WHILE BHP’S TARGET IS LESS THAN PERFECT, IT DOUBLES RIO TINTO’S GOALS OF CUTTING OPERATIONAL (SCOPE 1 & 2) EMISSIONS TO 15% BELOW 2018 LEVELS BY 2030.

While BHP’s target is less than perfect, it doubles Rio Tinto’s (ASX, LON: RIO) goals of reducing operational (Scope 1 & 2) emissions to 15% below 2018 levels by 2030.

“We are … realistic about the magnitude of the task that the world faces in meeting the Paris goals,” chief executive Mike Henry said in a webcast.

“Unfortunately, today the world is not currently on track … The world will need to increase action if it is to achieve the ambitions of Paris.”

BHP had already pledged to achieve net zero operational — scope 1 and 2 — emissions by 2050. It had also said it would bring those emissions below fiscal 2017 levels by the 2022 financial year.

A study published in May showed that eight of the world’s top ten largest mining companies were not doing enough to help keep global temperatures from increasing by less than 2°C a year by 2050.

Hardest to tackle

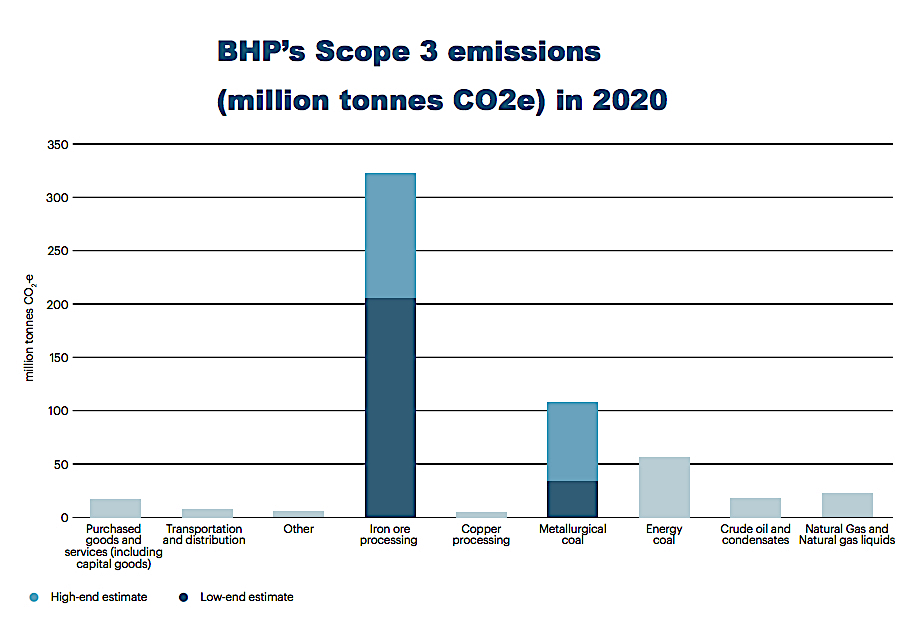

Scope 3 emissions are undoubtedly the hardest to tackle, but since they account for as much as 97% of BHP’s total, and are larger than Australia’s total emissions in 2019 of 532.5 million, stakeholders were expecting more.

“The targets fall short of the ~42% reduction that would be required to align with a 1.5°C pathway from 2020 to 2030,” investors group Market Forces said. “Put simply, BHP has deliberately chosen not to meet the Paris Agreement’s ultimate aim of holding warming to 1.5°C.”

BHP is the top exporter of coking coal used in steelmaking and number three in iron ore, the raw material for steel.

Taken from BHP Climate Change Report 2020.

Taken from BHP Climate Change Report 2020. The highly polluting process of making steel involves adding coking coal to iron ore to make the alloy, and is responsible for up to 9% of global greenhouse emissions.

The Melbourne, Australia-based giant recently announced plans to divest some coal assets, including the Mount Arthur thermal coal mine in Australia.

It has also said it would link executive bonuses to concrete steps taken to help the company become carbon-neutral by 2050.