Euro Sun Mining - ideal takeout target in a gold rush One obvious stock pick is Euro Sun Mining (TSX:ESM, OTCQB:CPNFF).

In its 10-million-ounce Rovina Valley gold project in Romania, Euro Sun (TSX:ESM, OTCQB:CPNFF) owns Europe’s second-largest commercial gold resource. With permitting for mine construction also well on the way to completion, the asset has to be one of the sector’s most attractive takeout targets.

However, with Euro Sun’s (TSX:ESM, OTCQB:CPNFF) market-cap sitting at just $36.9 million, Rovina Valley’s gold is currently valued at only $2-3 an ounce (“/oz”).

Historically, you would expect to see a project of this quality, and at this late stage of development, valued closer to $20/oz valuation.

But with the gold price rocketing, something has surely got to give.

After all, Rovina Valley is drill-ready with a vast gold resource and is located in one of the world’s safest jurisdictions.

In short, this project ticks all the boxes for a significant acquisition.

How much longer can Euro Sun (TSX:ESM, OTCQB:CPNFF) trade at such a discount?

With increasingly cashed-up gold miners now on the hunt to boost their reserves, the answer is almost certainly “not long”.

Gold – in the early stages of a strengthening bull market

A big part of the investment case for Euro Sun (TSX:ESM, OTCQB:CPNFF) comes down to whether you believe gold’s bull market will continue into the medium term?

The renowned safe-haven asset was already performing exceptionally well as we entered 2020, boosted by growing concerns about the escalating US/China trade war and fears about weakening global growth.

Then the Coronavirus struck.

That black swan has changed everything, and with central banks now rushing to print money on an unprecedented scale, the outlook for many is frightening.

And there is nothing the price of gold loves more than fear.

As other markets recoil from the impact of Covid-19, gold has continued to soar.

There is no sign of this slowing down anytime soon.

The longer this run continues, the better the prospects for companies like Euro Sun (TSX:ESM, OTCQB:CPNFF).

To see how big an opportunity could be in front of you right now, take a step back for a moment.

Look at the graph below.

Gold price in dollars per ounce over the past 12 months (Source: Kitco)

Bar a very brief dip in mid-March 2020, when a huge S&P sell-off led investors to panic-sell to cover other losses, gold has now traded above $1,500/oz since late December 2019.

Remember, this price is a crucial threshold for the sector as a whole.

Now take a look at this second graph.

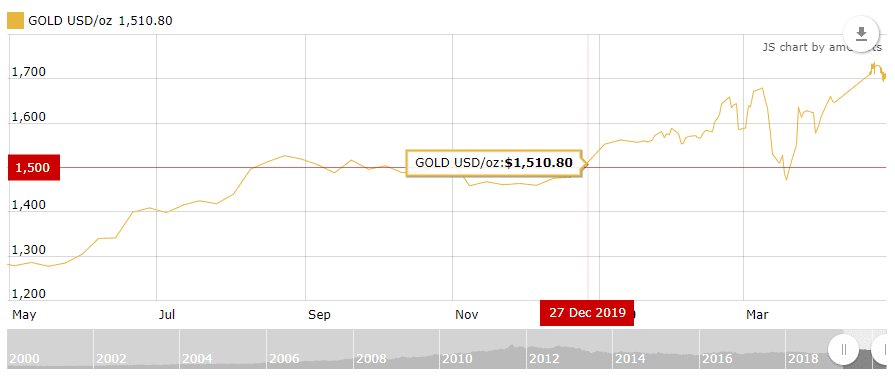

Gold prices in dollars per ounce since 2000 (Source: goldprice.org)

The last time we saw a gold bull run break out beyond $1,500/oz was back in 2011. When it did, it stayed above this key psychological barrier until 2013.

This sustained period of price strength was marked by a massive surge in acquisitions from major gold producers as they used extra cash on their balance sheets to build up their long-term reserves and resources.

With so much turmoil in the world today, and the extraordinary actions of central banks gathering pace, gold’s run shows no sign of stopping in the near future. Bank of America even predicts that gold will reach $3,000/oz within 18 months!

This can only be positive for takeout targets like Euro Sun (TSX:ESM, OTCQB:CPNFF).

So, what makes Euro Sun (TSX:ESM, OTCQB:CPNFF) such an attractive takeover target?

In broad terms, there are three main criteria that miners use in their hunt for new projects. These are:

- Quality – the major miner wants to produce as much metal as it can for as little cost

- Jurisdiction – the major miner wants to operate over the long-term in an area that is safe and mining-friendly

- Progress – the major miner wants projects that are as close to being “shovel ready” as possible

Rovina Valley scores about as high as you can get in all three areas.

The project is the European Union’s (“EU”) second-largest gold deposit, with 10.11 million equivalent ounces of gold in the measured and indicated categories. These are the two most valuable categories for any mining asset to have.

It also boasts a considerable amount of upside potential in the form of the Stanija prospecting permit, where sampling has returned grades of up to 25.9 grams per tonne gold and 0.34% copper. Stanija, also wholly-owned by Euro Sun (TSX:ESM, OTCQB:CPNFF), is based just six kilometers away from Rovina Valley.#

Location of the Rovina Valley project and neighboring Stanija Prospect (Source: Euro Sun Mining)

Meanwhile, Rovina Valley is based in Romania’s “Golden Quadrilateral”, one of Europe’s largest gold-producing areas. This is a critical jurisdictional de-risking factor for Euro Sun (TSX:ESM, OTCQB:CPNFF).

Since joining the EU in 2007, Romania has taken full advantage of its membership of the world’s largest trading block, regenerating its economy and opening up for international business – particularly in the mining space.

Euro Sun (TSX:ESM, OTCQB:CPNFF) broke new ground in November 2018 when it became the first non-state-owned firm in Romania to be awarded a mining licence. The clincher was the firm’s deep-rooted commitment to Environmental, Social, and Governance (“ESG”) principals, which saw it win government-backed authorizations at Rovina Valley previously denied to other firms.

In a March 2020 update, Euro Sun (TSX:ESM, OTCQB:CPNFF) went on to state publicly that it is confident it will win a construction permit and deliver a definitive feasibility study for Rovina Valleyin 2020. Notwithstanding any minor Covid-19-related delays, the asset will at this point be “shovel ready” and primed for production.

With Europe’s second-largest gold resource in an EU-member state and permitting well on the way to completion, Rovina Valley really is an ideal takeout target.

It is no surprise that billion-dollar fund manager Ruffer and specialist resource investor Orion Mine Finance have taken such considerable stakes in Euro Sun (TSX:ESM, OTCQB:CPNFF).

These backers represent some of the smartest money around. They recognize true value when they see it.

With Rovina Valley’s 10 million ounces of gold priced at only $2-3/oz, against an expected value of $20/oz, it is obvious what attracted them to this investment.

Given the huge discount currently being offered by the market, it will not be long before Euro Sun (TSX:ESM, OTCQB:CPNFF) sees a significant and hugely positive rerate.

Read more at:

https://www.valuethemarkets.com/2020/05/06/euro-sun-minings-rovina-valley-project-an-ideal-takeout-target-in-a-gold-rush-tsxesm-otcqbcpnff/