RE:Smart investors read this trying to hide cheap warrants cbw Bestbuy8888 wrote: https://thedeepdive.ca/brief-mixed-emotions-cannabis-wheaton-income/

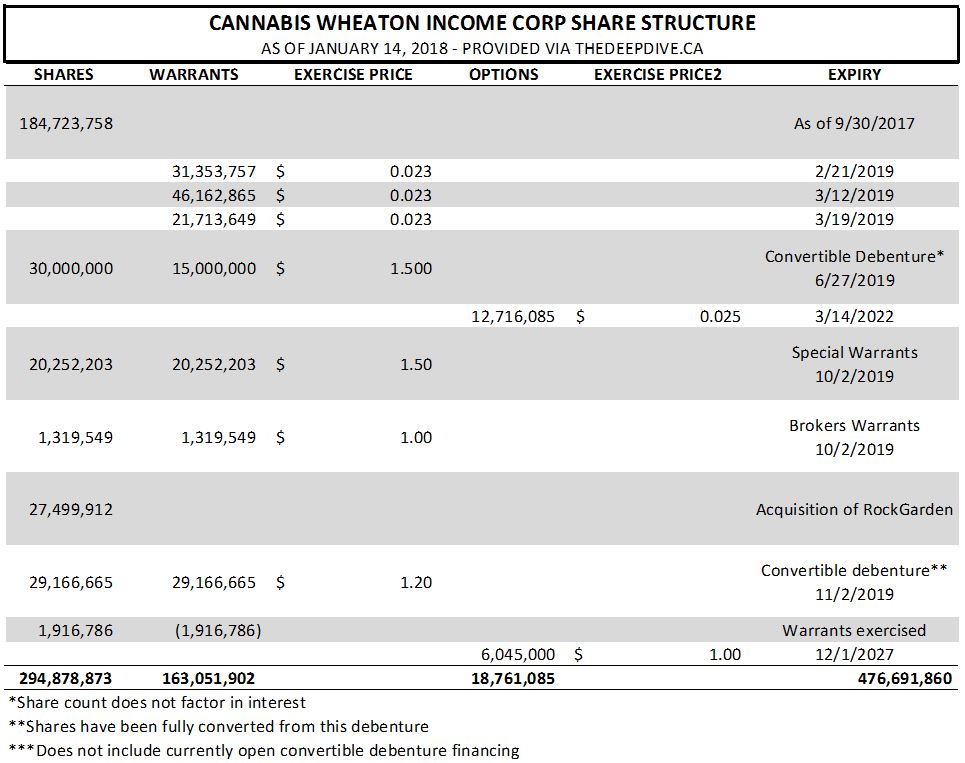

As it currently stands, it is estimated that there are roughly 294.9 million shares outstanding for Cannabis Wheaton. It is believed that all currently outstanding debentures have been exercised, however the company did not give a final share count figure in relation to the June 27 raise. Once the companies atrocious amount of outstanding warrants are factored in along with the current outstanding options, we receive an estimated fully diluted share count of 476.7 million units.

Please note that this does not include figures from the currently outstanding convertible debenture equity financing that was recently increased to $100 million in size. With shares priced at $1.55 each, along with warrants, expect this large raise to have a negative effect on upward momentum for quite some time once it closes.

Based on the January 12, 2018, closing price of $2.03, the market valuation for Cannabis Wheaton is roughly $598.6 million. On a fully diluted basis, this figure is increased to $967.7 million.

Closing Remarks

Based on these three points, its fair to say we currently have mixed emotions on Cannabis Wheaton Income Corp. Although they have an exceptional business plan that is working swimmingly, their share structure is less than desirable. The funny business that occurred earlier this year also puts us off from thinking too positively of the company, or at least its management.

That being said, they have produced results which needs to be factored in to the equation. They have a well known team of individuals that have a very successful history within the sector. Further to this, they’ve rarely had an issue with actually getting investors to buy in – again, the business plan is excellent. However, even after our dive into the history of this one, we were left questioning what we think of the company. For that reason alone, right now, we’re out.

Great find! Look at those dollar figures once we truly get up and running.

The genius business plan behind Cannabis Wheaton

Ethically questionable financings aside, Cannabis Wheaton truly has an innovative and ingenious business plan. For those that are unaware, they act as a “streaming company” to companies in the cannabis sector. What this means, is that they essentially provide funding up front for these enterprises to establish their operations. In return for this, Cannabis Wheaton receives an equity portion of the facility that uses the funding, as well as typically a percentage of all cannabis production.

Although it is capital intensive to initially establish, it gets easier as client production comes online. The company can then sell the cannabis that it receives from the partial ownership of the facilities to fund future investments and acquisitions. From here it becomes a major snowball effect as the company continues to grow and provide more investment funding.

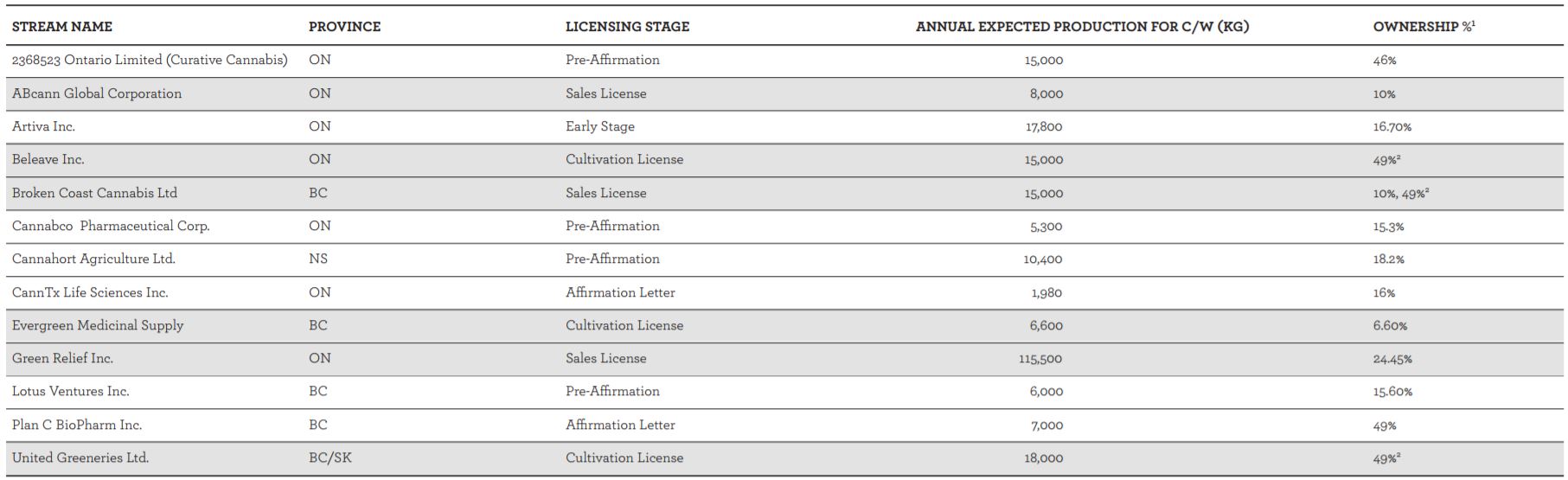

As an example of how successful this business concept will soon be, here’s an excerpt from the companies investor presentation. Note that this diagram is from late 2017, and as such does not include a number of addition investments in which the company has made.

Snippet from CBW’s investor presentation outlining current streaming partners.

Snippet from CBW’s investor presentation outlining current streaming partners. At the time that this investor presentation was created, Cannabis Wheaton’s total expected production on an annual basis is roughly 235,580 kg. Bases on the companies targeted run rate of $7.75 in revenue per gram sold, it equates to roughly $1,825.7 million in revenues on an annual basis once all operations are producing.

However, in the time since this report, there have been some additions to the companies profile. They include:

- Sustainable Growth Strategic Capital Corp – 5,500 KG annually

- FV Pharma Inc – 200,000 KG annually

- Level Ten Inc – 8,100 KG annually

In total, this brings the estimated annual capacity of Cannabis Wheaton to an estimated 449,180 KG of cannabis product. At a targeted price of $7.75 a gram, it comes to a mind boggling potential revenue of $3,481.1 million annually. With potential revenues of this magnitude, its clearly easy to see how the aforementioned snowball effect takes hold, funding future growth.