Editor's note: Seeking Alpha is proud to welcome Andrew Bucci as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

Introduction:

Mission Ready Solutions (TSX.V: MRS) (OTCMKS: OTC:MSNVF) is a company operating primarily in the defense and aerospace sector in the United States, focusing on innovation, manufacturing, and distribution of leading defense and tactical solutions for military and first responder markets.

To date, the company has been primarily focused on laying a strong foundation to execute ambitious growth plans, but is now turning its attention to raising its public profile and showcasing its recent wins and growth trajectory to institutional investors. These efforts were recently kicked off by a webcast from management detailing the company, a recording of which is available online.

For those unfamiliar with the company, MRS has historically worked to develop innovative products, often in partnership with United States Government agencies and various prestigious academic institutions, such as: The Department of Defense, Homeland Security, Special Operations Command, and the Massachusetts Institute of Technology (MIT).

Research and development (R&D) efforts have yielded some impressive products, including the Ballistic Combat Shirt (also known by its commercial name, Flex9 Armor), which has been co-patented with the US Army and is now being rolled out to US troops for fielding. As a co-patent holder, MRS holds the exclusive rights to license, manufacture, and distribute this product to any non-federal US entities, and customers abroad such as foreign militaries.

The original business strategy pursued by MRS was to leverage its portfolio of innovative patented products to drive sales for its manufacturing operations, which sought to capitalize on interest from various allied countries. However, due in part to lengthy lead times for adequate testing of products, highly bureaucratic procurement processes, and the complex regulatory environment for foreign military sales, the company has lagged in its ability to translate interest in the products into sales.

Seeking alternative strategies to better tap into the defense and first responder markets, the company opted to enhance its in-house R&D and manufacturing offerings by pursuing a significant acquisition of a well-established distribution company. Although the acquisition only closed a few months ago, the new strategy is already yielding promising results.

Acquisition of US Department of Defense Prime Vendor: Unifire Inc.

On April 23, 2019, after an almost 9-month process, MRS announced final approval of its complete acquisition of Unifire Inc., a United States Department of Defense Prime Vendor, with privileged access to contracts worth a combined $11 billion USD.

Founded in 1987, Unifire is a specialized solutions provider to the US Defense Logistics Agency ("DLA"). Unifire is 1 of only 6 companies eligible globally (and the only one owned by a public company) to compete for orders through a DLA Special Operations Equipment (SOE) Tailored Logistics Support Program (TLSP) $4 billion USD bridge contract. A 10-year $33 billion USD renewal of this contract is expected in 2020.

In acquiring Unifire, MRS will issue 26.3 million common shares and make deferred cash payments totaling $4 million USD to the two principal owners, Darrell Siria (now retired Unifire CEO) and Dan Raczykowski (staying on as Unifire COO).

For Unifire, a key benefit of being acquired by MRS is access to new capital to rapidly scale the business. Previous company news releases have stated that Unifire has historically been limited in its access to capital, which has constrained its ability to bid competitively on orders through the DLA SOE contract and others.

To address the anticipated growth capital needs, MRS in a recent interview highlighted that it has secured a credit facility which provides immediate access to a minimum of $20 million USD, and is scalable up to $100+ million USD in the short term.

Early results since closing the acquisition and accessing the credit facility have been promising, with MRS announcing an aggregate $75 million CAD in new contract awards since April.

Understanding the DLA SOE TLSP Contract

Unifire holds a number of lucrative contracts, but in my opinion it is the status as 1 of only 6 eligible prime vendors on the current DLA SOE TLS contract presents the best opportunity for rapid growth in the short and medium term.

Source: Mission Ready Solutions Investor Deck, slide 15.

For the contract, various government agencies and authorized purchasers will place orders for specific off the shelf products with the DLA. These orders are then passed along to the 6 eligible prime vendors to bid on. The winning bid is then selected by DLA, based on a combination of factors, and sent to the purchaser for approval.

The contract is currently operating on a 1-year bridge extension worth $4 billion USD, after the previous 5-year $10 billion USD contract concluded in March of this year. As noted, a 10-year $33 billion USD renewal is anticipated in 2020. The SOE contract is exclusive to eligible small businesses only (i.e. those with less than 500 employees) that are named as awardees.

Although incumbent companies are not automatically renewed, no existing holder has previously lost its status on the contract upon renewal. Additionally, as the current prime vendors already have established systems and distribution networks in place, they are better positioned to bid competitively than new entrants. Bids for the renewal were due this past January, and were open to any eligible small business.

During the recent MRS webcast the company highlighted why Unifire is in a strong position to be included on the renewal, but management also noted that the decision ultimately rests with the US Government for what companies are chosen.

Prime Vendor Competitive Landscape

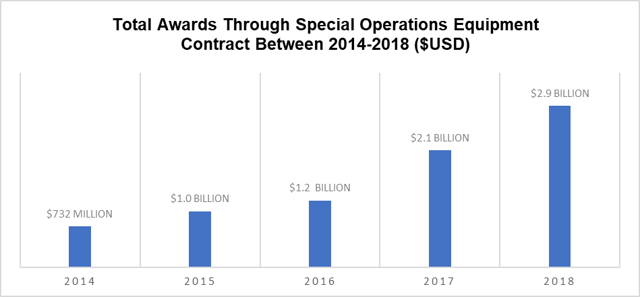

Spending through the SOE contract has been steadily increasing over the years, and demand is expected to remain strong moving forward. This is reflected in the higher allocation in the upcoming renewal ($33 billion USD for 10-years, versus $10 billion USD for 5-years). Additionally, the defense sector has the added benefit of being relatively insulated from global economic downturns, which are not likely to impact funding levels given the long contract horizons.

Source: proprietary graph based on public contracting data.

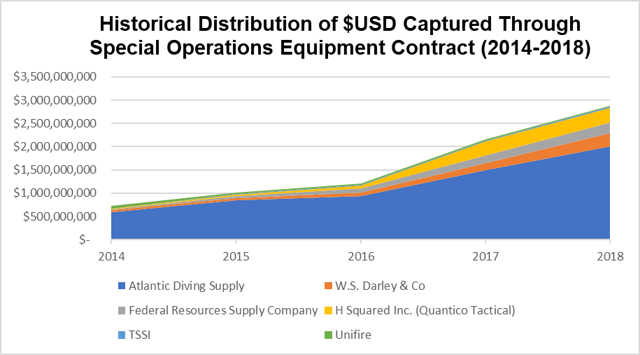

Concerning the competitive landscape for the SOE contract, one prime vendor has historically dominated the field.

| Historical Distribution of $USD Captured Through Special Operations Equipment Contract (2014-2018) |

| | 2014 | 2015 | 2016 | 2017 | 2018 |

| Atlantic Diving Supply Inc.("ADS") | 80.43% | 83.45% | 77.83% | 69.39% | 69.62% |

| W.S. Darley & Co. | 6.56% | 5.35% | 6.73% | 6.66% | 10.14% |

| Federal Resources Supply Company | 2.25% | 4.47% | 7.50% | 7.73% | 7.76% |

| H-Squared Inc. (Quantico Tactical) | 1.15% | 2.92% | 5.25% | 13.68% | 11.18% |

| Tactical & Survival Specialties Inc. ("TSSI") | 0.87% | 0.83% | 0.88% | 1.07% | 1.10% |

| Unifire Inc.* | 8.74% | 2.99% | 1.82% | 1.48% | 0.19% |

| Total | 100% | 100% | 100% | 100% | 100% |

Source: proprietary table based on public contracting data, *Includes data for Source One Distributors, acquired by Unifire in late 2015.

Atlantic Diving Supply Inc. ("ADS") has traditionally taken the lion's share of awards in this space. However, competitors have been able to capitalize on the increasing spending through the contract, which has seen the proportion captured by ADS decrease despite bringing in record sales.

Source: proprietary table based on public contracting data

Although Unifire has lagged in the rankings on the SOE contract in previous years, the acquisition by MRS has put the company in a strong position to dramatically increase its market share. Factors which will help benefit the company moving forward include:

Public vs. Private Company Advantage

Unifire, through its parent MRS, is the only prime vendor in this space which is publicly owned. This provides certain advantages over its competitors, such as easy access to capital markets for financing, and having more stringent and transparent reporting requirements that are viewed more favourably by US federal entities. Its status as a public company also likely played a key role in how MRS was able to secure its current credit facility scalable up to $100+ million USD.

The ability to more readily access equity financing in the future will allow the company to run a leaner balance sheet in the long term, and reduce its dependence on its credit facility and the associated costs. This can ultimately translate to better margins, and in turn allow the company to bid more competitively on contracts.

In comparison, the other 5 prime vendors do not share this luxury and appear more likely to be reliant on debt financing for growth and to fund discretionary dividends. As private entities, detailed information is not readily available, but there is still enough to give a snapshot of how some of these companies are operating. For example, a publicly available Rating Action from Moody’s Investor Service from July 2018 on an ADS $240 million USD term loan, noted that at the time ADS debt/EBITDA was approximately 4.7x (based on pro forma materials provided). The note further commented that meaningful debt repayment beyond minimum requirements was not likely given it is anticipated the company will use excess cash to fund discretionary dividends.

Similarly, public filings from Alaris Royalty Corporation dated December 31, 2018, provide insights into financing provided to another competing prime vendor, Federal Resources Supply Company (FRSC). The filings disclose investments made in FRSC in 2015 for $47 million USD. This is comprised of a 15-year secured loan of $40 million USD bearing interest at 17.625% annually, as well as $7 million USD for preferred shares providing annual distributions. Additional infusions of cash in exchange for contractual annual distributions were also made in subsequent years.

While these examples are anecdotal, they are worth noting because the prime vendor space is very competitive and operates with tight margins. Debt financing and prioritizing dividends versus repayment of debt appears to have worked fine here in the past, because it was likely the standard approach among competing private companies. However, with the emergence of Unifire as a publicly held company, which is not likely to issue dividends or take on significant debt levels, the landscape is poised for a dramatic shakeup in the coming years.

Possible Headwinds for ADS Inc.

Additional factors which may benefit Unifire as it begins to implement its ambitious growth plans, are certain outstanding matters concerning the most successful prime vendor in the space, ADS.

On April 12, 2019, the Washington Post reported that following an investigation from the Small Business Administration (SBA), ADS lost its status as a small business and therefore was ineligible to bid on or be awarded small business contracts (this would include the pending 10-year $33 billion DLA SOE renewal). Central to the issue is whether ADS is below the 500 employee threshold to be considered a eligible small business. ADS has maintained it has always fallen below this threshold, with the most recently cited figure being 446 employees.

ADS immediately appealed the finding, which was partially successful. In May 2019, a judge for the SBA’s Office of Hearings and Appeals vacated the original size determination and remanded the case back to an area office forfurther review. Until a new size determination is made, ADS continues to be recognized as an eligible small business, but some uncertainty will remain in the sector until the matter is officially closed. Given the leading role ADS plays as a DLA supplier, it is unlikely the 10-year SOE renewal will be awarded until that occurs. This may result in an additional extension of the current bridge contract for another year. ADS is heavily reliant on the DLA SOE contract, with public contracting data suggesting it accounted for 77% of its total federal contract awards in 2018. If the company is not included on the upcoming renewal, it will likely face significant challenges given its apparent high leverage. The risks posed by reliance on certain key contracts is similarly highlighted in the Moody's Rating Action described above.

This is not the first time ADS has been in the spotlight concerning its operations as a small business. In 2017, the company agreed to pay $16 million USD to settle allegations under the False Claims Act concerning fraudulently obtained small business contracts. Similarly, in August of 2019, the former CEO of ADS agreed to pay $20 million USD to settle similar allegations. In both settlements, there were no admissions of liability and allegations were not proven.

From an investment standpoint, the prudent approach is to assume that ADS will continue to be recognized as a small business and a competitor for Unifire in the prime vendor space. However, it is clear from these cases that ADS is running close to its max capacity for employees, which may eventually constrain its ability to capitalize on the increasing dollars moving through the prime vendor contracts. This will create opportunities for competitors such as Unifire, who have significant room to grow before they run up against the small business 500 employee cap.

Recent Efforts to Streamline Unifire and Key Hires

During the acquisition process, The MRS management team worked with Unifire to identify opportunities to streamline operations to be able to hit the ground running once the deal officially closed. The company has since been working to implement a variety of efficiency solutions, without disrupting Unifire’s ability to perform on contracts. This includes the automation of previously time-consuming processes, and the implementation of a leading customer-relationship management ("CRM") system with integrated enterprise resource planning (ERP) functionality.

Additionally, management has begun to bring in key personnel with an intimate knowledge of the prime vendor space. The most important of which is the recently announced hiring of John Stone as the new President of Unifire. Mr. Stone, who was one of the first sales employees for ADS, played a key role in leading their TLS sales strategy as the company progressed from approximately $1 million USD in 1999, to $1.3 billion USD in 2010. His knowledge and experience in the TLS space should enable Unifire to scale its business more effectively, and benefit from lessons learned during the ascent of ADS to its leading prime vendor status.

Preliminary Price Target and Valuation

Since closing the Unifire acquisition 5 months ago, MRS has announced $75 million CAD in new contract awards. Revenue is booked progressively as goods are delivered, which can occur over varying time horizons depending on the specific terms of each award. As payment is ultimately rendered from the DLA, the risk of uncollectible amounts should be minimal, provided performance on the awards is satisfactory; according to slide 11 of the MRS Investor Deck, Unifire has a 98% score for on-time deliveries and fill rates.

Assuming Unifire maintains its current pace of $15 million CAD in new awards per month on average, the company will reach $120 million CAD by the end of 2019. Although it is difficult to determine the delivery flow of orders, for the purposes of a preliminary price target, I will assume $20 million CAD of the projected $120 million CAD awards target for 2019 will be captured in the current fiscal year’s financials. I will further assume the remaining $100 million CAD will be booked as revenue in 2020.

For 2020, based on the current pace of monthly awards, Unifire should capture $180 million CAD in new contracts in 2020, for which I will assume at least 50% will be booked as revenue in that fiscal year.

These assumptions total to a projected $300 million CAD in contract awards from April 2019 to the end of 2020, with $190 Million CAD booked as revenue in 2020.

In researching the prime vendor landscape, it is my view that operating margins of at least 6.5% should be a realistic target for MRS in the medium term. This is based on the advantages detailed above (e.g., public company, streamlining efforts, etc.), as well as historical financial disclosures made by ADS Tactical (the parent of ADS) in 2011 detailing their margin profile, when it was preparing for an IPO that was eventually shelved due to adverse market conditions.

Concerning an appropriate earnings multiple, current reference pointssuggest the typical average multiples for public companies in the defense & aerospace sector is around 12x. In my view this is an appropriate figure, as the multiple applied to ADS in 2011 was 10.75, when market conditions were much poorer. Since it is difficult at this stage to project future amortization and depreciation cost changes to estimate future Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA), I will simplify and apply the 12x multiple to operating income only. It is my view this is reasonable since EBITDA = operating income + depreciation + amortization.

Additionally, it is probable that within the next year the company’s outstanding share count will increase from its current level of 173,920,974. This base count includes the 26.3 million shares issued for the Unifire acquisition, but I have also included a provision for an additional 15 million shares outstanding to account for likely future increases, in my projections below.

Based on these figures, my 12-month price target for MRS is:

(($190 million CAD*6.5%) *12)/188,920,974 shares outstanding = $0.79 CAD (rounded)

Based on this price target, the projected market cap on the adjusted share count used in my calculation is approximately $149.2 million CAD.

It should be emphasized, there are various components of these calculation assumptions that can dramatically impact this target based on the company’s actual experience in the future. For example, while it is my view that the assumption that contract awards for the company will remain flat at $15 million CAD per month in 2020 is reasonable, this sector has also seen rapid upward swings in awards for growing prime vendors. For example, according to public contracting data H-Squared Inc. (Quantico Tactical) went from $63.1 million USD in awards on the SOE contract in 2016, to $295.8 million USD won in 2017. Additionally, in a recent interview the Chief Operating Officer of MRS, Marcus Trieber, noted that the majority of prime vendors in this space earn between $250-$350 million USD in annual sales, with the largest capturing over $2 billion USD.

While there are still many unknowns, the price target is intended primarily to facilitate discussion. Others may disagree with the assumptions I have chosen to include, but I have tried to use what I consider reasonable metrics given the information available. In analyzing historical public contract data in this sector, I have relied on the assumption that this data is complete and accurate.

Investment Risks

As with all small cap stocks, there are significant risks with investing in early stage companies, and interested investors should endeavor to conduct their own research before making a decision on whether to take a position.

Specific risks which could impact the investment thesis presented in this article, include: the outcome of the upcoming renewal of the SOE contract, short term liquidity needs, and the complex nature of the sector's regulatory environment.

Not being included on the SOE renewal would have a significant impact on the total value of contracts that Unifire is able to participate on. For example, the current SOE bridge contract represents 36% of the total $11 billion USD worth of contracts Unifire has access to at this time. As noted, the risk of not being included on the renewal should be minimal, but will remain present until the contract is ultimately awarded. This risk is however also mitigated by ongoing efforts to expand on Unifire's current roster of contracts, which would reduce its reliance on the SOE contract vehicle in the future. Additional information concerning these efforts are detailed in the recent investor webcast recording.

Regarding liquidity needs for the company, MRS has largely addressed concerns through its securing of a credit facility for up to $100+ million USD to scale the Unifire business. However, with a minimal cash balance reported in its most recently reported financials, the company may need to raise additional cash to fulfill obligations that the credit facility cannot be applied to, such as the deferred payments component of the Unifire acquisition. As a public company, the risk of not being able to meet these obligations should be minimal, but may result in future equity financing which would dilute shareholder ownership. The near term likelihood of a raise is unclear, as a small raise of $434,250 CAD was completed in August, and the most recently reported balance sheet showed a significant increase in prepaid expenses. Over the prior period, prepaid expenses and deposits increased by $2,279,605 CAD, which may also address shorter term liquidity needs.

Concerning the company's regulatory risk, MRS operates in a highly regulated environment and must maintain its compliance to remain in good standing as a federal contractor. This includes staying below the 500 employee threshold to be classified as an eligible small business, which enables the company to compete for contracts reserved for such entities. The risk of possible compliance issues is present for all competitors in this space, but should be minimal given the experience company personnel have operating in this sector.

Conclusion

Mission Ready Solutions is a unique largely undiscovered company poised to dramatically shakeup the sector it operates in. The company’s recent success in winning significant contract awards amounting to $75 million CAD, competitive advantages as a public company, and recent key hires, show that efforts to transform the Unifire business are getting traction. As such, the forward outlook looks very promising.

Through Mission Ready’s fully owned subsidiary Unifire, investors can take a position in a niche multi-billion dollar market with a limited number of competitors, which has until now been largely accessible only to private investments.

With upcoming institutional investor roadshows anticipated across Canada and the United States this fall, and ramping up promotional activity, it will likely not be long before the market takes note of what has the potential to be a very successfully growth story in the coming years.

With a recent close of $0.215, the 12-month price target of $0.79 represents a potential upside of ~268% from current levels.