National Bank's view on DCBO Strong first quarter numbers are more reason to like Docebo (Docebo Stock Quote, Chart, News TSX:DCBO), according to National Bank Financial analyst Richard Tse, who delivered an update to clients on the company on Tuesday.

Tse called Docebo a below-the-radar growth name that’s set to prosper during COVID-19 and beyond.

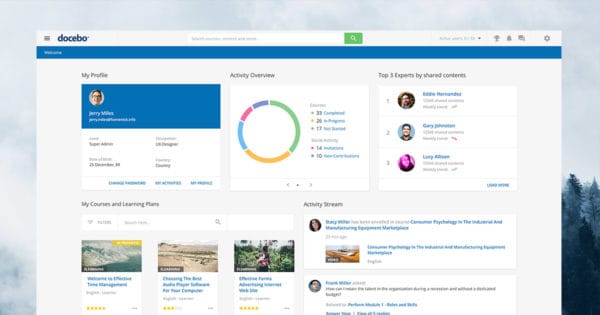

Docebo, which offers cloud-based and AI-powered e-learning through a customizable learning platform that allows customers to deliver, track and certify online courses and training, has seen its share price spike in recent trading as the world turns more towards remote work and online content delivery in the wake of COVID-19.

Toronto-based Docebo released its Q1 financials on Tuesday, showing revenue of $13.5 million, a 57-per-cent jump over the comparative period last year and an adjusted EBITDA loss of $2.4 million. (All figures in US dollars except where noted otherwise.)

The company has seen year-over-year growth in recurring revenue of over 50 per cent for all of its quarters as a public company (Docebo had its IPO last fall), with management crediting the strength to its core mid-sized enterprise market and divisions of larger global companies.

Founder and CEO Claudio Erba said Docebo has seen higher use and interest in its platform as the COVID-19 crisis has continued.

“Although we must be pragmatic and appropriately cautious in the current environment, as economies recover from this pandemic we believe there will be lasting changes in remote working behaviour that further underscores importance of LMS for every enterprise. Our focus is to continue executing our strategy to advance the platform, remain responsive to our customers’ needs, and manage growth in a capital efficient manner,” said Erba in a press release.

For his part, Tse had been calling for Q1 revenue and adjusted EBITDA of $11.4 million and negative $1.1 million, respectively, compared to the resulting $13.5 million and $2.4 million, respectively. The greater-than-expected earnings loss was caused by early investments (especially in Sales and Marketing) which the analyst thinks will drive incremental growth and operating leverage going forward.

Tse said while Docebo was a name he liked before the work-from-home shift, it’s also going to be a beneficiary of the trend on the other side of the health crisis, as remote work becomes a larger part of our reality.

“With 90 per cent of the Company’s revenue considered recurring in a market that should benefit from the push to work-from-home, Docebo has a solid and resilient base of revenue as we look ahead. In terms of balance sheet flexibility, Docebo exited the quarter with a cash balance of $43.2 million with a relatively small cash burn (negative CFO) of -$2.5 million for Q1, and we continue to see the Company tracking to positive cash flow exiting this year,” Tse wrote.

Tse’s forecasts now call for fiscal 2020 revenue and EBITDA of $56 million and negative $7 million, respectively, and for fiscal 2021 revenue and EBITDA of $79 million and $0.0 million, respectively.

With the update, Tse has maintained his “Outperform” rating but upped his target from C$20.00 to C$23.00 per share, which at press time represented a projected return of 18 per cent.

“Our thesis remains unchanged – we continue to believe Docebo’s technical edge comes from its Artificial Intelligence (AI) and Social Learning capabilities as it relates to customizing and optimizing content, but equally compelling is the Company’s sales and marketing prowess,” Tse said.