VANCOUVER, BC / ACCESSWIRE / April 8, 2019 / Ximen Mining Corp. (TSX-V: XIM, "Ximen" or the "Company") announces that it has entered into an option agreement with Don Althen, an individual who is arm's length to the Company, dated April 5, 2019 (the "Option Agreement") under which the Company has acquired an option, exercisable in the Company's sole discretion, to purchase all of Mr. Althen's interest in:

- a promissory note issued by 0995238 B.C. Ltd. ("0995238") to Mr. Althen dated August 10, 2017 in the amount of $780,000 plus interest (the "First Promissory Note");

- a promissory note issued by 0995238 to Mr. Althen dated May 29, 2018 in the amount of $1,000,000 plus interest convertible into common shares in the capital of 0995237 at a deemed price of $0.02 per common share (the "Second Promissory Note");

- certain mining equipment located in Del Bonita, Alberta (the "Mining Equipment"); and

- 5,333,334 common shares in the capital of 0995237 (the "Shares" and collectively with the First Promissory Note, the Second Promissory Note and the Mining Equipment, the "Optioned Assets").

The principal asset of 0995237 is its option to acquire the Kenville Gold Mine located west of Nelson, British Columbia.

The Kenville Gold Mine has played a major role in the rich history of BC Gold mining. It was the first underground lode gold mines in British Columbia and was once the largest producer in the Nelson Mining Camp. There have been multiple new targets and veins discovered in the last several years and Ximen is looking forward to the potential opportunity that exists ahead.

Says Anderson CEO Ximen Mining Corp

About the Kenville Gold Mine

The Kenville Gold mine was discovered and staked in 1888 and was the first hard rock gold mine in British Columbia. It was mined intermittently until 1954, with recorded production of 2,029 kilograms of gold, 861 kilograms of silver, 23.5 tonnes of lead, 15 tonnes of zinc, 1.6 tonnes of copper and 37 kilograms of cadmium from 181,395 tonnes processed. The property is located 8 km west of Nelson, BC, is accessible by paved road and is connected to the power grid. Existing infrastructure includes mining equipment, offices, mechanic shop, core storage and accommodation.

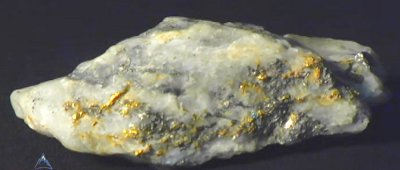

The mine deposit consists of multiple, gold-silver quartz veins hosted by diorite. Between 2007 and 2008, 13,000 meters of diamond drilling was conducted that targeted previously un-tested areas southwest of the historic mine, and detailed sampling was conducted within the mine on the 257 Level. There are six other historical levels within the mine footprint; only this level was rehabilitated and remains open and accessible. Based on the mine sampling and drill hole information available at the time, new zones of gold mineralization were identified, and mineral resources were estimated (see table below).

2009 Historic Mineral Resource Estimate - Kenville Mine

| Class | Tonnage | Gold g/t | Ounces |

| Measured | 3,312 | 31.72 | 3,377 |

| Indicated | 21,312 | 18.84 | 12,912 |

| M+I | 24.624 | 20.58 | 16,289 |

| Inferred | 522,321 | 23.01 | 356,949 |

Reference: "Technical (Geological) Report on the 257 Level of the Kenville Mine, Nelson, British Columbia", July 22, 2009, by R. Munroe, P.Geo.

A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or mineral reserves. As such the issuer, Ximen Mining Corp., is not treating this historical estimate as current mineral resources or mineral reserves.

Ximen considers this historic mineral resource estimate to be relevant and reliable in that it was based upon the results of underground sampling and diamond drill information available at the time. The historic mineral resource estimate uses the categories of Measured, Indicated and Inferred mineral resources as defined by the Canadian Institute of Mining, Metallurgy and Petroleum. Estimations were done using a polygonal method. Measured and Indicated Resources are based on projections of mineralized veins exposed on the 257 Level. Inferred Resources in the historical estimate are based on assumed continuity beyond measured and (or) indicated resources. The inferred mineral resources are based on historical drill and channel assay information verified by underground channel samples collected in 2007/8. The resource tonnages were estimated using an assumed specific gravity. A cut-off grade of 1.1 grams per tonne was used. No allowance for dilution was included based on an anticipated "resue" mining method, which would separate mineralized material from waste rock.

Significant diamond drilling was conducted after the above mineral resource estimate was made between 2009 and 2012. At least 4 new veins were identified with potential strike lengths of over 700 metres. The results of this drilling have not yet been reviewed by the Company's Qualified Person. A complete review of the technical information is required with the aim of completing a new resource estimate that includes the more recent diamond drill results.

In addition to the historic gold mine, elsewhere on the property historic soil geochemical surveys and results of scout drilling indicate potential for porphyry-type copper-molybdenum-silver-gold mineralization.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

Pursuant to the terms and conditions of the Option Agreement and subject to the Company's exercise of the option to acquire the Optioned Assets, the Company will pay the following consideration to Mr. Althen:

- a total of 1,408,333 shares in the capital of the Company (the "Consideration Shares" and each a "Consideration Share") at a deemed price of $0.80 per Consideration Share;

- cash payments totaling $1,380,000, payable in installments; and

- settling of debt owed by Mr. Althen to arm's length third-parties in the aggregate amount of $270,000.

The exercise of the Company's option to acquire the Optioned Assets is subject to the Company being satisfied with its further due diligence investigations of the Optioned Assets prior to May 30, 2019 and acceptance of the Option Agreement by the TSX Venture Exchange.