Echelon Wealth Partners analyst Gianluca Tucci says that the valuation remains attractive on nana-optic structures maker Nanotech Security Corp (Nanotech Security Corp Stock Quote, Chart, News TSXV:NTS), which just announced new orders for its colour-shifting optical thin film (OTF).

Echelon Wealth Partners analyst Gianluca Tucci says that the valuation remains attractive on nana-optic structures maker Nanotech Security Corp (Nanotech Security Corp Stock Quote, Chart, News TSXV:NTS), which just announced new orders for its colour-shifting optical thin film (OTF).

In an update to clients on Tuesday, Tucci maintained his “Speculative Buy” rating and $0.80 per share target price for NTS, which translated to a projected 12-month return of 57 per cent at the time of publication.

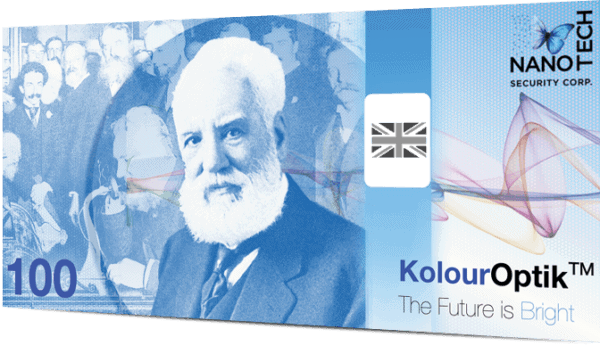

Vancouver-based Nanotech, which designs and produces its nano-optic structures and colour-shifting materials used in the banknote and brand protection markets, on Tuesday announced two new orders for its colour-shifting OTF from a major banknote and secure document integration supplier, both of which are expected to be annual recurring orders, while the second of the two represents new business for NTS.

“We are honoured to be supplying our colour-shifting OTF to this customer for the 20th consecutive year,” said Troy Bullock, President and CEO, in a press release. “Over the first six months of the year we have focused on growing our OTF business and are very encouraged to see a new banknote win with this strategic customer.”

“While we continue to view F2019 as a transition year in its sales & marketing efforts, we note progress has been made in diversifying from banknotes and in particular, to the commercial market…”

Nanotech has been in retooling mode this year, working to create a salesforce focusing on both direct sales and working with key partners, aiming to develop a more traditional sales pipeline targeting both small and large customers and branding of currently unbranded products.

Tucci says that with consideration to the the two announced orders, he is leaving his estimates unchanged for the time being but will incorporate updated financial targets at the time of the company’s next earnings call in December.

“While we continue to view F2019 as a transition year in its sales & marketing efforts, we note progress has been made in diversifying from banknotes and in particular, to the commercial market where NTS recently booked its first sales – we note the commercial market also provides recurring revenue and with the launch of NTS’ first two products in April, we expect early modest traction to grow in this vertical into the new year. We believe NTS has more than ample cash to continue developing new products for the commercial and banknote markets and believe at current levels, the risk/reward is appealing and worth the patience,” said Tucci.

Tucci figures that NTS is currently trading at a multiple of 2.2x his calendar 2020 EV/Revenue estimate versus its Security comparables at 4.2x and its SaaS comparables at 7.8x.

The analyst thinks that NTS will generate fiscal 2019 (year end September 30) total revenue and adjusted EBITDA of $7.8 million and $0.3 million, respectively, and fiscal 2020 total revenue and adjusted EBITDA of $11.6 million and $1.6 million, respectively.

Nanotech’s share price has been on a downward path since late 2017, dropping from a high of $1.70 in October 2017 to a low of $0.39 by August 20 of this year. The stock has rebounded over the past couple of weeks, including on Tuesday where it closed up two cents to $0.53.