Over 90% of the time, sentiment data is completely useless to me. I only care about it when we see it at or near extremes, which is not often. Some people dismiss sentiment data altogether in favor of tools that can be used more frequently. Not me. I’ll stay patient all day and just wait for my pitch. The unwinds from extremes in sentiment can be very powerful and last much longer than investors usually expect.

Currently, we’re seeing an interesting setup in Silver. Commercial Hedgers, which are traditionally the “Smart Money”, have on pretty much their smallest hedges of all-time. In fact, Commercial Hedgers, who are always short Silver Futures, it’s just how short, are now almost net long! That never ever happens. So it’s got my attention.Silver is in a very tight and narrowing range. The bulls are frustrated and the bears are frustrated. No one is making money here from a directional play. The resolutions from these tight ranges into an apex, just like this, tend to be explosive.

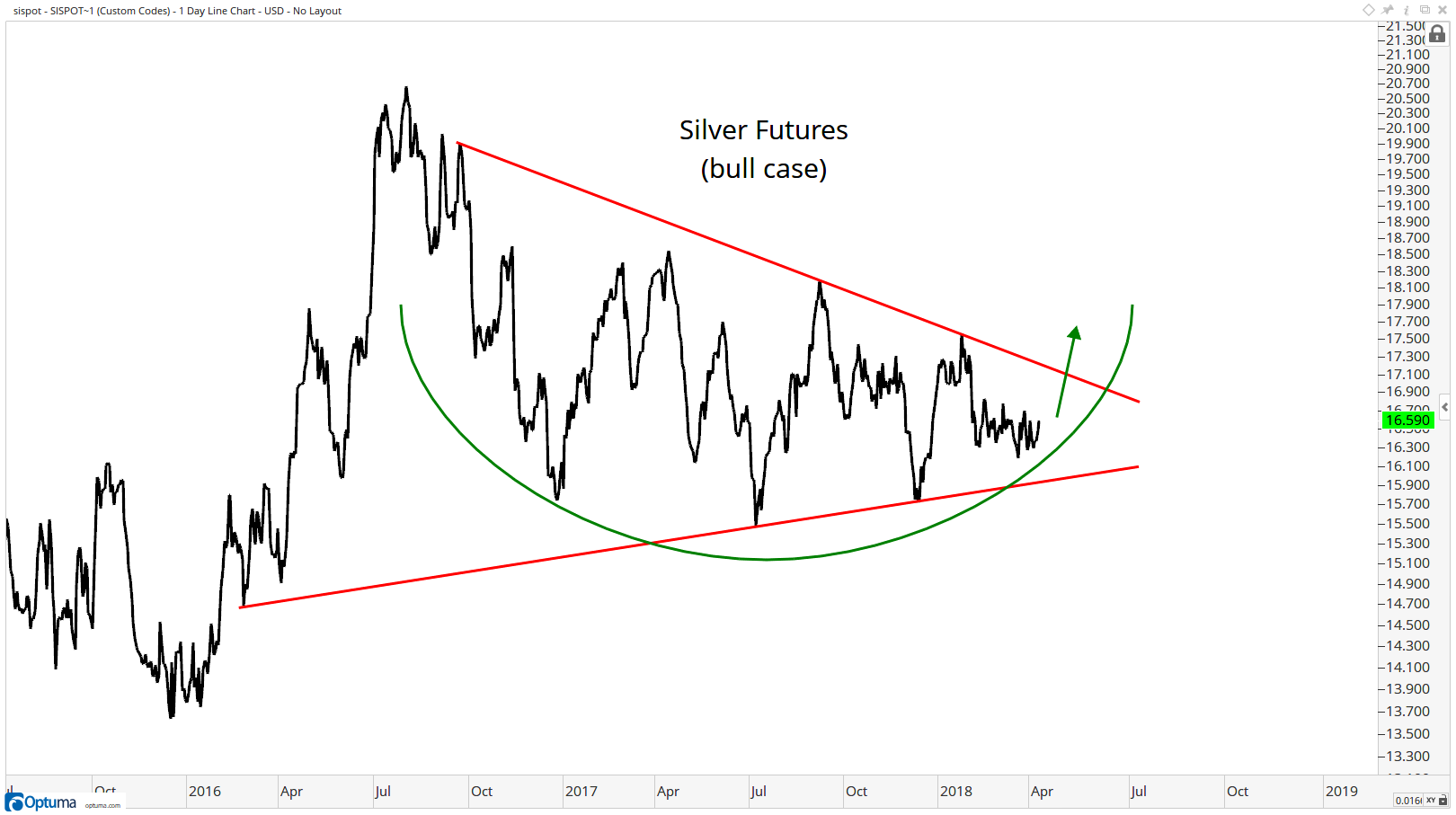

First the bull case. To me, this is the higher probability outcome and we resolve this mess higher:

Here is the bear case for Silver. If we’re going lower, it will likely look something like this:

Based on the futures positioning right now, the setup is for an explosive move higher. The smart money has never been this bullish of Silver. For a community of investors who live their lives short, in order to hedge, they are actually almost net long right now:

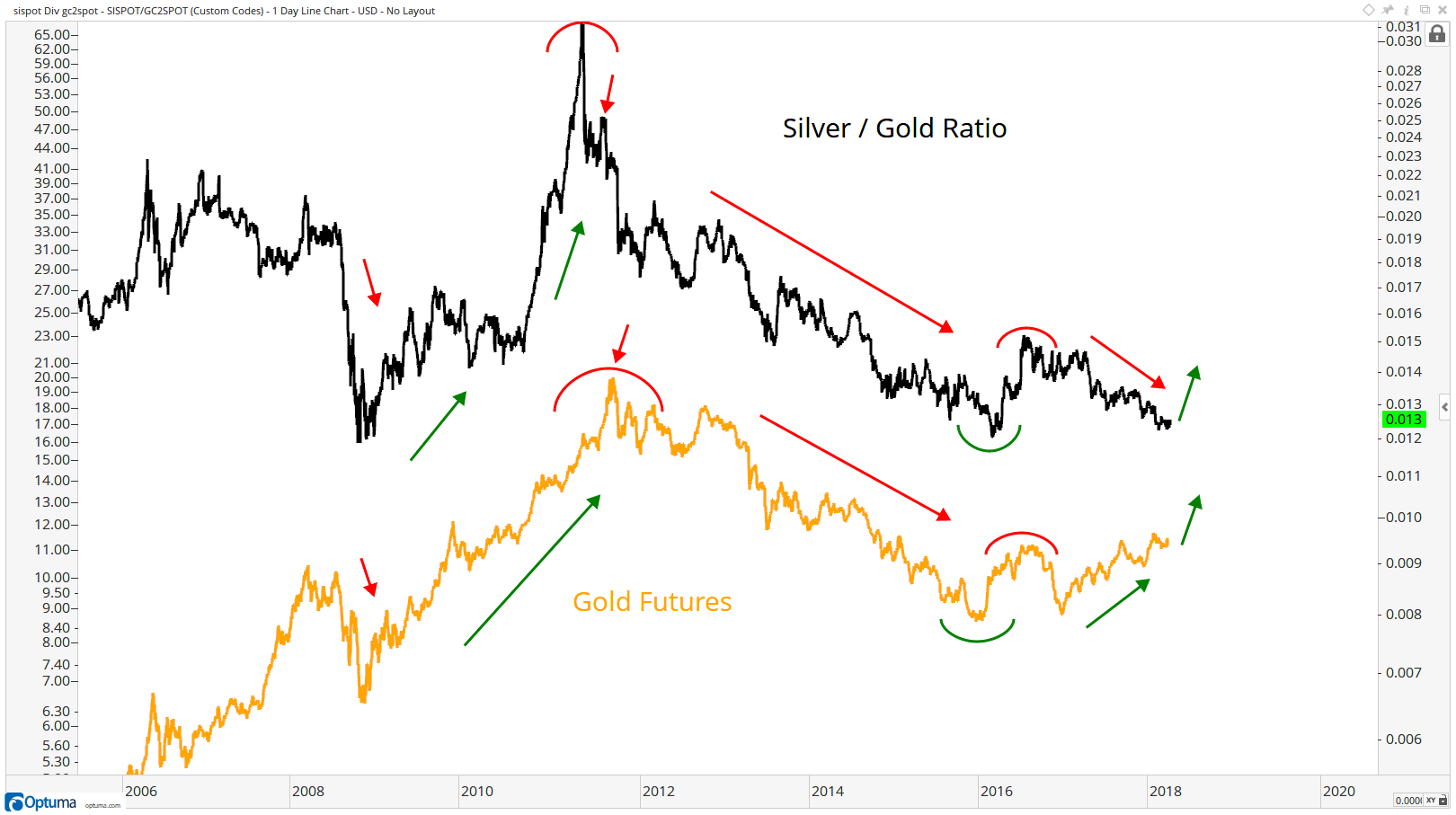

One of the great tells for precious metals is the Silver / Gold ratio. When precious metals are rallying, Silver, the more aggressive and volatile of the two, tends to outperform Gold, the more conservative and less volatile metal. It’s a risk appetite thing. The bulls jump on the Silver train to get the higher beta trade. To the downside, when precious metals are selling off, Silver tends to get hit a lot harder than Gold, again that beta.

So what we get is a high correlation between the Silver / Gold Ratio and the overall direction of price of precious metals. Here is the chart overlaying the two. Notice how the Silver / Gold ratio has been declining while Gold itself has hung in there pretty well:

Here is a closer look at just the Silver / Gold ratio. With momentum putting in a bullish divergence, it looks like an upside resolution here is imminent. This is the evidence of risk appetite that we’re looking for to confirm what we’re seeing elsewhere:

We want to be long Silver if we’re above 17 with a short-term target above 20.50 and ultimately back up to the high 20s. I think the risk vs reward here is very much skewed in favor of the bulls.

Cheers,

JC