Buckle your seatbelt — the market has been on a bumpy ride this week. And in light of the recent sell-off in pot stocks, it’s worth taking a deeper look at what’s happening in the markets. Consider this your pot-stock correction survival guide. Of course image: https://duip7hn7nchpo.cloudfront.net/editor-ray-blanco.png

, this isn’t the first correction in pot stocks we’ve weathered over the past year. But it is the first time in a long time that all the pot markets have dipped this much. This past Tuesday was the first time in five months that the S&P 500 index dropped more than 1% in a single day. That’s not much of a move — but in the context of how positive the rest of the market has been lately, it shook some people up. Investors forgot that stocks can go down, too! That volatile day for the big stock averages translated into more abrupt swings in the pot indexes too with declines extending into Friday. The five-day chart isn't pretty for the U.S. pot index:

, this isn’t the first correction in pot stocks we’ve weathered over the past year. But it is the first time in a long time that all the pot markets have dipped this much. This past Tuesday was the first time in five months that the S&P 500 index dropped more than 1% in a single day. That’s not much of a move — but in the context of how positive the rest of the market has been lately, it shook some people up. Investors forgot that stocks can go down, too! That volatile day for the big stock averages translated into more abrupt swings in the pot indexes too with declines extending into Friday. The five-day chart isn't pretty for the U.S. pot index:

image: https://s3.amazonaws.com/agorafinancialwebsite/wp-content/uploads/2018/02/USPot.png

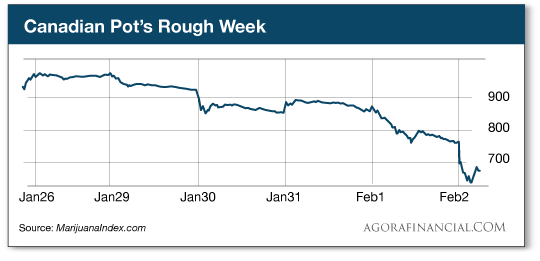

And even though Canadian weed has been a shining star recently, it also took a big slide this week.

And even though Canadian weed has been a shining star recently, it also took a big slide this week.

image: https://s3.amazonaws.com/agorafinancialwebsite/wp-content/uploads/2018/02/CanadianPot.png

But it’s important to remember a few things before you let the panic set in. The fact is corrections like we’re seeing here aren’t uncommon. They’re not even cause for concern. As I said back in August, during the last pullback in the pot stock market, corrections are a good thing! They offer price sensitive investors a discount window that they can jump in on that they may otherwise have passed on. Markets — yes, even the pot markets — are cyclical by nature. They go up. They go down and they repeat this action. If you scale the lenses back a bit, pot is still performing exceptionally well for the long term. The North American index, an average of top U.S. and Canadian pot stocks, is still up almost 120% over the past three months:

But it’s important to remember a few things before you let the panic set in. The fact is corrections like we’re seeing here aren’t uncommon. They’re not even cause for concern. As I said back in August, during the last pullback in the pot stock market, corrections are a good thing! They offer price sensitive investors a discount window that they can jump in on that they may otherwise have passed on. Markets — yes, even the pot markets — are cyclical by nature. They go up. They go down and they repeat this action. If you scale the lenses back a bit, pot is still performing exceptionally well for the long term. The North American index, an average of top U.S. and Canadian pot stocks, is still up almost 120% over the past three months: image: https://s3.amazonaws.com/agorafinancialwebsite/wp-content/uploads/2018/02/Perspective.png

image: https://s3.amazonaws.com/agorafinancialwebsite/wp-content/uploads/2018/02/Perspective.png

In the context of the roaring rally that propelled pot stocks higher over the past few months, this current correction doesn’t look so bad. The point is markets don’t move straight up, even in the strongest rallies. Corrections relieve the pressure from the system to keep things from getting overbought. They’re just scary enough to get the weak hands out of the market, and they give stronger traders the opportunity to buy more on the way up. Remember, we expect some volatility in pot. It's the nature of the beast. But these speculative pot stocks are much more likely to return big gains when compared to companies like GE or IBM. And the pot business is stronger than ever! While there’s no shortage of drama — from the political shenanigans in Washington to the volatility we just looked at in the markets — the long-term trend is up and to the right. It’s an exciting time to be a marijuana investor. This industry is in motion and there’s no stopping it. For Technology Profits Daily,

In the context of the roaring rally that propelled pot stocks higher over the past few months, this current correction doesn’t look so bad. The point is markets don’t move straight up, even in the strongest rallies. Corrections relieve the pressure from the system to keep things from getting overbought. They’re just scary enough to get the weak hands out of the market, and they give stronger traders the opportunity to buy more on the way up. Remember, we expect some volatility in pot. It's the nature of the beast. But these speculative pot stocks are much more likely to return big gains when compared to companies like GE or IBM. And the pot business is stronger than ever! While there’s no shortage of drama — from the political shenanigans in Washington to the volatility we just looked at in the markets — the long-term trend is up and to the right. It’s an exciting time to be a marijuana investor. This industry is in motion and there’s no stopping it. For Technology Profits Daily,

image: https://duip7hn7nchpo.cloudfront.net/signature-ray-blanco.jpg

Ray Blanco

Ray Blanco