Welcome to the July 2019 edition of the lithium miner news. This past month saw lithium prices drift lower, and a busy month of lithium market and company news (Altura Mining had three big news items). A key recent trend has been more Li-ion megafactories (now at 91) planned, and a move for more in Europe (CATL in Germany, Great Wall in Europe) and the US (LG Chem). Added to this is the continued 2019 theme of lithium mergers and acquisitions.

Lithium spot and contract price news

During July, 99% lithium carbonate China spot prices were down 1.93%. Spodumene (5% min) prices were down 0.2%.

Fastmarkets (formerly Metal Bulletin) reports 99.5% lithium carbonate battery grade spot prices cif China, Japan & Korea of US$10.50-12.00/kg (11,000-12,500/t), and min 56.5% lithium hydroxide battery grade spot prices cif China, Japan & Korea of US$13-15.00/kg (13-15,000/t). China lithium spodumene prices are USD 585-650/tonne.

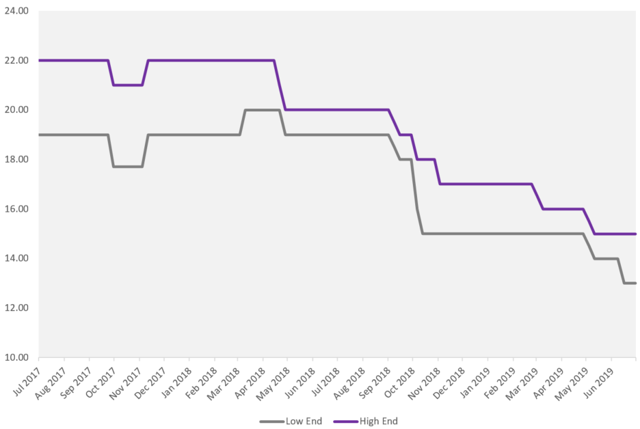

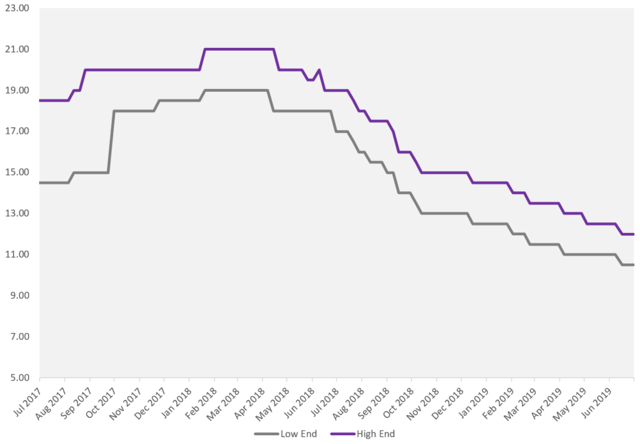

The charts below courtesy of Fastmarkets show lithium prices fallen further in recent months, particularly lithium hydroxide.

Lithium hydroxide, battery grade, cif China, Japan &Korea

Lithium carbonate, battery grade, cif China, Japan & Korea

Source: Fastmarkets

On July 12 The Financial Times reported:

Morgan Stanley says it’s even more bearish on the future of battery raw material lithium, saying it expects prices to fall by 30 per cent over the next six years. The investment bank said it expects lithium prices to keep falling until 2025, compared to an earlier forecast of 2021.

Lithium demand versus supply outlook

On July 2 Argus Media reported:

Lithium expected to remain under pressure in near term. Lithium prices are expected to remain under pressure in the near term with a recovery not likely until after 2020, Australia's Department of Industry, Innovation and Science said in its June Resources and Energy Quarterly Review. It expects lithium hydroxide prices to fall by around 15pc in 2019 to just over $14,000/t on oversupply and growing inventories, while lithium concentrate prices are likely to face a larger period of oversupply this year and next year. "The current lithium oversupply is a side effect of miners attempting to position output to meet expected rapid rises in future demand. Demand growth is expected to outstrip supply by 2023," the review said.

On July 5 Caspar Rawles from Benchmark tweeted:

June @benchmarkmin assessment published at 1956.6GWh capacity by 2028, increase of 5.25%, now tracking 91 plants. Battery majors LG Chem and BYD both add new plants in China.

On July 6 Kitco Media reported (audio): "Battery materials will bounce back - Benchmark Minerals (Andrew Miller)."

On July 10 Investing News released a great series of expert interviews from the recent 2019 Lithium Supply & Markets Conference in Santiago, Chile. It is excellent viewing.

On July 24 Mining.com reported:

Cobalt, nickel, other battery metals face supply crunch by 2020s — report. Growing global demand for batteries that power electric vehicles (EVs) and high tech devices is set to cause a supply crunch of lithium, cobalt and nickel by the mid-2020s, global consultancy Wood Mackenzie predicts. WoodMac expects global sales of EVs to account for 7% of all passenger car demand by 2025, 14% by 2030 and 38% by 2040.

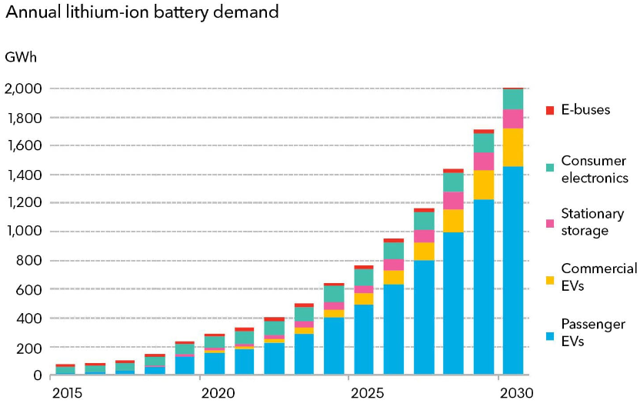

Below are recent charts released by Bloomberg New Energy Finance in their excellent report BNEF 2019 Electric Vehicle Outlook.

Bloomberg NEF 2019 Li-ion battery demand forecast

Source: Bloomberg NEF 2019 Electric Vehicle Outlook

Lithium market and battery news

On June 28 Nikkei Asian Review reported:

China's CATL hikes investment with $2bn German battery plant. Chinese company CATL, the world's largest maker of car batteries, intends to invest up to 1.8 billion euros ($2.05 billion) in a planned factory in Germany, encouraged by the strong global appetite for electric vehicles and plug-in hybrids.

On July 9 Reuters reported:

China's Great Wall-linked battery maker plans to build 20 GWh factory in Europe. “We plan to have five production bases worldwide, including in the United States, but it will take time,” said SVOLT general manager Yang Hongxin at an event in the Chinese city of Baoding. “The global plan is to reach a capacity of 100 GWh by 2025.”

On July 12 Reuters reported:

LG Chem considering building 2nd U.S. EV battery plant. LG Chem, one of the leading EV battery makers in the world that counts General Motors and Volkswagen (VOWG_p.DE) among its customers, is weighing investing about 2 trillion won ($1.70 billion) in the plant that could begin production in 2022, one of the people said. Kentucky and Tennessee are among the candidates for the plant's site, the person said. A decision on the plant's site is expected to be made by the end of this month. LG Chem's new factory would primarily supply to Volvo, Fiat Chrysler Automobiles, and potentially to Hyundai Motor, GM and Volkswagen, one of the people said.

On July 17 Bloomberg reported:

Toyota strikes deal with world’s top supplier of electric car batteries. Toyota Motor Corp. agreed to buy batteries from Contemporary Amperex Technology Co. Ltd. as part of a broader partnership. The two companies are also discussing various topics from the development of new technology to recycling... Toyota has also partnered with BYD, Panasonic in batteries.

On July 17 Reuters reported: "How lithium-rich Chile botched a plan to attract battery makers."

On July 19 Investing news reported:

Lithium Market Update: Q2 2019 in Review... Despite the downtrend in prices and stocks, many remain bullish on the future of the metal. Despite disappointing prices throughout the quarter, all producers agree on the long-term demand outlook for lithium. “Lithium carbonate and lithium hydroxide demand is expected to continue to grow at double-digit rates in the future.… Significantly more supply of both products will be needed,” SQM CEO Ricardo Ramos said in May. For Tianqi Lithium (SZSE:002466) President Vivian Wu, the lithium market is now on track to healthy sustainable growth as lithium prices stabilize after months of volatility. “(Prices) will not go back to the crazy peak seen in the past few years … They will stay at a place where strong players like Tianqi grow, but will be challenging for a lot of new greenfield projects,” Wu said... For lithium expert Joe Lowry of Global Lithium, all the worry investors have over lithium pricing is misplaced. “What investors need to be concerned about is if the companies they own shares in will produce a vast majority of battery quality product,” he recently wrote in a post.

On July 22 Stockhead reported:

Macquarie’s bullish backflip good news for lithium players. It’s an extremely good sign when one of the biggest local bears in the lithium sector suddenly turns bullish on the battery metal. But more recently it has backflipped on those predictions given German car giant Volkswagen’s aggressive push into electric vehicles [EVs]. VW board member Stefan Sommer told Reutersthat the company would need 150 GWh of battery production in both Asia and Europe by 2025, and double that by 2030. After a bit of number crunching, this is Macquarie’s expectation now: “Assuming an average battery size of 60Kwh, that implies 5m units of full EVs by 2025 and 10m by 2030. Global EV sales were less than 2m units last year.” The good news for lithium players is that the sell-off in stocks thanks to Macquarie’s predictions of mass oversupply is widely expected to be reversed in the 2020s.

Lithium miner news

Albemarle (NYSE:ALB)

No significant news for the month.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772], Mineral Resources [ASX:MIN], Neometals (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT], International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

On June 24, Neometals announced: "Neometals zeolite product evaluation results." Highlights include:

-

Neometals has successfully produced commercial grade samples of Type X zeolite from both Mt Marion and thirdparty sourced spodumene leach residue via its patent pending technology.

-

The Neometals products have been evaluated against a leading Japanese synthetic zeolite product and found to be comparable in terms of quality and impurity content.

-

Product evaluation success provides confidence ahead of planned pilot plant to support the Class 3 Engineering Study evaluation.

-

Manufacturing zeolites from spodumene leach residue could eliminate waste disposal and associated costs from lithium production and generate significant coproduct revenue.

On June 28 Bacanora Lithium announced:

Bacanora Lithium plc signing of investment and offtake agreement with Ganfeng Lithium. Completion of the Strategic Investment is anticipated by the end of July 2019 and would form a major part of the Company's finance package for an initial 17,500 tonnes per annum lithium carbonate operation at the large scale, high grade Sonora Project in Mexico.

Key Terms:

- Cornerstone strategic investment of 29.99% in Bacanora for £14,400,091

- GFL has been granted pre-emption rights proportionate to its shareholding in Bacanora

- GFL shall appoint one Director to the Board of Bacanora

- Project level investment of 22.5% in Sonora Lithium Ltd ("SLL"), the holding company for the Sonora Lithium Project, for £7,563,649

- GFL has an option to increase its interest in SLL to up to 50% within 24 months at a valuation based on the share price of Bacanora at the time of subsequent investment

- GFL shall appoint one Director to the Board of SLL

- Additional long-term offtake at a market-based price per tonne

- 50% of Stage 1 lithium production

- Up to 75% of Stage 2 lithium production.

Investors can also read my article: "Ganfeng Lithium Looks To Be A Great Buy." Regarding Neometals investors can read my recent article: "An Update On Neometals", and my January 2019 CEO interview here.

Sociedad Quimica y Minera S.A. (NYSE:SQM)

No news for the month.

Investors can read the company's latest presentation here.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466]

No news for the month.

Construction is ongoing at their Kwinana lithium hydroxide plant in Western Australia, and is expected to be finished soon.

Livent Corp. (LTHM)[GR:8LV] - Recently spun out from FMC Corp. (NYSE:FMC)

No significant news for the month.

Investors can read my recent article "Livent Is Looking Cheap."

Orocobre [ASX:ORE] [TSX:ORL] (OTCPK:OROCF)

No significant news for the month.

Upcoming catalysts include:

- H2 2020 - Olaroz Stage 2 (42.5ktpa) commissioning.

- H1 2021 - Naraha lithium hydroxide plant (10ktpa) commissioning (ORE share is 75%).

You can read the latest investor presentation here, or my article "An Update On Orocobre."

Galaxy Resources [ASX:GXY] (OTCPK:GALXF)

On July 16 Galaxy Resources announced: "June quarter 2019 quarterly activities report." Highlights include:

Production & Operations

-

Mt Cattlin production volume of 56,460 dry metric tonnes (“dmt”), grading 6.0% Li2O, exceeding production guidance of 45,000 –50,000 dmt.

-

Mt Cattlin production unit cash cost of US$337/ dmt produced FOB, placing the project as one of the lowest cost lithium concentrate operations in the world.

-

A total of 29,439dmt of lithium concentrate shipped.

-

Targeting volume of 60,000–70,000dmt to be shipped in in Q3 2019.

Q3 2019 Development Projects

-

Pilot pond earthworks for the Sal de Vida Project completed, with pond liners to be installed during Q3 2019.

-

Preliminary testing of alternative process technologies for Sal de Vida has achieved superior lithium extraction results than those recorded in the existing base case flowsheet.

-

Argentina management team bolstered by three senior appointments.

-

Feasibility works progressed to plan for the James Bay Project.

-

Phase 2 test work on the upstream operation at James Bay is nearing completion, validating the process design criteria of the concentrator.

Exploration

- "An outcropping pegmatite 2.5km north of the Mt Cattlin operation identified and to be drill tested in the September quarter."

Corporate

-

Simon Hay commenced as Chief Executive Officer on 1 July 2019, bringing a wealth of experience in mining operations, project development and construction, as well as mineral product marketing in China and globally.

-

Closing cash of US$176.3million and nil debt as at 30 June 2019.

Upcoming catalysts include:

2019 - Sal De Vida partner and construction announcements. Any China conversion plant announcements. James Bay FS.

2022 - Sal De Vida production may begin.

Investors can read my recent article "Galaxy Resources Plan To Be A 100,000tpa Lithium Producer By 2025", and my CEO interview here, and the latest company presentation here.

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On July 9 Pilbara Minerals announced: "Production, sales and corporate update." Highlights include:

-

Shipped tonnes for June 2019 Quarter of 43,214 dmt; at the higher end of recently stated guidance.

-

Pilbara Minerals expects its production and sales to return to full capacity for the December 2019 Quarter, based on the latest discussions with customers.

-

New offtake agreement signed with China’s Great Wall Motor Company, with first shipment expected in August 2019.

-

Strong progress on proposed POSCO JV for the downstream chemical conversion facility in South Korea. In-principle agreement reached on final joint venture terms; andRespective Board authorisations expected during the Sept Qtr.

Upcoming catalysts:

2019 - Production ramp up.

Q1 2020 - Stage 2 commissioning planned.

Investors can read my recent article "An Update On Pilbara Minerals", and an interview here.

Alita Resources Limited (Formerly Alliance Mineral Assets Limited ("AMAL")) (merged with Tawana Resources) [ASX:A40][SGX:A40]

On July 11 Alliance Mineral Assets Limited announced: "Strong lithium production continues at Bald Hill Mine." Highlights include:

-

A total of 38,717wmt of high grade lithium concentrate produced for the quarter grading 6.20%Li2O. This represents a slight increase in tonnage and about a 3% increase in contained lithia from the March 2019 quarter production of 38,291wmt at 6.1% Li2O.

-

Total Half Year lithium concentrate production was 77,008wmt at 6.15% Li2O equating to 78,937wmt of 6.0% Li2O equivalent which was at the upper limit of previous production guidance.

-

A total of 18,669dmt of concentrate was shipped to Jiangxi Bao Jiang Lithium Industrial Limited [JBJLIL] during the quarter representing a total of about 58,063dmt shipped to JBJLIL during the Half Year. The JBJLIL contract provides for 98,000dmt to 118,000dmt (at Alliances’ choice) for 2019 inclusive of 2018 product shipped in February 2019.

-

Total shipments for the Half Year was 62,994dmt inclusive of a trial shipment to a new customer of about 4,935dmt.

On July 16 Alliance Mineral Assets Limited announced:

Change of company name to Alita Resources Limited. The Board of Alliance Mineral Assets Limited (ASX: A40; SGX: 40F) (Company or Alliance), is pleased to announce the formal change of the Company’s name to Alita Resources Limited (Company or Alita). This follows approval by shareholders of the name change at the Company’s Extraordinary General Meeting held on 11 July 2019, and subsequent receipt of a new Certificate of Registration from the Australian Securities and Investments Commission effective 16 July 2019.

Note: Its tickers on the ASX and the Singapore Exchange remain unchanged.

Investors can read the company presentation here or a CEO interview here.

Altura Mining [ASX:AJM] (OTC:ALTAF)

On July 9, Altura Mining announced: "Altura lithium offtake update." Highlights include:

-

Binding Offtake Agreement [BOA] signed with established Chinese lithium materials producer Shandong Ruifu.

-

BOA has a five-year term for 35,000 tonnes per annum of lithium concentrate, commencing in July 2019.

-

Agreement reached with Shaanxi J&R Optimum Energy [JRO] to terminate existing offtake arrangements.

On July 23, Altura Mining announced:

$22 million placement secures Ningbo Shanshanas cornerstone shareholder. Subscription and Cooperation Agreement signed to raise $22.4 million. Strategic partnership strengthened with one of the world’s leading battery material producers. The issue of 200 million fully paid ordinary shares at a price of 11.2 cents per share (“Placement”) will result in Shanshan becoming Altura’s single-largest shareholder with an equity interest of 19.4% and follows Shanshan’s recent substantial on-market equity purchase. The issue price compares favourably to the last closing price of 11.0 cents and the 30-day VWAP of 11.53 cents.

On July 24 Altura Mining announced:

Altura signs Terms Sheet with Zinciferous Limited....The Terms Sheet, which is non-binding, provides a potential opportunity for Altura to participate in the downstream processing of lithium in a newly constructed lithium conversion facility in China.

Investors can read my latest article "An Update On Altura Mining". Investors can also read a company presentation here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

On June 27, AMG Advanced Metallurgical Group N.V. announced:

AMG Advanced Metallurgical Group N.V. successfully prices $307.2 million of tax-exempt bonds, generating $325 million in proceeds......Financial closing is scheduled for July 11, 2019. The bonds are guaranteed by AMG. ....The bonds will fund a new greenfield resid spent catalyst recycling facility near Zanesville, Ohio approximately 25 miles from AMG-V’s current spent catalyst recycling facility in Cambridge, Ohio.

Upcoming catalysts:

End 2019 - Stage 2 production at Mibra Lithium-Tantalum mine (additional 90ktpa) to begin.

Lithium Americas [TSX:LAC] (LAC)

No significant news for the month.

Upcoming catalysts:

- 2019 - Cauchari-Olaroz plant construction.

- H2 2020 - Cauchari-Olaroz lithium production to commence and ramp to 40ktpa.

- 2022 - Possible 2022 lithium clay producer from Thacker Pass Nevada (full ramp by 2025).

NB: LAC now owns 50% of the Cauchari-Olaroz project and partners with Ganfeng Lithium (50%).

Investors can read my article "An Update On Lithium Americas."

Nemaska Lithium [TSX:NMX] [GR:NOT] (OTCQX:NMKEF)

On July 19 Nemaska Lithium announced:

Nemaska Lithium announces CAD 600M equity investment proposal from the Pallinghurst Group. Enters into a letter of intent for a CAD 200M private placement and a CAD 400M rights offering guaranteed by way of a stand-by commitment. The private placement and rights offering both to be concluded at CAD 0.25 per share.

Lithium juniors

Lithium juniors include AIS Resources [TSXV:AIS] (OTCQB:AISSF), American Lithium Corp. [TSX-V: LI] (OTCQB:LIACF), Argentina Lithium and Energy Corp. [TSXV:LIT] (OTCQB:PNXLF), Argosy Minerals [ASX:AGY] (OTC:ARYMF), AVZ Minerals [ASX:AVZ] (OTC:AZZVF), Bacanora Minerals [TSXV:BCN] [AIM:BCN] [GR:1BQ] (OTC:BCRMF), Birimian Ltd [ASX:BGS] (OTC:EEYMF), Critical Elements [TSXV:CRE] [GR:F12] (OTCQX:CRECF), Dajin Resources [TSXV:DJI] (OTCPK:DJIFF), Enigri (private), Eramet (EN Paris:ERA) (OTCPK:ERMAY), European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTC:ERPNF), Far Resources [CSE:FAT] (OTCPK:FRRSF), Force Commodities [ASX:4CE], Infinity Lithium [ASX:INF], Kidman Resources [ASX:KDR] [GR:6KR], Latin Resources Ltd [ASX: LRS] (OTC:LAXXF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Power International [ASX:LPI] (OTC:LTHHF), LSC Lithium [TSXV:LSC] (OTC:LSSCF), MetalsTech [ASX:MTC], MGX Minerals [CSE:XMG] (OTC:MGXMF), Millennial Lithium Corp. [TSXV:ML] (OTCQB:MLNLF), Neo Lithium [TSXV:NLC] (OTC:NTTHF), NRG Metals Inc. [TSXV:NGZ] (OTCQB:NRGMF), North American Lithium (private), Piedmont Lithium [ASX:PLL] (PLL), Prospect Resources [ASX:PSC], Rock Tech Lithium [CVE:RCK], Sayona Mining [ASX:SYA] (OTCPK:DMNXF), Savannah Resources [LSE:SAV], Standard Lithium [TSXV:SLL] (OTC:STLHF), Sigma Lithium Resources, and Wealth Minerals [TSXV:WML] (OTCQB:WMLLF).

Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) - Price = US$26.63.

The LIT fund moved up slightly for the month of July. The current PE is 20.11.Given lithium demand should rise ~4-5 fold between end 2018 and end 2025 the lithium sector PE of ~20 looks to be good value.

SOURCE: Seeking Alpha

Conclusion

July saw lithium prices slightly lower again. The 2019 trend of bargain lithium acquisitions continued this month with the Ningbo Shanshanas/Altura Mining deal, the Ganfeng Lithium/Bacanora Lithium deal, and the Pallinghurst Group/Nemaska Lithium deal. Ganfeng has been very active this year (Lithium Americas 50% stake, Pilbara Minerals A$50M equity placement, Bacanora 29.99% stake, and the late 2018 Altura Mining off-take deal). Another 2019 acquisition was the Wesfarmers/Kidman Resources buyout, following the late 2018 Albemarle 50% stake in Mineral Resources Wodgina lithium project. Clearly 2019 is the year of mergers and acquisitions, as the big players take advantage of cheaper valuations before the real lithium demand boom begins.

My highlights for the month were:

- Morgan Stanley: "Expects (lithium) prices to fall by 30 per cent over the next six years."

- Tianqi Lithium: "The lithium market is now on track to healthy sustainable growth as lithium prices stabilize after months of volatility."

- Joe Lowry: "All the worry investors have over lithium pricing is misplaced."

- Benchmark Minerals is now tracking 91 megafactories.

- Benchmark Minerals Andrew Miller says: "Battery materials will bounce back".

- WoodMac: "Cobalt, nickel, other battery metals face supply crunch by 2020s".

- China's CATL hikes investment with $2bn German battery plant.

- China's Great Wall-linked battery maker plans to build 20 GWh factory in Europe.

- LG Chem considering building 2nd U.S. EV battery plant.

- Investing News - "Despite disappointing prices throughout the quarter, all producers agree on the long-term demand outlook for lithium."

- Macquarie’s bullish backflip good news for lithium players.

- Ganfeng Lithium takes a key strategic equity and off-take partner interest in Bacanora Lithium and their Sonora Project.

- Pilbara Minerals - Strong progress on proposed POSCO JV for the downstream chemical conversion facility in South Korea.

- Alliance Mineral Assets Limited changes name to Alita Resources Limited.

- Altura Mining signs 5 year binding off-take agreement (35,000 tpa spodumene) with Chinese lithium materials producer Shandong Ruifu. Altura secures $22 million placement with Ningbo Shanshanas as a cornerstone shareholder. Altura signs Terms Sheet with Zinciferous Limited for a downstream processing of lithium in a newly constructed lithium conversion facility in China.

- AMG raises $325 million in tax-exempt bonds.

- Nemaska Lithium announces CAD 600M equity investment proposal from the Pallinghurst Group.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles:

Disclosure: I am/we are long NYSE:ALB, JIANGXI GANFENG LITHIUM [SHE: 2460], JIANGXI GANFENG LITHIUM [HK: 1772], SQM (NYSE:SQM), ASX:ORE, ASX:GXY, ASX:PLS, ASX:AJM, AMS:AMG, TSX:LAC, TSXV:NLC, ASX:AVZ, ASX:NMT, ASX:CXO, TSXV:PLU, TSXV:CYP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.