Taseko Mines (TGB) is making good progress with its Florence Copper project, having recently announced that the production test facility is fully operational and producing copper. Taseko is also benefiting from copper prices stabilising a bit below US$3 per pound, which both helps its results at Gibraltar and improves its ability to secure financing for Florence Copper. Financing remains the chief obstacle to the full-scale Florence Copper operations, but the outlook for that is better at US$2.90 to US$2.95 copper compared to US$2.65 copper.

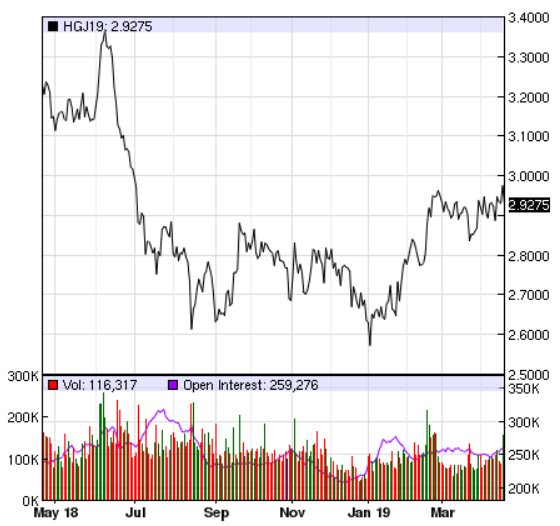

Copper Prices

Copper prices have remained reasonably strong recently, hovering at around US$2.90 to US$2.95 per pound for much of the past couple months. This represents a decent amount of improvement compared to the second half of 2018.

Source: Nasdaq

Copper prices have been supported by solid data from China along with items such as sluggish production from Chile's Codelco, which has been dealing with aging mines with declining ore grades. Including other producers, Chile's copper production still grew to its highest ever levels in 2018. However, I'd put limited stock in Codelco's talk that Chile's copper production could reach 7.25 million tonnes (around 24% above 2018 levels) by 2025. In 2011, Chile had talked about copper production reaching 7 million tonnes by 2020, and it looks likely to fall well short of that level. There was previously talk in 2008 of Chile reaching 7 million tonnes of copper production by 2015 as well.

New projects and investments will probably allow Chile to boost production a bit from current levels, but it will likely fall well short of reaching 7.25 million tonnes by 2025.

Florence Copper

Taseko announced that its Florence Copper production test facility is fully operational with results in line with expectations so far. I believe that the permitting situation should be fine for Florence Copper given its lengthy history of legal victories and with Excelsior Mining's (OTCQX:EXMGF) similar Gunnison Copper Project in Arizona getting the required permits and starting construction.

The risk to the full Florence Copper project becoming a reality still lies mainly with the potential financing challenges. There are multiple ways to potentially finance Florence Copper, but it is important for Taseko not to take on too much additional debt or significantly adversely affect the project economics though.

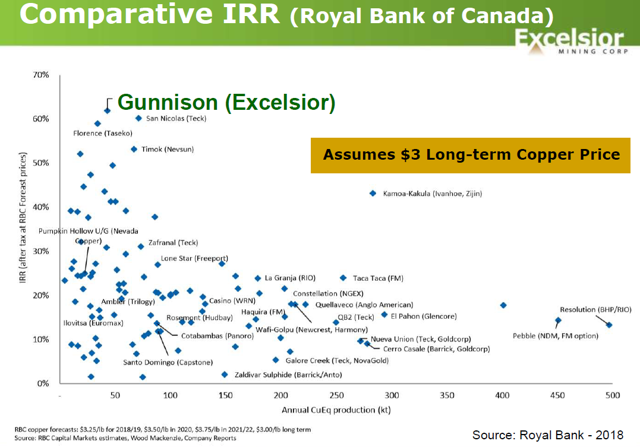

Florence's base project economics are seen as quite good, with Excelsior Mining's presentation also highlighting Florence Copper's strong IRR at $3 copper.

Source: Excelsior Mining

The financing outlook has improved with the higher copper prices, as I had mentioned that a copper price of close to US$3 per pound may be necessary to get Florence Copper financed at a reasonable cost. The copper price is now reasonably close to US$3 per pound, while it was at US$2.64 per pound when I wrote that article in January.

The improved financing outlook is reflected in the yield-to-maturity on Taseko's 8.75% Secured Notes due 2022, which has come down to 10.3%after peaking at nearly 15% in early January. This is still a bit elevated, but if copper prices incrementally improve and operations at Gibraltar go smoothly, Taseko's bond prices should increase some more.

Potential Financing

The Excelsior Mining financing deal is an interesting one that could provide a benchmark for Taseko's financing. Part of the deal involved Excelsior selling off approximately 4.3 million pounds of copper per year (at 25% of spot prices) in return for US$65 million.

For Taseko to raise close to US$200 million under similar terms, it would be selling off approximately 13 million pounds of copper per year at 25% of spot prices.

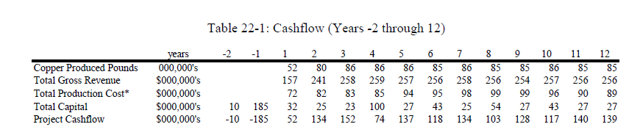

The Technical Report for Florence Copper projected an average of approximately US$115 million per year in cash flow from Florence Copper during its first 10 years of production at US$3 copper prices.

Source: Taseko

If there is a US$0.20 per pound decrease in margins from the Technical Report (to be more conservative) and Taseko sells a copper stream of 13 million pounds per year, the cash flow would decrease to an average of around US$71 million per year over the first 10 years of production.

This would be still quite strong and would put Taseko in a good position given that it wouldn't have taken on additional debt to put Florence Copper into production.

Conclusion

Florence Copper has been progressing well, reaching full operational status with its production test facility. I believe the permitting risk is low and that financing the project remains the main hurdle. The stronger copper prices should provide more viable financing options for Taseko to get the full Florence Copper project operational.

If Taseko can negotiate a larger version of the Excelsior Mining copper stream deal with Triple Flag Mining Finance, it should leave Florence Copper able to generate strong cash flow still. I'd consider a deal along those lines to be a big plus for Taseko, allowing it to significantly deleverage once Florence Copper is fully operational.