Having followed the cannabis sector since early 2013, I can say that it has been quite a wild ride. The stocks have been extremely volatile, and great fortunes have been made and lost by investors and traders in publicly traded cannabis stocks. I have been maintaining an index that illustrates the volatility of the sector, the New Cannabis Ventures Global Cannabis Stock Index:

Looking at the index returns by year helps one better appreciate the volatility, as it removes the huge spike from early 2014, which I will detail below. Note that the index is rebalanced quarterly, with all qualifying members equally weighted.

Looking at the index returns by year helps one better appreciate the volatility, as it removes the huge spike from early 2014, which I will detail below. Note that the index is rebalanced quarterly, with all qualifying members equally weighted.

- 2013: +59.1%

- 2014: -17.8%

- 2015: -70.0%

- 2016: +88.8%

- 2017: +91.8%

- 2018: -54.9%

- 2019: -34.1%

The First Wave

The very first cannabis stocks began trading in 2009, but it wasn't until Colorado and Washington voters approved legalization in 2012 that the sector really began to attract traders. The earliest companies were all relegated to the OTC and were not only speculative but also not really cannabis companies at all. Instead, there was a lot of hype from these opportunists, most of which never amounted to anything and some of which have gone away. A notable exception was GW Pharma (GWPH), which dual-listed on the Nasdaq in May 2013 (and now trades exclusively on that exchange).

The powerful rally during the first wave was caused by too many investors chasing too few companies (really bad companies!) with relatively tight floats as Colorado dispensaries opened their doors to all adults on January 1, 2014, and the momentum quickly faded. To put things in perspective, the index rose from 159.07 at the end of 2013 to a peak of 1009.98 on March 18th, a meteoric gain of 535% in fewer than three months.

The stocks came crashing back down as many more new penny stocks suddenly morphed into cannabis plays. Some of the new publicly traded companies that began trading near the end of this period were actually "real", though they were ancillary and not direct cannabis companies, including KushCo Holdings (OTCQX:KSHB) and Medicine Man Technologies (OTCQX:SHWZ), neither of which did reverse mergers to go public, in contrast to most companies.

Also at the tail-end of the first wave, Canadian cannabis companies began to gain a bigger following. At the time, the country had implemented the first federally legal medical cannabis regime, though it was somewhat slow to grow due to a lack of buy-in from doctors that were required to authorize patients. At the end of 2015, though, the promise of legalization for adult-use appeared as Justin Trudeau and the Liberal Party, which had included legalization prominently as part of their platform, gained control of Parliament. As I noted at the end of 2015, the entire market cap of the Canadian licensed producers ("LPs") was less than that of GW Pharma.

The Second Wave

The bear market following the parabolic spike in 2014 ended in early 2016, with the index reaching an all-time low at the time of 31.80 on February 18th, down 97% from its prior peak. During 2016, investors began to focus increasingly on the Canadian LPs. I created a second index then, the New Cannabis Ventures Canadian Cannabis LP Index, and it languished in the first half of the year but took off in July as investors began to better appreciate that the Liberal Party would introduce legislation. The Cannabis Act was formally introduced in April 2017 and signed into law in June 2018.

For the full year of 2016, the index gained 337.5%, far exceeding the return of the Global Cannabis Stock Index. By the time the all-time high hit in early 2018, the index had gained 1339%.

For the full year of 2016, the index gained 337.5%, far exceeding the return of the Global Cannabis Stock Index. By the time the all-time high hit in early 2018, the index had gained 1339%.

Several factors helped fuel the meteoric rise in interest in Canadian LPs, including investment bankers beginning to cover the space and help raise larger and larger amounts of capital via "bought deals", companies moving from the venture exchanges to the Toronto Stock Exchange and even Nasdaq and the NYSE beginning in February 2018. M&A and strategic investments, including the initial investment by Constellation Brands (STZ) into Canopy Growth (CGC) were prominent developments as well.

While the Canadian stocks were certainly a big part of the run-up in cannabis stocks during the second wave, there were also some key developments in the United States as well. The elections in November 2016 were a momentous occasion, with cannabis the clear winner at the polls. Key states like California and Massachusetts saw ballot initiatives for adult-use pass, as did Nevada and Maine (Arizona failed), and several states received voter approval for medical cannabis programs, including Arkansas, Florida, Montana and North Dakota. California, with its massive population and large illicit market, and Massachusetts, being the first East Coast state, were exciting, but Nevada too offered the industry a new branding test site given the tourism. That state, which had a medical program already, was able to quickly open its doors by the following summer. Florida, of course, has become the most successful medical market subsequently.

Also near the end of 2016, Innovative Industrial Properties (IIPR) went public on the NYSE after conducting an IPO, becoming the first cannabis-related company to trade on a major American exchange. This wasn't fully appreciated at the time, as the stock stagnated for almost an entire year below the $20 IPO price.

Stocks surged to new recent highs as 2017 came to an end, with investors excited about California opening to the adult-use market on January 1. Additionally, Canada's House of Commons had just passed the Cannabis Act, paving the way for the country to legalize in the months ahead. The first Cannabis ETFs had launched in 2017, with Horizons introducing its Marijuana Life Sciences ETF (OTC:HMLSF) in April on the Toronto Stock Exchange and then a well-timed conversion of the Tierra XP Latin America Real Estate ETF at the end of the year to the ETFMG Alternative Harvest ETF (MJ). This was the first ETF to be listed on a major U.S. exchange. Ironically, despite literally zero exposure to U.S. companies operating in California, the ETF was flooded with buyers not apparently understanding this dynamic.

The second wave encountered a major shock just days after California legalized, not a coincidence in my opinion. Jeff Sessions, Attorney General at the time, rescinded the Cole Memo, a move that introduced tremendous uncertainty for industry investors and operators who no longer knew how the Federal government might change its enforcement policies given that cannabis remained federally illegal. While things remain murky to this day, though we have seen baby steps at the federal level in terms of bipartisan discussion of some key issues, like banking and research, the shock seemed to end when President Trump and Republican Senator Cory Gardner struck an alleged deal in April 2018 indicating that the President would support congressional efforts to protect state-legal cannabis.

Investor sentiment quickly improved, and several American cannabis companies went public through Canada via reverse-mergers on the Canadian Securities Exchange. These multi-state operators ("MSOs") included MedMen (OTCQB:MMNFF), Green Thumb Industries (OTCQX:GTBIF), Trulieve (OTCQX:TCNNF) in Q2 and Q3 and then Acreage Holdings (OTCQX:ACRGF), Cresco Labs (OTCQX:CRLBF), Curaleaf Holdings (OTCPK:CURLF) and Harvest Health & Recreation (OTCQX:HRVSF). Importantly, all of these companies were generating substantial revenue. Similarly, leading CBD company Charlotte's Web (OTCQX:CWBHF) conducted a true IPO in Canada on the Toronto Stock Exchange. Finally, investors were able to invest in real companies. Of course, Tilray (TLRY) was the first Canadian LP to list directly on a major exchange and rallied from its IPO price of $17 to a high of $300 within months. Near the end of 2018, Altria (MO) made a $1.8 billion strategic investment into Cronos Group (CRON).

The second wave had already seen its highs, and the flood of supply weighed heavily on the sector, leaving the cannabis sector down almost 55% in 2018. Stocks in general ended down in 2018, with a very tough Q4, but they rebounded to begin 2019, as did the cannabis sector. During Q1, the Global Cannabis Stock Index rallied over 57%, but the balance of the year proved disastrous. A leading catalyst for the poor performance was the emergence of the vaping crisis in September, which was really an illicit market issue but one that led to some states suddenly halting the legal sale of highly popular vaping products, precipitating a capital crunch.

Before the pandemic, another industry black swan event, hit in early 2020, the industry was continuing to struggle despite the vaping crisis fading. The public companies were moving quickly to reduce the cash burns in their business and to rationalize their operations. During the early days of the second wave, investor optimism resulted in weak capital structures, incentives to grow too quickly and poor corporate governance. Investors threw money hand over fist at Canadian LPs, who proceeded to race to build global empires. MSOs had to operate much leaner, but they still raced to plant flags in as many states as possible rather than focusing on building excellent organizations. M&A deals were expensive and ill-conceived.

The last several months of the second wave, which culminated in my view with a blowout low in March, began in July, when CannTrust (OTCPK:CNTTQ) revealed that it was flagged by regulator Health Canada for compliance issues. Then listed on the NYSE, the company was a highly respected company among the leaders in terms of revenue that had just raised $170 million in a secondary offering. At the same time, Constellation abruptly fired Bruce Linton, co-founder and co-CEO of Canopy Growth, a signal to investors that not all was well in Smiths Falls. Earlier in the year, Vic Neufeld departed from his role as CEO of Aphria (APHA) after the company struggled with governance issues.

Even without the vaping crisis and the pandemic, the industry was going to struggle. First, the roll outs in key markets were disappointing. Canada has suffered from a lack of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets (as well as the illicit Canadian market). California still lacks sufficient retail distribution, especially in Southern California. Massachusetts has been extremely slow to roll out its program. Both of these states suffer from a not-in-my-backyard philosophy that is far too prevalent. An interesting contrast, by the way, has been the highly successful Oklahoma medical cannabis program, which is a de facto adult-use program.

Another challenge is that the Canadian companies (not the American ones) were overbuilt for both Canada as well as the rest of the world. Europe has been very slow to develop despite a German medical cannabis program that features pharmacy distribution and reimbursement by insurance companies. The companies have abandoned several new projects and have written off many production assets.

Finally, for any investor who didn't really understand the ramifications of the capital crunch, they became apparent late in the year. While stocks in general were continuing to march to all-time highs, cannabis stocks continued to be pressured as companies that were able to do so sought to address weak capital structures. Equity sales increased despite relatively low prices, and a rather dramatic move by Aurora Cannabis (ACB) to allow holders of its convertible debt maturing in early 2020 to convert at a reduced price to equity through a convoluted process weighed very heavily on the sector. The index, which had dropped for 8 consecutive months, ended the streak with a meager 1.1% gain in December due to a last-day rally, but it ended up dropping 21% in the 4th quarter. During that same time, the S&P 500 advanced more than 8%. The first two months of 2020 extended these trends, with the Global Cannabis Stock Index declining 25.6% while the S&P 500, after initially rallying about 5%, fell 8%.

Tying it all together, the second wave began in February 2016 and ended in March 2020. Measuring from those points, the Global Cannabis Stock Index fell 46.5% as the second wave ended below the trough of the first wave. At the same time, the S&P 500, excluding dividends, returned 26.5% over those 49 months.

The Third Wave

I didn't immediately grasp this in March, but I believe that the pandemic will ultimately serve as the most important catalyst for growth of the legal cannabis industry to date. In the early days, it was not clear how things would play out from both a supply and demand perspective. With the exception of Massachusetts, which shut down adult-use sales while continuing to allow medical sales, every single jurisdiction deemed cannabis an "essential service", a decision that illustrates how cannabis has overcome stigma to become mainstream.

Still, operations were extremely challenged across the country and in Canada, with many operators forced to move to delivery or curbside pickup. Many of these jurisdictions had never permitted these forms of transactions. Early reports are that many of the leading operators were able to quickly implement delivery and curbside and are finding that it has allowed them to serve an even larger base of consumers. I believe that these temporary changes will become permanent, and this leaves me increasingly confident in the ability of the industry to better compete with the illicit market, which, frankly, has several advantages, an important one of which is convenience. With the ability to serve customers with delivery or order-ahead, legal operators have one huge advantage over illegal ones: They can transact over the internet, allowing consumers to enjoy the experience of ordering cannabis just like they procure other goods. Curaleaf and Trulieve pointed out on their earnings calls that they have been able to accept electronic payments, and Columbia Care (OTCQX:CCHWF) has offered a credit card for more than a year now.

It was difficult to determine initially whether the spike in demand was simply pantry-loading or sustainable, but now, two months later, it is quite clear that demand has continued to increase for legal cannabis, based on data. Looking ahead, the weak economy may hinder some demand as well as lead to pricing pressure as consumers trade down, but I expect new consumers to enter the market as they attempt to deal with anxiety and sleep issues.

The real driver of legal cannabis demand is making it legally available. I have already pointed to the potential of new consumers entering the market where it is already legal and perhaps some conversion from the illicit market as convenience increases. Another driver of this trend could be an increasing awareness and appreciation of health and wellness, and illicit market consumers, on the back-end of the vaping crisis as well as current pandemic, may opt for regulated and tested cannabis, even at higher prices. Bigger than these drivers, though, will be a wave of legalization ahead.

I was optimistic as we began 2020 that the legalization in Illinois would be a major catalyst for the proliferation of legalization across the country. This was the first time a state had legalized through the legislative process rather than through the ballot box, a major departure from the way things have developed over the last seven years since the voters in Washington and Colorado approved adult-use. The key advantages are speed and a stronger program. After a successful ballot initiative, the legislature must then work out the details ahead of implementation, adding time. In the case of Illinois, the roll out was spectacular, as the state designed what I believe has been one of the best legal programs to date.

The pandemic has killed my thesis, for now, as states have bigger fires to extinguish. A key state that many had expected to go legal this year, for example, was New York. Now, though, the case for cannabis has been strengthened, as states are pressured to help address massive budget deficits and soaring unemployment. Later this year, voters in New Jersey and very likely Arizona will get the chance to have their states join Alaska, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Nevada, Oregon, Vermont and Washington (as well as the District of Columbia), where cannabis is legal for adult-use (note that Maine, Vermont and the District of Columbia don't yet have commercial programs). Over the next two years, we could see a wave of legislative approvals, with states likely to do so including Florida, Minnesota, New Mexico, New York and Pennsylvania.

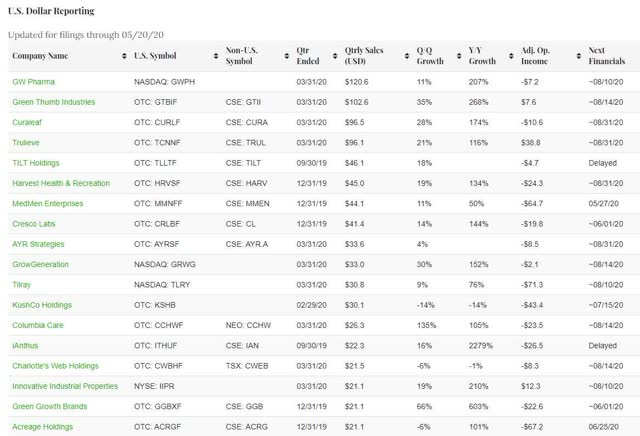

As we move into this next phase of development for the publicly traded cannabis sector, I believe that many of the MSOs are surprisingly well positioned considering the many obstacles they face, including being relegated to junior exchanges. We have been keeping track of industry leadership with the New Cannabis Ventures Public Cannabis Company Revenue & Income Tracker. While the largest Canadian LPs have lower revenue and massive operating losses, the leading MSOs are breaking through the $100 million quarterly revenue milestone and operating at or near profitability.

To be clear, there are haves and have-nots in the sector, and the differences are rapidly becoming clear, with several MSOs able to raise debt capital and execute sale/leasebacks, allowing them to fund growth without dilution. The rising tide I envision won't lift all boats, and those companies with access to capital and the ability to generate cash flow from operations will gain share. I should point out that I am tracking several private MSOs that share these characteristics as well.

To be clear, there are haves and have-nots in the sector, and the differences are rapidly becoming clear, with several MSOs able to raise debt capital and execute sale/leasebacks, allowing them to fund growth without dilution. The rising tide I envision won't lift all boats, and those companies with access to capital and the ability to generate cash flow from operations will gain share. I should point out that I am tracking several private MSOs that share these characteristics as well.

While some markets have been slow to develop due to regulatory burdens, I expect Canada and California to improve, ultimately fulfilling the expectations of investors at the top of the second wave. For the same reasons that will stimulate more aggressive adoption by new states, these existing markets are likely to see less resistance to a more rapid expansion of retail distribution.

I have become more bullish since early May as I have thought through the challenges and opportunities for the industry and have factored recent data into my outlook, but I am not a blind bull. Years of observing the industry have conditioned me to understand how the industry moves in fits and starts and to appreciate that everything seems to take longer than expected. I continue to expect cannabis to remain federally illegal for quite some time and believe it will be challenging to implement a federally legal program (look at Canada!), but that has actually never been part of my investment thesis. With that said, I expect cannabis investors to get overly optimistic should the Democrats take control of the Senate in November.

While I don't expect legalization, I do hope for and even anticipate some reforms that would tremendously strengthen the American cannabis industry, and I anticipate that Democratic control of Congress, no matter whom is President, would hasten things that are hard to continue to prohibit, like research and banking. At present, the medical benefits and risks of cannabis are not studied amply, as conducting this research can risk federal funding. The credibility of the industry, which relies primarily on anecdotal evidence, will always be questioned until proper clinical trials are conducted, like the ones GW Pharma did to gain approval of Epidiolex to treat seizures in patients with rare forms of treatment-resistant epilepsy.

The banking issue is the height of absurdity. Unlike power companies, which sell a lot of electricity to legal (and illegal) cannabis operators with absolutely no recourse, banks are reluctant to accept deposits from cannabis operators or companies that sell equipment or services to the industry (no problem, though, with banking power companies!). Lacking regulatory clarity, most but not all banks shy away. The SAFE Banking Act would be an important first step in addressing a public safety issue, allowing the industry to more easily access traditional banking. It's not yet clear how things will play out, but the ability to accept credit cards would be a game-changer. Even better, access to traditional mortgage debt would unleash non-dilutive capital.

One change that would most quickly reward cannabis investors is extremely difficult to handicap but could become the most important driver of returns, and that is a willingness of the major exchanges to list cannabis operators. At present, Canadian companies dominate the cannabis-related listings on those exchanges, but, increasingly, ancillary companies have been able to maintain listings or even conduct an IPO. It's no surprise to me that GrowGeneration (GRWG) has rallied dramatically over the last six months since it was able to migrate from the OTC. The stock is currently up 62% in 2020. As the SAFE Banking Act is written in its current format, this issue isn't explicitly addressed, but if the exchanges are able to view listing MSOs as riskless to them legally, they would likely open their doors, which would dramatically expand the investor base, leaving it more institutional.

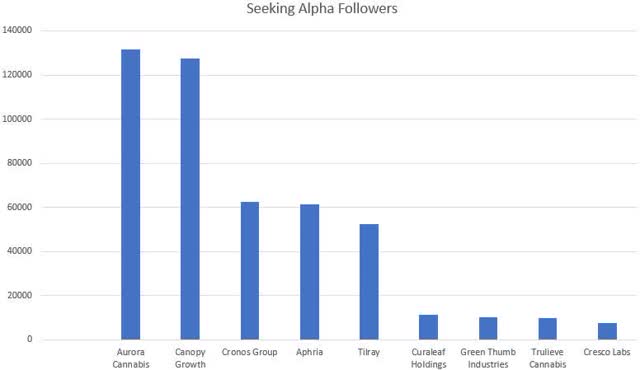

As a contrarian, I look positively at things like the relatively low number of followers here at Seeking Alpha for the leading MSOs compared to the Canadian LPs despite a presumed home-court advantage given the relative population sizes:

Each of the companies has a market cap in excess of $1 billion. Despite generally higher revenue and substantially better profitability, the largest American MSOs are wildly less popular than the largest Canadian LPs. I believe the higher exchange listings for the LPs are helping create this disparity. Oddly, even GW Pharma (47,649 followers) and Innovative Industrial Properties (23,112 followers), which have offered better fundamental performance and returns for investors, lag the largest LPs. Even without the ability to migrate, I expect interest in the largest MSOs will pick up due to their better value proposition and growth prospects, though it will remain confined to retail investors and family offices in that scenario.

Each of the companies has a market cap in excess of $1 billion. Despite generally higher revenue and substantially better profitability, the largest American MSOs are wildly less popular than the largest Canadian LPs. I believe the higher exchange listings for the LPs are helping create this disparity. Oddly, even GW Pharma (47,649 followers) and Innovative Industrial Properties (23,112 followers), which have offered better fundamental performance and returns for investors, lag the largest LPs. Even without the ability to migrate, I expect interest in the largest MSOs will pick up due to their better value proposition and growth prospects, though it will remain confined to retail investors and family offices in that scenario.

Conclusion

The first wave of cannabis stock investing was a poorly informed retail audience piling on a momentum trade where the low-quality companies never had a chance to succeed, and it ended quickly. The second wave saw the public sector become more investible, but poor governance, overly aggressive expansion and weak capital structures by companies and excessive speculation by investors resulted in extremely negative returns for the sector despite its fundamental progress during a time of favorable returns in the broader market. Following an extreme capital crunch brought on by two black swan events, the third wave begins with strong companies within the sector and potentially new entrants that are building their companies on sounder fundamental principles in the position to finally deliver on the promise of legalized cannabis that investors have been pursuing for more than seven years.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Business relationship disclosure: At New Cannabis Ventures, we work with several publicly-traded companies, including Aurora Cannabis, Charlotte's Web, Cresco Labs, Fire & Flower, INDIVA, KushCo Holdings, Organigram, Plus Products, Schwazze (Medicine Man Technologies), TerrAscend and Vireo Health, providing each of them with Investor Dashboards. Please see our disclaimer for more detail: https://www.newcannabisventures.com/disclaimer/ . None of these companies has paid me to write this article, and I am not recommending investment in any company mentioned in this article, including the clients of NCV.