Next Stop $25 All Bubbles Eventually Pop: Canopy Growth Remains A Strong Sell With 46% Downside

The cannabis bubble still hasn’t popped.

Valuations remain lofty like spaceships in outer space.

I give an estimation of 2019 earnings for CGC, and explain potential downward adjustments.

Shares remain a strong sell and I reiterate my 12-month price target of $25.

I was wrong: the bubble hasn’t popped yet. I predicted last week that the Canadian cannabis bubble would pop on October 17th, the official day recreational cannabis becomes legal in Canada. That hasn’t happened … yet.

I remain convinced that Tilray (TLRY) is still trading at dangerously elevated levels, but this article focuses on the market leader Canopy Growth (CGC) which, while admittedly executing very strongly, still trades at unjustifiable levels. CGC remains a strong sell.

(Pinterest)

Bubbles, Bubbles, Bubbles

Blowing bubbles is surely a favorable childhood memory for many. It is magical how something with liquid and thin walls is able to keep flying, defying the forces such as air which slowly but surely will eventually break through, ending the bubble’s journey.

Stock market bubbles are quite similar.

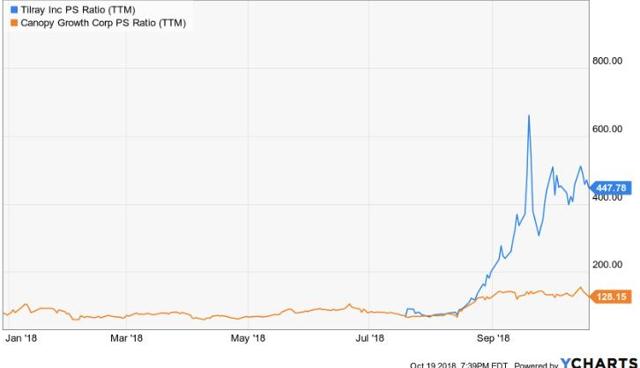

Cannabis stocks, especially CGC and TLRY, have seen a miraculous run in defiance of underlying fundamentals:

These two names just keep seeing their price to sales numbers float higher on a trailing basis:

Now with legalization out of the way, we can finally see whether the promised growth will show in their future quarterly earnings reports. The projection of future earnings however gives a dim picture as their stock prices are pricing in expectations which do not look like they can be met.

The Growth Is Real, But Run The Numbers!

While the future market for CGC certainly is very promising, it is however still possible for shares to underperform if their valuation is so absurd that it has already priced in even the rosiest of expectations. How much should CGC be worth?

As we can see below, CGC has done a great job in signing supply agreements with the Canadian provinces:

(2018 August CGC Presentation)

Recall that these supply agreements mean that CGC has contracts to supply 67,500 kg of cannabis per year to the government upon which these would be distributed to retailers for resale to the public. The government has apparently done this to make sure their citizens get high quality legal cannabis.

It is clear that CGC has done a great job in executing and preparing for legalization, this is evident from their 36% market share of supply agreements thus far. I however caution readers from extrapolating that this means CGC will really be able to corner 36% of the retail cannabis market. I will discuss the reasons why in a moment. First though, let’s try to calculate projected earnings based on the current supply agreements. 67,500 kg per year would be roughly $434 million in revenues using their $6.43 average selling price per gram in their previous quarter.

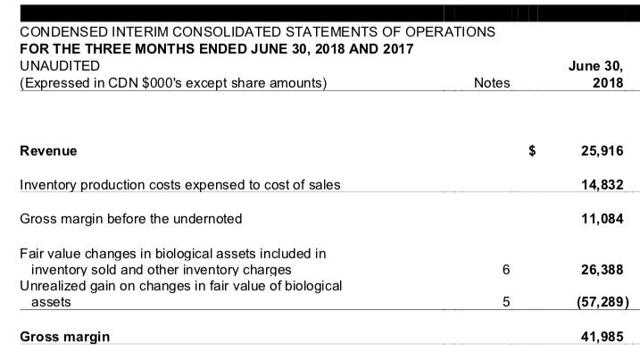

We can estimate their gross margins using their income statement:

(FY2019 Q1 CGC Financials)

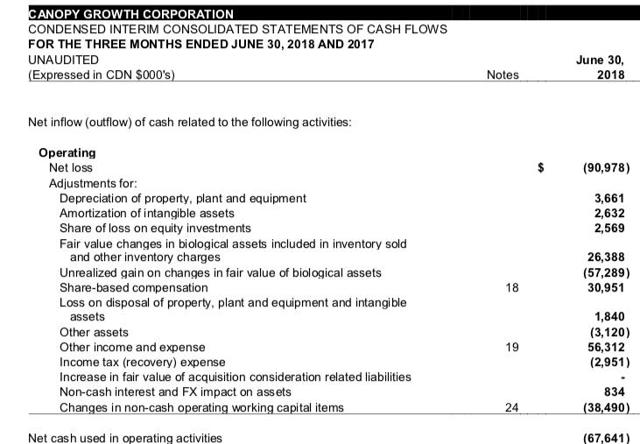

We should use the “gross margin before the undernoted” because the following two adjustments appear to be non-cash line items were are adjusted out in the cash flow statement:

(FY 2019 Q1 Financials)

This suggests gross margins of 42.7%. There is no use in looking at operating margins because we already know CGC is operating at a loss. How does this 42.7% gross margin compare to peers, and what are their net margins? Constellation Brands (STZ), which CGC shareholders should be very familiar with due to their $4 billion investment into CGC, has roughly 50% gross margins, 30% operating margins, and 21% net margins (Morningstar). Philip Morris (PM) has roughly 63% gross margins, 40% operating margins, and 21% net margins (Morningstar). Let’s be generous and assume CGC will have 25% net margins. If we add in $104 million in medical marijuana sales (derived by annualized their latest quarterly number and assuming 50% growth) then we end up with $538 million in total revenues and $134.5 million in net income.

CGC has approximately 324 million shares outstanding (after incorporating the STZ investment) and a market cap of $15.2 billion. This suggests that CGC trades approximately 113 times these projected earnings. That’s already not cheap, but this however is likely to be an overestimation of projected earnings.

-

For one, 25% net margins are very aggressive considering that even mature and efficient companies like STZ and PM are unable to achieve such margins.

-

More importantly, we need to understand that the government is incentivized to seek the lowest price from suppliers and thus CGC is unlikely to sell at their $6.43 average selling price, as otherwise retail stores would not be able to compete with the black market. Over capacity remains a prevailing theme in the cannabis space. According to recent estimates, CGC has capacity to produce at least 500,000 kg per year, but they are closely followed by competitors. Aurora Cannabis (ACBFF) is projecting to have over 570,000 kg in production capacity by the end of 2019, and Aphria (OTCQB:APHQF) is projecting to have over 255,000 kg also by the end of 2019. Note that I have only listed three players, but the combined production capacity would be over 1.2 million kg per year. Recall that the long term projection of the Canadian cannabis market is about $6.84 billion in annual sales. At an optimistic average retail price of $8 per gram, this would imply a total market of around 855,000 kg per year. Because there will be so many players with large and increasing production capacities, this means that the government may be the ones with negotiating leverage which would cause the average price sold from suppliers like CGC and TLRY to drop significantly. I find it much more likely that CGC, TLRY, ACBFF, and others will compete for supply agreements in the future based on lowest price. CEO Neufield of APHQF has made similar statements in the past, namely that he expects oversupply to hit Canada by late 2019 and for this to lead to price concessions. While CGC certainly has the scale to survive such a scenario, they would still see a significant impact to their bottomline. This also suggests that the $6.84 billion long term market projection may not apply to CGC because they will not be able to sell anywhere near retail prices to the government.

-

Finally, one should not underestimate the reach of the black market. Bill Blair, Liberals’ Border Security and Organized Crime Reduction Minister, estimates that the current Canadian cannabis black market to be a $4-$6 billion industry. While I do believe that a majority of sales will be through legalized venues, I have doubts that the black market will completely disappear especially if prices are competitive enough. Consider that this black market is already established, whereas the system of legal retail stores still needs to be built out. This would potentially reduce the market size and potential revenues for CGC.

Price Target

I reiterate my 12-month price target of $25, or approximately an $8 billion market cap. This would be 59 times my previously mentioned 2019 earnings estimate. When we get more clarity on the actual financial results, it should become clear that even my projected earnings might prove to be too optimistic. This may lead to a selloff as investors realize that a significant mispricing has taken place here. Shares have 46% implied downside to my price target.

Risks

-

I continue to express skepticism about the global market. I do not have confidence that CGC or other Canadian players will be able to take significant global market share. Considering the strict regulations already seen in Canada with the supply agreements, I have a hard time believing that CGC would be able to secure large supply agreements abroad when governments are likely to give preference to domestic players. That said, I might be wrong. The global market was recently estimated to be $200 billion by TLRY CEO Kennedy. If CGC can take significant global market share, then shares will prove to not only be not a sell, but a strong buy. That said, I need to reiterate my skepticism.

-

Shares are likely to remain volatile for the near future. Such swings may be detrimental to short-sellers as they may be forced out of their short positions. Those looking to short are thus advised to be wary of the volatility and perhaps even consider using out options instead. That said, according to interactive brokers, there are 500,000 shares to short, thus it is not as expensive a short as TLRY.

-

It is projected that in the near future the edibles market will also be legalized for Canada. Unlike dry cannabis, the edibles market promises to have much higher margins and pricing power. It is thus far unclear how that market will be regulated, but this may add upside to projected earnings. I should note that the edible market is likely to take away from the dried flower market - after all there is only a finite amount of cannabis that can be ingested everyday! Edibles thus may help increase profit margins but investors should not “double-count” this as a separate market.

Conclusion

Bubbles come in all shapes and forms, but they all share one similarity: they pop. CGC is executing and firing on all cylinders but the stock price is just unjustifiable. I believe that investors are underestimating the downward impact from oversupply and the black market. I reiterate my strong sell rating and price target of $25.