Aurora's (ACB) first quarter fiscal 2020 results last week continued the trend this quarter of Canadian cannabis companies badly missing their revenue and earnings targets this earnings season. The entire industry is shrinking significantly quarter over quarter as cannabis retailers across Canada return unsold product to the producers. That unsold product is then written down on the books of the producers, with nearly every large Canadian LP writing down a significant amount of inventory this quarter. But the written-down product that now sits in large "return to sender" boxes in the LP's lobby hasn't disappeared, and the oversupply problem is growing.

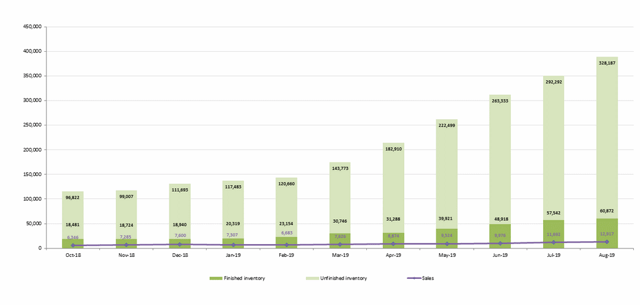

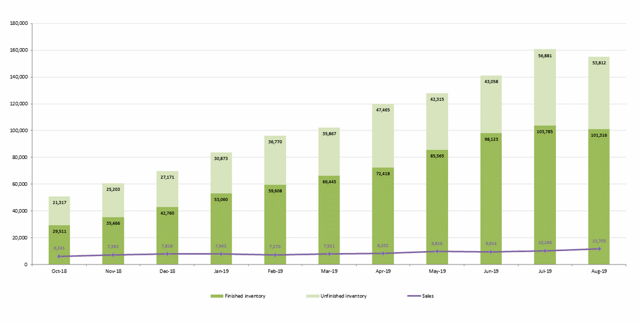

The overarching problem for the Canadian cannabis companies is, clearly, oversupply. And the oversupply is massive, and growing, as these charts from Health Canada show. They are somewhat outdated and clearly the situation has gotten worse.

Of course more stores in Ontario, the legalization of edibles and a crackdown on the illegal market will make some difference on the demand side going forward. But it's hard to imagine any of these demand drivers making much of a difference in the face of enormous current production capacity that is multiples of current demand and ongoing production expansion. Without exception, the Canadian LPs reported production during the calendar third quarter that was multiples of sales. Hexo (OTC:HEXO), for example, produced 16,824 kg of dried cannabis and sold 4,009 kg (see release). Canopy Growth (OTC:CGC) produced 40,570 kg of cannabis and sold 7,756 kg (see release). And this was during a quarter where supply from CannTrust (OTC:CTST) was removed from, or not supplied to, the market. Demand has to go somewhere; it does not disappear.

As we enter a period of intense oversupply, the survivors will be the companies that can either reach self-sufficiency or have the cash resources to fund continued losses. While the cannabis oversupply is clearly the main story, it was really only a matter of time before overinvestment resulted in oversupply. Instead, perhaps the most shocking news to come out of the quarter is that Aurora - which is neck and neck with Canopy Growth as the largest cannabis company in the world - is evidently now in financial distress.

Aurora announced in conjunction with its earnings release that it had agreed with holders of C$155 million of its convertible bonds due in March 2020 to adjust the conversion price down to a lower price, which would be 6% below a volume weighted average price (VWAP) over this current week, in order to issue shares in satisfaction of the bonds. This is plainly a way of distributing stock by offering bondholders something they are not otherwise entitled to, and incentivizing them to participate by offering them a nice discount (6%) to help ensure that the bondholders are able to immediately re-sell the shares they are issued at a profit, or at least without a loss, and structuring the offering using a VWAP mechanism, which can cause the stock to price to spiral down during the VWAP period as the bondholders short stock that they intend to cover with the issuance, thereby causing the price to drop and more shares to be issued.

If the assumption is that companies will take the best course of action available to them, then the conclusion is: this was the best option available to Aurora at this time to deal with the convertible bond maturity. Other options that management presumably considered but decided not to pursue:

- Refinancing the converts with new debt or new converts. Presumably this was not practical likely because new debt would be prohibitively expensive.

- Secondary stock offering. Presumably this was considered too risky as it could fail or might require a greater than 6% discount to price.

- Other cash-raising opportunities such as asset sales or partnership opportunities. Presumably these were not available because funding for Canadian cannabis companies has completely dried up.

Now I don't have any direct evidence that these are true, but the fact that Aurora struck this deal with bondholders indicates that they likely are true.

In addition, Aurora announced two other emergency measures. First, that it was suspending construction on the Nordic 2 and Aurora Sun facilities, saving C$190 million in planned capex. Second, that it had sold 29 million shares for $125 million under its $400 million ATM program. Even with these measures, Aurora is in a surprisingly weak financial condition. Its working capital balance as of September 30, 2019 was C$123.8 million, of which C$45 million is restricted cash that must be held as cash collateral per the credit agreement. That leaves C$78.8 million of breathing room as of September 30, 2019 (all results from earnings release).

September 30, 2019 Cash Position

Working Capital: C$123.8 million

Restricted Cash: C$45 million

Available Working Capital (Less Restricted Cash): C$78.8 million

As a rough estimate of cash burn for the current quarter I start with the C$39.7 million Adjusted EBITDA loss in the calendar third quarter and subtract C$16.7 million in net interest paid, giving a C$56.4 million expected cash loss this quarter before factoring in any cap ex. There will be some cap ex but the company is obviously cutting as much cap ex as possible so we'll just have to see how low they can get that number.

Estimated Cash Burn Rate

Calendar Q3 2019 Adjusted EBITDA: C$39.7 million

Calendar Q3 Net Interest Paid: C$16.7 million

Capex: [unclear]

Cash Burn: C$56.4 million plus capex

Keep in mind that this does not factor in ongoing employee stock dilution or a small reduction in interest expense as a result of the cancellation of a portion of the converts. But it is a rough guide. Also keep in mind that capex will not go to zero even considering the halt on Nordic 2 and Aurora Sun construction.

It's clear that these numbers are very tight. Available working capital of C$78.8 million may only provide enough liquidity to cover a quarter of cash burn at C$56.4 million plus capex. As a result, it is clear that we can expect Aurora to continue to sell shares aggressively through its ATM program, under which $275 million remains (and the capacity can easily be increased).

Big picture, these developments indicate that Aurora, notwithstanding its leadership position, is nearly out of money and will need to issue stock onto the market in the immediate future to fund ongoing losses. Its weak financial position could be a significant competitive disadvantage going forward compared to well-funded competitors like Canopy Growth and Cronos (OTC:CRON).