ETH Price Correlated With Increasing Unique Ethereum Address New data indicates that the number of active Ethereum addresses could accurately predict the future price movements of ETH. Unique addresses have been rising since March, and the price of the token has been continuously surging.

Active ETH Addresses Corresponds With The Price?

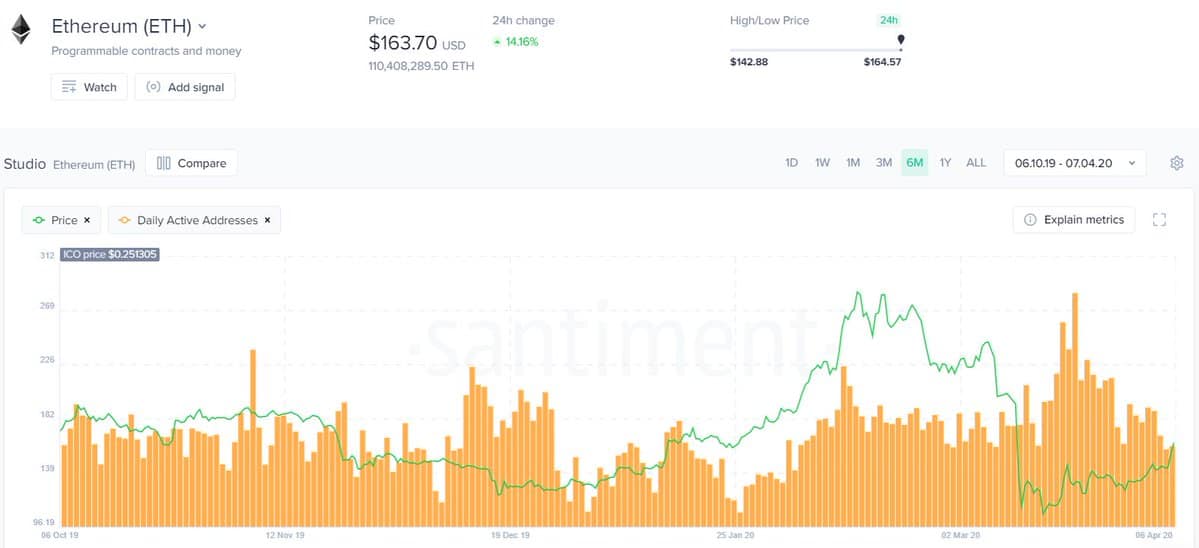

Information provided from the popular monitoring resource, Santiment, suggested that the number of active Ethereum addresses has been increasing since mid-March. More specifically, after the price plunges that took place on the 12th-13th of the month.

ETH Addresses / Price. Source: Santiment

ETH Addresses / Price. Source: Santiment Shortly after those dates, the rise in unique Ethereum addresses reached a few consecutive 6-month highs. According to the report, this is a precise price forecast:

“$ETH’s daily active addresses have once again proven to be an accurate and efficient metric to predict future price movements.” – said in Santiment’s tweet.

The second-largest cryptocurrency by market cap has been indeed surging in the past few weeks.

Ever since it dropped to $90 on March 13th, Ethereum has almost doubled its value. At the time of this writing, ETH is trading at $174 – representing an increase of 93%. In the past 24 hours alone, it has risen by almost 25%.

ETHUSD 1h. Source: TradingView

ETHUSD 1h. Source: TradingView Naturally, this sort of price development affects the total market cap of the asset, which has now grown to over $19 million.

On its way up, ETH managed to break all previous resistance lines at $146, $165, and $170.

Ethereum Accumulation and Distribution

Another report compiled before the most turbulent days in March indicated that the largest 100 Ether wallet addresses had started accumulating higher percentages of the token’s total supply again. At the time, ETH’s price was consolidating, and they took the opportunity to acquire more.

Additionally, data on Ethereum distribution noted that cryptocurrency exchanges held 17% of the total supply. Those included Huobi, Binance, Bitfinex, Poloniex, OKEx, Gemini, KuCoin, Bitstamp, Kraken, and Bittrex. Huobi was the clear leader in this manner by a massive 4.75M ETH portion in its balance.

Binance followed with 2.78M ETH, Bitfinex – 2.58M ETH, and Kraken took the fourth sport with 2.5M.

https://cryptopotato.com/analysis-eth-price-highly-correlated-with-the-increasing-unique-ethereum-addresses/