Gold exploration trends: Drilling up, optimism returns Data used represents reporting companies listed on the following stock exchanges: TSX (+TSX-V), ASX, LSE (+LSE-AIM), NYSE, and JSE.

Mining Intelligence data indicates that exploration activity in the gold sector jumped in July — to the highest point since the beginning of 2019, and both the number of drilled projects and the number of drillholes reported in July, were up in all major regions.

A trend towards exploration of advanced projects, rather than greenfield opportunities, was reversed in July with companies willing to take on more early-stage exploration risks.

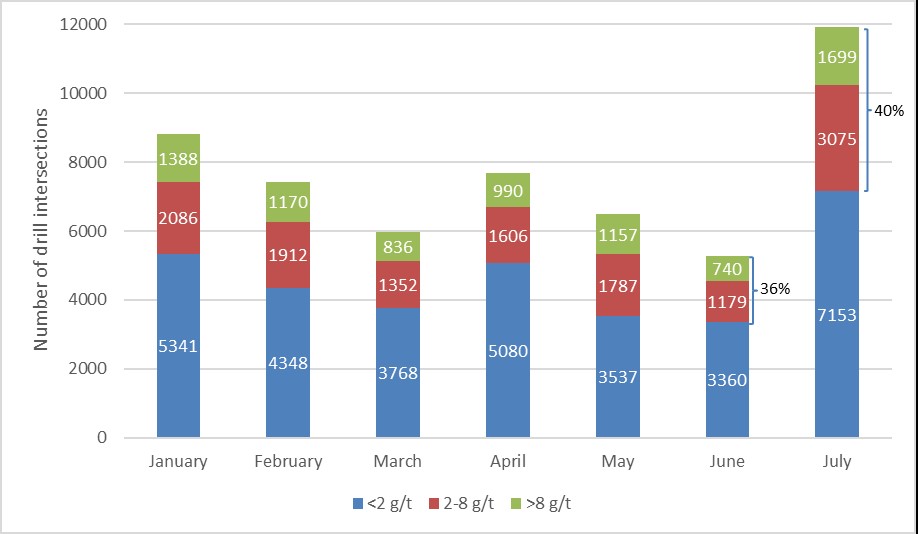

There was a noticeable improvement in overall drill intersection grades, with reported gold intersections with grades greater than 2 g/t have risen from 36% of their total count in June to 40% in July 2019.

Surge in gold prices and overall optimism reviving across the gold mining sector have finally encouraged miners, developers and explorers to pour more money into drilling campaigns.

Analysis:

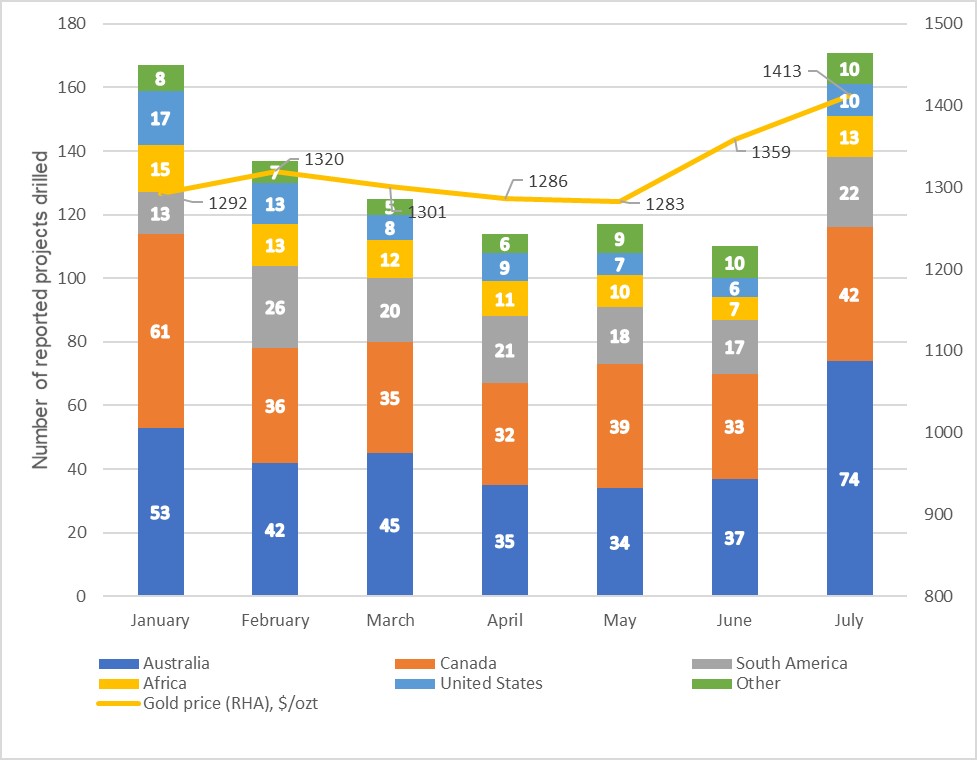

In July 2019, companies reported exploration results for 171 projects (Figure 1), which is the highest count observed since the beginning of 2019. Australia was the leading country in terms of a number of reported drilled projects (74), followed by Canada (42) and South America (22). The number of reported drilled projects was up in all major regions, with Australia doubling their count.

Figure 1: Number of reported drilled gold projects by region, January-July 2019

Figure 1: Number of reported drilled gold projects by region, January-July 2019

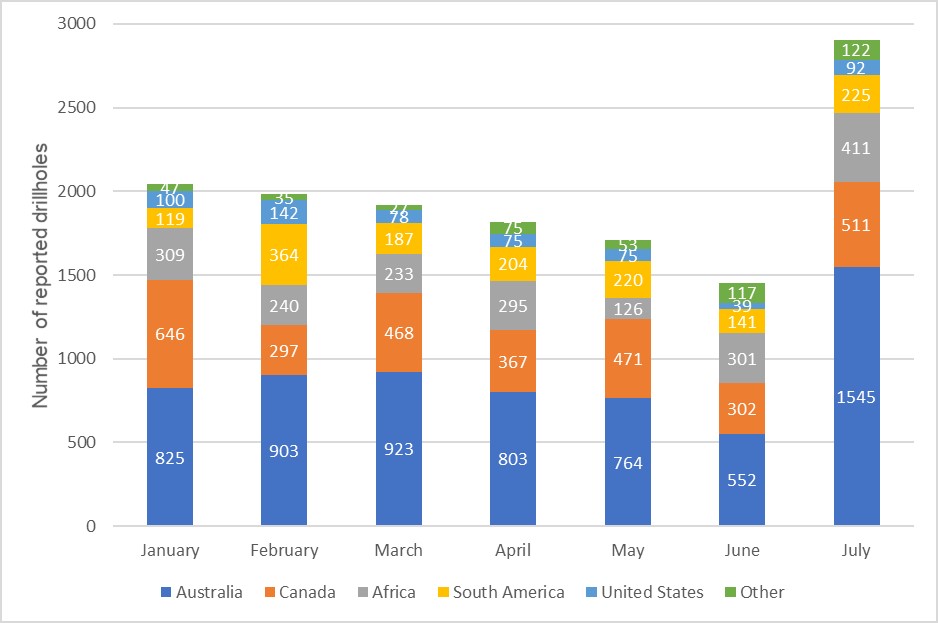

Source: Mining Intelligence In July, companies reported results from 2,906 drillholes, which is twice more than in June (1,452 drillholes), and the highest number yet in 2019 (Figure 2). The amount of reported drillholes was up in all major regions and surged by a staggering 139% in Australia.

Figure 2: Number of gold drillholes reported by region, January-July 2019

Figure 2: Number of gold drillholes reported by region, January-July 2019

Source: Mining Intelligence Weight of early and advanced exploration projects in their total count increased from 54% in June to 64% in July (Figure 3).

The number of greenfield exploration projects drilled reported in July was 39, which is 144% more than in June, and the highest number since the beginning of 2019.

While still being prudent when allocating budgets to exploration campaigns, companies have noticeably shifted focus towards much riskier early-stage drilling programs.

Figure 3. Development status of reported drilled projects, January-July 2019.

Figure 3. Development status of reported drilled projects, January-July 2019.

Source: Mining Intelligence As for the drill intersections grades, there was an increase in grades greater than 2 g/t that have risen from 36% (1,919 out of 5,279 intersections) in June to 40% of their total count (4,774 out of 11,927) in July 2019 (Figure 4).

Figure 4: Reported gold drill intersections, January-July 2019. Source: Mining Intelligence

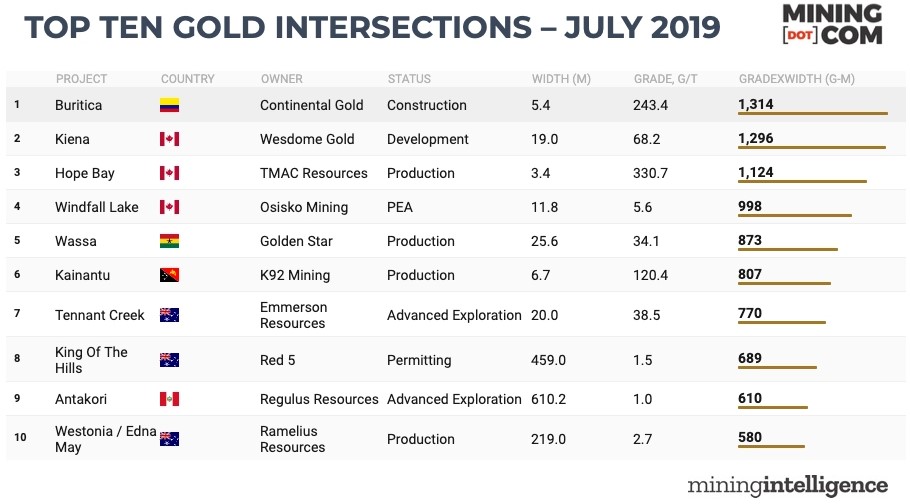

Figure 4: Reported gold drill intersections, January-July 2019. Source: Mining Intelligence List of the top highest-grade gold intersects in July 2019, in gram-meters:

Grade width is calculated at width at the drill interception (in metres) multiplied by the grade (in grams of gold per tonne). Where multiple high-grade intersections were reported for an individual project, only the best interval has been considered.

https://www.mining.com/gold-exploration-trends-drilling-up-optimism-returns/