OTCPK:WLDCF - Post by User

Post by

stranger5on Feb 19, 2018 10:16am

1004 Views

Post# 27582760

Here is that Great Article

Here is that Great Article

from today 11:02 News shareribs bites Soft Commodities

ICC Labs - The Next Takeover Candidate for Aphria and Co.

( shareribs.com ) Dear reader, every German investor who has dealt with the megatrend cannabis knows the big Canadian producers Canopy Growth (stock market value: 5.25 billion CAD), Aurora (market value: 4.75 billion CAD) and Aphria (stock market value: 2.26 billion CAD). The Toronto-listed ICC Labs Inc. (WKN: A2JAMF), the largest legal cannabis producer in South America, is unfairly almost unknown in Germany. Compared to the Canadian competition, the ICC Labs share is extremely undervalued with a stock market value of just $ 185.8 million. As the big players from Canada make no secret of their expansion plans to South America, ICC Labs is in our eyes a very attractive takeover candidate. This offers smart investors a profit potential of more than 400 percent. ICC Labs has secured licenses for cannabis cultivation in two South American countries, where it can produce extremely low-cost production of pharmaceutical-grade CBD extracts primarily for global export. ICC Labs is a fully licensed and broad-based cannabis producer in the politically stable agricultural country of Uruguay. On the one hand, the company targets the domestic market and was selected by Uruguay's government to produce cannabis for recreational use and distribute it to registered users through pharmacies. To date, ICC Labs has a license to produce up to 2 tonnes of cannabis per year, but expects to grow to 10 tonnes per year due to the huge demand. Anyone who has thought that the cannabis market in Uruguay is uninteresting is wrong.  Source: https://www.icclabs.com According to official government sources, the domestic need for recreational cannabis is 26.5 million tons per year. This is based only on the 55,200 people who are registered as regular users and the maximum allowed consumption of 40 grams of cannabis per month. Individuals in Uruguay are considered regular users if they consume cannabis at least once a week. Another 92,300 persons are considered occasional users, but have not been included in the above calculation. So far, only 15 percent of the total needs can be covered by licensed producers. By comparison, in Canada at the end of September last year, there were 235,621 active customer registrations with licensed producers for medicinal cannabis, with individuals registered with more than one licensed manufacturer (Source: www.canada.ca/en/health-canada/ services / drugs-health-products / medical-use-marijuana / licensed-producers / market-data.html ). Overall, ICC Labs has land with a total area of approximately 232 hectares. In a greenhouse in San Jos, more than 20,000 cannabis plants are currently growing on an area of around 6,555 square meters. 300 kilograms have been sold so far. The expected production of this greenhouse is 5,000 kilograms by the end of 2018.

Source: https://www.icclabs.com According to official government sources, the domestic need for recreational cannabis is 26.5 million tons per year. This is based only on the 55,200 people who are registered as regular users and the maximum allowed consumption of 40 grams of cannabis per month. Individuals in Uruguay are considered regular users if they consume cannabis at least once a week. Another 92,300 persons are considered occasional users, but have not been included in the above calculation. So far, only 15 percent of the total needs can be covered by licensed producers. By comparison, in Canada at the end of September last year, there were 235,621 active customer registrations with licensed producers for medicinal cannabis, with individuals registered with more than one licensed manufacturer (Source: www.canada.ca/en/health-canada/ services / drugs-health-products / medical-use-marijuana / licensed-producers / market-data.html ). Overall, ICC Labs has land with a total area of approximately 232 hectares. In a greenhouse in San Jos, more than 20,000 cannabis plants are currently growing on an area of around 6,555 square meters. 300 kilograms have been sold so far. The expected production of this greenhouse is 5,000 kilograms by the end of 2018.  Source: https://www.icclabs.com Another greenhouse with an acreage of about 2,000 square meters and an outdoor area of 40 hectares (seeding on 27 hectares) are located in Canelones. In the town of Flores, the sowing of hemp seeds on an area of around 147 hectares has already taken place. ICC Labs can plant a total of 200 hectares here. ICC Labs is also building the first CBD extraction plant in South America with a production capacity of 150,000 kilograms per year. Priced at $ 0.90 per gram of cannabis, Uruguay's selling price is low, but still provides ICC Labs with a 50% profit margin thanks to its extremely low-cost production! At these prices, Canadian producers would lose a long time. However, supplying the international market with CBD extracts is even more interesting and lucrative for ICC Labs. Here, revenues of more than $ 300 million and profit margins of around 75 percent are welcome. The large neighbor Brazil (200 million inhabitants) and other South American countries, such as Argentina (41 million inhabitants), Chile (17 million inhabitants), Colombia (50 million inhabitants) and Mexico (127 million inhabitants) now allow the Use of cannabis for medical purposes.

Source: https://www.icclabs.com Another greenhouse with an acreage of about 2,000 square meters and an outdoor area of 40 hectares (seeding on 27 hectares) are located in Canelones. In the town of Flores, the sowing of hemp seeds on an area of around 147 hectares has already taken place. ICC Labs can plant a total of 200 hectares here. ICC Labs is also building the first CBD extraction plant in South America with a production capacity of 150,000 kilograms per year. Priced at $ 0.90 per gram of cannabis, Uruguay's selling price is low, but still provides ICC Labs with a 50% profit margin thanks to its extremely low-cost production! At these prices, Canadian producers would lose a long time. However, supplying the international market with CBD extracts is even more interesting and lucrative for ICC Labs. Here, revenues of more than $ 300 million and profit margins of around 75 percent are welcome. The large neighbor Brazil (200 million inhabitants) and other South American countries, such as Argentina (41 million inhabitants), Chile (17 million inhabitants), Colombia (50 million inhabitants) and Mexico (127 million inhabitants) now allow the Use of cannabis for medical purposes.  Source: https://www.icclabs.com Other destinations for ICC Labs products include Germany (82 million inhabitants), Australia (23 million inhabitants) and, of course, Canada (36 million inhabitants). BIDIOL is the first CBD oil product marketed and distributed by ICC. BIDIOL is manufactured under the highest quality standards and monitored by the Ministry of Health in Uruguay. BIDIOL is expected to contain 16.7 mg of CBD per milliliter dissolved in virgin olive oil. ICC Labs expects to manufacture 1.2 million 30 ml bottles of its proprietary BIDIOL brand of CBD oil this year. In February 2017, ICC Labs sold 10 percent of this production to the Canadian producer Emblem (www.emblemcorp.com). In the fourth quarter of 2017, a further 10 percent of this production went to Mexico in advance and 15 percent to Brazil. In addition, just a few weeks ago, ICC Labs sold 150 kilograms of pure CBD to the Canadian company Nuuvera (www.nuuvera.com). A few days later, the big player Aphria made a takeover bid for Nuuvera, which rated the partner of ICC Labs with 826 million CAD! Quantum leap thanks to expansion to Colombia On January 25, 2018, ICC Labs also obtained a growing and export license for medicinal, non-psychoactive cannabis with high CBD content in Colombia, resulting in an interim price jump of more than 30 percent to $ 2.00 entailed. As early as this month, the sowing of hemp seed on an open area of about 101 hectares is to start here. Start-up costs in Colombia are minimal as the land is likely to be leased only. Initially, an external laboratory will be used for the CBD extraction. Next year you can follow your own laboratory. The potential for expansion is gigantic, since outdoor area is abundant! In Colombia, due to the excellent climatic conditions, three harvests per year should be possible, whereas in Uruguay there is only one harvest per year. As a result, 15,000-20,000 kilograms of CBD extract per year could be produced in Colombia - almost double that of CBD production in Uruguay. This could ultimately reduce production costs even further from $ 0.60 per gram of cannabis to $ 0.45 per gram. Source: www.youtube.com/watch?v=vddfsYNK_qc

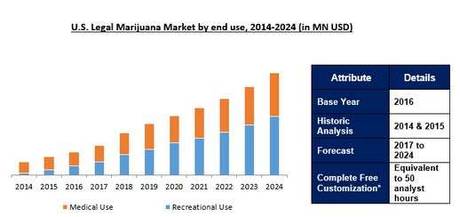

Source: https://www.icclabs.com Other destinations for ICC Labs products include Germany (82 million inhabitants), Australia (23 million inhabitants) and, of course, Canada (36 million inhabitants). BIDIOL is the first CBD oil product marketed and distributed by ICC. BIDIOL is manufactured under the highest quality standards and monitored by the Ministry of Health in Uruguay. BIDIOL is expected to contain 16.7 mg of CBD per milliliter dissolved in virgin olive oil. ICC Labs expects to manufacture 1.2 million 30 ml bottles of its proprietary BIDIOL brand of CBD oil this year. In February 2017, ICC Labs sold 10 percent of this production to the Canadian producer Emblem (www.emblemcorp.com). In the fourth quarter of 2017, a further 10 percent of this production went to Mexico in advance and 15 percent to Brazil. In addition, just a few weeks ago, ICC Labs sold 150 kilograms of pure CBD to the Canadian company Nuuvera (www.nuuvera.com). A few days later, the big player Aphria made a takeover bid for Nuuvera, which rated the partner of ICC Labs with 826 million CAD! Quantum leap thanks to expansion to Colombia On January 25, 2018, ICC Labs also obtained a growing and export license for medicinal, non-psychoactive cannabis with high CBD content in Colombia, resulting in an interim price jump of more than 30 percent to $ 2.00 entailed. As early as this month, the sowing of hemp seed on an open area of about 101 hectares is to start here. Start-up costs in Colombia are minimal as the land is likely to be leased only. Initially, an external laboratory will be used for the CBD extraction. Next year you can follow your own laboratory. The potential for expansion is gigantic, since outdoor area is abundant! In Colombia, due to the excellent climatic conditions, three harvests per year should be possible, whereas in Uruguay there is only one harvest per year. As a result, 15,000-20,000 kilograms of CBD extract per year could be produced in Colombia - almost double that of CBD production in Uruguay. This could ultimately reduce production costs even further from $ 0.60 per gram of cannabis to $ 0.45 per gram. Source: www.youtube.com/watch?v=vddfsYNK_qc  And it gets much better. About two weeks ago, ICC Labs applied for the construction of a new greenhouse in San Jos in Uruguay with an area of approximately 92,900 square meters. Since it is a government-owned country some 50 kilometers from the headquarters of ICC Labs, the application should pass easily. The approval is expected in May 2018. Immediately afterwards, the construction, which is expected to take eight months, is to begin. The medicinal flowers produced THC-containing flowers and their derivatives are intended for export to Germany, Australia and Canada. Once the plant reaches full capacity, 120,000 kilograms of dried flowers are produced each year to produce high-THC products. Gigantic market potential According to Ameri Research experts, the volume of the legal cannabis market worldwide is set to rise to $ 63.5 billion by 2024. Growth drivers include the wave of legalization, increasing use for medical purposes, high tax revenues, and increased investment in research and development (Source: www.ameriresearch.com/legal-marijuana-market-reach-63-5-billion-2024 ).

And it gets much better. About two weeks ago, ICC Labs applied for the construction of a new greenhouse in San Jos in Uruguay with an area of approximately 92,900 square meters. Since it is a government-owned country some 50 kilometers from the headquarters of ICC Labs, the application should pass easily. The approval is expected in May 2018. Immediately afterwards, the construction, which is expected to take eight months, is to begin. The medicinal flowers produced THC-containing flowers and their derivatives are intended for export to Germany, Australia and Canada. Once the plant reaches full capacity, 120,000 kilograms of dried flowers are produced each year to produce high-THC products. Gigantic market potential According to Ameri Research experts, the volume of the legal cannabis market worldwide is set to rise to $ 63.5 billion by 2024. Growth drivers include the wave of legalization, increasing use for medical purposes, high tax revenues, and increased investment in research and development (Source: www.ameriresearch.com/legal-marijuana-market-reach-63-5-billion-2024 ).  Source: https://www.ameriresearch.com According to Hexa Research, the US market for medical cannabis is expected to rise from $ 5.44 billion in 2016 to $ 19.48 billion in 2024 by 2024. Expected growth will be driven by increasing acceptance of medicinal benefits associated with cannabis, especially for patients with cancer, diabetes, HIV, AIDS, Alzheimer's disease, multiple sclerosis and chronic pain (Source: www.hexaresearch.com/ press-release / us-medical-cannabis-market-analysis ). An important market segment of the legal cannabis industry is cannabidiol (CBD) made from hemp. According to a report by Forbes, the Brightfield Group estimates that CBD sales in 2016 have already reached $ 170 million and should exceed the billion mark in the next five years, with annual growth of 55 percent (Source: www.forbes.com / sites / debraborchardt / 2017/08/23 / hemp-cannabis-product-sales-projected-to-hit-a-billion-dollars-in-3-years ). Matt Karnes, a Greenwave Advisors expert, has even higher expectations and expects the CBD market to reach almost $ 3 billion in 2021 (Source: www.cbdtesters.co/2017/12/18 / cbd-consumer-market-expected-reach-2-1-billion-2020 ). CONCLUSION: Including 137.6 million shares outstanding, the market value of ICC Labs Inc. (WKN: A2JAMF ) is $ 185.8 million. The company has a cash balance of approximately $ 19.4 million and can easily handle the upcoming expansion. At around 30%, the prestigious and multi-billion dollar investment holding Union Group ( www.uniongrp.com ) is the largest shareholder of ICC Labs. ICC Labs has a significant location advantage in Uruguay, as it is allowed to grow industrial hemp with a CBD content of more than 10 percent. In other countries, the CBD content is limited to a maximum of 5 percent. As a result, ICC Labs can achieve a CBD yield of 33.8 kilograms per acre, while European producers come to 11.3 kilograms per acre and Canadian producers lag behind at 0.6 kilograms per acre as they only harvest the seeds and not allowed to process the whole plant. Incidentally, an acre is around 4,047 square meters. As the cannabis producer with the world's lowest production costs, ICC Labs is also able to offer attractive wholesale conditions. Thanks to field cultivation and harvesting with industrial machines, ICC Labs is able to cut production costs below the cost of a normal greenhouse operation. While ICC Labs only has a cost of $ 4 per gram of CBD extract, the Canadian competition has to spend $ 20-30 per gram! Production takes place according to international standards. The Ministry of Health of Uruguay also guarantees the quality of ICC Labs products. We see the price target for ICC Labs Inc. (WKN: A2JAMF) on sight of 6-12 months at 4.50 euros. GMP Securities analysts in their recent update estimate that ICC Labs could deliver tremendous earnings momentum. According to the experts, ICC Labs could generate more than $ 450 million in revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) of approximately $ 150 million a year. Given the industry-standard valuation (6-8x EBITDA), ICC Labs could justify a valuation of $ 7.00 per share, analysts said. In the coming weeks and months, we expect a strong newsflow. According to the company, ICC Labs intends, among other things, to enter the field of cannabis research by cooperating with one of the most renowned research institutions in the world. In addition, we anticipate the signing of additional international export agreements in North America, Latin America and Europe, additional cultivation licenses (THC), the first large free field harvest, the completion of the CBD extraction plant and the launch of business activities in Colombia. The shares of ICC Labs Inc. (WKN: A2JAMF ) can be traded cheaply in Frankfurt, Stuttgart and Tradegate or directly in Canada. Please always limit your purchase orders. Sincerely, Your PROFITEER editors Image sources: www.icclabs.com , www.ameriresearch.com , www.youtube.com/watch?v=vddfsYNK_qc

Source: https://www.ameriresearch.com According to Hexa Research, the US market for medical cannabis is expected to rise from $ 5.44 billion in 2016 to $ 19.48 billion in 2024 by 2024. Expected growth will be driven by increasing acceptance of medicinal benefits associated with cannabis, especially for patients with cancer, diabetes, HIV, AIDS, Alzheimer's disease, multiple sclerosis and chronic pain (Source: www.hexaresearch.com/ press-release / us-medical-cannabis-market-analysis ). An important market segment of the legal cannabis industry is cannabidiol (CBD) made from hemp. According to a report by Forbes, the Brightfield Group estimates that CBD sales in 2016 have already reached $ 170 million and should exceed the billion mark in the next five years, with annual growth of 55 percent (Source: www.forbes.com / sites / debraborchardt / 2017/08/23 / hemp-cannabis-product-sales-projected-to-hit-a-billion-dollars-in-3-years ). Matt Karnes, a Greenwave Advisors expert, has even higher expectations and expects the CBD market to reach almost $ 3 billion in 2021 (Source: www.cbdtesters.co/2017/12/18 / cbd-consumer-market-expected-reach-2-1-billion-2020 ). CONCLUSION: Including 137.6 million shares outstanding, the market value of ICC Labs Inc. (WKN: A2JAMF ) is $ 185.8 million. The company has a cash balance of approximately $ 19.4 million and can easily handle the upcoming expansion. At around 30%, the prestigious and multi-billion dollar investment holding Union Group ( www.uniongrp.com ) is the largest shareholder of ICC Labs. ICC Labs has a significant location advantage in Uruguay, as it is allowed to grow industrial hemp with a CBD content of more than 10 percent. In other countries, the CBD content is limited to a maximum of 5 percent. As a result, ICC Labs can achieve a CBD yield of 33.8 kilograms per acre, while European producers come to 11.3 kilograms per acre and Canadian producers lag behind at 0.6 kilograms per acre as they only harvest the seeds and not allowed to process the whole plant. Incidentally, an acre is around 4,047 square meters. As the cannabis producer with the world's lowest production costs, ICC Labs is also able to offer attractive wholesale conditions. Thanks to field cultivation and harvesting with industrial machines, ICC Labs is able to cut production costs below the cost of a normal greenhouse operation. While ICC Labs only has a cost of $ 4 per gram of CBD extract, the Canadian competition has to spend $ 20-30 per gram! Production takes place according to international standards. The Ministry of Health of Uruguay also guarantees the quality of ICC Labs products. We see the price target for ICC Labs Inc. (WKN: A2JAMF) on sight of 6-12 months at 4.50 euros. GMP Securities analysts in their recent update estimate that ICC Labs could deliver tremendous earnings momentum. According to the experts, ICC Labs could generate more than $ 450 million in revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) of approximately $ 150 million a year. Given the industry-standard valuation (6-8x EBITDA), ICC Labs could justify a valuation of $ 7.00 per share, analysts said. In the coming weeks and months, we expect a strong newsflow. According to the company, ICC Labs intends, among other things, to enter the field of cannabis research by cooperating with one of the most renowned research institutions in the world. In addition, we anticipate the signing of additional international export agreements in North America, Latin America and Europe, additional cultivation licenses (THC), the first large free field harvest, the completion of the CBD extraction plant and the launch of business activities in Colombia. The shares of ICC Labs Inc. (WKN: A2JAMF ) can be traded cheaply in Frankfurt, Stuttgart and Tradegate or directly in Canada. Please always limit your purchase orders. Sincerely, Your PROFITEER editors Image sources: www.icclabs.com , www.ameriresearch.com , www.youtube.com/watch?v=vddfsYNK_qc  Remember our website (www.beprofiteer.com ) for regular updates, news and rumors outside of regular issues of the PROFITEER. Note:

Remember our website (www.beprofiteer.com ) for regular updates, news and rumors outside of regular issues of the PROFITEER. Note:

Editors and contributors of PROFITEER / shareribs.com publications do not hold any of the securities discussed in this publication at the time of publication.

The editors and staff also state that they do not intend to sell or purchase short-term portions of the securities discussed.

PROFITEER / shareribs.com and its employees are remunerated for the preparation, electronic distribution and publication of this publication as well as other services. This is a potential conflict of interest because PROFITEER / shareribs.com is interested in a positive representation of ICC Labs Inc.

The client of this publication holds shares in the companies discussed at the time of publication and has no intention at short notice of buying or selling them. This creates the possibility of a conflict of interest.

PROFITEER / shareribs.com can not exclude that other stock market letters, media or research firms discuss the companies we have introduced or recommended during the same period, which can lead to a symmetrical generation of information and opinion.

The prices / prices of financial instruments specified in these publications by PROFITEER / shareribs.com are, unless otherwise indicated, daily closing prices of the last trading day prior to the respective publication. Please also note our risk warning.

Source: shareribs.com , author: (beprofiteer)