I prefer bullion myself. Archive image.

The rally in the gold price gained fresh momentum on Tuesday as investors piled into physically-backed gold ETFs to secure hard assets amid expectations of continued global ultra-low or negative interest rates and currency debasement.

Gold for delivery in August, the most active contract on the Comex market in New York with 19m ounces traded by lunchtime, touched a high of $1,810.80 an ounce, up 1% from yesterday’s settlement.

Gold is now up 19%, or $287 an ounce so far this year. The last time gold traded above $1,800 an ounce was September 2011, but it ended that year at $1,565 an ounce.

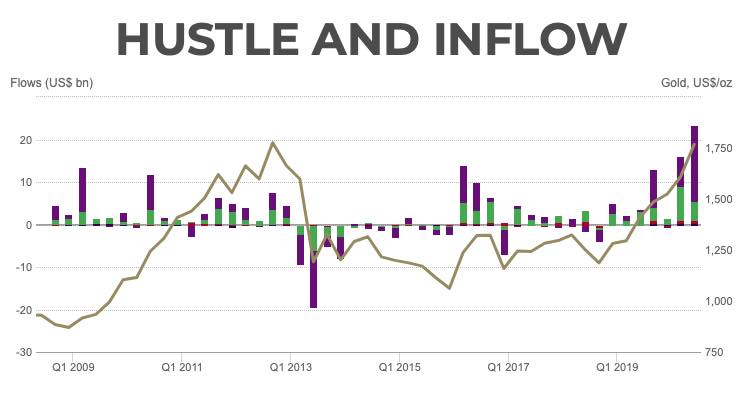

H1 inflows are also significantly higher than the multi-decade record level of central bank net purchases seen in 2018 and 2019

The World Gold Council reported Tuesday that gold-backed ETFs recorded their seventh consecutive month of positive flows, adding 104 tonnes in June – equivalent to $5.6 billion.

June’s net inflows took global holdings to new all-time highs of 3,621 tonnes after 734 tonnes – worth $39.5 billion – were added to vaults during the first six months of the year.

This year’s inflows compare to the previous record set in 2009 when 646 tonnes were added – for the entire calendar year. In terms of dollar value, first half inflows also dwarf the 2016 total of $23 billion, according to the WGC:

“To put this strength of demand into context, H1 inflows are also significantly higher than the multi-decade record level of central bank net purchases seen in 2018 and 2019, and could absorb a comparable amount of about 45% of global gold production in H1 2020.”

In June, global gold ETFs registered three consecutive days of outflows near the beginning of the month – the first consecutive daily declines since March – before regaining momentum.

All regions saw net inflows during the month, with North American funds accounting for the lion’s share, says the WGC.

Source: World Gold Council

Source: World Gold Council