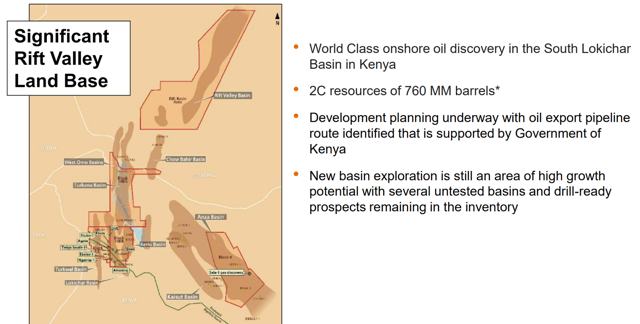

Africa Oil Corporation Land Base - Africa Oil Corporation Investor Presentation

Africa Oil Corporation has a significant rift valley land base with a world class onshore oil discovery in Kenya. The company has 760 million barrels of resources here that have the potential to generate $10s of billions in profits as prices recover. African countries are looking to grow their economy and oil is a great way to do that, which Kenya will support. That means this resource can bring strong profits for the company.

The new basin has a number of drill-ready prospects in the inventory and is a region of high growth. Africa Oil Corporation owns the land here to take advantage of these assets which could result in more production going forward. The company is also looking at an oil export pipeline support by the Kenyan government that should result in low production prices once production starts.

The potential in this basin can be seen in the company's recent success in the South Lokichar Basin. The company has only explored 20% of the entire basin, but has had a very high success rate opening up 8 discoveries in a row. The company's 3D seismic testing shows additional potential and the company has several untested play types. These play types could generate significant production for the company.

In the Basin Center Fan reservoirs of the South Lokichar Basin, the company had wells in the Twiga South test oil at high rates up to 3270 barrels per day and the company estimated unrestrained potential of more than 10 thousand barrels per day. The company anticipates apparent inflow into the reservoirs that have yet to be flow tested. That means significant potential production for Africa Oil Corporation.

Overall, we can see that Africa Oil Corporation has significant assets that have the potential to generate significant production.

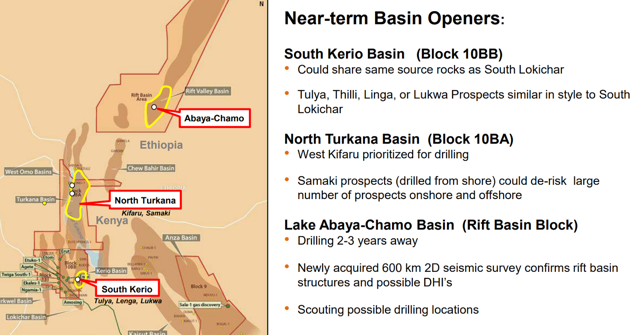

Africa Oil Corporation Basin Openers - Africa Oil Corporation Investor Presentation

In the remainder of the company's assets, the company has several basin-opening prospects that are drill ready. These resources could share the same source rocks as South Lokichar meaning they could have a comparable amount of production. The company has prioritized these regions for drilling and anticipates drilling is several years away.

And that drilling means that Africa Oil Corporation will be able to continue its production going forward for years to come. In the North Lake Abaya prospects, the company has found source rocks with 5-7% and are early mature for oil. These resources could generate significant production at economical rates and will have accessible infrastructure making it even more profitable.

Overall, in 2018 in the Lokichar basin, the company plans to continue with technical studies to increase both resource size and certainty. At the same time, the company plans to continue with progress development studies and prepare its infrastructure for growing production. That means that Africa Oil Corporation will move closer towards significant production, and that now is the time to invest.

Most importantly, starting in early-2018, the company plans to start further production testing. This production testing will provide the company with crucial reservoir information to allow the company to accurately predict well rates. That accurate prediction will allow accurate production meaning the company will become a top-tier investment.

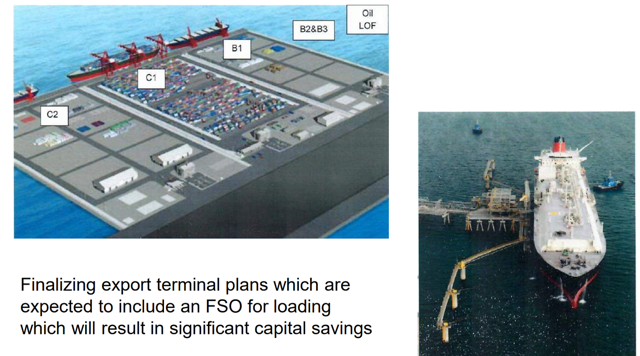

Africa Oil Corporation Export Terminal - Africa Oil Corporation Investor Presentation

And Africa Oil Corporation isn't simply preparing to produce oil and then wondering what it's going to do with it. The company is finalizing plans for a new export loading terminal which will provide it with significant capital savings and reduced costs. Overall, this shows the strength of Africa Oil Corporation's anticipated future assets and the strength of the corporation's setup.

Overall, we can see how Africa Oil Corporation has an incredibly strong portfolio and the infrastructure to backup a massive increase in production. That production should come from the company's massive portfolio of assets and makes the company a strong investment.

Africa Oil Corporation Financials

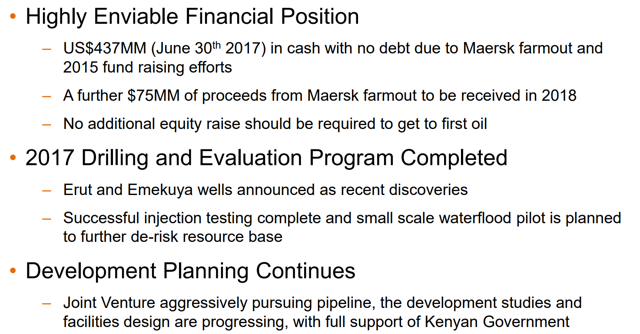

Africa Oil Corporation has a highly enviable financial position to backup its significant portfolio of assets putting it in an incredible place going forward.

Africa Oil Corporation Financials - Africa Oil Corporation Investor Presentation

Africa Oil Corporation, a company with a market cap of less than half a billion, consists of almost all of that market cap in cash and no debt thanks to the company's support from giant Maersk at the start of the crash. The company should receive $75 million of additional proceeds from Maersk in 2018 providing it with significant additional capital. As a result, that means the company will need no additional equity raise for first oil.

The company has recently completed its 2017 drilling and evaluation program and plans to de-risk its resource base going forward. The company's development plan continues to aggressively pursue its pipeline, and with the full support of the Kenyan government, the company could reach production soon. That production will result in significant profits for shareholders.

As a result of this strong financial portfolio, the company has no debt and there will be no further dilution of shareholders, along with the company's portfolio, the company is a strong investment.

Conclusion

Africa Oil Corporation has had a difficult time since the start of the oil crash. The company has an incredible distribution of assets that have huge potential. Testing has shown that these assets can produce 10s of thousands of barrels per day unrestrained, something that means significant production. On top of that, Africa Oil Corporation has noticeable other regions for production.

Africa Oil Corporation has an incredibly strong financial portfolio thanks to Maersk. The company has no debt and more than $0.4 billion in cash. It anticipates it'll receive another $0.075 billion in cash in 2018, cash that means the company won't need to additional any extra equity. As a result the company will soon achieve first oil meaning huge potential and profits going forward.

Disclosure: I am/we are long AOIFF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.