Production at Escondida began in 1990 and peaked in 2007 at more than 1.4 million tonnes of copper. Image: BHP

Copper jumped 3.7% in New York on Tuesday to trade at $3.25 a pound ($7,165 a tonne), the highest since end-February, as worries about supply disruptions in key producing region resurface.

Workers at the Escondida copper mine in Chile put down quite a marker in the third round of contract negotiations with part-owner and operator BHP.

Workers at the Escondida copper mine in Chile put down quite a marker in the third round of contract negotiations with part-owner and operator BHP.

The union is demanding a one-time bonus equivalent to 4% of dividends distributed to BHP shareholders in 2017.

That works out to about $34,000 per worker. It would be the biggest bonus payout to mineworkers ever in Chile.

The union also wants a wage increase of 5%, which is more than double the inflation rate in the South American nation.

BHP has until next Friday to respond, but after two rounds of failed talks, the reception of the proposals is likely to be cool.

Due to its size, Escondida can on its own change global copper supply dynamics.

BHP, which owns 57.5% of the mine, has spent nearly $8 billion expanding the mine (including a $3.4bn water plant) in the past five years to maintain output above one million tonnes (2018 guidance is 1.18–1.23mt).

That means Escondida is responsible for nearly 5% of the world’s primary copper supply.

Ahead of the copper industry’s annual gathering in Santiago in April, Colin Hamilton of BMO Capital Markets summed it up this way:BHP has spent some $8 billion over five years to maintain output above one million tonnes

“Put in simple terms, at more than 300kt Escondida's planned output recovery in 2018 will be the second largest year on year gain by a single operation in recent copper history, after Las Bambas in 2016.

“To have such reliance on a single operation for copper supply growth, particularly one with a history of output hiccups, clearly comes with some risk.”

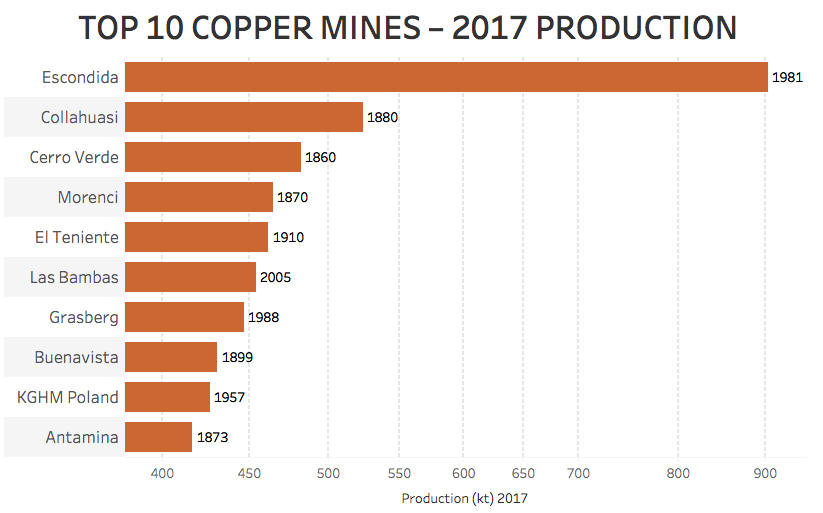

Source: Company reports, MiningIntelligence, Wood Mackenzie. Notes: Annual copper production 2017 except Codelco's El Teniente and KGHM Poland operations = 9 months 2017 annualized. KGHM Poland consists of Rudna, Polkowice-Sieroszowice and Lubin mine complex. Reserves as at end-2017 except KGHM, Codelco mines at end-2016. Grasberg reserves include Block Cave under development and undeveloped Kucing Liar deposits.

Last year’s walkout lasted 43 days and ended only when workers invoked a legal provision that allows them to extend their existing contract by 18 months (to end July).

The 2017 strike at Escondida was the longest in Chile since the 74-day action at state-owned Codelco’s El Teniente mine in 1973, which took place shortly before the military coup that overthrew socialist President Salvador Allende.

The threat of copper supply disruptions due to a slew of labour contract negotiations in top producers Chile and Peru, boosted prices at the beginning of the year.

The majority of those talks quickly ended in deals.

There is little indication of that happening at Escondida.