🤞Tesla's Cobalt Lie🤞 Tesla's Cobalt Blues; Growth Fallacies And Supply Chain Risque Majeure

Summary

In its Q2-18 shareholder letter, Tesla predicted that beginning in Q3-18 it will, absent a severe force majeure or recession, achieve sustained quarterly profits with continued rapid growth.

In Tesla’s Q2-18 conference call, Elon Musk predicted profits and positive cash-flow for every future quarter, unless there's a recession or force majeure that interrupts Tesla’s supply chain.

While Tesla may be able to manufacture and sell 7,000 cars per week, its battery supply chain can’t support higher production rates so continued rapid growth is impossible.

Since the DRC dominates cobalt mining, China dominates cobalt refining and non-battery cobalt demand is extremely inelastic, the structural force majeure risks in the cobalt market are daunting.

The Japanese have recently announced plans for a government sponsored cobalt procurement organization for their automakers that could easily morph into a force majeure that disrupts Tesla’s battery supply chain.

Introductory Note.

The level of misinformation about Tesla Inc.'s (TSLA) battery technology and related supply chain issues is staggering. While Tesla is the poster child for EV mythology, the issues exist to a greater or lesser extent with all companies that make or plan to make EVs.

This article is an attempt to separate fact from fairy tale and create a solid foundation for well informed conversation among rational people who have differing opinions about what the facts mean.

While I firmly believe every person is entitled to his own opinion, objective truth is objective truth and arguments over what the facts are must begin with hyperlinks to source documents that support a factual assertion.

The NCA technology used in Tesla’s cars is owned by Panasonic and Sumitomo Metal Mining.

In 2004, the head of Panasonic’s (OTCPK:PCRFF) battery research center approached Sumitomo Metal Mining (OTCPK:SMMYY) about jointly developing high-energy cathode materials for lithium-ion cells. The companies ultimately formed a venture to develop and jointly commercialize a novel lithium-nickel-cobalt-aluminum-oxide, or NCA, chemistry for lithium-ion batteries. The project took years of concerted effort and Panasonic introduced the first NCA cells to PC manufacturers in 2006. Twelve years later NCA still holds the energy density crown.

When Tesla was designing the Model S, it decided to upgrade its battery chemistry from the lithium-cobalt-oxide, or LCO, cells it used in the Roadster to the newer generation of NCA cells. The primary advantages of the chemistry upgrade were:

- Increasing cell-level specific energy by ~20%;

- Improving thermal stability and safety; and

- Reducing cell costs.

Today, every Tesla EV uses NCA cells and it’s my understanding that Sumitomo:

- makes an NCA-80,15,5 cathode powder, which is 9.2% cobalt by weight, for use in the 18650 cells that Panasonic manufactures in Japan for Tesla’s Models S and X; and

- makes an NCA-84,12,4 cathode powder, which is 7.3% cobalt by weight, for use in the 2170 cells that Panasonic manufactures in Nevada for Tesla’s Model 3.

From Sumitomo’s perspective, the NCA venture with Panasonic is a showcase relationship that takes full advantage of Sumitomo’s core competencies in metal mining, smelting and refining, and advanced materials processing. Sumitomo is obviously proud to be the sole supplier of the NCA cathode powders Panasonic uses to manufacture batteries for Tesla. For more detailed discussions of the NCA venture with Panasonic, see Sumitomo’s CSR Report 2015 and its Integrated Report 2017.

Over the last four years, Sumitomo has completed three capacity expansions at its NCA cathode powder production facilities in Niihama City, Japan.

- The first expansion announced in October 2014 and completed in December 2015 increased production capacity from 850 to 1,850 tons per month, or 22,200 TPY.

- The second expansion announced in October 2016 and completed in January 2018 increased production capacity from 1,850 to 3,550 tons per month, or 46,200 TPY.

- The third expansion announced in July 2017 and completed in June 2018 increased production capacity from 3,550 to 4,550 tons per month, or 54,600 TPY.

Overall, it appears that Sumitomo’s capacity expansions were sized to fully utilize its refined cobalt production capacity of 4,200 TPY in NCA cathode powders that average 7.7% cobalt by weight. If you assume that cathode powder represents 40% of cell weight, Sumitomo can make cathode powders for 32.8 million kWh of cells per year. It does not, however, have the refined cobalt supplies or processing facilities to make greater volumes.

With an average battery pack size of 85 kWh, Tesla’s combined Model S and Model X run rate of 100,000 cars per year will absorb 8.5 million kWh of Sumitomo’s cathode powder capacity, leaving 25.6 million kWh of cathode powder capacity available for Tesla’s Gigafactory and all of Sumitomo’s other NCA customers.

I do not know whether Sumitomo and Panasonic sell NCA batteries to customers other than Tesla. But even if I assume the answer is, “absolutely not,” their supply chain can’t support the production of more than 340,000 long-range Model 3 battery packs per year unless Panasonic stops making cells for Model S and Model X battery packs.

If Sumitomo and Panasonic have hedged their bets by diversifying their customer bases to include companies other than Tesla, the Gigafactory’s supply chain will be weaker and the production caps lower.

Given Sumitomo’s status as sole supplier of Panasonic’s NCA cathode powders and hard limits on Sumitomo’s (a) refined cobalt production capacity, and (b) NCA cathode powder production capacity, I don’t see any reasonable foundation for Tesla’s apparent belief that “continued rapid growth” is possible, much less likely.

The geopolitical risks of cobalt mining, refining and use are enormous.

Cobalt Mining. In 2017, the world’s miners produced 120,200 tonnes of cobalt concentrates that yielded 104,800 tonnes of refined cobalt. The huge Mutanda and Tenke Fungurume copper mines in the Democratic Republic of Congo, or DRC, produced 40,700 tonnes of concentrates as a byproduct of copper mining while a dozen smaller copper mines in the DRC produced 40,600 tonnes of concentrates as a byproduct. Roughly 36,000 tonnes of cobalt concentrates were produced as a byproduct from nickel mines in a dozen countries. Less than 2% of the world’s cobalt concentrates were produced as a primary mine product.

Over the next five years, two additional mega-projects in the DRC (the Katanga Mine and the Roan Tailings Reclamation project) are expected to add about 45,000 tonnes of cobalt concentrates (~39,200 tonnes of refined cobalt) to global supplies. Additionally, three small projects in North America and Australia are expected to add about 6,300 tonnes of cobalt concentrates (~5,500 tonnes of refined cobalt) to global supplies.

While stock market investors may have been lulled into complacency by fake-news reports that cobalt isn’t a big issue, the International Energy Agency, or IEA, which expects cobalt demand for EV batteries to soar 10x to 25x by 2030, is very concerned that a single poor nation with the historic instability of the DRC controls 68% of global cobalt supplies. <sarcasm font on> But they also fret over the market behavior of a 15-nation trading block named OPEC that controls 40% of oil supplies and 60% of the international oil trade. Surely power brokers in the DRC will take a kinder and gentler approach. <sarcasm font off>

Cobalt Demand. Cobalt is an extraordinary minor metal because it’s essential for a wide variety of technologies including:

- High energy lithium-ion batteries;

- Superalloys for combustion turbines;

- High-speed steel and machine tooling;

- Hardened carbides and diamond tooling;

- Catalysts;

- Pigments;

- Magnets; and

- Other specialty materials.

Since cobalt has always been expensive, industrial users have switched to substitutes wherever possible and the remaining industrial demand is extremely inelastic. Moreover, non-battery cobalt demand is highly price insensitive because cobalt costs are a relatively insignificant percentage of total product cost. Demand growth among industrial users is modest, but those cobalt users will always be able to outbid the battery industry to obtain the supplies they need.

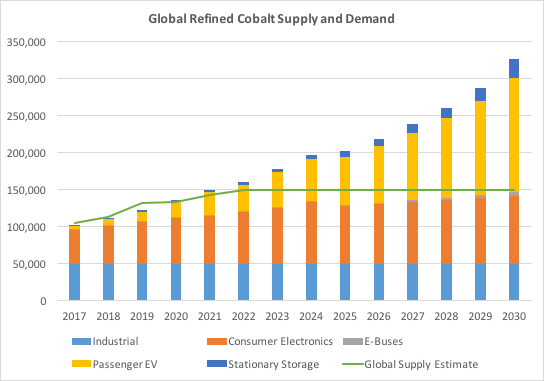

In 2016, the battery industry used about 47,000 tonnes of cobalt while non-battery industrial applications used another 47,000 tonnes. In 2017 battery industry demand was about 55,000 tonnes while non-battery industrial demand was 49,000 tonnes. By 2030, Bloomberg New Energy Finance believes global cobalt demand will exceed 325,000 tonnes per year, fueled primarily by growth in cobalt demand for electric vehicles and stationary batteries.

Global cobalt supply and demand balance

The following graph combines demand forecasts from Bloomberg New Energy Finance with supply forecasts from a variety of sources. The application classes are stacked in increasing order of price sensitivity.

Geopolitical cobalt supply and demand balance

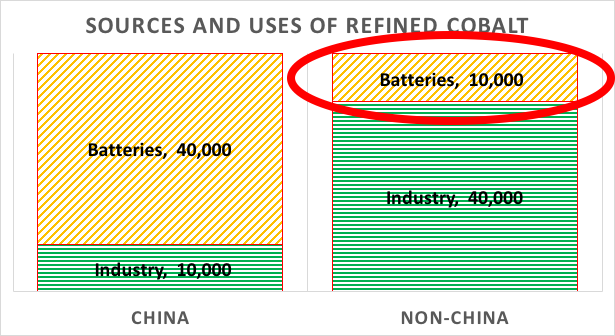

While the refined cobalt supply and demand graph paints an increasingly grim picture for the EV and stationary storage sectors from 2020 onwards, it only tells part of the story. Since 2007 the market share controlled by Chinese cobalt refiners has rocketed from 24% to 50% and the overwhelming bulk of the market share growth has been in the battery sector. In 2017, a mere 20% of the cobalt refined in China (10,000 tonnes) was used for industrial applications. The remaining 80% (40,000 tonnes) was used by the battery industry. That means non-Chinese cobalt refiners served roughly 80% of industrial cobalt demand (40,000 tonnes) and only 20% of battery industry demand (10,000 tonnes).

The key takeaway from a geopolitical perspective is that China controls the overwhelming bulk of the refined cobalt available to the battery industry and automakers in Korea, Japan, North America and Europe will all be competing for the same 10% of global cobalt supplies that are refined by non-Chinese companies and available to the battery industry. When the music stops in 2020 and the cobalt market goes into permanent deficit, the overwhelming majority of non-Chinese party-goers will be left without seats.

New Japanese Cobalt Supply Chain Initiative

Two weeks ago, Japan's Ministry of Economy, Trade and Industry announced plans to organize a joint procurement organization to lock down stable long-term cobalt supply chains for that country’s automakers. The joint procurement organization will apparently be formalized by next March and its mandate will be to secure ethical cobalt supplies by signing long-term contracts with cobalt producers and potentially investing in new cobalt projects with support from the government.

On balance, I find this initiative quite worrisome. Japanese culture is very different from North American culture and their kieretsu system of business interrelationship encourages a degree of cooperation among corporations and government entities that Americans don’t understand. I won’t even try to predict how Panasonic and Sumitomo will respond if a government sponsored cobalt procurement organization asks them to focus their mines, processing plants, battery factories and other resources on serving the needs of the Japanese auto industry first, but it’s not hard to see how that kind of dynamic could quickly morph into a force majeure that disrupts or destroys Tesla’s battery supply chain.

Conclusion

Most of us grew up in extraordinary times when the word “shortage” meant “it will cost more but you can still get all you want if your wallet is deep enough.” With each passing day, I’m increasingly convinced that the cobalt cliff will teach all of us that the word “shortage” means “not available in sufficient quantities at any price.”

While Tesla’s executives are spinning fake news headlines and trying to convince the market that cobalt is a non-issue, Japan's Ministry of Economy, Trade and Industry is following China’s lead and pulling out all the stops to ensure that Japanese automakers have adequate cobalt supply chains.

Without rock-solid battery material supply chains, Tesla’s gigafactory is a $5 billion boondoggle with no alternative utility. Pretending that precarious cobalt supply chains are a non-issue because they detract from an exponential step-change growth story-line is irresponsible.

I continue to believe Tesla’s “continued rapid growth” story is an impossibility, a force majeure. I also believe the unrecognized risks inherent in its battery supply chains are enormous. Under the circumstances, I believe Tesla’s stock is worthless and bankruptcy is inevitable.

I am aware of reports that Mr. Musk wants to take Tesla private at $420 per share and that his planned structure would give existing shareholders a choice to either accept a cash payment or stay with Tesla through a special purpose fund that would offer semi-annual liquidity windows. At this point I can’t assess the merits or risks of the proposal because no details are available. That being said, most of Tesla’s institutional shareholders operate under charters that preclude investments in illiquid securities. Likewise, many retail shareholders use their Tesla shares as collateral for margin accounts that can’t hold illiquid securities as collateral. Since my problems with Tesla’s broken business model have nothing to do with the legal structure that allows investors to participate in the business, I don ’t think the potential buyout is relevant to the issues discussed in this article.

https://seekingalpha.com/article/4197370-teslas-cobalt-blues-growth-fallacies-supply-chain-risque-majeure