Welcome to the winner edition of Natural Gas Daily!

Oil prices are dropping like rocks today, but there's an important distinction we need to remind readers. May contracts settling at -$37/bbl has no real significance to the oil market. What we mean by that is that May contracts can trade to -$100/bbl, and it won't really impact physical oil trades. All this price implies is that no one wants to take delivery of the contract since May expires tomorrow.

For oil producers, the drop in May contracts today will impact the monthly settlement price, so swaps that are priced on the average monthly price will be impacted, but given it's only 1 day out of 30 for now, the impact is minimal.

Of course, if you were long or short May contracts, you either lost a lot of money or made a lot of money. But the significance and implications to the oil market are not as linear as one would believe it to be.

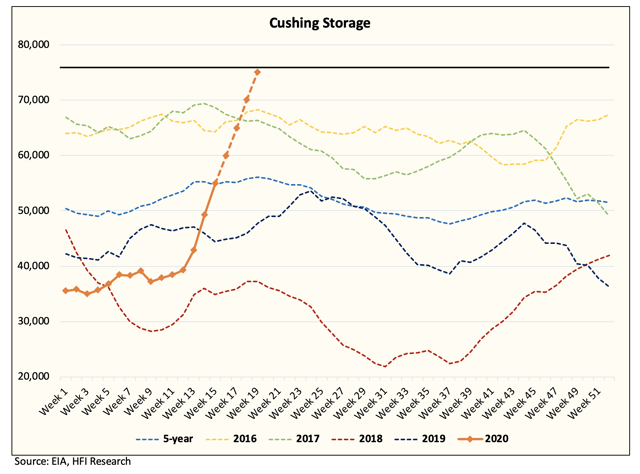

One clear implication from this is that oil storage in Cushing is limited. This isn't a surprise, though, since we published a report last Friday titled, "Cushing Tank Top Scenario Makes For A Very Bullish Natural Gas Price Outlook."

Because Cushing is the largest storage facility in the US and connects directly to Canadian, US Bakken, Niobrara, Anadarko, and Permian producers, storage facility on the producer side would get full, which would then translate into a widespread shut-in.

Producers will be forced to shut-in in large quantities by early May, resulting in a sharp reduction in oil production. This will directly impact associated gas production. We estimated last Friday that the shut-in potential could take ~14 Bcf/d off the market, and this is what natural gas prices are starting to price in today.

What's the potential upside in natural gas?

This really depends on the duration of the shut-in. If we make an assumption that the shut-in will last 2 months from May to June, and a total of 14 Bcf/d of gas production was curtailed. We can assume that LNG exports will also be shut-in reducing supply impact by 8 Bcf/d.

Over the span of 61 days, ~6 Bcf/d would be curtailed net. This would translate into a reduction of 366 Bcf for natural gas storage. Simultaneously, the market would have to resume a gradual resumption of production, which would likely take months. So-net, we could be talking about ~500 Bcf being curtailed from now into November.

Translating the ~500 Bcf into a price outlook, and we peg summer month contracts to trade solidly above $3/MMBtu with a ceiling to $4/MMBtu.

Volatility will likely be extreme, so this price target is going to be very fluid.

However, the question is really, "how much supply will be impacted and for how long?"

It's no longer a question of if, but when.