Welcome to our Cannabis Earnings series where we break down the latest earnings to help you focus on the most important topics.

Introduction

If the year of 2019 can be described as a "comeback" year for Aphria (APHA), then we think the stock will be on the offensive this year. The new management team has quietly turned around the company by positioning it as one of the best-capitalized players in Canada. With the second-largest completed capacity - funded capacity became meaningless after stumbles at Aurora (ACB) and Green Organic Dutchman (OTCQX:TGODF) - Aphria is shaping up to be a long-term survivor in the Canadian market.

(Amounts in C$)

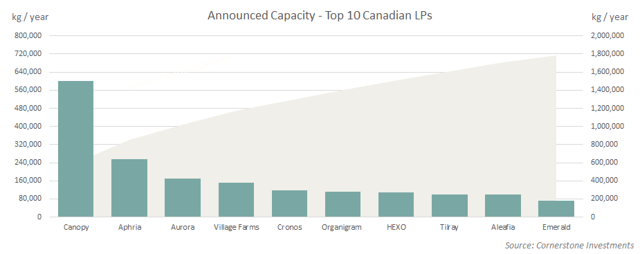

Second-Largest Capacity

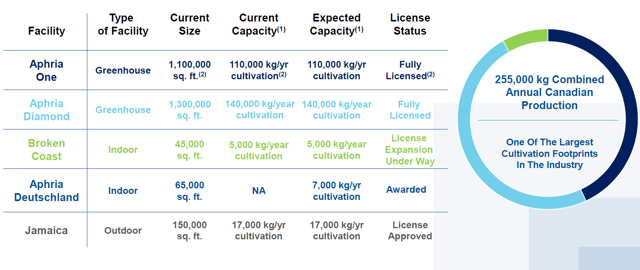

Aphria has emerged as the second-largest producer by installed capacity based on our estimates. Aurora has suspended its Aurora Sun and Nordic 2 constructions, significantly cutting its capacity behind Aphria. Meanwhile, Aphria has successfully completed construction and licensing at its Diamond facility adding 1.3 million sq ft of growing space and 140,000 kg of run-rate annual capacity. Only Canopy (CGC) has a larger capacity, but it has paid dearly for its BC Tweed greenhouse assets as we analyzed before. Aphria also secured a partner for its Diamond facility which provided professional input on greenhouse construction and operation. As a result, the company avoided costly delays and cost overruns that have been prevalent in the industry.

(Source: Public Filings)

We think Aphria has achieved two competitive advantages with the latest completion. First of all, Aphria now has the second-largest capacity in Canada which affords it the ability to capture dominant market share. Secondly, Aphria has been able to achieve its capacity without significant dilution. Aphria didn't require third-party investments and secured cheap non-dilutive debt financings to help finance its constructions. For example, Aphria borrowed $80 million against its Diamond facility with a floating interest rate of ~6% initially. The last financing before this was a US$350 million convertible senior unsecured notes issued in April 2019. The convertible notes bear an interest rate of 5.25% and have a conversion price of US$7.82 vs. the current price of US$4.94. We think Aphria's ability to achieve attractive financing terms is a major competitive advantage, especially during the current downturn which made capital scarce for cannabis companies.

(Source: IR Deck)

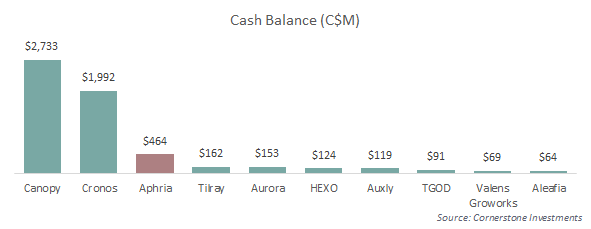

Solid Balance Sheet

Aphria has $464 million of cash at the end of August 2019 which excludes the $80 million recent debt raise. Canopy and Cronos (CRON) both received multi-billion dollar investments from outside investors, and Aphria is the best-capitalized among those without such an investment. Aphria is also nearing the completion of its Extraction Centre of Excellence and it has spent $48 million out of a total budget of $62 million. As a result, we think Aphria has one of the most mature operational profiles in Canada and should incur limited amounts of capital expenditures in the future. The company was waiting for the Diamond license before it could submit an amendment to allow for the co-located extraction center. Aphria's ability to complete most of its facilities last year provided a greater degree of flexibility for the company in 2020.

(Source: Public Filings)

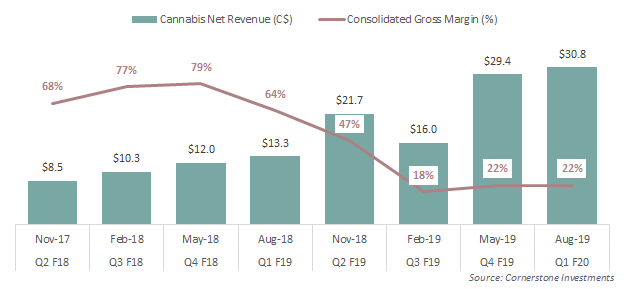

We think Aphria is well-positioned in 2020 to compete in Canada because its scale will likely put the company closer to profitability. Aphria was one of the few profitable cannabis companies in Canada before legalization. In the last quarter ended on August 31, 2019, Aphria reported a positive adjusted EBITDA of $1.3 million from cannabis operations. For the next few quarters, we expect margins to suffer initially from the commissioning of Diamond but it should improve once the facility enters full production. As a result, we expect 1H 2020 to remain noisy but improvements should be evident in the second half.

(Source: Public Filings)

Aphria, currently, trades at EV/Sales of 14x based on its cannabis operations. The distribution business has extremely low margins, and we value the distribution business no more than the original acquisition price of $27 million (Aphria acquired CC Pharma in January 2019 for €18.92 million). Aphria is cheap relative to Canopy at 23.5x and Cronos at 24.4x, but it trades at a premium relative to Tilray (TLRY) at 9.5x and Aurora at 10x. Overall, we think the valuation is reasonable given Aphria's superior operational capacity and financial strength relative to Tilray and Aurora.

Looking Ahead

Aphria has emerged from 2019 as a stronger and more mature cannabis company. The company executed in 2019 by completing all its greenhouse facility construction while retaining ~$550 million of cash after the latest financing. As many Canadian companies face cash shortfalls and curtain capacity expansion, Aphria has the luxury to continue investing while operational efficiencies lower production costs. We are turning slightly more positive on Aphria's 2020 outlook based on discussions above. However, we think Aphria's fate remains subject to the health of the overall Canadian market. We, currently, do not foresee material improvements in Canada until the end of 2020 given Ontario's decision to allow up to 20 new retail stores per month. As a result, we think the first half of 2020 will see limited improvement in Aphria's financial results given the ramp-up at Diamond and continued oversupply in Canada. However, we think Aphria is one of the best-positioned to benefit from any potential improvement in the Canadian market. As a result, Aphria is our top pick in Canada heading into 2020.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

***********This is why I called us the Pepsi of cannabis. Look out Coke (Canopy), there's a new kid in town

***********Next year we are #1.

***********Anybody disagree?.............. How about you Professor?