RE:Good post RedThis is a fantastic discussion to have Bubba140. Also glad that bovalena, redrum, highper, etc. are providing great input this week. It's important for management to review and respect all of the input that I've seen here. It reinforces that management behavior is always subject to review and questioning and criticism. Also that the behavior will be compared to other management teams in the region. When shareholders put some thought and research into their comments it's constructive, not bashing.

As I said, the granting of options and the timing of insider selling is always a source of concern and subject to comment. I agree with questions related to the timing. But I also think the magnitude of the dilution has been much more reasonable than I've seen with other management teams. And when I saw AMK selling off 25% of their interest in Treaty Creek to outside investors, for example, I got a lot more steamed over that than a 2% options dilution by TUO because I was an AMK shareholder at the time (to the point where I moved that money to TUO). Imagine what we'd be saying on this board if Dino had knocked down the TUO interest in Treaty to 15%. I've already posted what I thought of the Tudor $.10 option grants to insiders (and the wives of insiders) when the stock was selling for $1.26 on the open market.

You make a great point with respect to ArcWest and the Todd Creek option. When compared to the Del Norte deal with Big Ed, it looks like ArcWest did a better deal. But if we were over on the ArcWest bulletin board talking about their two options with Teck it would be a different story. Those were written very much in favor of Teck, probably to get the big name miner into the picture. Dino would look like a genius with the Del Norte deal by comparison. There are few folks with the knowledge of Big Ed that I would like to see working Del Norte, and the commitment for exploration was several million dollars. Also, how did you think Mr. Sprott got into his Decade investment? As a Decade shareholder, I apprciated that.

Everyone has different perspectives, and you present perfectly valid facts and opinions. From my angle, it looked like an OK way (not perfection) to get some work done on Del Norte, since I doubt that Barrick was asking Dino for a chance to spend $15 million on those claims. On a different topic, I'm surprised I'm not seeing everyone over on the ArcWest board. They are being very aggressive, have Jeff Kyba looking for properties, and the stock has not yet been discovered.

Would love to see discussions of this type continue, because the future of the company will be more important to all of us than the past. After the latest investment by Mr. Sprott the press release indicated some of the money would be used to acquire additional properties. This is a significant move on the part of TUO to go hunting for more claims. It's a great time because there are good properties out there that are still being sold cheaply by companies that have not had the success of TUO. So we can now be aggressive. But I'd love to see input on how best to do that. Mr. Sprott has said he looks at these boards. I know the folks at TUO do as well. We have the opportunity to influence the future direction if the ideas are good. That might be fun, no?

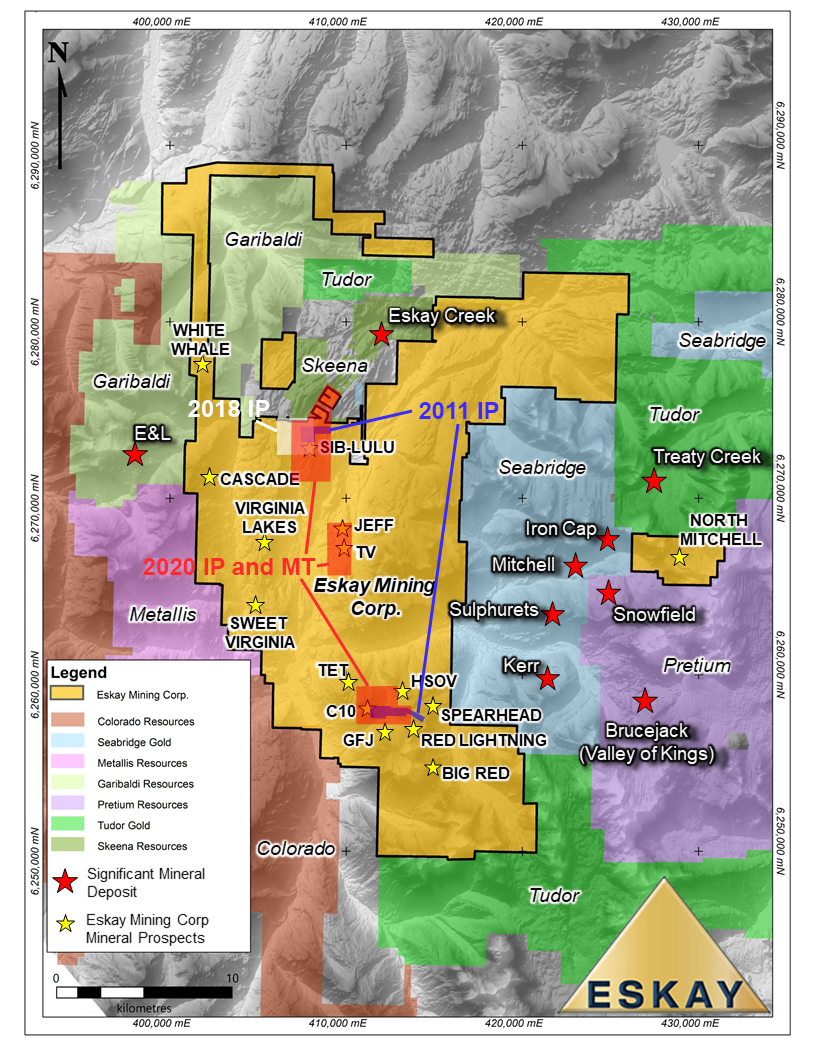

So let me start that conversation. Eskay Mining has a claim they call North Mitchell. It borders Treaty Creek (north), Pretium (south), and KSM (west). It's right in the middle of everything going on in the Sulphurets Fault system. I'd love to get my hands on it. Can we?