All financials are in Canadian dollars and all images are from HEXO's Management Discussion and Analysis, unless otherwise noted.

Summary

HEXO (HEXO) is a mid-sized Canadian cannabis producer that is quickly growing into a top-tier producer. Over the past year, HEXO's revenues have increased more than ten-fold, and the company is expecting revenue to jump to $400 million next year - an eight-fold increase over current run-rate revenue.

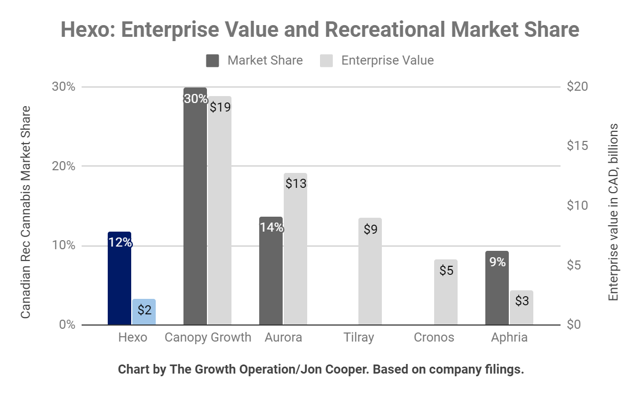

This quarter, HEXO sold 2,537 kg equivalents of adult-use cannabis, giving HEXO approximately 12% market share of the Canadian market based on Stats Canada data. Based on available filings, this places HEXO as the third-largest Canadian cannabis company by recreational cannabis market share. That market share may be especially promising given the expected growth of the Canadian recreational cannabis market and HEXO's growing cultivation capacity. HEXO will also benefit from the addition of more provincial markets through their acquisition of Newstrike Brands (OTCPK:NWKRF).

Despite strong recreational cannabis sales, HEXO is not yet profitable based on either EBITDA or operating cash flow. Given company estimates of low growth next quarter and doubling revenue in the July quarter, HEXO is unlikely to be profitable until at least the October 2019 quarter. Further, HEXO trades at elevated multiples when compared to non-cannabis companies: HEXO trades at an enterprise value of ~$2.2 billion despite last quarter revenue of only $13 million. Those ratios may give some investors pause and are likely to lead to significant volatility, especially if market enthusiasm for cannabis wavers or if HEXO fails to hit their revenue targets.