GREY:UEXCF - Post by User

Post by

mangoeon May 09, 2020 4:20pm

225 Views

Post# 31007599

John Quakes on Uranium Stocks severely undervalued

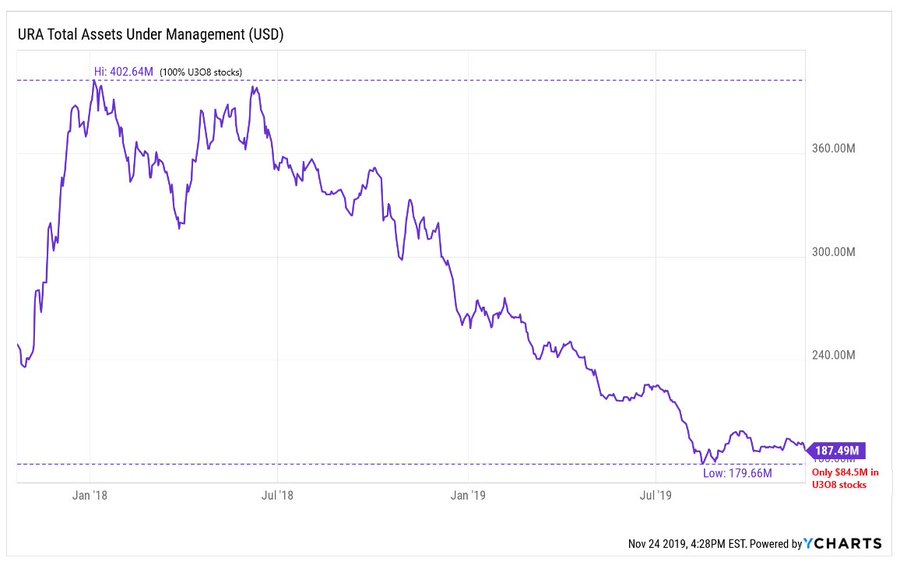

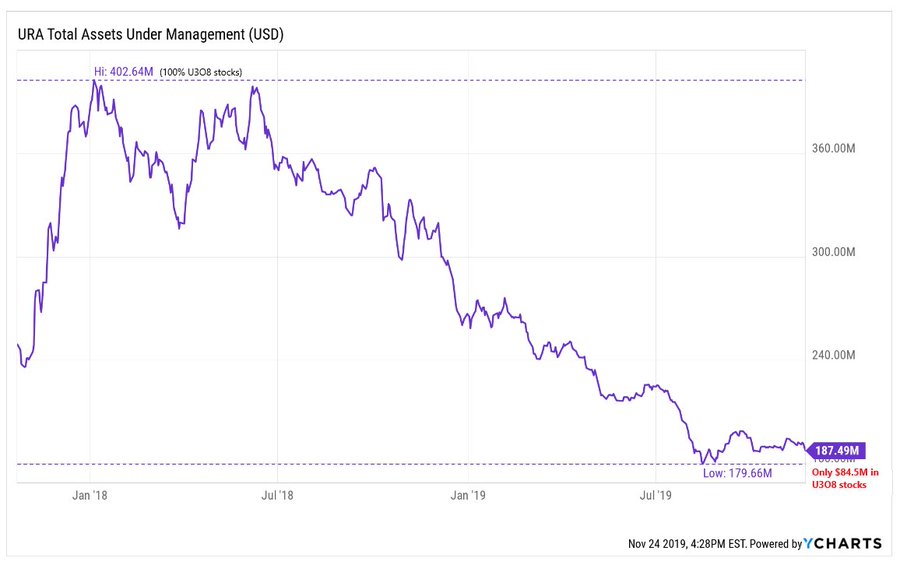

John Quakes on Uranium Stocks severely undervalued1) Why are #Uranium #stocks so severely undervalued relative to Spot #U3O8 price? There are several reasons but biggest by far was decision by Global X Uranium ETF $URA in January 2018 to switch from 100% to only 50% U3O8 stocks! They had to unload over US$200M in U stocks! ..2

2) In January 2018, $URA held over US$400M worth of #uranium stocks. The switch to 50% led to a selling-off of US$200M worth of #stocks into a tiny illiquid sector, driving down share prices of almost every U stock across the board starting in March 2018. But it got worse... /3

2) In January 2018, $URA held over US$400M worth of #uranium stocks. The switch to 50% led to a selling-off of US$200M worth of #stocks into a tiny illiquid sector, driving down share prices of almost every U stock across the board starting in March 2018. But it got worse... /3

3) $URA had been the Sentiment Indicator for #Uranium sector. Where $URA went, #U3O8 #stocks would follow. As U stock prices plummeted, $URA plummeted, so more investment firms redeemed $URA units, creating a downward spiral so by end of 2019 over US$320M in U stocks sold..4

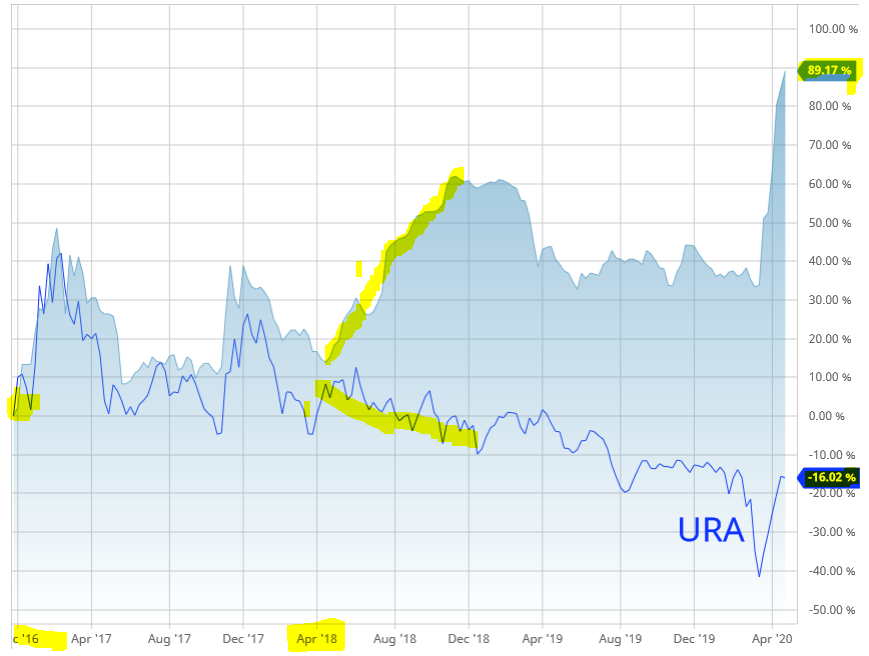

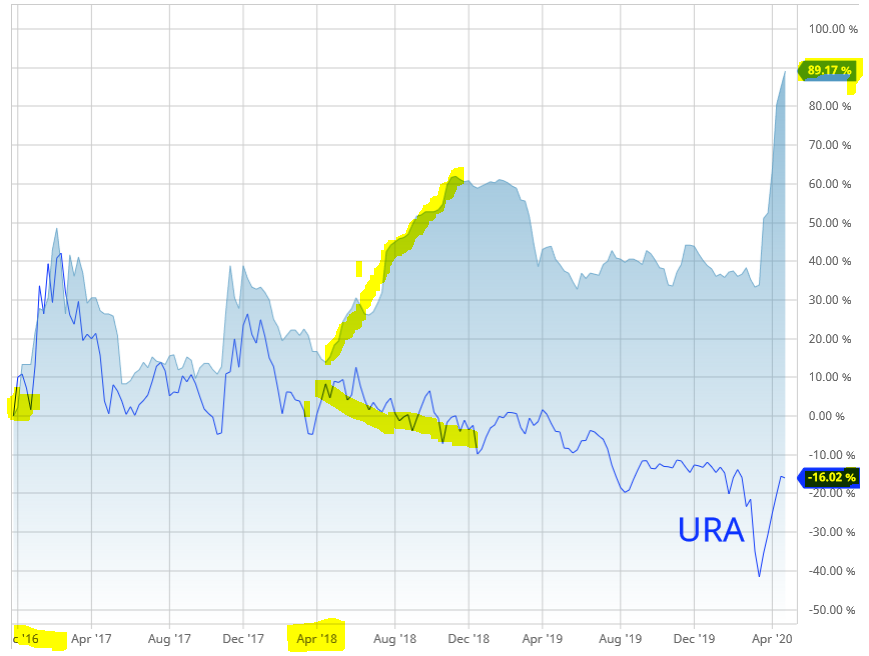

3) $URA had been the Sentiment Indicator for #Uranium sector. Where $URA went, #U3O8 #stocks would follow. As U stock prices plummeted, $URA plummeted, so more investment firms redeemed $URA units, creating a downward spiral so by end of 2019 over US$320M in U stocks sold..4  4) In this chart of #Uranium Futures vs $URA, you can see impact of Global X U sector sell-off. Traditionally, $URA & U #stocks tracked with Ux Futures... but they diverged in mid-2018 and $URA & U stocks continued falling even as Ux Futures were rising. Massive divergence.. /5

4) In this chart of #Uranium Futures vs $URA, you can see impact of Global X U sector sell-off. Traditionally, $URA & U #stocks tracked with Ux Futures... but they diverged in mid-2018 and $URA & U stocks continued falling even as Ux Futures were rising. Massive divergence.. /5

5) This chart starts at the decade low for both $URA & #Uranium price in November 2016 up to today. Over that time period #U3O8 price has risen over 89% while disgraced $URA sector Sentiment Indicator has fallen -16%, creating a -105% price disconnect for U #stocks in general../6

5) This chart starts at the decade low for both $URA & #Uranium price in November 2016 up to today. Over that time period #U3O8 price has risen over 89% while disgraced $URA sector Sentiment Indicator has fallen -16%, creating a -105% price disconnect for U #stocks in general../6  6) Investors hate new $URA, continuing to redeem ETF units in 2020 & forcing Global X to sell even more #Uranium stocks. That only stopped in late March after Ux Futures started to spike higher. With U stocks severely undervalued, a #ViolentUpside correction is now very likely.

6) Investors hate new $URA, continuing to redeem ETF units in 2020 & forcing Global X to sell even more #Uranium stocks. That only stopped in late March after Ux Futures started to spike higher. With U stocks severely undervalued, a #ViolentUpside correction is now very likely.