Excelsior Mining (OTCQX:EXMGF)

Featured In: July 2016

Average Cost per Share: C$0.24

Current Market Price (August 17, 2018): C$0.90

We’ve owned Excelsior Mining since mid-2014, with an average cost basis of C$0.24. The company remains focused on advancing its Gunnison Copper Project to first production in 2019. I was able to visit Gunnison for a second time this recent April (pictures can be viewed here) and came away even more convinced that this will be a profitable ISR operation in the very near future.

That said, 2018 has been a rocky year for MIN shareholders. Over the first six months of the year, Excelsior was one of the very top performers within the copper development space with shares peaking at C$1.50 in early June. However, a June 25th news release announcing the receipt of the final necessary EPA operating permit triggered a sell-off in MIN shares. This has been compounded by recent weakness in the copper price, resulting in a current Excelsior share price 24% below where we started the year and 38% below the early June high.

The late June sell off was counterintuitive in that receipt of the UIC from the EPA was a massively positive fundamental development for Excelsior. This was the final permit needed by the company to commence construction at Gunnison. In hindsight, it becomes clear that the market treated this as a “buy the rumor, sell the news” event. Frankly I should have seen this coming as market excitement over imminent receipt of the permit continued to build throughout the spring and into June. This included buy recommendations from multiple newsletter writers and the aforementioned site visit which was one of the larger ones I’ve attended.

Another source of selling pressure over the past seven weeks has been uncertainty surrounding the appeal process for the recently received UIC permit. Upon receipt of the permit on June 25th, a 30-day window was opened for third parties to appeal the ruling. On July 13th, it was announced that an appeal had been filed by an individual. Upon review, it was clear that this appeal was not a credible threat and it was dropped shortly thereafter.

On July 25th, a second appeal was filed. This was a more sophisticated effort backed by the Dragoon Conservation Alliance, Arizona Mining Reform Coalition, Grand Canyon Chapter of the Sierra Club, Center for Biological Diversity, and Patagonia Area Resource Alliance. The full appeal can be read here.

Given the friendly regulatory environment for mining in the United States, the care that Excelsior put into the permitting process, and the relatively minimal footprint of the Gunnison ISR operation, I am very confident that Excelsior will successfully fend off this appeal. As stated by CEO Stephen Tweryould in an August 6th news release:

“The remaining appeal raises no new objections that were not previously addressed as part of the comprehensive permit review process that was undertaken by the United States Environmental Protection Agency (“EPA”). Excelsior’s view is that this lone appeal will not be successful, and the Company intends to use all available legal means to have this appeal dismissed as soon as possible.Appeals are reviewed by the Environmental Appeals Board. In order to be successful, the petitioner must demonstrate either a finding of fact or conclusion of law that is clearly erroneous, or an exercise of discretion on an important policy consideration that the Environmental Appeals Board should, in its discretion, review. The petitioner also must identify where in the record the issue was raised, or explain why it was not previously raised, and explain why the EPA’s response to the comment was clearly erroneous or otherwise warrants review. Given the thoroughness of the process over the past 30 months, this is a difficult hurdle to meet and prevail.”

The question here is timing. The sooner this gets resolved, the sooner Excelsior can officially break ground at Gunnison. We are now in the middle of a 75-day window (ending October 12th) for the EPA to send in its response to the Appeal’s Board. Upon submission of the EPA’s rebuttal, the parties behind the appeal have until Nov 5th to respond to the EPA. The Appeal’s Board then will have 30 days to rule on the merits of the appeal by Dec 5th.

There are a few different ways this process can play out:

1. The best-case scenario is that Excelsior and the parties behind the appeal come to an agreement between themselves and the appeal is dropped before the EPA and the Appeal’s Board get involved. If this happens, it will be this month or next. A feasible settlement would be Excelsior agreeing to install an additional number of monitoring wells around Gunnison in exchange for the appeal being dropped. In this scenario, construction would commence in October 2018.

2. If no settlement is reached between Excelsior and the parties behind the appeal, the second best scenario for MIN shareholders is that the Appeal’s Board rules firmly against the appeal after considering the EPA’s response. The Appeal’s Board will make a determination by Dec 5th at the very latest. In this scenario, construction would commence in December 2018.

3. Less ideal is the possibility that the Appeal’s Board calls another public meeting to discuss the Gunnison Project. This public meeting wouldn’t take place until February 2019. If no further objections are raised after the public meeting, construction can commence shortly thereafter in early Q2 2019.

4. The worst-case scenario is that the Appeal’s Board calls for a February 2019 public meeting and then after the meeting requests that the EPA rewrite certain sections of the UIC permit. It usually takes the EPA a maximum of two to three months to make these fixes. Then the EPA would reissue the UIC permit, which begins another 30-day appeal period open only to the parties that appealed in the original window. This would result in construction being delayed until Q3 2019 with first production at Gunnison in mid-2020.

So in a best case scenario, Excelsior can break ground at Gunnison in the next sixty days. In a worst-case scenario, the company may have to wait another 12 months. Given this uncertainty, why would Excelsior be an attractive investment at this point in time?

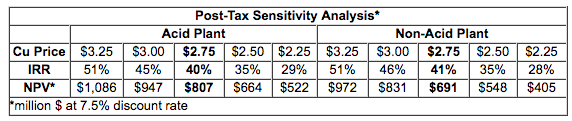

The reason comes down to valuation. Remember that the Gunnison economics are extremely compelling. Excelsior released a Feasibility Study in late 2016 projecting an after-tax NPV of US$691m, an after-tax IRR of over 40%, a payback of less than three years, and an initial capex of US$46.9m. This assumes a 7.5% discount rate, $2.75 copper, and no acid plant. Importantly, it does NOT incorporate the recent cut in the US corporate tax rate. A sensitivity analysis from this study can be seen below.

Source: Company filings

It is rare these days to find a project with an IRR north of 40%, a payback of less than 3 years, and an after-tax NPV greater than 10x the initial capex. Projects of this quality are valued at a minimum of 50% of NPV once under construction. This implies a project value of US$345m upon breaking ground at Gunnison, or C$2.03 per MIN share.

This compares favorably to Excelsior’s current share price of C$0.90 and implies healthy upside of 125%.

Given the magnitude of this potential share price appreciation, it shouldn’t matter to longer term investors which of the aforementioned permitting scenarios play out. Even in the worst-case scenario, it pays to stick around while the appeals process plays out over the next year.

An implied assumption I’m making is that, regardless of whether it takes sixty days or one year, the appeal process will indeed play out in Excelsior’s favor. For the reasons outlined above (friendly permitting environment, the care MIN put into the permitting process, the minimal footprint of the proposed ISR operation, etc.), I view this as a “when” and not an “if” question.

I’ve included below the catalysts that MIN shareholders can expect over the coming months. Here I assume that permitting scenario #2 is what ultimately transpires:

- EPA sends response to Appeal’s Board by end October 12th 2018

- Appeal’s Board rejects appeal by end December 5th 2018

- Break ground @ Gunnison by end December 2018

- Debt component of initial capex (US$50-60m) raised by end Q1 2019

- First production @ Gunnison by end Q3 2019

- Production rate of 25m pounds per annum achieved by end Q1 2020

- Production rate of 125m pounds per annum achieved by end 2024

MIN’s immediate future depends on how this appeal process plays out. We’ll know by the end of September whether there is any chance of reconciliation between Excelsior and the parties behind the appeal. Otherwise, we’ll find out definitively by Dec 5th whether (1) Excelsior gets to break ground this year or (2) the appeal process extends into 2019.

Disclosure: I am/we are long EXMGF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.