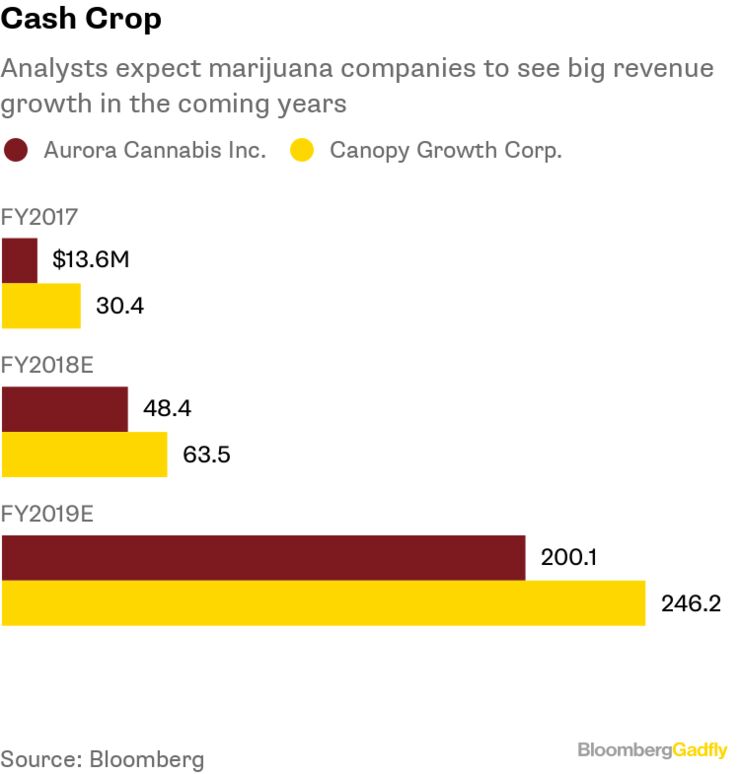

growing number of states relaxing their marijuana laws It’s easy to see what all the excitement is about. ETFMG’s largest holding is Cronos, and analysts expect similar growth from its stable of stocks. Consider Vancouver-based Aurora Cannabis Inc. and Ontario-based Canopy Growth Corp., two of the biggest producers of medical marijuana and the fund’s second- and third-largest holdings. Analysts expect the two firms’ collective revenue to climb to $446 million in the 2019 fiscal year from $44 million in 2017, a 914 percent jump.

The bonus is that, unlike typical growth companies, there are fewer unknowns around marijuana. Growth stocks are often a bet on new and unproven technology. But there’s already widespread agreement that pot has many beneficial medical uses -- and there’s little doubt about its recreational efficacy.

Even when new technology works, there’s no guarantee it will be adopted. Pot, on the other hand, is already widely used in the U.S. One in eight Americans polled by Gallup in July said they smoke marijuana, and 45 percent said they’ve tried it, the highest percentage since Gallup first asked the question in 1969.

And when new technology becomes widely adopted, the threat of regulation -- and its chilling effect on profits -- hangs over firms. Just look at Google or Facebook. Or Apple, which is confronting concerns that phone addiction is a looming public health problem.

By contrast, a growing number of states are relaxing their marijuana laws. Nine states and Washington, D.C., allow recreational use of the drug, and 29 states allow medical use. And unlike new technology, investors can look to existing drug regulations for a preview of how rules around marijuana are likely to work.