TWO OF THE TOP MINING ENTREPRENEURS ON THE PLANET HAVE JOINED FORCES FOR THE SECOND TIME! THIS IS SURE TO SPELL BIG NEWS FOR GOLD INVESTORS.

Gold X Mining Corp. (TSX.V:GLDX, OTCQX:SSPXF) is the company and the potential it holds is huge.

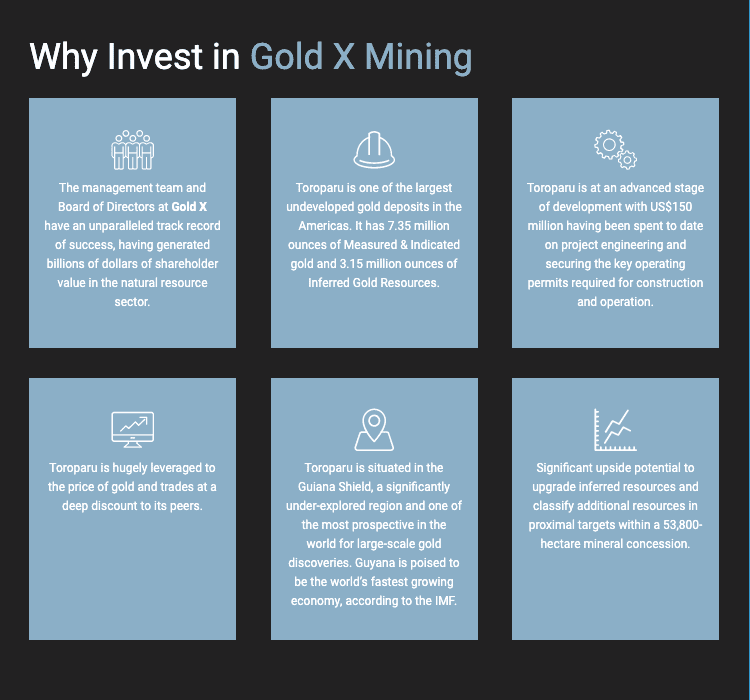

Gold X is advancing one of the largest undeveloped gold deposits in the Americas towards a production decision. The management team and board running this venture have an unparalleled track record of success, having developed and sold numerous resource companies in their careers, creating many billions of dollars of shareholder value in the process. And in the middle of this sensational bull run on gold, we believe their story has much further to go…

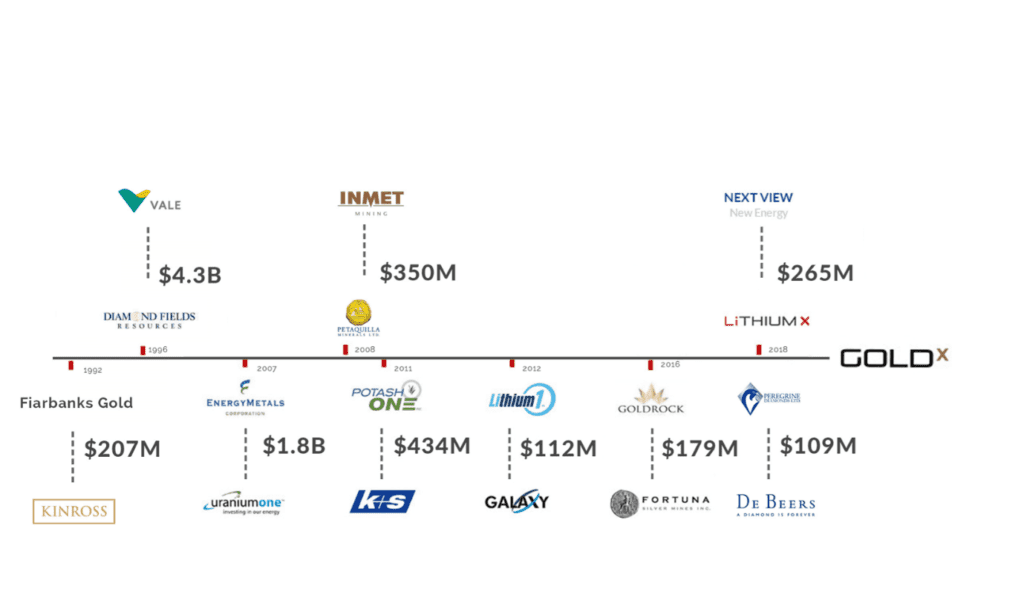

Great things happen when serially successful mining entrepreneurs join forces to forge a path to future fortunes. Paul Matysek and Robert Friedland are two such individuals. Paul, a geologist/geochemist by background, has created immense value for shareholders, not once, not twice, but FIVE times over! That’s right, he has been CEO and/or Chairman of five successful natural resource companies, each of which he developed and subsequently sold, generating C$2.8 billion of shareholder value!

Paul has built his unparalleled reputation by selling companies at a premium in natural resources including uranium, potash, lithium, and gold. His formula has been to find deeply undervalued assets in resources he thinks have strong underlying fundamentals for price appreciation, and methodically de-risk those assets, to a point where an eager buyer sweeps in to purchase them at a premium. For instance, back in 2004 uranium was around $10 per lb. He saw a potential price increase and took a gamble. It paid off when the price of uranium rocketed to above $100 and Paul sold Energy Metals to Uranium One for C$1.8 billion in 2007, just before the global financial crash.

He followed this up in 2011, when he teamed up with Gold X Chairman Robert Friedman. Together they developed and sold Potash One to K&S for C$434 million in a similar story of leveraging the price of potash to benefit shareholder returns. A year later Paul sold Lithium One to Galaxy Resources for C$112 million.

In 2016, Paul and Gold X CFO Bassam Moubarak sold Goldrock Mines to Fortuna Silver for C$179 million, and most recently, in 2018, Paul, Bassam and Gold X strategic advisor Brian Paes-Braga again developed and sold Lithium X to NextView New Energy for C$265 million. Prior to teaming up with Paul, as CFO Bassam helped put Petaquilla Minerals into production by raising in excess of US$ 120 million and played a key role in the sale of Petaquilla Copper to Inmet for C$350 million.

If that isn’t enough bench strength, there’s newly appointed Gold X Chairman Robert Friedland, who has amassed a personal fortune of $1.1 billion according to Forbes, predominantly from the resource sector! Having spent the past five decades making a name for himself in the mines of more than 30 nations, he has led some of the world’s biggest mineral discoveries during this time, including Oyu Tolgoi, Voisey’s, Fort Knox and Kamoa Kakula. Throughout this journey he has raised over $25 billion on world capital markets for his Ivanhoe Group of Companies, a staggering sum used to advance a diverse portfolio of natural resources exploration and development projects!

In terms of transactions, Friedland first sold Fairbanks Gold’s Fort Knox Deposit to Kinross in 1992 for C$207 million. Then, in one of the most legendary transactions in mining history, he sold Diamond Fields to Inco (now Vale) for C$4.3 billion after discovering the Voisey’s Bay nickel deposit in 1996. In 2011 he teamed up with now Gold X CEO Paul Matysek to sell Potash One to K+S and most recently, in 2018, sold Peregrine Diamonds to DeBeers for C$109 million.

In fact, Friedland is such a well-known developer of natural resources that he has been inducted into the prestigious Canadian Mining Hall of Fame. As a side note, Friedland very rarely sits on the board of companies outside the Ivanhoe Group of Companies, so he clearly sees potential in Gold X and its management team.

READ OUR SPECIAL REPORT – For a deep dive into the huge opportunity and leading management team that Gold X has brought to the market.

AN UNTAPPED NATION

Guyana is a small South American country sharing borders with Brazil, Suriname and Venezuela. Guyana is home to Gold X’s Toroparu Project, one of the largest undeveloped gold deposits in the Americas, it has a 7.35 million ounce Measured and Indicated gold resource with significant copper and silver credits, and is at an advanced stage of development after having spent US$150 million on the project to date.

Formerly known as Sandspring Resources, Paul Matysek rebranded the company as Gold X Mining Corp. He saw unbridled promise in the Toroparu Project, as a world class opportunity for leveraging gold price momentum to create significant shareholder value. This project had been flying under the radar for many, many years. Paul Matysek spotted its potential and jumped on the opportunity to leverage its hidden prospects to the rising price of gold. His newly appointed Chairman Robert clearly sees the scope of opportunity in Toroparu as well.

The International Monetary Fund (IMF) has projected Guyana to become one of the world’s most rapidly growing economies! Despite the oil price war and reduction in demand caused by Covid-19, the IMF sees a growth projection of 52.8% for Guyana this year alone based on initial production from the massive offshore Guyana oil fields with more than 8 Billion barrels discovered to date by Exxon Mobil Corp. It is an English-speaking democratic republic governed by British Common Law and a member of the Commonwealth of Nations, World Trade Organization and CARICOM.

The excitement around Guyana gained momentum after oil major ExxonMobil made major discoveries and set offshore production on an explosive path. The country is also well endowed in gold, bauxite, magnesium and hydro. In terms of gold, Mark Bristow from Barrick Gold has been quoted as saying that the Guiana Shield is “a significantly under-explored region and one of the most prospective in the world for large-scale gold discoveries.”

Gold X has already cultivated a long-term relationship with the Guyanese government and local population. Furthermore, both Paul Matysek and Robert Friedland have experience in Guyana and the knowledge required to unlock the deep value hidden there.

READ OUR SPECIAL REPORT – For a deep dive into the huge opportunity and leading management team that Gold X has brought to the market.

M&A ACTIVITY HEATING UP IN GUYANA

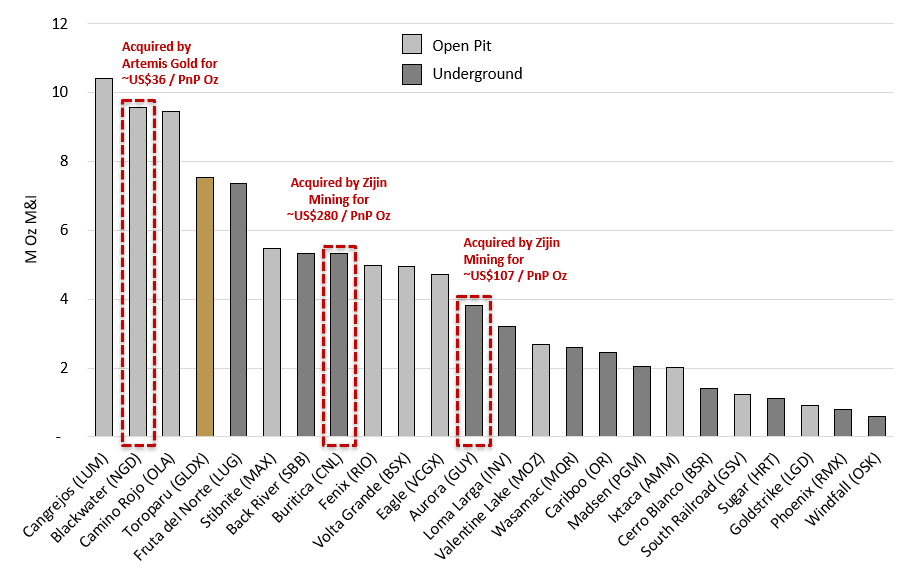

A bidding war just took place for Guyana Goldfields’ Aurora mine located 58km to the northwest of Gold X’s Toroparu deposit, which looks to be over after Zijin Mining offered C$323 million for the project. Zijin, one of China’s largest state-controlled gold producers with a market capitalization of approximately US$20 billion, also bought Continental Gold and its Buritica deposit in Colombia last year for C$1.4 billion.

One of the competing bidders for Guyana Goldfields was Gold X’s largest shareholder Gran Colombia who made a joint bid to acquire Guyana Goldfields and Gold X based on major synergies it saw in combining the Aurora mine and Toroparu deposit. Gran Colombia believed that combining the two deposits would both significantly de-risk starting underground production at Aurora while simultaneously reducing the capital cost required to start production from the 5 M-oz Toroparu open pit by approximately US$200 million.

PROVIDING UNPARALLELED LEVERAGE TO A RISING GOLD PRICE

The price of Gold has been rocketing upwards for the past two years and with the world in chaos it shows no signs of slowing down anytime soon. This bull run is providing the perfect conditions for early investors in Gold X to generate record returns, as the Toroparu project provides unparalleled leverage to this rising gold price. The net present value (NPV) set at 5% works out around US$495 million when gold is $1,300/oz, increasing dramatically to US$760 million at $1,500/oz gold!

Major financial institutions are forecasting the long-term price of gold to be upwards of $1,500 per ounce, but of course it is far higher than that today at over $1,800 per ounce. The price of gold tends to rise as geopolitical tensions intensify. With Covid-19 still rampaging, the US-China trade war intensifying, Russia ramping up tensions globally and general worry all round, the price of gold seems likely to remain on an upward trajectory as we navigate these turbulent times.

Just last week Gold X undertook a major milestone when its creditors gave a show of faith and commitment to the project by converting their debt into equity 28 months before maturity. This resulted in Gold X converting US$20 million worth of secured convertible debentures into equity at C$3.20 per share. Gold X is now debt free with a significantly improved balance sheet, and shareholders enjoying 100% ownership of the Toroparu deposit.

The conversion gives Gran Colombia Gold (TSX:GCM) a 20.2% equity ownership stake in the company and Wheaton Precious Metals (TSX:WPM) a 9.5% stake.

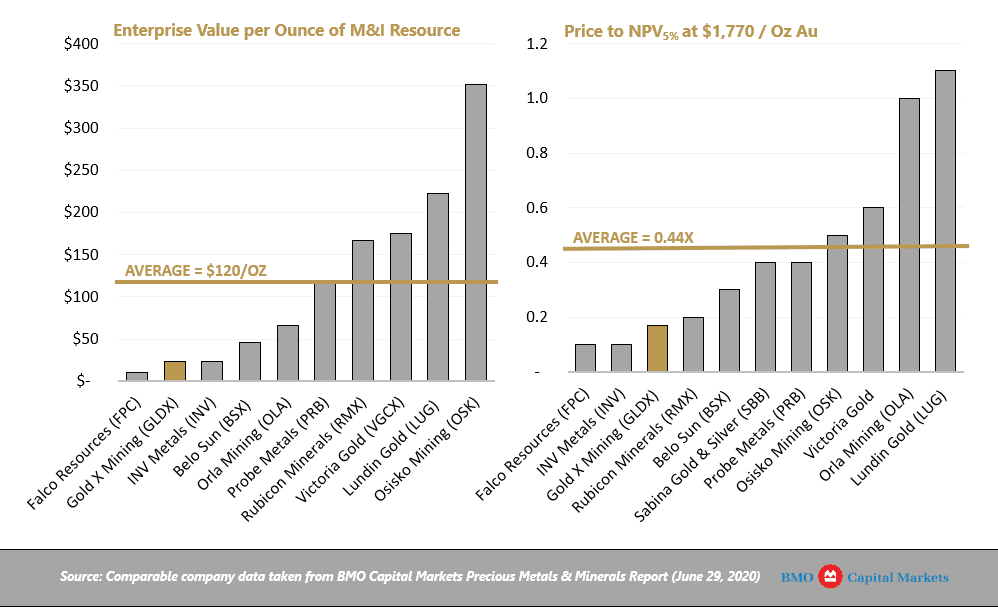

Despite its size and advanced development stage, Gold X trades at a deep discount to its peers. The next phase of exploration in the second half of 2020 could add significantly to the value of the project and could see Gold X further enhancing the potential to become a takeover target as part of a consolidation of gold mining assets in Guyana.

Gold X’s 53,800 hectare concession also has significant potential for additional satellite or larger scale gold discoveries, increasing its attraction to investors.

READ OUR SPECIAL REPORT – For a deep dive into the huge opportunity and leading management team that Gold X has brought to the market.