RE:Seeking Alpha opinion article QUOTE

The monthly dividend

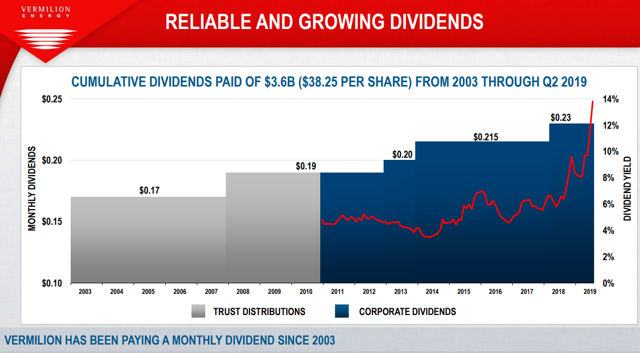

What differentiates VET from most other energy plays is its monthly dividend. VET has paid out huge amounts over the years but more importantly, maintained dividends through two major oil price drops.

Source: VET Aug Presentation

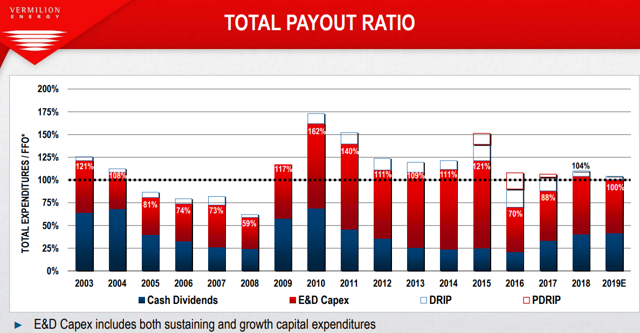

Both cases are highly instructive to look at what we might see from VET going forward. In 2007, VET had just raised its dividend (called trust distribution back then) and while the front half of 2008 proved fantastic, the back half of 2008 and most of 2009 was rather horrifying. VET stuck through that time frame paying the dividend, even as its payout ratio ballooned. In fact 2010 total payout ratio which included growth capex went as high as 162%.

Source: VET Aug Presentation

That extremely high payout ratio which was heavily equity financed, dropped production per share by 10% but VET stuck through that era knowing its capital projects would eventually bail it out. VET was able to deliver that and slowly but surely production per share stabilized and started rising.

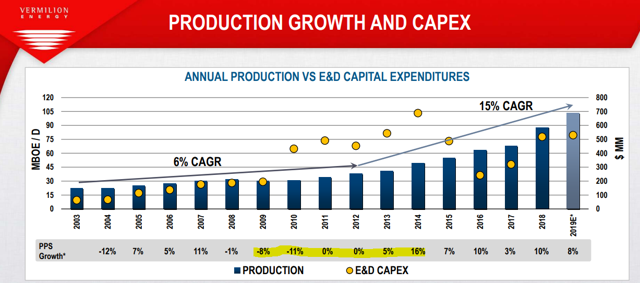

Source: VET Aug Presentation

While that was impressive, remember that 2008-2009 price drop was rather brief. The 2014-2017 time frame was far more challenging. Prices dropped 75% from the peak and unlike the big rebound of 2009-2010, prices stayed depressed. VET did one better this time. It not only maintained the dividend but raised it in 2018 and also grew production per share.

How was this possible?

There were two key reasons in our view. The first being that VET's production base has matured and the base decline rates continue to fall. As a result the amount VET spends in maintaining production has been falling and was far lower in 2016 than it was in 2010.

The second reason is that when oil prices fall, energy service costs fall as well. This acts as an offset for all companies and VET has been able to leverage this rather nicely during downturns.

Our point from all of this is that while no one can predict exactly when the next recession will strike, VET appears to be one of the best equipped to maintain their dividends and sustain production.