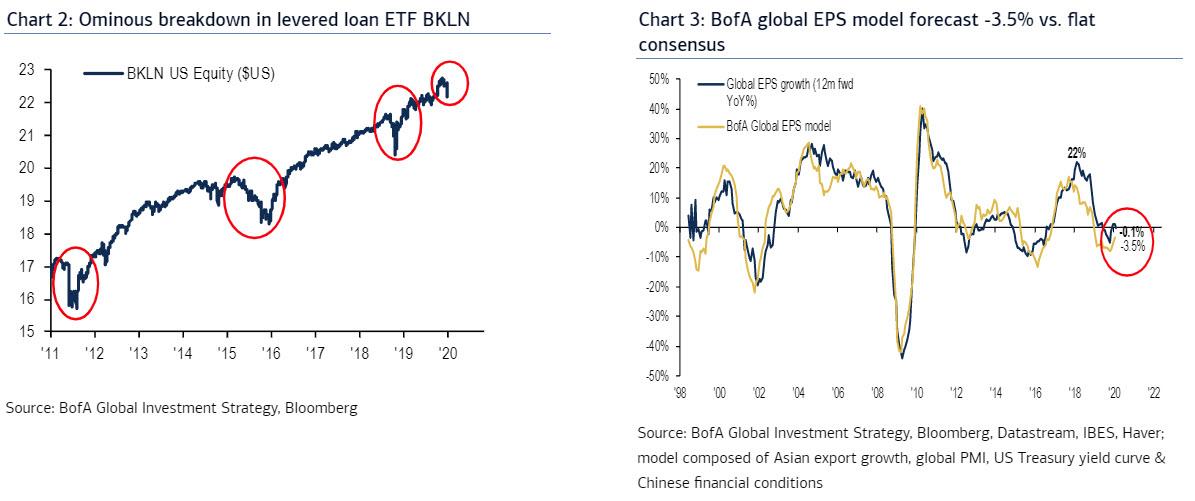

fun times Credit event: risk of credit event surging…extreme bond ETF volumes (e.g. HYG), ominous breakdown in levered loan ETF BKLN (Chart 2), CDS widening; exogenous shocks often expose bad leverage (e.g. Kobe earthquake led to Barings, Asia crisis… LTCM); liquidation of $1tn annualized bond inflows exposing systemic "ghost in the machine" remains biggest 2020 market risk (catalyst for policy response).

Macro: risk of global recession rising…BofA economists cut 2020 global growth to 2.8%, lowest since 2009 (link); BofA global 2020 EPS model forecasts -3.5% (vs. flat consensus)…model inputs (global PMIs, Asian exports) deteriorating (Chart 3).

Peak globalization: COVID-19 reminder that US/China tension, bifurcated global supply chains, competing technology standards…all negative for corporate profits in 2020s.

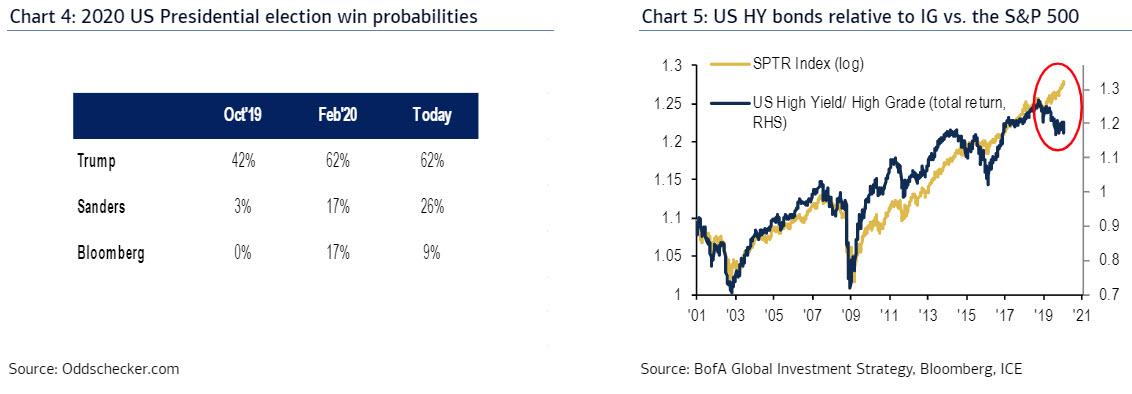

Politics: Oddschecker.com shows probability of Sanders victory in Nov'20 election @ 26%, up from 3% Oct'19 (Chart 4); US political risk hitting US$, helps explain surprise YTD outperformance of China stocks (A-shares) vs. S&P500.

Big Top: we had it coming…SPX highs, gigantic bond inflows, record low IG default risk, Microsoft, Apple, Google, Amazon all >$1tn, "toppy" corporate behavior; new lows in bond yields popped "irrational bubble" (we thought it would be Q2); "Showtime" for markets…big secular monthly floors for stocks (SPX 3000, NYA 12000, MXWD 500) must hold to prevent "Big Top", end of bull market narrative (credit signals poor - Chart 5).