Authored by Ronan Manly via BullionStar.com,

In the midst of the ongoing fractures in the paper gold markets that have triggered bullion bank panic from London to New York, forcing their public fronts, the LBMA and CME Group (COMEX) to rush out damage control statements claiming “healthy gold stocks in New York and London”, we have consistently reminded those interested in the topic that the claims of the LBMA-COMEX do not stand up to scrutiny, in regards to both the London gold float, and the deliverable gold inventories in the COMEX approved New York vaults, especially when it comes to ‘Eligible gold’.

To wit, from recent BullionStar articles:

3 April – “Eligible gold just means any gold which happens to be in the approved COMEX vaults that is in the form of 1 kilo bars or 100 oz bars. Essentially, this could be anything. It is gold that is already owned by random entities, which would include mints, refiners, and jewellery companies, so eligible gold may have absolutely nothing to do with COMEX or CME.”

9 April – ”CME refers to 9.2 million ozs ( 287 tonnes) of gold held in its approved vaults, with irrelevant claims that 5.6 million ozs of this is eligible gold. Eligible gold is gold which just happens to be in the form that satisfies the deliverable unit of the contracts (1 kg bars or 100 oz bars).”

31 March – “In COMEX parlance, registered gold means gold currently in the approved vaults that COMEX approved whose vault operators previously attached warrants to as part of the COMEX futures delivery process. On the other hand, eligible gold is unrelated to COMEX gold futures trading, and could be owned by anyone, for example mints, refineries, jewellery companies, investment funds, banks or individuals.”

Gold Pool 20.20 – Joint message from CME Group and LBMA, 01 April. Misleadingly not explaining Eligible gold. Source

‘Healthy Gold Stocks’ – On Life Support

While consistently pointing out these ‘eligible gold’ facts to anyone who would listen, the paper market apologists are not in this camp, with LBMA CEO, Ruth Crowell, painting over the cracks last week on 9 April, claiming “I’m happy to report that [gold] stocks are very healthy“, and cheerleaders from the likes of the impotent World Gold Council, who should know better, choosing to disregard the compositional definitions of said gold holdings while cheerleading some more.

50% Haircut – Now you see it, now you don’t

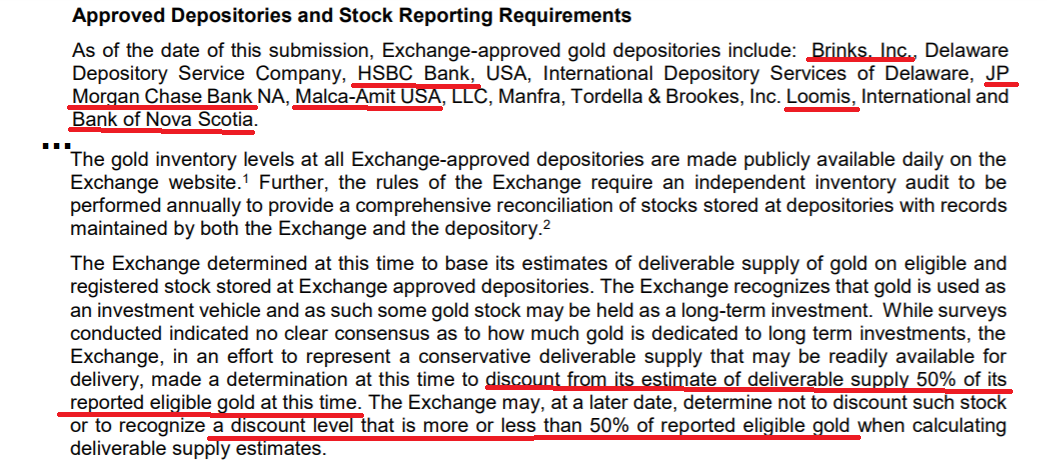

It was therefore intriguing to discover private COMEX correspondence to COMEX regulator Commodity Futures Trading Commission (CFTC), dated 9 April 2020 (the same day that LBMA claimed very healthy gold stocks in New York), that covers a detailed discussion about deliverable gold supply from the COMEX (the Exchange), and most importantly that:

“The Exchange recognizes that gold is used as an investment vehicle and as such some gold stock may be held as a long-term investment.“

Because of this, the letter continues:

“the Exchange, in an effort to represent a conservative deliverable supply that may be readily available for delivery, made a determination at this time to discount from its estimate of deliverable supply 50% of its reported eligible gold at this time."

Not only that, but the CME concedes that:

“surveys conducted indicated no clear consensus as to how much gold is dedicated to long term investments.“

Said another way, no clear consensus means they don’t know. So the CME does not even know how much of the eligible gold in the COMEX approved vaults is held as long term-investments. Why then even assume 50% of the eligible gold is part of deliverable supply? Why not choose 30%, or 20%? Why even include any eligible gold at all as deliverable supply? With this new bombshell, in one foul swoop, the CME admission now casts doubt on the entire ‘Eligible gold’ category.

Why should any of this matter, you may ask? Because simply put, ‘gold price’ discovery is jointly driven by bullion bank trading of COMEX gold futures and London unallocated spot, with the two venues accounting for the majority of global ‘gold’ trading volume, but with synthetic and cash-settled positions having almost nothing to do with physical gold inventories, while dominating the formation of the ‘international gold price’. But when physical gold demand in an environment of constrained supply starts to make its influence felt, as is happening right now, the paper gold markets that run on fumes operated by the bullion bank cartel and fronted by the LBMA and COMEX, need to do all that they can to prevent the paper gold markets from imploding.

The importance of this CME admission cannot be overstated. What the COMEX has now revealed to the CFTC is that there is far less physical gold available in the New York vaults that can be used for gold futures contract deliveries, because the CME, in its own estimate revision, has just slashed the largest deliverable supply category by half.

But it’s even more serious, since the CME goes even further, telling the CFTC that it may in the future increase the discount/haircut level above “50% of reported eligible gold when calculating deliverable supply estimates“, bringing implied deliverable supply to less than 50% of eligible gold inventories.

And just like that, with this bombshell, there is a new market reality. What will the cheerleaders at the World Gold Council think now? How will the LBMA spin this revelation? Given that “gold is used as an investment vehicle and as such some gold stock may be held as a long-term investment“, should the LBMA CEO not now order a 50% haircut to be applied to the London gold float, which would immediately cut that float from circa 1000 tonnes to somewhere around 500 tonnes?

More importantly, how will COMEX gold futures holders who plan to stand for delivery in New York now process this new information on reduced deliverable supply?

Page 2 of CME (COMEX) letter to CFTC, 9 April. Source

From Approved to Unapproved

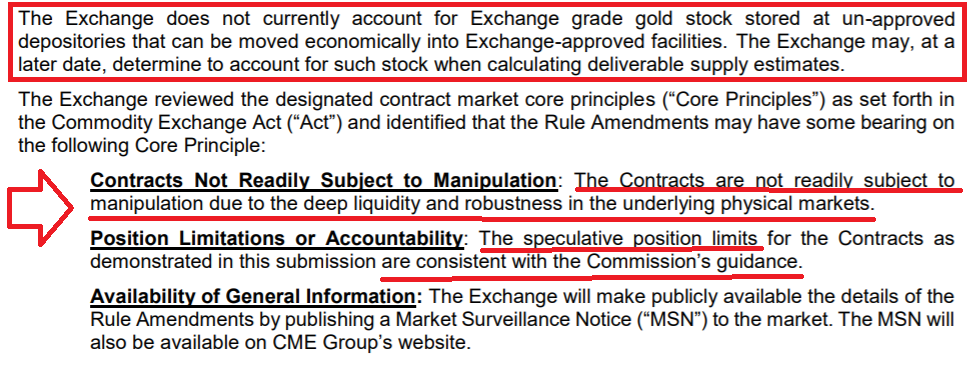

But wait. There’s an even bigger bombshell buried in the CME’s letter to the CFTC. For in what can only be described as outright panic about the precarious levels of gold inventories in the COMEX approved gold vaults in New York City and Delaware (which are the vaults of HSBC, JP Morgan, Scotia, Brinks, Lommis, Malca-Amit, MTB, IDS Delaware, and Delaware Depository), the COMEX has also signaled to the CFTC of a plan to count gold stored in unapproved vaults (i.e. outside the entire COMEX gold vault system) as part of deliverable supply. For the same letter says that:

“The Exchange does not currently account for Exchange grade gold stock stored at un-approved depositories that can be moved economically into Exchange-approved facilities. The Exchange may, at a later date, determine to account for such stock when calculating deliverable supply estimates."

Yes, you read that correctly, Such is the level of panic in the paper gold market that COMEX is considering claiming to have access to gold that is not even in the COMEX vaults network. Such a move would crystalize the growing belief that COMEX is running on gold fumes, and bring LBMA – COMEX panic stations to the proverbial ‘Code Red’ status.

50% Haircut – Revising COMEX vault holdings

So how does this 50% haircut to eligible gold look when applied to the actual claimed gold vault holdings in approved COMEX vaults?

The latest daily COMEX gold vault inventory report, dated April 15, for gold vault holdings April 14 (COMEX Gold_Stocks April 15), claims that for COMEX’s flagship liquid 100 oz gold futures contract, the COMEX approved vaults hold just 142.3 tonnes of registered gold (4.57 million troy ounces) and 277.8 tonnes of eligible gold (8.93 million ounces), for a total of exactly 420 tonnes (13.5 million ounces).

Uninformed parties, cheerleaders, or the LBMA, might at this point try to claim that the amount of gold available for COMEX gold deliveries in 420 tonnes. However, that would be incorrect. Applying the CME’s 50% reduction to eligible gold immediately chops the eligible gold total down to 138.9 tonnes, giving a revised total of just 281 tonnes, i.e. 142.3 tonnes registered + 138.9 tonnes eligible). You can see that under this revision the eligible total of 138.9 tonnes is actually now less than the registered total. In other words, under the CME assumptions, over half the deliverable gold supply is already under warrant.

400 oz gold bars – Another 50% Haircut

But wait. There’s more. As part of the recent moves by the LBMA-CME axis to keep the paper gold show on the road a while longer, the duo recently colluded to launch a new COMEX (Enhanced Delivery) gold futures contract (4GC), which because of a lack of confidence in the availability of physical gold in New York, claims to allow settlement in 400 oz gold bars as well as the existing gold bars sizes of 100 oz and 1 kilo, although in practice it will be used for inter-contract spread trading to try to reign in the 100 oz contract price (GC) closer to spot.

While the details of this new contract, as well as its use of paper fractional entitlements called Accumulated Certificates of Exchange (ACE) can be read here, the important point to note is that the COMEX daily gold vault reports now have a new category called “Enhanced Delivery (400 oz AND eligible brands)" which covers vaulted gold that is eligible for the new 4GC contract but not eligible for the existing GC (100) contract.

The first time this new 400 oz category appeared on the COMEX daily gold vault report was Monday March 30, at which time none of the 9 vaults in the COMEX vault network reported having any 400 oz gold bars in their vaults. When BullionStar pointed out this fact the same day, CME promptly removed the new version of the report from its website on March 31 and re-uploaded a version of the report that had deleted of a 400 oz bar category. Then a week later on April 6, CME published a daily vault report which again had an Enhanced Delivery (400 oz and eligible brands) category. Of the 9 COMEX vaults, 5 have zero gold bar holdings in this category, Brinks had 1.21 tonnes in the eligible gold category, Loomis had 0.76 tonnes in eligible gold, HSBC claimed to hold 21.5 tonnes in the eligible gold, while JP Morgan claimed a sizeable 126.8 tonnes of 400 oz bars in the eligible gold category. Note that all reported holdings were in the eligible gold category. The totals were 38,874 ozs (Brinks), 24,404.7 ozs (Loomis), 691,811.8 ozs (HSBC), and 4,078,063.4 ozs (JP Morgan) respectively, adding up to 4,833,154 ozs for the four vaults as of April 6.

Given that JP Morgan New York hardly had 126.8 tonnes of London Good Delivery gold bars already sitting in its New York vault before April 6, since New York is not a center of 400 oz gold bar storage, the appearance of this gold at the JP Morgan vault under Chase Manhattan Plaza is probably some type of gold swap between London and New York, and possibly involving the New York Fed and Bank of England.

Fast-forward to today and the COMEX gold vault report dated April 15, for activity April 14, and the status of vault reporting for the new 400 oz gold bar category is pretty much as it was on April 6, with the Brinks and Loomis vaults claiming to hold between them 1.97 tonnes of ‘eligible gold’, HSBC claiming to hold 19.44 tonnes as eligible gold (which is 2 tonnes less than last week), and JP Morgan still claiming to hold the exact same amount of 126.8 tonnes (or 4,078,063 ounces) as ‘eligible gold’.

Adding the JP Morgan, HSBC, and Brinks and Loomis claimed holdings under the 400 oz bar category gives a total of 4,573,579 ozs (or 148.3 tonnes). Applying CME’s 50% discount which assumes that half of this eligible gold is not part of deliverable supply leaves just 74.15 tonnes of gold as eligible in this category.

It’s not just speculation that the 400 oz gold also gets a 50% haircut. The CME actually does the same haircut in its April 9 letter to the CFTC, where it quotes the 4,833,154 ozs said to be held across the JP Morgan, HSBC, Brinks and Loomis vaults, stating that half of this equals 2,416,600 ozs, or 24,166 GC 100 oz contracts:

“Further, the current level of inventory for 400 troy ounce gold bars and eligible brands in Exchange approved vaults as of April 7, 2020, was 4,833,154 troy ounces or 24,166 contract equivalents after accounting for a 50% reduction, meaning that the combined inventory for all gold deliverable against the Gold Enhanced Delivery Futures (4GC) contract is 70,063 contract equivalents." – source: bottom of page 3 of CME letter to CFTC, April 9

Adding this remaining 74.15 tonnes to the 281 tonnes of deliverable supply for the 100 oz gold futures contracts, gives a grand total of just 355.15 tonnes of deliverable supply on the COMEX (or 11.4 million ounces), a far cry from the 563 tonnes (18.27 million ounces) reported without the 50% eligible haircut. Overall the 50% eligible gold haircut takes 213 tonnes of gold off the COMEX market, which is nearly 40% of all the gold bars which COMEX claims are in its approved vaults.

The daily link to the COMEX New York vault report file (which changes daily) can be opened here.

COMEX scenario plan – Inclusion of unapproved vaults in deliverable supply, and CORE PRINCIPLES – Page 4 of CME (COMEX) letter to CFTC, 9 April. Source

CFTC – Asleep at the wheel

Finally, the COMEX letter to the CFTC wraps up with some brazen and hilarious claims by the CME that COMEX gold futures contracts are “Not Readily Subject to Manipulation" due to “the deep liquidity and robustness of the underlying physical markets." You can’t make this up. The CME letter makes these claims after saying it tested them against the Core Principles” of the Commodity Exchange Act.

These are the same gold futures contracts that the US Department of Justice (DoJ) last September referred to when it charged JP Morgan precious metals traders, including JP Morgan Chase head global precious metals, and then LBMA Board member, Michael Nowak, with “alleged participation in a racketeering conspiracy and other federal crimes", after an investigation by the FBI New York Field Office in which, wait for it, the CFTC Division of Enforcement provided assistance.

These are the same gold futures that starred in the DoJ charges of racketerring under the Racketeer Influenced and Corrupt Organizations Act (RICO Act), wire fraud, bank fraud, and “widespread spoofing, market manipulation and fraud".

And also placing “deceptive orders for gold, silver, platinum and palladium futures contracts traded on the New York Mercantile Exchange Inc. (NYMEX) and Commodity Exchange Inc. (COMEX), which are commodities exchanges operated by CME Group Inc."

This is the same JP Morgan which now claims to hold 126.8 tonnes of gold in its New York vault that has been accepted as backing the new hastily introduced Gold Futures (Enhanced Delivery) 400 oz contract hatched by the LBMA and CME. Surely JP Morgan should have nothing to do with any gold market trading or continue to be a member of the LBMA and COMEX after its traders have been charged with the above. Where is the CFTC in all of this?

That’s right, the CFTC is the recipient of the CME letter, which probably went into the trash can as soon as it was received. After all, the CME proves in its letter that the entire regulatory framework is a rubber stamping exercise which had already been agreed with the CFTC since the increased “speculative position limits for the Contracts as demonstrated in this submission are consistent with the Commission’s guidance.“

For those who want to see what the Core Principles of the Commodity Exchange Act were designed to do when first enacted, you can look at SEC. 5. 7 U.S.C. 7¿ DESIGNATION OF BOARDS OF TRADE AS CONTRACT MARKETS on page 112 here, where there are such gems as:

(3) CONTRACTS NOT READILY SUBJECT TO MANIPULATION.— board of trade shall list on the contract market only contracts that are not readily susceptible to manipulation.

(4) PREVENTION OF MARKET DISRUPTION.—The board of trade shall have the capacity and responsibility to prevent manipulation, price distortion, and disruptions of the delivery or cash-settlement process through market surveillance, compliance, and enforcement practices and procedures.

Conclusion – Audit the COMEX

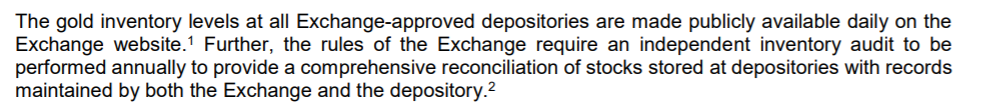

The COMEX claims that under its rules, all approved gold depositories (i.e. all 9 of its approved vaults in New York City and Delaware ) are required to conduct an independent inventory audit each year, and then submit the audit reports to the Exchange within 30 days of the completion of the audit.

Page 2 of CME (COMEX) letter to CFTC, 9 April. Source

Yet not one of these COMEX vault audit reports has ever been published by the CME / COMEX nor by any of the vault providers. Why have they never published these audit reports, and why has the regulator, the CFTC, never directed that they do so?

COMEX Delivery Facilities and Procedures – Section 703 (a), 6. Source

In contrast, gold-backed Exchange Traded Funds (ETFs) such as the SPDR Gold Trust (GLD) conduct bi-annual physical independent audits of gold bar inventory and publish these reports on their websites. The gold-backed ETFs even go as far as publishing their gold bar lists on a daily basis, such as GLD here.

In comparison, Excel spreadsheets of claimed gold vault holdings in New York such as in the vaults of JP Morgan, are not worth the proverbial paper they’re written on. If COMEX is to have any credibility in the global gold market, it needs to immediately publish the annual audit reports from all approved COMEX gold depositories, including date audits conducted and auditor documents, in a similar fashion to the gold ETF audit documents.

COMEX should also then be required by the regulator to publish an industry standard weight list of all Registered gold all and Eligible gold in its approved vaults (of which the deliverable supply is a subset), showing bar serial number and refiner brand for all 100 oz gold bars and 1 kilo gold bars held across all vaults, and for 400 oz bars, the bar serial number, refiner brand gross weight, and fine weight.

Of course, given that the COMEX is part of the bullion bank swamp that gets FOIA exemptions from the CFTC to hide crucial facts about the market maker program of its new collusive LBMA – CME gold price contract, neither COMEX nor the CFTC are never going to do this. And so with the CME, CFTC, JP Morgan and LBMA in continued panic mode about vaulted and physical gold stocks in New York and in London, it will be a further case of spin, misinformation, manipulation and outright ‘whatever it takes’ to keep the paper markets as the dominant source of gold price discovery.

In that case, perhaps the CME – COMEX should at least take note of point 6 of the Core Principles of the Commodity Exchange Act which covers Emergency Authority, and get a draft copy ready for the next joint LBMA-CME ‘nothing to see here‘ press release, as Emergency Authority seems like the next logical step in the bullion bank toolkit as the price of physical continues to detach from the paper pyramid:

(6) EMERGENCY AUTHORITY.—The board of trade, in consultation or cooperation with the Commission, shall adopt rules to provide for the exercise of emergency authority, as is necessary and appropriate, including the authority—

(A) to liquidate or transfer open positions in any contract;

(B) to suspend or curtail trading in any contract; and

(C) to require market participants in any contract to meet special margin requirements.