Supply Shortages Will Ensure Higher Gold Prices Gold bars and coins are getting a lot harder to come by.

Supply shortages bode well for gold's intermediate-term uptrend.

Gold's strength versus stocks and commodities is another positive.

Gold's relative outperformance against most major assets has been a result of the coronavirus-related financial market panic as the search for safety continues. One consequence of this panic is a drastic shortage of physical gold bullion and bullion coins, which has put strong upward pressure on prices. In this report, we'll discuss these bullish fundamental factors which should keep gold's longer-term bull market firmly intact in the months ahead.

In the last few reports, we've talked about the historical tendency for gold prices to dramatically outperform equities in the months following a major stock market decline. While gold often suffers residual selling pressure along with stocks during a crash, once the panic subsides investors tend to quickly reassess gold as a worthwhile investment and return to the safety of the yellow metal. This was what happened in the immediate aftermath of the 2008 credit collapse, and it's happening again right now after the recent market panic.

Indeed, in the last few days, gold has regained most of the ground it lost during the coronavirus panic. Gold's price performance in recent days is, among other things, a testimony to the intense demand for physical gold bullion. And as previously discussed, gold bars are difficult to come by right now.

Underscoring this theme, a March 25 Bloomberg article drew attention to the physical metal being in short supply, as some of the world's wealthiest investors are urgently trying to get their hands on it. The article noted that supply chain disruptions related to the global pandemic are contributing to the tight physical bullion market. Bloomberg reported:

Switzerland's refining industry, a major international hub for processing gold into bars and coins, has largely shut because of efforts to contain the global virus. Grounded flights are disrupting plans to transport bullion around the world and gold mining firms are scaling back activities, decelerating the precious metals industry as demand for gold increases.

The article further noted that finding some of the most sought-after bullions coins, including the Canadian Maple Leaf and the South African Krugerrand, has become a major challenge in the wake of the COVID-19 pandemic, with one industry member noting that buyers are becoming "desperate" to obtain physical gold.

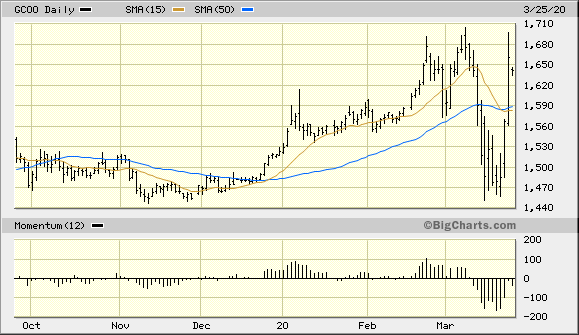

All of this has had a decidedly forceful impact on the yellow metal price. From a short-term technical perspective, the gold futures price (continuous contract) is now back above its 15-day and 50-day lines - a sign that buyers have put aside their "throw the baby out with the bathwater" mentality. Indeed, gold's return to strength further underscores that investors recognize the metal's value as a safe haven in a time of extreme economic uncertainty.

Source: BigCharts

Source: BigCharts

Gold's relative strength is also undeniable when compared to most major assets, including equities and virtually all other commodities. This should serve to commend the precious metal to asset managers who view relative strength as a key consideration when making asset allocations.

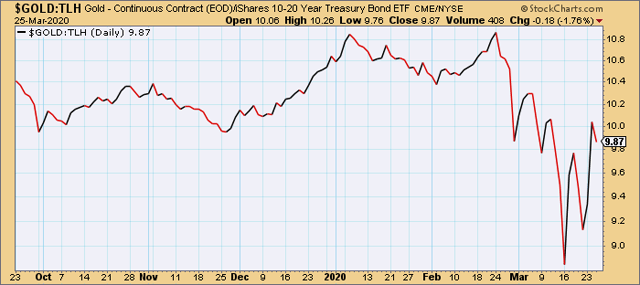

As I mentioned last time, the only major asset that's outperforming gold at the moment is U.S. Treasury bonds. Longer-term bonds are clearly still in high demand right now among investors as worries over a global recession proliferate; it's no surprise, given that U.S. sovereign bonds are universally regarded as a safe place to park cash until uncertainty disappears. But while gold continues to underperform against T-bonds, the metal's relative strength versus T-bonds has drastically improved in the recent trading sessions. Shown below is a ratio chart comparing the gold price with the iShares 10-20 Year Treasury Bond ETF (NYSEARCA:TLH), my favorite long bond proxy.

Source: StockCharts

Source: StockCharts

As you can see, gold is closing the gap in its underperformance against long-dated sovereign bonds. Assuming gold's relative performance versus bonds continues to improve, it will make the metal look even more attractive to institutional money managers who place high value on relative performance comparisons. And when the institutional crowd returns to the gold market in full strength, it will provide an extra boost of upside momentum for the precious metal.

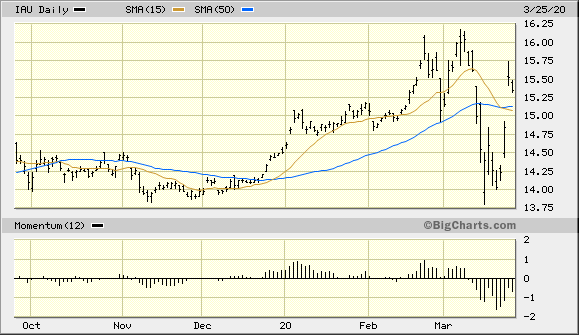

Turning our attention to the iShares Gold Trust (NYSEARCA:IAU), my preferred gold trading vehicle, the fund rallied 5% on March 24 in one of its best 1-day performances ever. This testifies to the strong demand for gold ETFs among investors frightened over the prospects of a global recession. Yet gold's explosive rally could also be viewed as a case of "too much, too soon" in the immediate term. Accordingly, participants should be aware that IAU may need to spend a few days consolidating its latest gains before it tries to overcome the previous high from March 9 at $16.04.

Source: BigCharts

Source: BigCharts

Moreover, we should ideally see a 2-day higher close above the 15-day moving average in IAU in order to get a confirmed near-term breakout signal. A higher close above the $15.52 level (the March 24 close) in the coming days would show that buyers are serious about following through with the historic 5% rally above the 15-day moving average on March 24. Until that happens, though, it's still possible that this was simply a violent 1-day short covering event that might require several more days of consolidation before gold prices resolve to higher levels. In any case, a close above $15.52 for IAU is required to confirm a buy signal per the rules of my technical trading discipline.

In conclusion, gold's continued relative outperformance versus stocks and commodities should serve to increase institutional interest in the metal, and rising institutional participation in gold is one of the necessary ingredients for gold to resume its intermediate-term (3-6 month) bull market. The physical shortage of gold bullion and coins, however, suggests that the worldwide intensive demand for gold won't be disappearing anytime soon and will also likely push gold prices higher in the coming months - with or without institutional participation. Accordingly, a bullish intermediate-term bias toward gold is warranted.

https://seekingalpha.com/article/4334268-supply-shortages-will-ensure-higher-gold-prices