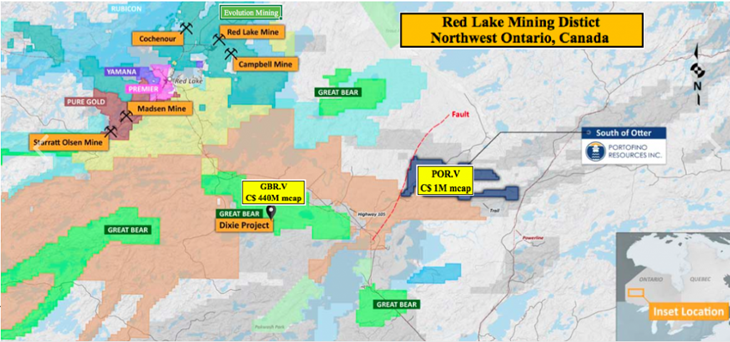

Feb 2020 Streetwise Report On Portofino Resources Inc. Last September Portofino Resources Inc. (POR:TSX.V; POT:FSE) announced a binding agreement for the right to acquire a 100% interest in mining claims in the famous Red Lake mining district of Ontario. Portofino joins both majors and juniors including Australia-listed Evolution Mining and Canada-listed Yamana, Great Bear Resources, Premier Gold Mines, Pure Gold, Rubicon Minerals, Pacton Gold, BTU Metals and GoldOn Resources.

Portofino's block comprises 14 mining claims covering ~5,120 hectares. The claims are near investment crowd favorite Dixie project, being drilled out by Great Bear Resources (GBR). GBR's latest results from a fully financed 200,000-meter drill program were impressive. One of several intervals was 48.7 grams per tonne (g/t) gold (Au) over 8.7 meters (m), including 1.2m @ 281.9 g/t Au.

Gold price had its best year (2019) in a decade….

So, ultra, high-grade Au mineralization, found at shallow depth (under 300m), across multiple drill programs in 2017–2019. GBR has a market cap of $440 million. Portofino's 5,120- hectare "South of Otter" property is less than 10 km east of GBR's 9,140-hectare flagship project.

If South of Otter hosts anything good, which remains to be seen, it might be high-grade Au, like Dixie, or high-grade copper (Cu) and zinc (Zn) mineralization, like that found on other nearby properties.

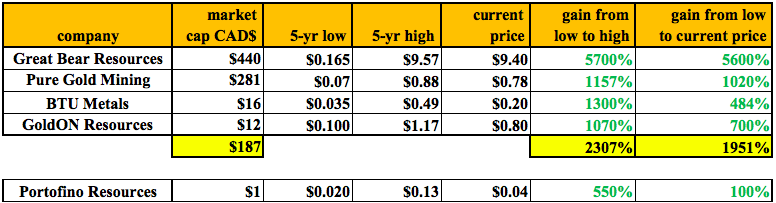

I'm shamelessly playing the close-olgy card here, but only because GBR is one of the best gold junior stories of the past decade, up ~5,600% from $0.165 in 4Q 2016 to $9.40 today. In fact, several juniors have done quite well. Pure Gold Mining is up ~1,020% since 4Q 2015. BTU Metals is up nearly 500% since 3Q 2018. One more, GoldON Resources, is up ~700% since 1Q 2019.

That's four Red Lake juniors with spectacular share price success. Four out of roughly 16 (25%) publicly traded companies with all, or substantially all, of their gold and/or base metals assets in and around Red Lake, Ontario. Portofino, with a market cap of just $1 million is perhaps the smallest player in the entire district. Yet, its under-explored property is both sizable and meaningfully prospective.

South of Otter is located within a geological setting that hosts the past-producing South Bay Mine (1.6 Mt @ 11.1% Zn, 1.8% Cu and 2.1 oz./t silver (Ag). GBR's Dixie project is also on this trend. In addition to being on trend, Portofino's property lies in a similar geological and structural setting.

Two historical operators, Goldcorp (recently acquired by Newmont) and Tri Origins, compiled a vast amount of geophysical data that mapped structures within the South of Otter claims. Portofino has commenced geophysical and geochemical surveys to further understand the geology and mineralization associated with past discoveries, which lie just north of the property but strike onto Portofino's claims.

Red Lake exploration program started last week

These surveys will provide Portofino with the data required to effectively target both gold and base metal mineralization and identify similar structures for exploration that are being explored along trend by companies including Great Bear Resources and BTU Metals. BTU recently reported an intercept of 44.3m of 1.14% Cu Eq, with intervals of up to 5.56% Cu, 99.6 g/t Ag plus 2 g/t Au.

Portofino's CEO David Tafel stated,

"We have been able to acquire a very prospective land package in a known gold mining camp proximal to the Dixie project which has recently produced multiple high-grade gold discoveries by Great Bear Resources. This acquisition allows us to diversify our project portfolio while we continue to advance our lithium projects."

The South of Otter property is ~40 km southeast of the town of Red Lake, Ontario, and less than 10 km east of GBR's Dixie Lake. Historical work on the claims included prospecting, sampling and limited diamond drilling.

With the gold price up US$300/oz (+24%) from the low of 2019, management is wisely seizing an opportunity to conduct meaningful programs that may, in part, be guided by ongoing successes at neighboring projects. Active drill programs are underway on properties in virtually every direction from Portofino's South of Otter property. In fact, one of the most aggressive drill campaigns in Canada (200,000 meters) is being done by Great Bear.

Portofino Resources' South of Otter Property

To earn 100% interest in South of Otter, Portofino has agreed to issue 500k shares and make payments over a four-year period totaling $70,000. The property vendor will retain a 1.5% Net Smelter Return (NSR), of which one half, (0.75%), can be purchased for $400,000.

Management has completed a review of all available historical assessment work on the South of Otter property and has announced an initial exploration plan starting this week. According to the press release,

"The first phase of Portofino's 2020 exploration program consists of ~25-line km of ground VLF/EM geophysics and soil geochemistry surveys. The objective is to delineate mineralized structures related to past gold and base metal discoveries in the region and outline targets for follow-up trenching and drilling. Multiple gold, copper and zinc deposits / prospects have been discovered both immediately to the north and south of the claim boundaries."

Utilizing historical geological and airborne magnetic surveys has enabled the company to advance its exploration program rapidly and cost effectively. Combined with the new data to be collected from the upcoming program, the company expects to delineate mineralized structures related to past gold and base metal discoveries and outline targets for follow-up trenching and drilling.

Portofino's property contains excellent targets for both Red Lake-style Au mineralization as well as gold-bearing base metal prospects. Historical work includes prospecting, sampling, plus limited drilling, as well as airborne magnetic geophysical surveys commissioned by a previous operator.

Portofino's brine lithium prospects in Argentina are highly prospective

Readers may recall that Portofino Resources is also known as a lithium play. It has locked up (through favorable option structures) three projects in the heart of the Lithium Triangle.

In the first half of 2019, Portofino continued to move the ball forward on two of its three projects. Although it's too early to know if the company has good lithium assets, one of its projects, Hombre Muerto West (HMW), is in the single best salar in Argentina—salar del Hombre Muerto.

Neighbors in and around Hombre Muerto include Livent Corp. (formerly FMC), Korean giant POSCO and Australia-listed Galaxy Resources. Last year, POSCO famously paid ~$364 million to Galaxy for 17,500 hectares, that's ~$20,800/ha. That land package reportedly had a 2.54 million tonne LCE Indicated + Inferred resource.

Over the past few months, a number of lithium juniors and producers have seen significant rebounds in their share prices. Eight well-known names—Neo Lithium, Advantage Lithium, Lithium Americas, Ganfeng, Livent, Wealth Minerals, Standard Lithium and Bacanora—are up an average of 125% from 52-week lows.

Gold sentiment is high and lithium sentiment might be turning. Portofino now has two segments (lithium and gold), each of which could be worth considerably more than the company's entire market cap of just $1 million.

It's early days, but a raging bull market in precious metals (underway?) and/or a bounce in lithium prices could draw attention to Portofino Resources (TSX-V: POR) this year and next.