Introduction

The recently-completed calendar third quarter reports from cannabis companies bring to mind another investment opportunity from 120 years ago. In 1896, gold was discovered along the Klondike River in the Canadian Yukon. The following year, over 100,000 men began the trek to the gold fields from Skagway, Alaska, in pursuit of their fortune. The route was so arduous and punishing that only 30 percent completed the two month trip through the Canadian wilderness, and only a small fraction of those found enough gold to even cover their costs. The photo below shows Chilkoot Pass at the height of the gold rush.

Source: SmithsonianMag.com

Source: SmithsonianMag.com

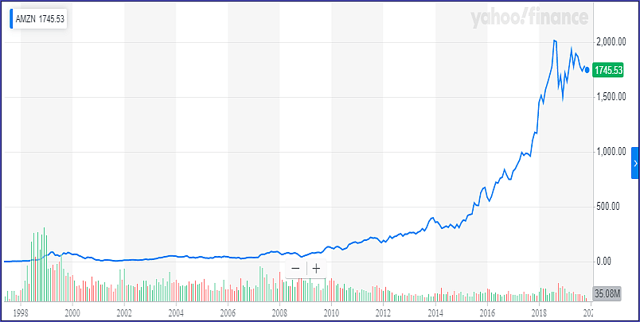

Investors feel a little like those miners. The trail is crowded, and there's a long way to go. Everyone is in the hole, and the payoff in our green gold rush is not on the horizon. Unlike the miners, we aren't in danger of starving or freezing to death, but some of our investments may be. At least we don't have to carry 100 pounds of supplies through a Yukon winter. For some perspective on where we are, it is helpful to look at the chart of a company in a different emerging industry from some years ago:

Source: Yahoo Finance

It is striking how long Amazon's stock price stayed in a range, 11 years in fact, before it took off. It will not take nearly as long for cannabis companies to show durable price gains. The cannabis industry is much farther along than ecommerce was in Amazon's early days. However, as this chart suggests, potential can take years to be realized.

The Trends

Calendar third quarter reports did not contain any significant new developments, but they confirmed existing trends in the direction of the industry. This is important because it gives the future more clarity in critical areas.

Regulation

Regulation is even more of a drag on business than anticipated. In Canada, the roll-out of retail is so slow that revenue is significantly below expectations. Canopy (CGC) reported a 15% decline in revenue, and Aurora (ACB) had a 24% sequential decline. These results seemed impossible a year ago. In the U.S., Deanie Elsner of Charlotte's Web (OTCQX:CWBHF) reports that a lack of direction from the FDA is severely restraining CBD. FDM (food, drug, mass market) stores will not stock ingestible CBD products without FDA approval as dietary supplements. More generally, the cautiousness of individual state regulators continues to slow down geographic expansion. The Marijuana Policy Project reports that states have taken as long as four years after legislative approval to begin sales. Companies are dialing back expansion plans that were based on a more developed sales environment. In just one example, Aurora has halted construction on one grow facility and delayed another.

Investor takeaway: Regulation is one of the most important factors in the success or failure of cannabis business in a state. It determines availability, sales volume, and profitability. Investors can give extra weight to companies with a strong presence in states with a favorable regulatory regime, like Illinois, and less weight to companies in areas with burdensome regulations, like California and Canada.

Taxes

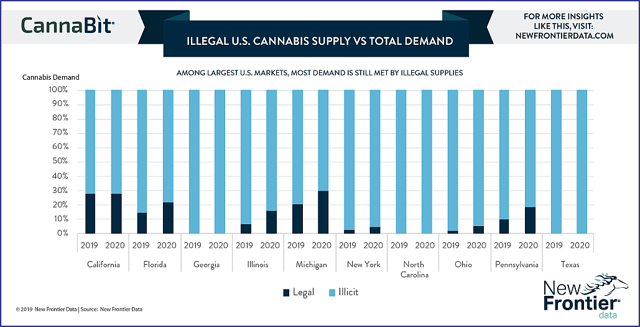

Tax revenue is near the top of the list of reasons why states are legalizing cannabis. Christiana Friedman shows how overly zealous levies on cannabis sales hold back legal markets.

Source: Seeking Alpha

In California medical cannabis has been legal since 1996 and recreational since 2016, but the legal sales share is less than 30%. There are many reasons for this, but the state's 80% markup plus 15% sales tax plus a tax of $9.65 and ounce on dried flower are a big part of it. The silver lining in this is that states are beginning to realize that just like other economic areas, high taxes can hold back an industry.

Investor takeaway: Investors can use each state's cannabis tax regime as part of their decision-making process. Know which companies with major operations in states where taxes are a destructive headwind. Although not complete, a Tax Foundation chart suggests Michigan, Massachusetts and Florida are most favorable, and California and Washington among least favorable.

Capital

The sector is becoming divided into three groups:

- Companies that still have large cash hordes: Canopy is in this category thanks to Constellation Brands (CTZ), as is Cronos (CRON) thanks to support from Altria (MO). Charlotte's Web announced a CAD $66 million completed share offering since quarter end.

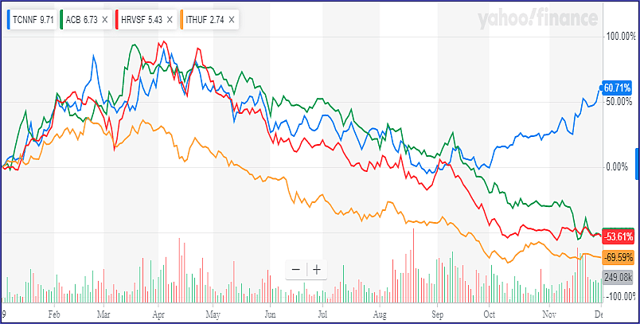

- Companies that are profitable or close to it: Trulieve (OTCPK:TCNNF) and Charlotte's Web are in this small group. As the chart of Trulieve, Aurora (ACB), Harvest (OTCQX:HRVSF), and iAnthus (OTCQX:ITHUF)below shows, this quality is becoming more prized by investors.

- Companies with a limited amount of time to achieve profitability based on the amount of cash available to them. This unfortunately includes most of the industry. Managements are aware of this and in the recent quarter took even more time than usual to show they have enough to get by. Which ones will survive is, frankly, very difficult to determine. Investors seem to be voting with their feet, fleeing what they perceive as the weakest. Ianthus at $1.34 a share, Harvest at 2.56, and Medmen (OTCQB:MMNFF) as .46 are good examples.

Source: Yahoo Finance

Investor takeaway: Companies that still have a runway measured in years rather than quarters have a greater chance of both survival and success, and that's where new money can go. Concerning shares in the fallen angels we all own, hold on. With most of your money gone, the remaining financial risk is small and maybe worth the chance that the company will come back. However, there is nothing in third quarter reports to indicate increasing investment in troubled companies is a good idea.

Management

Managements in some companies have a history of questionable practices and decisions. Investors are aware of past issues around Medmen (OTCQB:MMNFF), CV Sciences (OTCQB:CVSI), and to a lesser degree Harvest Health (OTCQX:HRVSF). It is not coincidental that these companies are among those that are struggling. The evidence is mounting that executives are not up to the job and none has shown that they can turn around the bad situations that they contributed to. Some of the original offenders are gone, but the persistence of problems shows that it takes more than personnel changes to fix a flawed culture or decision making process.

Investor takeaway: An emerging industry requires management that is more skilled than most, and investors cannot afford to see their investment dollars managed by people who have demonstrated faulty judgment or ethics. Anyone can make a wrong business decision, but decisions based on greed, deceit, or incompetence cannot be tolerated.

Conclusion

Third quarter reports have confirmed previously developing trends in the industry. Regulatory environments are a major determinant of success, taxes loom large, excellent management is essential, and we are one quarter closer to companies running out of capital. Clearly, success for everyone is now on a time frame of several years at least, and this is how people should view their investments. The potential for cannabis is as strong as ever. Legislatures (and the Federal government) reflect popular opinion that it will bring new health benefits and economic activity to the states, and there is very little opposition. What some perceive as opposition is simply a very careful and deliberate approach, which is to be expected for a product that has been illegal. Patience can be difficult, but patience is exactly what is needed to be a successful cannabis investor.

Disclosure: I am/we are long CWBHF, TCNNF, HRVSF, ITHUF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.