This is the only chart lithium price bears need seeAgain, maybe now MS and the others will realize mining is not easy and only low cost producers of lithium will succeed. Hard rock will be too expense to produce and these "hard rock" projects will not come online unless the price per tonee of lithium is well into the $10K+ . Low cost brine producers will be the ones that succeed and are profitable (lower operating costs).

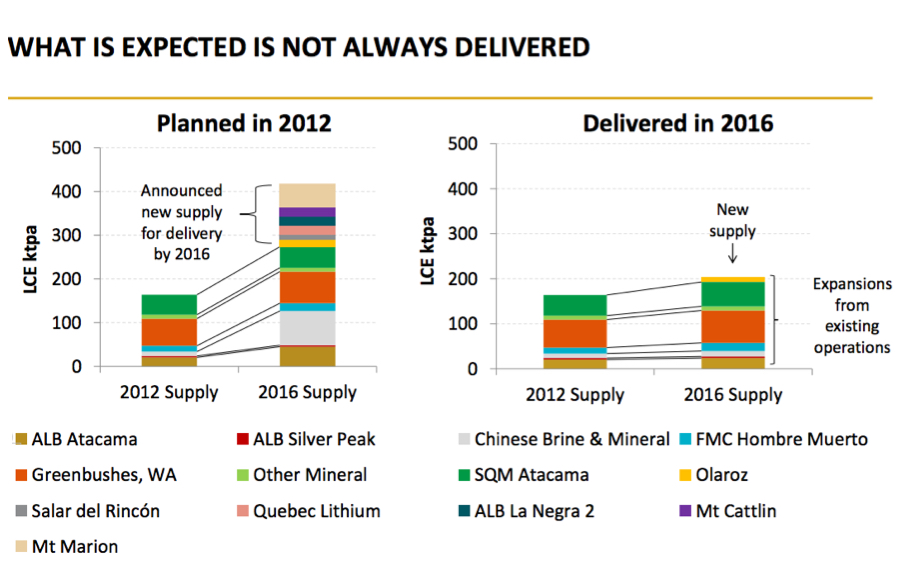

Orocobre is struggling to produce and it has 7 years experience! Look at the chart below and see how this forecast did not materialize. With so many variables to consider how can you really project past 2020 or even into 2025? From a reporting prespective, the quantative analyis provided by MS should have weighted heavily on the variable that mining producers will not in be in full production until *possible* 2024/2025. Supply will not meet demand for lithium. The requirement to secure lithium by supplies (battery producers/automakers/others (Dyson!)) is becoming paramount.

Just my humble opinion.

Taken from: https://www.mining.com/chart-lithium-price-bears-need-see/

A month ago Morgan Stanley sent shares of lithium producers and explorers tumbling after the investment bank forecast growing surplus in the market starting as soon as now, resulting in forecast prices halving from today’s levels.

Morgan Stanley said Chilean low cost brine producers SQM and Albemarle alone could bring 200kt per year by 2025 and after adding new and expansion hard-rock projects in Australia and China half a million extra tonnes per year could be available. Consider that global supply last year totalled just over 200kt.

Orocobre prides itself on being the first brine lithium producer to go into production in more than 20 years

The negative assessment raised eyebrows in the industry with executives criticizing the New York bank for underestimating the rise in demand, the complex nature of lithium mining leading to production ramp-up problems, and bottlenecks with processing of battery-grade lithium compounds.

A report released this week by Canaccord Genuity is much more sanguine about the outlook for the battery raw material. The Canadian financial services firm also predicts a rush of new tonnes hitting the market, but expects most of the new supply to come from higher-cost hard rock mines producing lithium concentrate or ore. The firm now sees surpluses only arising in 2020 and only if converter capacity can catch up with mine supply.

Interestingly, both Morgan Stanley and Canaccord in their respective reports reproduced a nearly one-year old graph about lithium mine supply from an investor slide presentation by Orocobre which prides itself on being the first brine lithium producer to go into production in more than 20 years.

The slide shows just how wide the gap between supply forecasts and reality can be. And in a bit of delicious irony, Orocobre's Olaroz operation has become the poster child for just how long it can take to bring a lithium project into full production (7 years in this instance):