Americas Silver: I Have Changed My Opinion!! Seeking Alpha Americas Silver: I Have Changed My Opinion

In my opinion, San Rafael, a flagship property owned by Americas Silver, does not perform in line with initial expectations.

Galena, the lagging operation, still burns cash.

It looks like the company is going to defer the final cash payment for the San Felipe project.

Additionally, the company has got involved in another project, Relief Canyon (plus a few financial issues related to Pershing Gold).

As a result, I have changed my positive opinion on Americas Silver.

In the beginning of 2018, I published an article on Americas Silver Corp. (USAS). The final conclusion was as follows:

"In my opinion, Americas Silver derisked significantly at the end of 2017. The San Rafael mine was declared commercial and the San Felipe payment issue was solved. In that way two significant risk factors have vanished. On the other hand, there are still a few risk factors that should be closely monitored by investors, particularly Galena performance"

However, today, it looks like the company is facing a few other problems. As a result, my previous thesis is no longer valid.

San Rafael performance

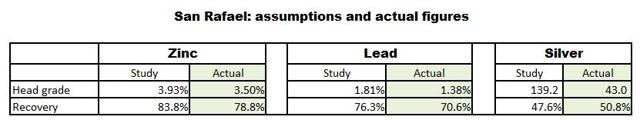

I am not impressed with San Rafael. To remind my readers, San Rafael is an extension of the Cosala mine, a polymetallic operation located in the state of Sinaloa, Mexico. Last year, Americas Silver terminated mining operations at the Nuestra Senora mine and put online the San Rafael operation. At that time, the company was confident that San Rafael was supposed to be a large, mostly-zinc operation and… it is but, as the table below shows, not everything goes according to an initial plan:

Source: Simple Digressions

Note that the head grades and recoveries reported at the Los Braceros mill (a processing facility treating the San Rafael ore) have been substantially lower than initial estimates planned for the first year of operations and disclosed in the preliminary feasibility study for San Rafael. The only positive exception is the recovery ratio for silver, which has been higher than estimates (50.8% vs. 47.6%).

Now, lower head grades and recoveries result in lower production. Let me take zinc as an example. Over the last three quarters of 2018, the mine processed 395 thousand tons of ore, producing 24.0 million pounds of zinc. However, applying initial estimates for zinc (head grade and recovery of 3.93% and 83.8%, respectively), the mine was supposed to deliver 28.7 million pounds of zinc. Taking into account that this year Americas Silver has been selling zinc at an average price of $1.37 per pound, the company has "lost" revenue of $5.4M (assuming the "payability" ratio of 84.6% for zinc). In my opinion, it is quite a lot of money (to remind, in 2018 YTD the total revenue delivered by two operating mines was $49.5M).

Further, I realize that the company encountered a number of technical problems at San Rafael (unplanned mill repairs), but these issues have nothing to do with the head grades and recoveries. Hence, I have lost my initial enthusiasm for this operation.

San Felipe

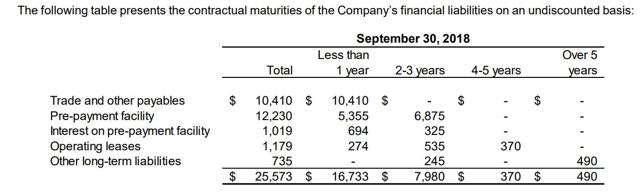

According to the company, in December 2018, it is supposed to pay $6M to Hochschild Mining (OTCPK:HCHDF) to finalize the acquisition of the San Felipe silver-zinc-lead project in Mexico. However, due to undisclosed reasons, this consideration is not included in the table depicting the company's contractual obligations:

Source: Americas Silver, 3Q 2018, report, page 13

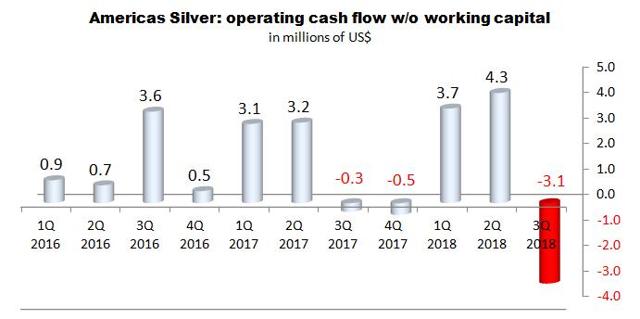

Now, as at the end of September 30, 2018, Americas held cash of $3.1M. Definitely, it is not a lot of money. What is more, as the chart below shows, in 3Q 2018, despite operating a new and very promising mine (San Rafael), the company was not able to deliver a positive cash flow from mining operations (San Rafael plus the second mine, Galena):

Source: Simple Digressions

As a result, in my opinion, there is a risk that Americas Silver may have problems with meeting its financial obligations, the San Felipe payment included. My suspicions are supported by this statement published in 3Q 2018 Management's Discussion (page 8):

"The Company is in discussions with Hochschild to restructure the remaining payments in light of the expected funding requirements for the Pershing combination"

Galena

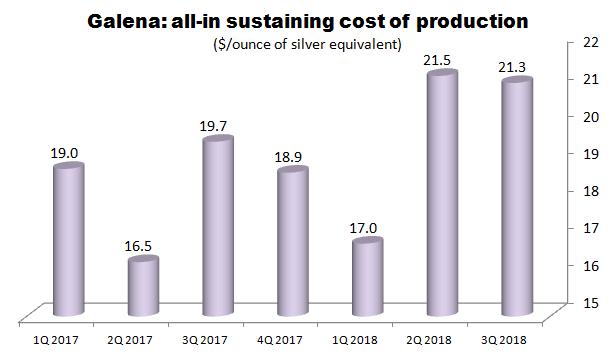

In my last article on Americas Silver, I recommended monitoring the Galena mine performance. To remind my readers, Galena is the second mine owned by the company - it is a silver-copper/silver-lead operation located in Idaho, USA. Currently, the company is mining at the silver-lead part of the mine. And, due to very high costs of production, over the last three quarters, Galena has been performing really badly:

Source: Simple Digressions

Note: the costs presented in the table above were calculated by the author, using the data reported by the company

Keeping in mind that today silver is trading at $14.5 per ounce, the mine is burning cash every day it operates (it burns $6.8 per each ounce of silver equivalent sold, assuming the cost reported in 3Q 2018).

Merger with Pershing Gold (PGLC)

This issue was discussed in articles published on Seeking Alpha by two of my fellow contributors, so let me skip it. Oh, maybe just one remark. Keeping in mind the fact that the company has limited cash holdings and the flagship property (San Rafael) does not perform in line with initial expectations, I see serious problems to develop the Relief Canyon gold project. Even taking into account that initial CAPEX stands at $23.6M, only.

Guidance for 2018

In 3Q 2018 report (the section titled "Guidance"), the company made the following statement:

"…the Company is re-assessing its guidance for the year and intends to update the market later in the Q4-2018"

I read it as: "The company is going to cut production guidance for 2018".

Summary

In my opinion, this year, the San Rafael mine, Americas Silver's flagship operation, does not perform according to initial estimates disclosed in a preliminary feasibility study. What is more, in 3Q 2018, partly due to some technical problems, the company burned cash. As a result, I think that Americas Silver may encounter quite serious financial problems going forward. Being more specific, a few projects may be delayed, postponed or even suspended. Let me list these projects:

- San Rafael - the company is still developing this mine; what is more, it plans to develop another satellite deposit called Zone 120

- Galena - the mine is a cash-flow-negative operation; to improve it, the company will have to invest additional cash

- San Felipe - in December, the company is obliged to pay the final installment of $6M

- Relief Canyon - to develop this project the company needs $23.6M; additionally, most recently, Americas Silver got involved in a high-cost financing facility (interest rate of 16% per annum) to support Pershing Gold (the current owner of the Relief Canyon project)

As a result, a few months ago, I changed my opinion on Americas Silver. Now, I no longer recommend these shares as a buying opportunity.

Disclosure: I am/we are long CEF, GDX, SAND, KL, ARREF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.