The bull market in gold (GLD) and silver (SLV) is the real deal. The price of gold at $1,844 per ounce is quickly approaching its all-time of $1,920 set back in 2011. Similarly, silver has gained upside momentum with a sharp rally in recent weeks breaking above the important $20/oz resistance level and now trading at $21.60. The combination of unprecedented levels of global fiscal and monetary stimulus coupled with record low interest rates is supporting the outlook for precious metals as a store of value amid uncertain macroeconomic conditions.

Supply and demand fundamentals are also positive with pressured mining output worldwide this year along with a wave of physical buying. Indeed, any bears betting against the sector is in a difficult spot attempting to go against the trend. What we highlight below are several gold and silver mining stocks that for various reasons have attracted relatively high short interest. In an environment where the commodity price continues to climb higher, shares in these miners can be supported by a bullish tailwind. The possibility that shorts are forced to cover can drive a further rally higher.

(Source: finviz.com)

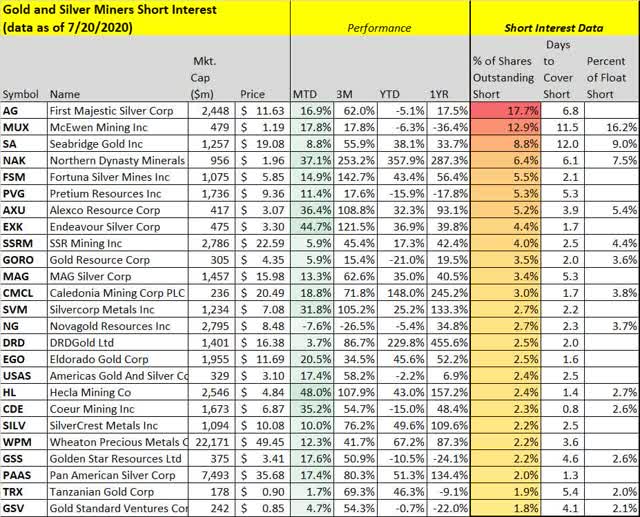

Short Interest Among Precious Metal Miners

The first point here is that short-selling among gold and silver miners is not a widespread phenomenon this year. Our data shows across a universe of approximately 180 gold and silver miners with a market cap above $50 million, the median average short interest as a percentage of total shares outstanding is only about 1%. The other dynamic is that for many small and micro-cap miners that only trade with over-the-counter shares, these stocks are not easily available for shorting and do not have readily available short interest data.

(Data by YCharts/table BOOX Research)

(Data by YCharts/table BOOX Research)

The list above highlights the miners we find with the most significant short interest levels. For context here, the world's two largest gold mining companies in Newmont Corp. (NEM) and Barrick Gold Corp. (GOLD) each have reported short interest at 1.3% and 0.8% of outstanding shares respectively as a benchmark. The days-to-cover metric which reflects the number of shares reported short relative to average trading volume along with the number of shares short as a percentage of the stock's float is also included.

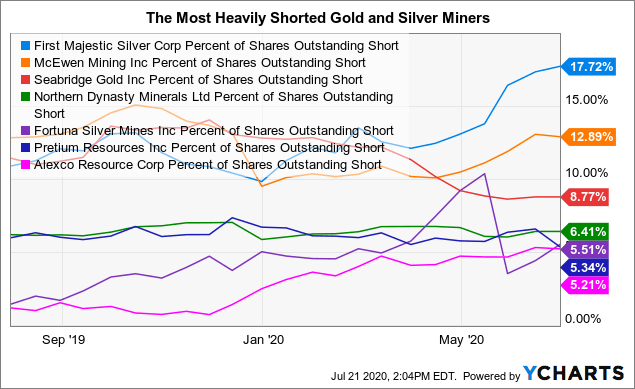

We find that First Majestic Silver (AG) with a market cap of $2.5 billion is the most heavily shorted miner with 17.7% of total shares outstanding reported short. The stock has underperformed in 2020, down by 5.1% year to date as of July 20th but impressively gaining momentum this month, up 17% in July. Similarly, McEwen Mining Inc. (MUX) with a market cap of $480 is also primarily a silver producer and has underperformed this year down by 6.3%. MUX has a reported short interest of 12.9% according to our data.

Data by YCharts

Data by YCharts One explanation for the bearish sentiment towards these names is related to their mining exposure to Latin America. During the early stages of the COVID-19 pandemic, various jurisdictions temporarily suspended mining operations leading to significantly lower production in the quarter. In Mexico, all non-essential businesses were ordered to be shut down by the local governments for much of April and May with similar measures taken in other countries like Peru and Argentina and even South Africa.

Most mining companies faced challenges dealing with COVID-19 including taking additional efforts to deal with safety which pressured productivity in the quarter. Overall, a trend in the sector has been higher all-in-sustaining-costs and weaker production in Q2. The upside is that the more limited global gold and silver output is a bullish theme for the commodity price.

First Majestic Silver reported that its Q2 production fell 45% year over year highlighting the near-term weakness. McEwen also announced Q2 output was down by more than 50% year over year pressured by the COVID-19 circumstances. The latest development is that operations are ramping up towards a more normal schedule.

(Source: finviz.com)

Essentially, traders have targeted these names with an expectation that the weak near-term operating conditions can pressure cash flows and their financial profile. On the other hand, if we consider that the disruptions caused by the COVID-19 pandemic and mining stoppages are only temporary, bullish investors can look ahead towards 2021 as these companies can normalize output. Favorably, the surging price of gold and silver can mitigate the weaker production results for the year.

In other cases, the higher short interest may simply reflect a view by traders that the recent rallies are overextended and shares have become expensive relative to fundamentals. That's could be the case with Northern Dynasty Minerals Ltd. (NAK) which is up 360% year to date as one of the best-performing stocks in the sector.

(Source: finviz.com)

NAK is an exploration and development phase mining company which currently has no producing mines or revenues. For these junior mines with limited or no revenues, the stock valuation is based more on the long-term expected value of their asset base. A recent report that NAK's "Pebble Mine" in Alaska is set to receive approval to begin construction has added to the bullish momentum. The higher price of gold makes the asset base more valuable.

Analysis And Forward-Looking Commentary

When investing in mining stocks it's important to be selective. Trends in fundamentals like production estimates, operating margins, cash flow generation, profitability, balance sheet strength often separate the winners from the losers. That being said, in a scenario with a surging commodity price of gold and silver, the revenue upside and asset valuation benefit can often cover some of the weaknesses.

By looking at the short interest data, we can identify some stocks that could gain with the potential that shorts begin to reassess the bearish case and close their positions. This dynamic is simply an incremental component to the upside potential.

We remain very bullish on precious metals and related miners. While it's likely not to be a straight line higher, we believe dips should be bought and investors can consider adding to allocation over days and weeks on any weaknesses to improve the cost basis. Our year-end price targets are $2,200/oz for gold and $25.00/oz for Silver, while related miners should have even more upside in percentage terms.

Silver has lagged gold this year based on its more industrial demand aspect pressured from the broader macro concerns. We highlight the ETFMG Prime Junior Silver ETF (SILJ) as a good option for investors to gain diversified exposure to small-cap silver miners including many of the stocks on the list above. We previously covered SILJ in an article here on Seeking Alpha and reaffirm our bullish thesis. The recent surge in silver which is now beginning to catch up to the gains of gold and represents a powerful tailwind that can drive further upside in silver miners. We hope the list serves as a starting point for further research.