Insider gold buying has picked up a bit over the past month, especially over the past week or so with gold prices showing signs of a sustained rally.

(Gold prices have rallied since the start of October. Credit: StockCharts)

The technical picture for gold has gotten much more bullish this week; prices have risen over its 50-day moving average and a recent MACD crossover indicates that further gains could be in store. A bullish view of gold is in place unless gold breaks below $1,225/oz, according to IG Group.

Gold prices are likely rising here due to the stock market sell-off, the U.S. conflict with Syria and fears that the Fed's recent rate hike will lead to softer earnings and lower GDP growth. The Fed is still planning on raising rates in December, which could lead to more stock selling (and higher gold prices).

Why follow insider buying?

I typically provide updates on insider buying/selling every 1-2 months or so, or when multiple transactions occur. Insider buying refers to when insiders - such as CEOs, executives or major shareholders - purchase shares of company stock on the public market.

I think that insider buying is generally a positive sign, because it means insiders are bullish on the company's stock, believe it is undervalued or mispriced, and believe it will rise. I pay attention to insider transactions carefully and I believe it can help investors outperform benchmark gold indexes, including the VanEck gold miners index (GDX), junior miners index (GDXJ) and the price of gold (GLD).

Notable insider buying has occurred recently at three gold companies in particular.

Sandstorm Buys More Entree Resources

Note: Green dots indicate insider buying transactions on Entree Resources. Source: Canadian Insider.

Note: Green dots indicate insider buying transactions on Entree Resources. Source: Canadian Insider.

Sandstorm Gold (SAND) continues to add to its large equity position in Entree Resources (EGI). The company bought 2.42 million shares of Entree at prices ranging from C$.485 - $C.55 between October 11-15, according to SEDI insider filings.

For some background, Sandstorm owned 25.09 million shares, or approximately 14%, of Entree before this purchase. It also holds a 5.62% gold and silver stream and a .42% copper stream on Entree's 20% owned Hugo North Extension property, and a 4.62% gold and silver stream and a .42% copper stream on the Heruga deposit.

Following the purchases, Sandstorm owns 27.514 million shares of Entree, or 15.77% of the company.

These purchases aren't too surprising, as Sandstorm had discussed previous insider buying and hinted towards future purchases in a previous press releaseon Oct. 9: "Sandstorm currently intends to acquire additional securities of Entre..."

However, the size of the purchases are pretty significant in my view, as Sandstorm spent more than C$1.2 million on its investment. Sandstorm's holding in Entree are currently valued at approximately C$14.3 million, or US$11.55 million.

Sandstorm bought share of Entree because it believes the stock is very undervalued. I see the strong support from Sandstorm as a positive sign for Entree shares.

Insiders Step Up at Belo Sun Mining

BSX data by YCharts

BSX data by YCharts

Insiders have been buying the dip at Belo Sun Mining (OTCPK:VNNHF), a gold junior focused on developing the 5+ million ounce Volte Grande project in Brazil.

Sun Valley Gold, a majority shareholder in Belo Sun, recently bought 1,573,500 shares of Belo Sun at prices between C$.195 - C$.205. This brings Sun Valley Gold's share holdings to 105.881 million shares, or 23.9% of the company based on its share count of 442.63 million.

Readers should also note that on June 20, Belo Sun repurchased 22.958 million of its common shares at a price of C$.22. This is nearly all of the shares it was able to purchase under the normal course issuer bid.

According to the news release: "The Board of Directors of Belo Sun believes that the underlying value of the Company is not reflected in the current market price of its common shares, and has thus concluded that the repurchase and cancellation of common shares pursuant to the NCIB presently constitutes an appropriate use of financial resources and would be in the best interest of Belo Sun shareholders."

Also, back in April, numerous insiders of Belo Sun purchased shares privately at a price of C$.335.

"The Supporting Directors each acquired the number of common shares as follows: Stan Bharti 12,932,835 common shares; Peter Tagliamonte 12,932,835 common shares; Denis Arsenault 2,985,076 common shares; Mark Eaton 1,000,000 common shares."

Belo Sun also agreed to lend the directors C$10 million to buy the shares, with a 2-year repayment period and a favorable rate of LIBOR plus 1%.

These purchases come after Agnico Eagle (AEM) dumped 44.5 million of its shares, or half its holdings, in April. It's unclear why it sold the stake, but Agnico still owns 44.5 million shares of Belo Sun.

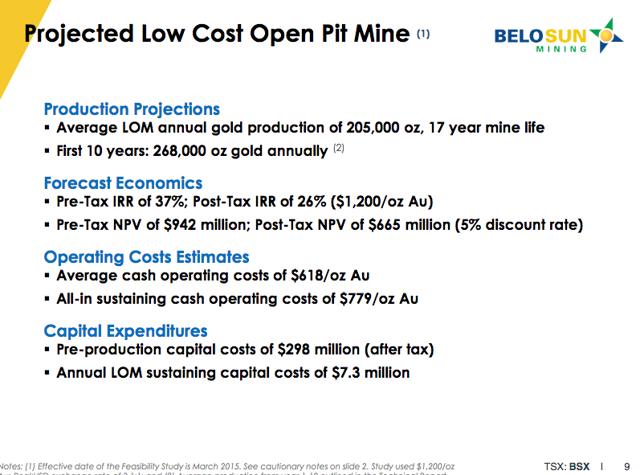

Volte Grande carries strong economics. Based on a feasibility study, the project carries a post-tax PNV of $665 million (5% discount) when using $1,200/oz gold prices, and that value shoots up to $855 million with gold at $1,300/oz. For a mine estimated to produce 200,000+ ounces of gold annually, the initial capital costs of $298 million are very reasonable.

Belo Sun's market cap of $85 million is just a small fraction of the project's feasibility study value, especially at higher gold prices.

So, why the undervaluation? Belo Sun has had permitting and approval issues at Volte Grande, which is perhaps the biggest reason for its undervaluation.

In April of 2017, a judge suspended its license until the company conducted a study on the mine's impact of nearby indigenous communities. And in September, a court ruled that the federal government should review its permits, which could lengthen the approval process.

Hedge Fund Purchases Shares at Guyana Goldfields

GUYFF data by YCharts

GUYFF data by YCharts

Insiders have been buying up shares of junior gold miner Guyana Goldfields (OTCPK:GUYFF).

Guyana operates the 3.9 million ounce Aurora gold mine. For 2018, its guidance calls for between 175,000 - 185,000 ounces of gold production at $945 - $995 AISC. The mine has 16+ years of life remaining based on gold reserves but there is exploration upside on its 200,000+ acre land package.

Recently, Guyana announced that Q3 production totaled 40,980 ounces of gold, at an average realized price of $1,200/oz, with record gold recoveris of 93.4%. Its balance sheet is very strong, with $93 million in cash versus $45 million in debt.

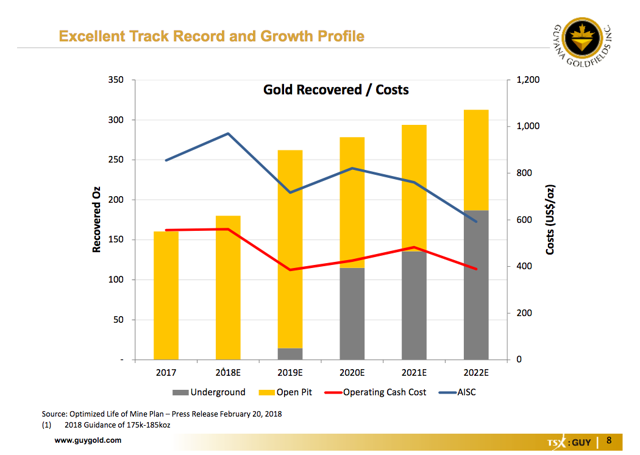

Production is expected to rise to 250,000+ ounces in 2019 and 300,000+ ounces by 2022, according to its corporate presentation.

Here's a summary of recent insider buying activity:

- On Sept. 5, Christopher Stackhouse, VP of Finance, bought 7,500 shares at a price of C$3.29.

- On Sept. 17, Ronald Stewart, Senior VP of Technical Services, bought 5,000 shares at a price of C$2.83.

- Between Sept. 28 - Oct. 10, hedge fund The Baupost Group, LLC, bought 1.3 million shares at prices ranging from C$2.87 - C$3.00.

Clearly, the Baupost Group has the most significant buys. This is the company's largest shareholder, owning more than 14%.

The Baupost Group has more than $30 billion in assets under management, is based in Boston and is a long-only hedge fund that is headed up by Seth Klarman.

Guyana is an interesting miner. It has large reserve and resource base, a long mine life (16+ years), and strong future cash flow, as it expects $400+ million in free cash flow from 2019-22 (based on $1,200 gold prices and its current mine plan). All-in sustaining costs are estimated to average $797/oz over the life of mine.

Subscribers of The Gold Bull Portfolio received early access to this article, as well as more detailed analysis and buy/sell/hold recommendations. Subscribers will also receive a full list of my Top Gold Stocks for 2019, which will be released shortly.

My top picks have outperformed the GDX every year for the past 3 years; please consider signing up today for access to these picks, plus a look at my real-life gold holdings and weekly gold updates.

Disclosure: I am/we are long SAND.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.