China’s state planner is closely studying proposals to establish rare-earth export controls, adding to concerns that the mineral critical in production of military equipment and tech devices will be used as a weapon in Beijing’s trade war with Washington.

The National Development and Reform Commission met with experts focused on promoting the development of the industry who suggested that the government set up a mechanism for tracking and approving exports of rare earths.

Departments of the NDRC have indicated they will fully take on the experts’ advice, and put measures in place as soon as possible, the state planner said in a statement Tuesday. The experts also asked that authorities crack down on illegal mining, production and smuggling of rare earths, according to the statement.

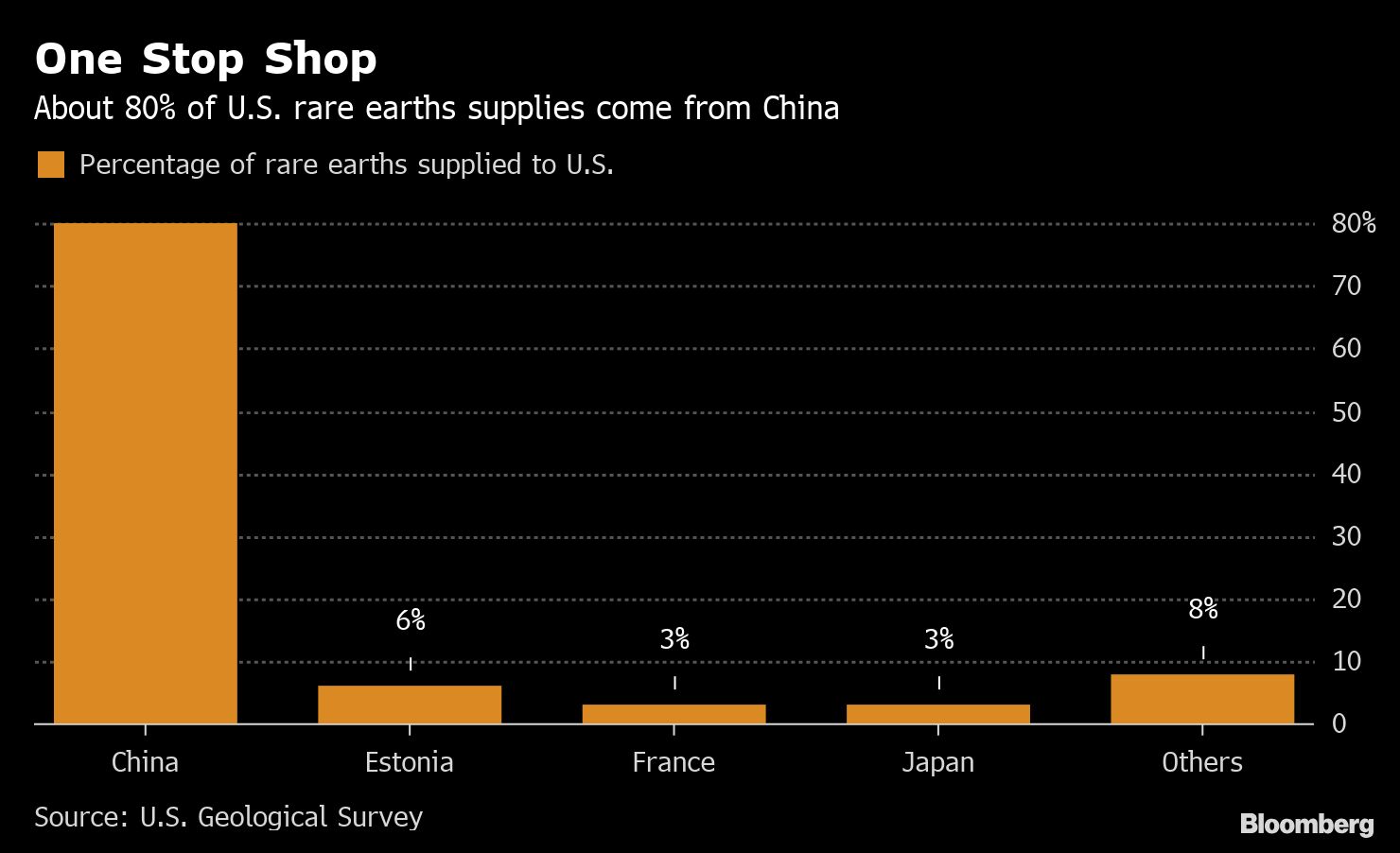

China was said to have been readying a plan to use its stranglehold to hurt the U.S. economy, and its deployment risks serious disruption to American manufacturers of components used in everything from dishwashers to military equipment. There are few alternatives for supply as most of the rare earths mined outside China — including the sole US mine in California — still end up in the Asian country for processing.

In recent weeks, the Trump administration has raised tariffs on $200 billion of Chinese goods, stepped up efforts to kneecap Huawei Technologies Co. and moved to stymie other Chinese tech firms. Meanwhile, Beijing has used state media to blast American policies, including hints that it could cut of rare earths supply. China’s retaliatory tariff increase on $60 billion of US goods took effect June 1.

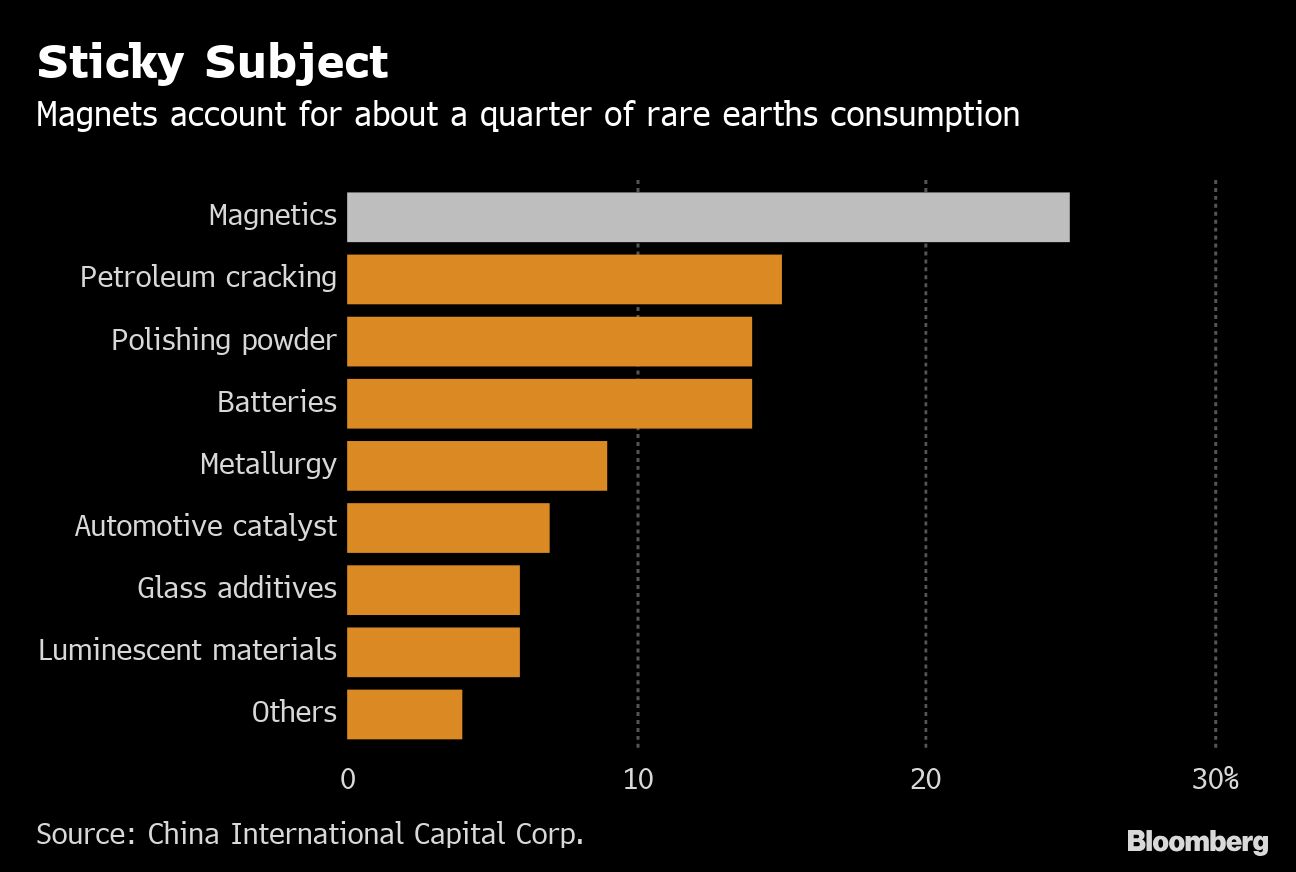

There is speculation export restrictions may cover so-called heavy rare earths, a sub-group with a wide variety of uses that include magnets in miniature motors in almost all automobiles and consumer goods. Disruptions to supplies of rare-earth permanent magnets would be a “ devastating” blow to the US economy because of their widespread demand, US industry veteran Jack Lifton has said.

The key questions for US manufacturers are how quickly any curbs bite, whether alternative sources can be found, when, and at what cost. China’s grip over global heavy rare earths production is almost total, according to Shanghai Metals Market, and it will take a significant amount of time to build up the necessary processing capacity in other countries.