Pretium Resources announced the signing of a commitment letter for a fully underwritten US$480 million debt facility.

Pretium Resources set two goals in 2018 and is about to deliver. Paying off the Osisko 8% stream and refinancing the credit facility.

PVG should not be considered as a long-term investment but rather an excellent trading tool until the preponderance of evidence suggests otherwise.

Image: The Brucejack, source: Mining.com

Investment Thesis

Pretium Resources (PVG) is an exciting new gold and silver mine in Canada that has been under the spotlight since it has been initiated by Robert Quatermain on October 28, 2010, for a price of $450 million.

Pretium has entered into an agreement to purchase the Snowfield Project and the Brucejack Project in British Columbia, Canada from Silver Standard Resources Inc. (Silver Standard) for total consideration of $450 million, payable by a minimum of $215 million in cash and the balance by way of Pretium common shares valued at the IPO offering price.

The nature of the deposit has created a bitter and controversial debate about the real nature of the gold and silver deposit that culminated with a recent Viceroy Research's independent report published on September 6, 2018.

We believe the company is trying to deliver the results projected by the Snowden resource model by selectively mining high-grade stopes through unsustainably accelerated mine development. Obviously, this practice would be entirely unsustainable, however, it does play to Pretium's benefit in the short term given we believe they are actively trying to refinance their high-interest loan book.

Short term, I used the small rally today to sell out my trading position at around ~$8.40 and will wait for another retracement at intermediate support around $7.50 to start buying back.

Long term, the recent refinancing makes me more comfortable and I raise my long-term buy recommendation target from $5.50 to $6.50/$7 now.

However, trading or investing PVG should be done in correlation with the future price of gold.

What is Pretium Resources debt situation?

I recommend reading my precedent article about the second-quarter earnings results analysis.

However, here are some primary elements.

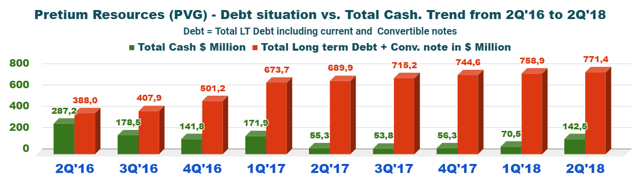

The net debt was $628.9 million as of June 30, 2018. Total cash position was $142.5 million and long-term debt was $771.4 million according to Morningstar. We have to add also different costs and obligation (e.g., Osisko (OR) stream, options, and warrants).

Vilroy Research said in its analysis:

As of Q2 2018, Pretium has ~$700M of debt (excl. convertible notes) and $142M of cash on their balance sheet. The company's net debt represents ~35% of its current market cap. This is one of the highest net debt-to-market cap ratios we have seen in the gold mining industry. In fact, the top 10 North American gold mining companies by market cap are levered approximately 12% on average. Pretium's leverage represents almost 3x this amount. We believe Pretium is a high-risk credit. According to page 8 of Pretium's Q2 2018 financial statements, Pretium's creditors would seem to agree with us: "the effective interest rate on the credit facility is 15.0%".

Pretium Resources set two goals in 2018 and is about to deliver.

- Pay off the existing 8% stream owned by Osisko, due to start in January 2020. Pretium Resources had two possibilities to pay off the stream, first at the end of 2018 for $237 million and second at the end of 2019 for $272 million.

- Refinancing of the 7.5% credit facility by the end of 2018, whereby the company has the "option to extend the due date one year to December of 2019 while paying a 2.5% extension fee on the principal and cumulated interest at December 31, 2018." Vilroy Research noted: "On December 31, 2018, Pretium is due to pay a $423M credit facility. Pretium has the option to extend this for one year for a 2.5% extension fee plus 7.5% payment-in-kind interest. It would result in a $455M liability by December 31, 2019."

The above elements mean that Pretium Resources has a liability of $695 million at the end of 2018. One solid argument that Vilroy Research noted in its analysis:

is that a provision within Pretium's credit and stream agreements requires Pretium to report monthly grades to its creditors. If indeed Pretium has distorted these grades, we believe this would be deemed a significant breach of contract.

On September 28, 2018, Pretium Resources announced that:

An agreement to sell the precious metals stream for US$150 million was part of the construction financing package for the development of the underground Brucejack Mine (see news release dated September 15, 2015). The Company has delivered notice of its election to repurchase 100% of the precious metals stream for US$237 million by December 31, 2018, to the holders of the stream.

On October 4, 2018, Pretium Resources announced that:

The signing of a commitment letter for a fully underwritten US$480 million debt facility [...]with The Bank of Nova Scotia, Societe Generale and ING Capital LLC. Upon execution of the loan documentation and satisfaction of conditions precedent, the Loan Facility will be available by way of a US$250 million senior secured amortizing non-revolving credit facility [...] and a US$230 million senior secured revolving credit facility...

The Loan Facility will be used to refinance the existing construction credit facility, approximately US$423 million due on December 31, 2018 [...] for the construction of the Brucejack Mine.

Viceroy Research noted wrongly in its research:

Our research suggests it is unlikely that Pretium will be able to refinance its existing loan structure, leaving it with little option but to roll over its expensive commitments for another year [...]

...which led the firm to an unsubstantiated conclusion that should be revised immediately. Viceroy Research has been extremely caustic in its assessment of the debt situation, in my opinion, stretching far beyond what should be acceptable from an impartial and fair analysis.

[...] This argument is the basis of conclusion that Pretium's equity is effectively worthless. As our NAV projections below show, the likely scenario in Pretium's situation is that the mine is turned over to creditors as collateral for their loans, which are unlikely to be repaid in full.

However, Viceroy Research cannot be tossed entirely despite what I regard as an evident tendency to aggravate unnecessary the fundamental situation of the company.

Viceroy Research made some excellent points in its evaluation of the intrinsic value of the mine based on its assessment of the Brucejack's NAV which suggest that "the debt is substantially impaired."

The problem is that we need more time and more data to determine the real Brucejack mine valuation. Pretium Resources will have to demonstrate that the mine is really what it sold it for a while back, with great production potential stretching well beyond a few insignificant quarters.

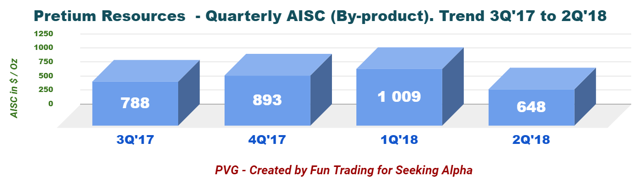

So far, production has been quite impressive and a few like me have said "too impressive" as the numbers below are showing. However, I do not condemn the company and know it is not as easy as it seems.

Hence, it is crucial to adopt a viable investing strategy and avoid gambling by defining precisely what are the facts and what is the expectation. PVG should not be considered as a long-term investment but rather an excellent trading tool until the facts will dictate otherwise.

Technical Analysis

PVG is forming a descending triangle pattern with line resistance at $8.80 (I recommend selling at least 35% of your position unless the future price of gold turns bullish which is not likely) and long-term line support at $6.50-7.00.

Author's note: Do not forget to follow me in the gold sector. Thank you for your support, I appreciate it. If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade and day trade PVG on a regular basis but do not have a position at the moment.

https://seekingalpha.com/article/4210138-pretium-refinancing-simple-equation-involving-price-gold