Implications of Wallbridge Being Bought Out

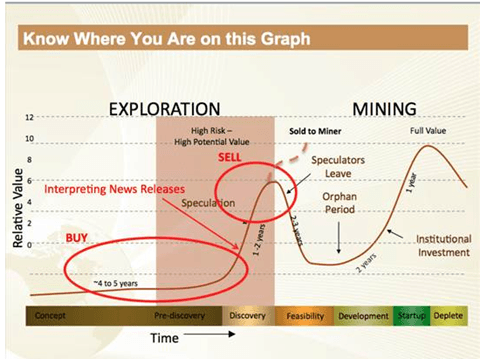

Hopefully this image comes out... during my research into WM, I subscribed to Gold Panda's articles on Seeking Alpha. The author has a series of articles detailing what he thinks are the best drill interceptions for the week. At the beginning of these articles, he always inserts the above chart as a kind of warning to always know where you are in this process.

At first, when I heard from ES that he is pretty certain that wally would be bought out, I was a bit disappointed because I felt like, as an investor of the stock, I won't get full value for what WM has in the ground + the potential of what they could find in the future. However, after thinking about it, and looking at that chart again, it seems like a buyout is the best way to get, maybe not "full potential value" but "fair immediate value".

Fast forward to the future, when WM has their updated RE, finished their feasibility study and are ready to produce ounces out of the ground. What if there is a snag when it comes to applying for permits? What if their cost estimates are way off mark? What if their drill results start coming up empty? There are a whole bunch more "what ifs" between the feasibility study and full on production. I guess that's why there is a huge dip in the charts.

On the other hand, with a buyout, while we don't get the full potential of the entirety of the Fenelon deposit, we will get what they have proven so far + a premium to compensate for the potential that is yet to be explored + we don't have to take on any more risks.