Comment: As my followers and regular readers know, I have been searching for my next cannabis recommendation for several weeks. In order to find a quality investment opportunity in this rapidly changing market, I began by laying out the characteristics I wanted to see to qualify a company for my next recommendation and in the process uncovered Sunniva Inc. (CSE: SNN)

Here is a summary of what I looked for:

- Management: the company must have management with a breadth and depth of knowledge in their area of interest. Senior management must be able to demonstrate a level of expertise that gives me confidence that they will be able to carry out the business plan to a successful endgame. Sunniva is led by Dr. Anthony Holler who previously founded ID Biomedical that was sold to GlaxoSmithKline in 2005 for $1.7 billion

- Business line: I wanted a company with a business plan that was unique and made sense. I expect Sunniva to be the first company authorized and growing in the U.S. and Canada, more specifically California and Canada. These are, at present, the two largest cannabis markets in the world.

- Level of development: I looked for a company that has made some progress toward its goal. In other words, the operations should have moved toward generating revenue and positive cash flow. Sunniva reported over CDN$10 million in revenue for the nine months ended September 30, 2017 and rapid growth should continue.

- De-risked operations: as we move forward it is important that investors have some protection from volatile markets. One way to accomplish this is to de-risk the business model. Sunniva will do this by signing contracts to pre-sell a substantial proportion of its production.

- Not dependent on the capital markets to fund day to day operations: the cannabis stock markets have been spectacular. But one only has to go back a year to realize investors are not always willing to provide capital to smaller companies. SNN is generating a growing level of revenue and has $12 million cash on hand.

- No company worth considering has been completely overlooked: I would have loved to find a great company whose stock was depressed but that is not possible. However, my calculations suggest SNN at current levels will provide investors with an excellent return.

Here is what I see with Sunniva:

Management: for me, the key to an investment in a company like Sunniva is management. Here are some highlights of SNN's senior management team:

Dr. Anthony Holler is a co-founder, chief executive officer (CEO), chairman and director. Holler, who is leading the SNN team, is the former CEO and founder of ID Biomedical which was a leader in high quality, low-cost manufacturer of flu vaccines that was sold to GlaxoSmithKline in 2005 for $1.7 billion. Dr. Holler invests in and takes an active role in every company he works with. He is engaged full time with a focus on increasing shareholder value.

Leith Pedersen is a co-founder, president, director and my main contact. Pedersen has an investment background as owner and CEO of Vida Wealth Management, Bahamas, investment advisor at Canaccord Wealth Management and partner and director of JF Mackie, an independent brokerage firm in Calgary, Alberta. He has impressed me with his extensive understanding of the industry and work ethic and seems to have a skill set perfectly suited for his role as president of SNN.

Dave Negus is a recent addition as chief financial officer (CFO). Negus has over 20 years of financial leadership most recently as CFO of Luvo, Inc., a forward-thinking food company. Previously, Negus was vice president, corporate controller at lululemon athletica and led the finance team through their initial public offering. Mr. Negus received his Chartered Professional Accountant designation at Deloitte.

There are several other executives in key positions but I cannot mention them all. Hopefully over time I will have the opportunity to speak with many of them.

Business: SNN has a business plan currently centered on being a low-cost producer of cannabis in both California and Canada. This will make SNN unique among existing licensed producers with domestic markets double the size of anyone else.

U.S. Location: SNN is located in Cathedral City in southern California in the Coachella Valley, a popular vacation spot for Canadians who frequent Palm Springs/Palm Desert. The average monthly temperature ranges from a low of 56 F in December to a high of 96 F in July. The rainiest month is January with an average of only 1.27". Clearly, this is an excellent location for greenhouse growing. California is now the world's largest cannabis market with a population of 39 million and a Gross Domestic Product of US $2.424 trillion. If California was a country, it would rank sixth largest in the world.

Arcview Market Research indicates consumer spending on legal cannabis in North America is beating expectations. The report projects retail cannabis sales will grow 33% from 2016 to about $10 billion last year. The data published projects by 2021 the legal cannabis market will reach a value of $24.5 billion, a 28% compound annual growth rate.

According to BDS Analytics, a leader in cannabis business intelligence, California's medical marijuana market already matches Colorado, Washington and Oregon combined. But the lack of clear regulatory parameters has, until recently, discouraged substantial capital investment in the cannabis industry in the Golden State. This means although it is the largest and longest-standing end-market, California's cannabis industry is still relatively immature.

For example, although cannabis became legal on January 1, 2018, California consistently lagged in clarifying its regulatory framework. Looking back, it was an early adopter of legalized medical marijuana but subsequently lagged Colorado, Washington, Oregon and Nevada in approving adult-use cannabis. Consider that although adult-use cannabis became legal on January 1, 2018 in California, many of the regulations were not clarified until just a few weeks before. As a result, San Francisco did not have dispensaries open for business until January 5th while Los Angeles did not even start taking applications to operate dispensaries until January 3rd implying dispensaries in L.A. will not open for business for several weeks. The overall result has been sub-scale market participants, the majority of which are not capable of producing quality cannabis or complying with upcoming state-level regulations.

This somewhat disorganized competitive landscape adds up to opportunity for SNN that broke ground on their flagship, municipally approved facility in Cathedral City, near Palm Springs in early November 2017. Subsequently, the state introduced licensing requirements. As required, the state licensing application will be submitted when construction is completed and the facility is ready to sell product. Referred to as the 'California Campus' it will feature 489,000 sq. ft. of state-of-the-art purpose-built greenhouse production. It is a two-stage project. Phase 1 will entail 324,000 sq. ft. of growing space and is targeted to produce over 60,000 kg. of cannabis annually with the first harvest scheduled for the third quarter of 2018. Phase 2 will involve an added 165,000 sq. ft. of production anticipated to be operational by Q1 2020 that is projected to produce an additional 40,000 kg. When fully operational, the California Campus will produce 100,000 kg. of premium flower and 30,000 kg. of other plant material that will be converted into higher margin cannabis oil.

The budget for Phase 1 is USD$54 million in total. SNN entered a strategic financing agreement with Barker Pacific Group (BPG) that will incur the construction and outfitting costs of building the facility. The final lease, signed October 2017, features a sale and leaseback of the land over a 15-year term with three five year extensions. BPG is a well-recognized real estate management and development company based out of California.

Sunniva Extraction Facility - Cathedral City, California: Sunniva has a licensed extraction facility in Cathedral City, California less than a mile away from the Sunniva Campus with operations commencing Q1 2018. The company recently received State licensing approval for this facility. The facility will produce pesticide-free products by converting clean flower and trim to extracted products such as cannabis oil. The oil will be used for drug delivery formats such as capsules, dissolvable strips, vaporization cartridges, tinctures and creams. The facility will leverage the Vapor Connoisseur private label relationships to provide these brands with full procurement services in addition to vaporization devices and custom oil cartridges. The facility is one of the few in California to be licensed for both volatile and non-volatile extraction. At capacity, this facility will have the ability to process over 500 lbs/day of bio-mass.

I believe SNN is well positioned to become the leading grower in the world's largest cannabis market based on their first mover advantage in California, the technology that promises to make them both a high quality and low cost, large scale producer and management's ability to convert successful results into optimal stock market valuations. I believe SNN will likely become California's only large-scale growing facility in the near term that satisfy the increasingly stringent local safety regulations for the cultivation and sale of cannabis. For these reasons, people are now referring to SNN as the 'Canopy of California.'

Canadian location: SNN is a late stage applicant to become a Licensed Producer located in Oliver, British Columbia. BC is an excellent choice for SNN and is often referred to as the California of Canada. It is the westernmost province and in the same time zone. BC is the third largest province in Canada and has a long and positive association with cannabis. In the days of the predominantly underground economy, "BC Bud" was an internationally known and coveted strain that was among the best the black market had to offer.

The town of Oliver is located at the south end of the Okanagan Valley in the only designated desert in Canada. It is renowned for the growing of fruit and grapes, the latter used to produce some of the best-rated wines in the world. Although its climate cannot replicate the conditions in California, it is the by far the best Canada has to offer. The average monthly high temperature is 72 F in July and the average low monthly temperature is 30 F in December. The average monthly high precipitation is only 1.63" in June and the average monthly low precipitation is .85" in October. The land for the facility will be leased from the local Osoyoos Indian Band that provided a letter to Health Canada in support of the proposed facility.

Sunniva Medical Inc. (NYSE:SMI) is the applicant for a license under the Access to Cannabis for Medical Purposes Regulations (ACMPR). The application is in final review and construction at Oliver is expected to begin in early 2018 and to be completed by year end. Initial deliveries should commence in the first quarter of 2019. Phase 1 is expected to be approximately 400,000 sq. ft. When Phase 2 is complete, the total campus is planned to be 700,000 sq. ft. of greenhouse facilities to produce 125,000 kg of premium cannabis and 35,000 kg of other plant material annually to be used for higher margin extracted products.

The strategy for Canadian production is to pre-sell up to 75% of the output under long-term supply contracts with sophisticated distribution partners. This will de-risk large volumes of output and is a strategy with which I concur. The remaining output is expected to be sold by SNN directly. These sales will have a much higher profit margin to offset the higher risk inherent in this strategy. I expect to see announcements on sales contracts as we move ahead.

In my opinion, SNN has the capability to capitalize on the thriving Canadian cannabis market at this point in time. Deloitte recently estimated the base market for Canadian legal recreational cannabis could start at between CDN$4.9 billion and CDN$8.7 billion. At the upper-end estimate, the potential adult-use cannabis market in Canada approaches the size of the Canadian wine market which is reported at CDN$9 billion according to the Canadian Vintners Association. However, Deloitte estimates the economic impact of legalization could be as much as CDN$22.6 billion once all ancillary services are taken into account.

When both campuses are operating at capacity based on current plans, it is expected that SNN's output will be approximately 225,000 kg. This represents CDN$2.25 billion in potential value at CDN$10 per gram

Greenhouse technology: An important component in growing in the two desert locations is having the technology to take advantage of the sunlight. What SNN has done is referred to as "purpose built." This means taking the latest hydroponics and greenhouse technology and selecting options that specifically benefit the growth of cannabis.

Some features of these state of the art greenhouses include:

- Diffused glass that provides a shadow-free growing environment and uniform distribution of lighting.

- Customized mobile bench-top systems that maximize utilization, increasing growing space by nearly 31%. Total facility utilization increases from 65% to 85%.

- Isolated growing bays with optimized lighting settings and blackout screens that ensure biocontainment and support high volume production and daily harvests.

- Specialized finishing bays that maximize resin production and drying chambers that protect essential terpenes (fragrant oils) prior to storage.

- Dedicated bays that simulate autumn-like conditions, triggering natural plant responses that push nutrients from roots and leaves to the flowers, maximizing resin production and overall flower quality.

- Microclimatic controls that ensure precise growing conditions.

- Advanced climate control sensors.

- Pharmaceutical grade bio-containment to minimize potential for contamination and pestilence, which present a serious threat if allowed to infect crops.

- Employee and personal access control, ensuring security and minimal chances for contamination.

- Airlock entry and exit points, minimizing the potential for outside contamination.

- Advanced software and barcode scanning to track plants throughout the harvest cycle, providing analytics to improve product quality in future cycles.

- In-house quality testing to ensure quality standards are met and detect plant flaws early.

- Commercial grade irrigation systems to ensure consistent nutrient delivery to plants and to substantially improve crop vegetation and maturation rates.

The base product is a 3rd generation system developed in the Netherlands that is fully automated and now is fully adapted for the growth of cannabis. This will result in major cost savings including a substantial reduction in labor and electricity costs.

The facilities are designed to comply with "Good Manufacturing Practice" (cGMP) protocols. A company operating to cGMP standards offers the market products whose quality, identity, purity, and strength has been tested and confirmed according to controlled manufacturing processes. This will also allow for product to be exported from Canada to other countries that require cGMP. The facilities will be largely-automated, using world-class commercial greenhouse technology. They will also enjoy major energy savings from automation and harnessing plentiful sunlight.

This will provide SNN the advantages of growing a high-quality product at a low production cost. Top quality is important in both California and Canada but will give SNN a particular advantage in California where we have said over 85% of product currently being sold is contaminated. Health Canada enforces strict standards and this will be seen more as a competitive edge in California. From a production cost perspective, SNN expects costs of under $1.00 per gram. When attained, this will certainly mark them as one of the lowest cost producers.

Natural Health Services Ltd. (NYSEMKT:NHS) - Don't make the mistake of underestimating the value of this business to a company like SNN. NHS owns and operates a network of 8 medical clinics in Canada located in Alberta, Ontario and Manitoba and specializes in medical cannabis under ACMPR. NHS connects patients with safe and effective medical cannabis products through Licensed Producers. SNN acquired 100% of NHS on February 8, 2017 for CDN$22.5 million in stock and cash.

NHS is Canada's largest network of true medical cannabis clinics working with 21 in-house physicians and two nurse practitioners specializing in the endocannabinoid system. These health care professionals provide unbiased expert consultation, education, and recommendations for patients. The NHS call centre in Calgary receives approximately 1,000 calls per day and has over 100,000 active medical documents outstanding and 75,000 active patients. There is up to a three-month backlog to get an appointment and the number of active patients is growing significantly per month.

NHS utilizes a unique triage system to that reflects the urgency of a patient's condition. This allows NHS physicians to serve 8-10 patients per hour prioritized by patient need. The fees are paid by provincial health plans and shared between the doctor and the clinic.

In addition, NHS has a proprietary, secure software platform called SPARK. The platform removes the need for NHS to provide its patients physical scripts, allowing the patients' script and medical documents to instead be entered into SPARK's database. With the use of a unique PIN, patients can use SPARK to select a Licensed Producer of their choice immediately and send their order and medical documents electronically for processing. Spark is currently integrated with 25 Licensed Producers that pay NHS a share of revenue for purchases of cannabis. When SNN has its own product for sale, it will be one of the LPs with the attendant increase in profit margins.

NHS recently initiated a pilot program with a large national pharmacy group to utilize NHS doctors and the Spark software on a referral fee basis to the pharmacy, to aggregate even more patients across Canada. This model could potentially be brought to all pharmacies. NHS has also recently hired Dr. Mark Kimmins to recruit additional doctors and lead the pharmacy pilot program(s).

NHS is proving to be an excellent acquisition as it reported CDN$7.4 million in revenues from the acquisition date to September 30, 2017 - a period of around nine months. The NHS business model is scalable with ample room to grow and SNN will benefit from leverage when production becomes available from the Canadian Campus.

Full-Scale Distributors, LLC (FSD) - FSD, through its brand, 'Vapor Connoisseur,' provides custom, private-label vaporizers. FSD currently serves over 80 brands in the North American marketplace. Vapor Connoisseur is recognized for its high quality and innovative vaporization devices. Products are tailored to client needs, ensuring both safety and reliability.

There is also a leverage opportunity for SNN with FSD. Eventually, SNN will sell vaporizers directly. When the California Campus is producing, they will sell oils, extracts and fully loaded oil cartridges for customized FSD vaporization devices, this is another opportunity in California where quality and consistency of product is not reliable and profit margin on upstream cannabis products carry a much higher profit margin.

This is a high growth industry. BIS Research estimates the global market for electronic cigarettes and vaporizers will reach US$50 billion in 2025, reflecting a CAGR of 22.36% since 2015.

Summary of financial results for the nine months ending September 30, 2017 in $CDN

- Revenue of $10.2 million for the nine months ending September 30, 2017 compared to nil for the same period in 2016.

- Revenue growth of 39% third quarter over second quarter increasing to $4.6 million in Q3 from $3.3 million in Q2.

- The adjusted net loss for the nine months ending September 30, 2017 was $4.1 million ($0.16 per share) compared to $5.5 million ($0.31 per share) for the same period in 2016.

- Reduction in debt with the repayment of $2.25 million in promissory notes.

- Closed an offering of special warrants for net proceeds of $6.2 million at $6.75 per warrant subsequently qualified by prospectus, and a concurrent private placement of $1.2 million.

- Received unanimous approval by Cathedral City's Planning Commission for its conditional use permit triggering the commencement of construction of the California cultivation facility.

- Wholly owned Natural Health Services Ltd., surpassed more than 100,000 medical documents and 75,000 active patients and expanded into Ontario and Manitoba.

- Acquired 100% of the membership interests in A1 Perez, LLC for total consideration of $1.3 million resulting in an additional oils and extracts manufacturing license and a manufacturing facility contiguous to SNN's existing facility on Perez Road, Cathedral City, CA.

- Reported adjusted working capital of $7 million as at September 30, 2017.

- In anticipation of the public listing and high growth to follow SNN strengthened its management team with the addition David Negus as CFO, including his core finance team and appointed Vinnie Shastry as President, California operations.

Sunniva Inc. going public process: went public by long form prospectus receipted on November 17, 2017 by the Securities Commissions of British Columbia, Alberta and Ontario. When trading commences on the Canadian Securities Exchange on January 10th, buy and sell orders are matched on the exchange and trading will start. There are no Initial Public Offering (IPO) securities because SNN does not need cash thanks in large part to the prearranged financing for construction of the California Campus and CDN$12 million on hand.

SNN intends to apply to list its shares on the OTCQB once its shares are listed on the CSE.

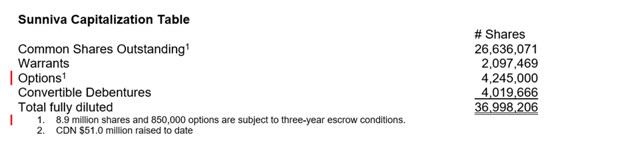

One of the most compelling reasons that should motivate prospective investors is SNN has accomplished everything I have described and has issued only 37.0 million shares on a fully diluted basis. All shareholders benefit if management is able to avoid the types of massive dilution some startup companies have incurred.

One of the most compelling reasons that should motivate prospective investors is SNN has accomplished everything I have described and has issued only 37.0 million shares on a fully diluted basis. All shareholders benefit if management is able to avoid the types of massive dilution some startup companies have incurred.

Before outlining the reasons I am totally in support of an investment in SNN, I must remind you of the investment risks that exist.

When an investment offers as much growth potential as SNN, there are also risks:

- We were reminded recently of the political risk associated with investing in cannabis in the United States as the Federal Government continues to list marijuana as a SCHEDULE 1 (CLASS I) drug that means it has high abuse potential, no medical use, and severe safety concerns. Although we completely disagree with the position, it is a risk factor.

- Forward looking statements such as plans and projections are not guaranteed to happen. But strong management can overcome a lot of bumps in the road ahead. As a cannabis advocate, I am optimistic about the long-term future for the industry but even that is a forward-looking statement.

- Finally, despite the success of operations, the stock market can decline and the price of stocks representing sound businesses will also decline. This is a risk that must be acknowledged.

However, I find the arguments in favor of investing in SNN very compelling.

- Management is led by Dr. Anthony Holler whose previous venture involved building ID Biomedical, a company producing high quality, low-cost flu vaccines. ID Bio was eventually sold to GlaxoSmithKline for CDN $1.7 billion. Holler has invested his own money in SNN and I am told he is a very hard worker. Investors can hope he will create a high quality, low-cost cannabis grower that will also be sold, perhaps to a big pharma company. Holler is backed up by a strong management team.

- SNN is entering California, the largest cannabis market in the world, at an early stage. I believe this gives the company a very real first mover's advantage and it could come to dominate cannabis growing in the state by producing a high quality, low-cost product. Combined with growing in Canada, the second largest cannabis market in the world, SNN will attract considerable investor attention.

- Both grow facilities will be located in desert regions to take advantage of free sunlight. When combined with the outstanding greenhouse, hydroponic technology SNN has sourced that will be used in both locations, there will be an opportunity to learn lessons in one facility that can be applied to the other.

- The combined planned output from the 'CanAm' operations is substantial. When both campuses are fully operational according to current plans, the annual output could exceed $2 billion at an assumed price of $10 per gram.

- Natural Health Services is Canada's largest medical clinic devoted to cannabis. The call centre receives approximately 1,000 calls per day and the patient base of 75,000 is increasing significantly. NHS reported revenues of CDN $7.4 million in the first nine months under SNN's ownership and is growing at around 40% quarter-to-quarter and there is as much as a three-month waitlist to get an appointment. This may go down as one of the great acquisitions in the cannabis industry.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

SOURCE - https://seekingalpha.com/article/4136527-sunniva-leading-worlds-two-largest-legal-cannabis-markets