RE:Got lucky and bought at lower price Sales and profits growth for key Asian gold jewelers continues to set the stage for an imminent and massive mining stocks rally.

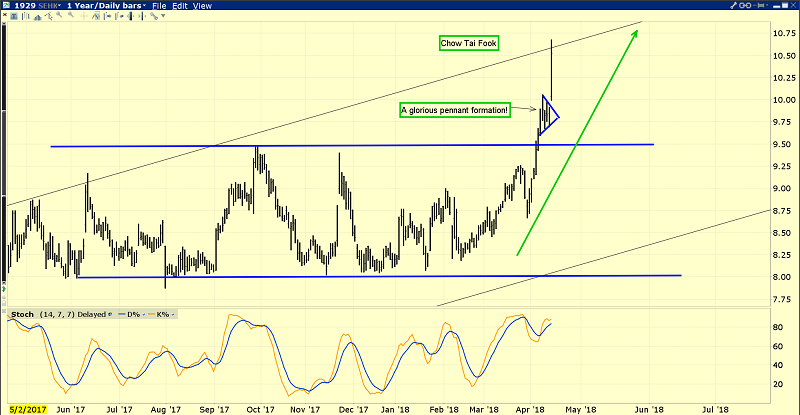

Chow Tai Fook Jewellery Group

This is the fabulous Chow Tai Fook chart (OTC:).

A major breakout to the upside is in play, and where Chinese jewelers go on the price grid, Western miners are likely to follow.

Some of the component stocks are beginning to join what I term the “bull era upside fun” even though bullion has yet to prove itself with a three-day close over $1370.

Daily Gold

This is the daily chart. Gold is coiled beautifully inside a drifting rectangle formation, and there’s already been one attempt to break out to the upside.

Most component stocks of the US stock market indexes look technically horrific. A move for gold up to the “promised land” of $1450+ is likely to be fueled by both love and fear trade factors.

That’s because the next rate hike and quantitative tightening ramp-up is likely to occur against a background of ever-stronger jewellery demand coming from both China and India.

Gold cycle expert Erik Hadik notes that many American wars and disasters have occurred around the date of April 19. It’s unknown if there will be any “blowback” from the latest US military adventurism in Syria, but from a cyclical perspective, it could happen